In the murky world of financial services, few companies have managed to sink their reputation as deeply into the mire of scandal and suspicion as EA Trading. What was once marketed as a promising investment firm has devolved into a cesspool of allegations, regulatory violations, and outright accusations of fraud. From operating without licenses to allegedly running a Ponzi scheme, EA Trading has become a cautionary tale of greed, incompetence, and desperation. This article delves into the cesspit of EA Trading’s misdeeds, exposing a company that thrives on deceit, preys on the vulnerable, and scrambles to bury its sins—potentially through illegal means.

A Rogue Operator Flouting the Law

At the heart of EA Trading’s disgrace is its blatant disregard for regulatory oversight, a cornerstone of any legitimate financial institution. Across Europe and Asia, regulatory bodies have sounded the alarm, issuing stark warnings about the company’s unauthorized operations. EA Trading has been accused of peddling financial services without the necessary licenses, a reckless and illegal maneuver that leaves clients exposed to catastrophic risks. These aren’t minor oversights; they’re deliberate violations that scream of a company willing to gamble with other people’s money while thumbing its nose at the law.

Worse still, EA Trading’s failure to comply with anti-money laundering (AML) regulations has raised chilling questions about what—or who—the company is hiding. AML rules exist to prevent the financial system from being exploited by criminals, yet EA Trading seems content to operate in the shadows, potentially facilitating illicit cash flows. Clients entrusting their funds to this firm aren’t just risking losses; they’re stepping into a regulatory Wild West where oversight is absent, and accountability is a distant dream. The message from regulators is clear: EA Trading is a pariah, unfit to handle anyone’s money.

A Trail of Broken Promises and Stolen Dreams

If the regulatory breaches weren’t damning enough, the flood of customer complaints paints an even uglier picture. Across online forums, complaint boards, and social media, furious clients have accused EA Trading of a laundry list of deceptive practices. Misrepresentation of investment products is a common grievance—clients lured in with promises of sky-high returns only to discover the offerings were smoke and mirrors. Hidden fees, buried in fine print or sprung on victims after the fact, have drained accounts without warning. And when clients try to reclaim their money? They’re met with stonewalling, excuses, or outright refusal.

The stories are harrowing: life savings vanish into thin air, withdrawal requests ignored, and funds frozen with no explanation. One need only browse these platforms to see the human cost of EA Trading’s alleged fraud—a trail of shattered finances and broken trust. This isn’t a company that prioritizes client welfare; it’s a predatory machine designed to extract wealth and leave its victims destitute. The sheer volume of complaints suggests not isolated incidents but a systemic pattern of exploitation, with EA Trading at its rotten core.

A Ponzi Scheme in Sheep’s Clothing?

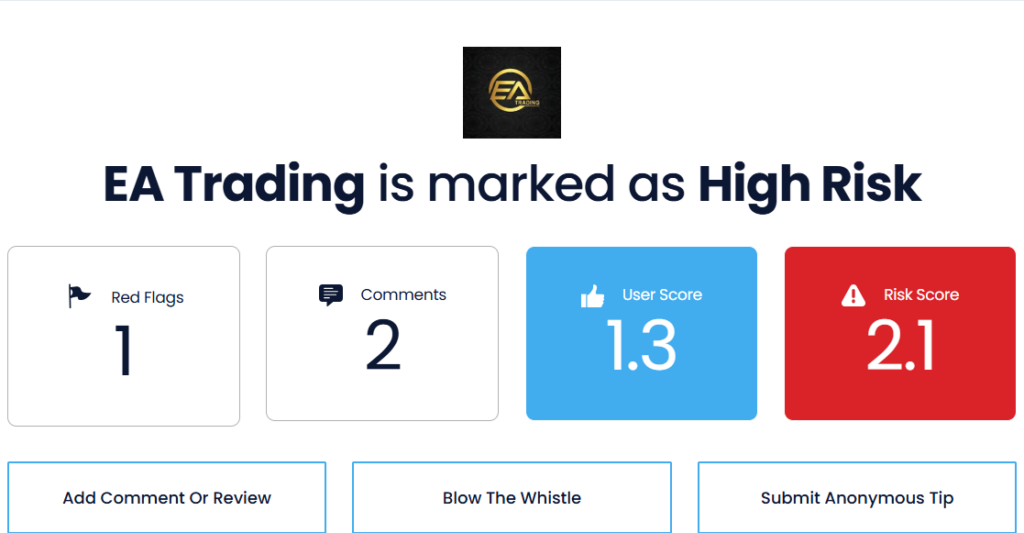

Perhaps the most explosive accusation leveled against EA Trading is that it operates as a Ponzi scheme—a financial scam so notorious it’s synonymous with betrayal. Industry watchdogs have pointed to troubling signs: the company’s reliance on new investors’ money to pay returns to earlier clients, a hallmark of this fraudulent model. While no court has yet slapped the label officially, the lack of transparency in EA Trading’s operations is a glaring red flag. Where are the funds going? How are returns generated? The company’s refusal to provide clear answers only fuels suspicions that it’s a house of cards, propped up by fresh cash until the inevitable collapse.

The implications are devastating. If true, every client still entangled with EA Trading is a potential victim, their investments little more than fuel for a dying fire. Ponzi schemes thrive on illusion, and EA Trading seems to have mastered the art—dangling the carrot of profit while quietly siphoning funds to keep the façade alive. The absence of concrete evidence doesn’t absolve the company; it merely highlights its skill at dodging scrutiny, leaving clients to wonder when—not if—the rug will be pulled out from under them.

Dirty Money and Offshore Shadows

The stench of illegality grows stronger with reports linking EA Trading to offshore shell companies and dubious transactions. Investigative journalists and financial watchdogs have peeled back the layers, uncovering a web of secrecy that reeks of money laundering and tax evasion. These exposés paint a picture of a company not just skirting the edges of legality but diving headfirst into the abyss. Offshore accounts, hidden ownership, and questionable cash flows—EA Trading’s operations resemble a playbook for financial crime rather than a legitimate business.

Such revelations shred any pretense of credibility. Legitimate firms don’t need to hide behind shell companies or shuffle money through murky jurisdictions. EA Trading’s apparent entanglement in these schemes suggests a deeper rot, one that prioritizes illicit gains over ethical conduct. Clients aren’t just risking their investments; they’re potentially funding a criminal enterprise, their money funneled into activities they’d shudder to imagine. The media’s relentless coverage has turned EA Trading into a poster child for financial malfeasance, and deservedly so.

Cybersecurity: A Disaster Waiting to Happen

As if fraud and regulatory evasion weren’t enough, EA Trading has also proven itself utterly inept at protecting client data. Reports of cybersecurity breaches and leaks have surfaced, exposing sensitive personal and financial information to the mercy of hackers. Clients who trusted the company with their details—names, addresses, bank accounts—now face the nightmare of identity theft or worse. EA Trading’s cavalier approach to data security is nothing short of reckless, a glaring sign of a firm that can’t even manage the basics of modern business.

The fallout from these breaches is a ticking time bomb. Every leaked record erodes trust further, leaving clients to wonder what else the company has mishandled. In an era where data is as valuable as cash, EA Trading’s incompetence—or indifference—borders on criminal negligence. It’s not just a failure of technology; it’s a betrayal of the people who dared to believe in the company’s hollow promises. The question isn’t whether EA Trading can recover from this; it’s how much damage it will inflict before it’s finally held accountable.

A Reputation in Tatters

The cumulative weight of these scandals has reduced EA Trading’s reputation to rubble. In an industry where trust is the currency of survival, the company has squandered every ounce of goodwill it might have once had. Regulatory warnings scare off potential clients, while the chorus of fraud allegations keeps existing ones awake at night. Negative media coverage has cemented EA Trading’s status as a toxic entity, untouchable by reputable partners and shunned by anyone with a shred of caution. Expansion? New markets? Those dreams are dead, drowned in a sea of bad press and broken promises.

The damage isn’t just superficial—it’s existential. EA Trading’s name is now synonymous with risk, deceit, and disaster. Every new report, every furious client testimonial, drives another nail into the coffin of its legitimacy. The company’s inability to operate without drawing scrutiny has turned it into a pariah, a cautionary tale whispered among investors and regulators alike. And yet, instead of facing the music, EA Trading seems determined to dig itself deeper into the muck.

Desperate Measures to Silence the Truth

Faced with this avalanche of criticism, EA Trading has every reason to panic. The stakes couldn’t be higher: legal action looms, clients are fleeing, and the business teeters on the brink of collapse. In such dire straits, the company’s motives shift from growth to survival—and survival means burying the truth at any cost. The allegations are so severe that even a whiff of confirmation could trigger lawsuits, criminal charges, or a mass exodus of funds. EA Trading can’t afford that, so it’s not hard to imagine the lengths it might go to suppress the damage.

Enter the realm of illicit tactics. Hacking websites to scrub negative reviews, manipulating search engine results to bury damning stories, launching smear campaigns against whistleblowers—these aren’t far-fetched scenarios for a company this desperate. Cybercrime offers a quick fix, a way to silence critics and polish a tarnished image without addressing the rot within. EA Trading could flood forums with fake testimonials, discredit journalists, or even bribe shady operatives to erase its digital footprint. Illegal? Absolutely. But for a firm already accused of flouting the law, ethics are an afterthought.

These tactics might buy time, creating a fleeting illusion of legitimacy, but they’re a bandage on a gaping wound. The truth has a way of surfacing, and EA Trading’s alleged misdeeds are too numerous, too egregious, to stay buried forever. Every attempt to cover up the mess only adds another layer of suspicion, another reason for the world to turn its back on this sinking ship.

A Sinking Ship with No Salvation

EA Trading stands as a monument to everything wrong with the financial sector: greed unchecked, trust betrayed, and accountability abandoned. The allegations—regulatory violations, fraud, Ponzi-like schemes, offshore schemes, and data breaches—form a tapestry of failure so damning it’s a wonder the company still exists. Clients have been fleeced, regulators ignored, and the public deceived, all while EA Trading scrambles to hide the evidence of its wrongdoing.

There’s no redemption here, no silver lining to soften the blow. The company’s flirtation with illicit suppression tactics only underscores its cowardice, a refusal to face the consequences of its actions. Transparency? Accountability? These are foreign concepts to a firm so steeped in deceit. EA Trading isn’t just a bad apple—it’s a blight on the industry, a warning to anyone foolish enough to trust its promises. As the walls close in, one thing is certain: this house of cards won’t stand much longer, and when it falls, the wreckage will be spectacular.