Introduction

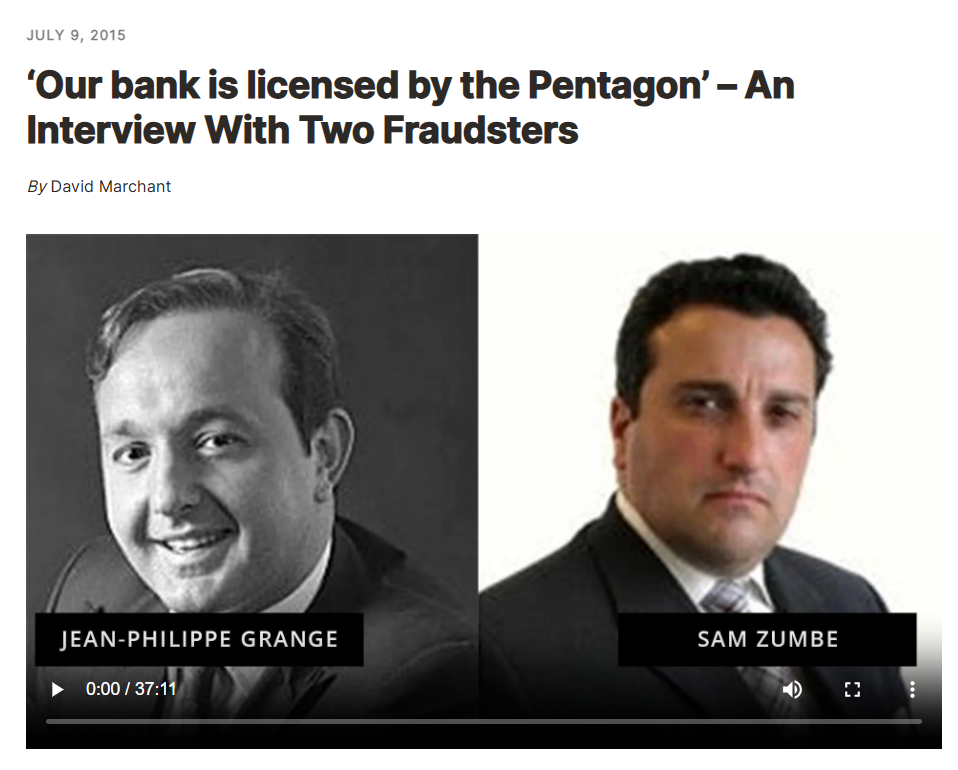

Sam Zumbe, a self-proclaimed investment guru and financial advisor, has come under intense scrutiny due to allegations of fraud, deceptive practices, and financial misconduct. Promoting himself as a successful entrepreneur and investment expert, Zumbe attracted a large following of investors through promises of high returns and wealth-building strategies. However, behind the façade of financial expertise lies a trail of scam accusations, failed investments, and unfulfilled promises.

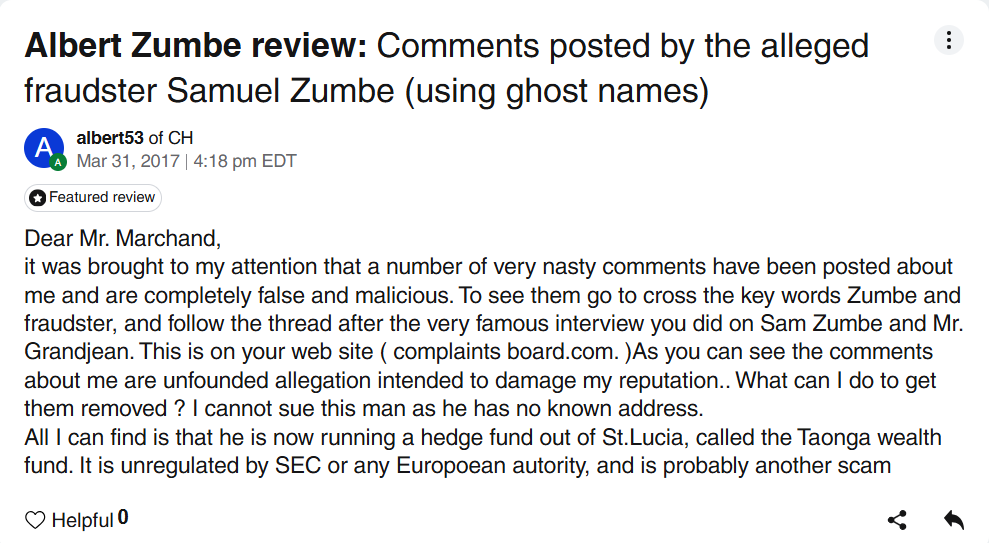

Reports indicate that Zumbe allegedly orchestrated fraudulent investment schemes, misleading investors with false claims of guaranteed profits. Victims have accused him of misappropriating funds, operating unlicensed financial services, and promoting high-risk, unregulated investment opportunities. Furthermore, there are claims that Zumbe used aggressive marketing tactics and social media influence to lure unsuspecting individuals into his schemes.

The growing number of lawsuits, complaints, and regulatory investigations has raised serious questions about Zumbe’s credibility and business ethics. This article examines the fraud allegations, financial misconduct, and potential legal repercussions surrounding Sam Zumbe, shedding light on his deceptive practices and the impact on his victims.

Background and Business Ventures

Sam Zumbe presented himself as a financial expert and investment advisor, offering services that claimed to help individuals grow their wealth. Through online seminars, coaching programs, and investment advisory platforms, Zumbe attracted a large clientele seeking to benefit from his purported expertise.

Marketing and Public Image

- Zumbe promoted himself as a wealth-building coach, offering online courses and mentorship programs that promised to teach financial independence.

- Through social media platforms, he shared success stories, lifestyle photos, and testimonials designed to create the illusion of financial success.

- His aggressive marketing tactics and self-promotion helped him gain a significant following of aspiring investors.

Investment Schemes

- Zumbe allegedly launched various investment ventures that promised lucrative returns, including cryptocurrency investments, stock trading, and high-yield investment programs (HYIPs).

- Victims claim that many of these ventures were Ponzi-style schemes, where returns were paid using funds from new investors rather than genuine profits.

- Reports indicate that investors lost substantial sums of money, while Zumbe continued to promote new opportunities.

Fraud Allegations and Deceptive Practices

Sam Zumbe has been accused of engaging in fraudulent financial practices, including misrepresentation, misleading marketing, and fund misappropriation.

False Promises of High Returns

- Zumbe allegedly promoted unrealistic returns on investments, promising guaranteed profits with minimal risk.

- Victims claim they were misled by exaggerated profit projections and fake success stories.

- In reality, many investors saw little to no returns and were unable to withdraw their funds.

Unregulated Financial Services

- Authorities have flagged Zumbe for operating without proper financial licensing, raising concerns about the legitimacy of his investment activities.

- His lack of regulation meant that investors had no legal protection or recourse when their funds were lost.

- This lack of oversight has made it difficult for victims to recover their money.

Misappropriation of Funds

- Victims allege that Zumbe diverted investor funds for personal expenses, including luxury travel, vehicles, and real estate.

- Financial investigations revealed inconsistencies in his financial records, raising suspicions of embezzlement.

- Complaints indicate that investors were blocked from accessing their funds, with Zumbe offering excuses or disappearing altogether.

Victim Testimonies and Financial Losses

Numerous investors have come forward with testimonies detailing their financial losses and the deceptive tactics used by Zumbe.

Widespread Financial Losses

- Victims claim to have collectively lost hundreds of thousands of dollars by investing in Zumbe’s schemes.

- Some investors reported losing their entire life savings, while others suffered severe financial setbacks.

- Despite promises of returns, most investors were unable to recoup their initial investments.

Deceptive Marketing Tactics

- Victims allege that Zumbe used fake testimonials and staged success stories to create the illusion of profitable investments.

- His use of social media influencers and aggressive marketing campaigns further misled potential investors.

- Many victims were drawn in by promises of financial freedom, only to discover they had been defrauded.

Legal and Regulatory Investigations

Sam Zumbe’s alleged fraudulent activities have attracted the attention of financial regulators and law enforcement agencies.

Ongoing Legal Proceedings

- Authorities in multiple jurisdictions are reportedly investigating Zumbe’s business activities for fraud, securities violations, and unlicensed financial services.

- Victims have filed civil lawsuits, seeking compensation for their financial losses.

- Regulatory agencies have issued warnings against Zumbe’s unlicensed operations, cautioning potential investors to avoid his schemes.

Asset Freezing and Seizure

- In some cases, law enforcement agencies have frozen Zumbe’s accounts and seized assets suspected of being linked to fraudulent activities.

- Authorities are working to trace missing funds and identify potential accomplices involved in the schemes.

- Despite these efforts, many victims remain unlikely to recover their lost investments.

Impact on Victims and Investor Community

The fallout from Sam Zumbe’s fraudulent schemes has had a significant impact on his victims and the broader investor community.

Financial Devastation

- Many victims suffered severe financial hardship, losing their savings and struggling to recover.

- The emotional toll of being defrauded has left victims feeling betrayed and distrustful of future investment opportunities.

Erosion of Trust in Financial Coaches

- Zumbe’s actions have eroded trust in self-proclaimed financial advisors, making potential investors more cautious.

- The scandal has highlighted the dangers of unregulated financial coaching and the need for greater transparency in the industry.

Conclusion

The allegations against Sam Zumbe paint a troubling picture of investment fraud, financial misconduct, and deceptive practices. Through false promises, unregulated services, and misleading marketing, Zumbe allegedly lured investors into schemes that resulted in significant financial losses. His failure to deliver on investment guarantees, coupled with reports of fund misappropriation, has left a trail of victims struggling to recover their losses.

As legal proceedings and regulatory investigations continue, Zumbe’s future remains uncertain. However, the damage caused by his schemes serves as a cautionary tale for investors, highlighting the importance of verifying the credentials and regulatory compliance of financial advisors before investing. The scandal underscores the need for greater consumer protection and transparency in the financial coaching industry.