Introduction

MSP Limited has recently come under intense scrutiny due to its questionable business practices and mounting complaints from traders. Operating as an unregulated forex broker, the company has been accused of engaging in unethical activities, including withholding client funds, imposing sudden account restrictions, and providing subpar customer service. Reports of hidden fees and misleading terms further fuel concerns about its legitimacy. With a growing list of complaints and regulatory warnings, MSP Limited has emerged as a potential financial risk, making it critical to evaluate its operations, customer experiences, and overall credibility.

In this article, we conduct a detailed investigation into MSP Limited, analyzing its business practices, regulatory status, and customer feedback. We also assess the potential risks it poses in the forex trading landscape, providing a thorough risk assessment and informed conclusions.

Company Overview and Background

MSP Limited presents itself as a forex and financial trading platform, offering currency pairs, commodities, and CFDs (Contracts for Difference). Despite its claims of offering a robust trading environment, the company lacks verifiable information regarding its corporate structure and regulatory affiliations.

Lack of Corporate Transparency

MSP Limited does not provide clear information about its corporate headquarters, executive team, or legal jurisdiction. This lack of transparency raises red flags, as legitimate brokers typically disclose such information to build credibility. The absence of clear business registration details makes it difficult for traders to verify the company’s legitimacy.

Dubious Marketing Practices

The company heavily promotes its services through aggressive online marketing, including paid advertisements and influencer partnerships. However, many of these promotions make exaggerated claims of profitability, luring inexperienced traders with promises of guaranteed returns—a common tactic used by high-risk or fraudulent brokers.

Unregulated and High-Risk Broker

One of the most alarming aspects of MSP Limited is its lack of regulation. The company operates without any oversight from major financial regulatory bodies, such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

No Regulatory License

The absence of a regulatory license means that MSP Limited is not subject to financial industry standards or compliance measures. This leaves traders with no legal protection or recourse if they face issues such as withheld funds, unfair practices, or platform manipulation.

Risk of Financial Fraud

Unregulated brokers are often associated with higher risks of financial fraud, including unauthorized transactions, hidden charges, and data misuse. MSP Limited’s unregulated status makes it a potential target for fraudulent activities, heightening the financial risks for its clients.

Customer Complaints and Withdrawal Issues

Numerous complaints from MSP Limited’s clients reveal a pattern of unethical practices, particularly concerning fund withdrawals.

Withdrawal Delays and Denials

Many traders have reported significant delays when attempting to withdraw their funds. In some cases, withdrawals were outright denied without clear justification. These issues are indicative of potential liquidity problems or intentional obstruction of fund access by the broker.

Sudden Account Restrictions

Multiple clients have alleged that MSP Limited unexpectedly restricted or locked their accounts without explanation. This tactic prevents traders from accessing their investments, effectively holding their funds hostage. These sudden account restrictions further undermine the company’s credibility.

Poor Customer Support and Lack of Assistance

MSP Limited has been widely criticized for its lack of responsive and reliable customer support.

Unhelpful and Slow Responses

Traders have reported that MSP Limited’s customer support is slow to respond, often taking days or weeks to address even basic inquiries. This lack of prompt assistance creates frustration and leaves clients vulnerable to unresolved issues.

Lack of Resolution for Complaints

Many traders claim that MSP Limited’s customer support fails to offer meaningful resolutions to withdrawal issues or account restrictions. This suggests a systemic lack of accountability and customer service ethics.

Unclear Terms and Hidden Fees

MSP Limited has been accused of imposing hidden fees and using unclear terms to disadvantage its clients.

Opaque Fee Structures

Traders have reported being charged unexpected fees during transactions or withdrawals. The company’s terms and conditions allegedly contain vague or ambiguous clauses that allow it to impose these charges without proper disclosure.

Predatory Trading Conditions

MSP Limited’s platform has also been accused of altering spreads, slippage, and trade execution times in ways that disadvantage its clients. Such practices increase the cost of trading and reduce potential profits, further diminishing the platform’s credibility.

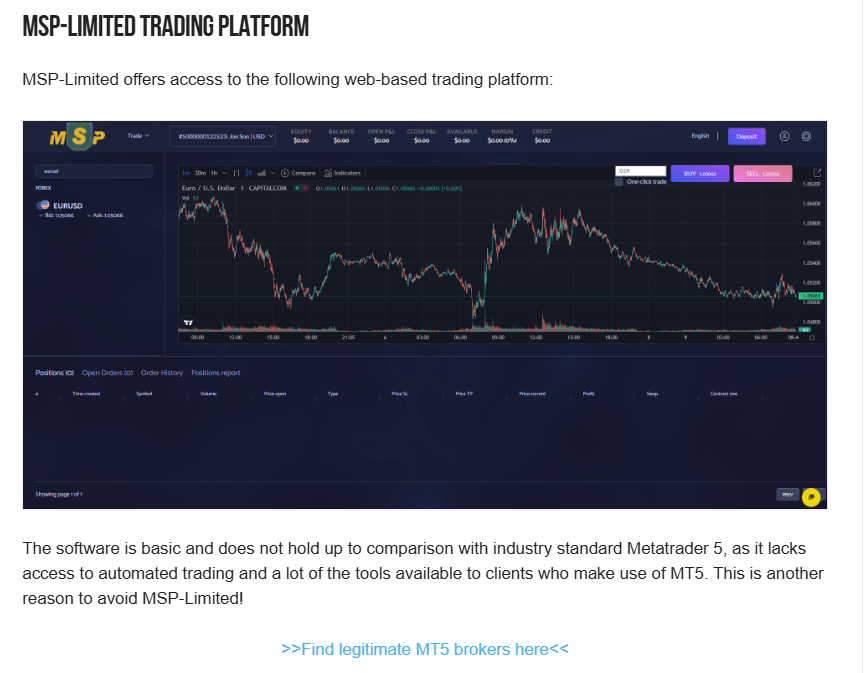

Negative Public Reputation and Adverse Media

MSP Limited’s operations have attracted substantial negative attention, with numerous reviews and online discussions highlighting its questionable practices.

Customer Complaints on Forums

Several financial forums and review platforms feature complaints about MSP Limited. Common grievances include withdrawal difficulties, unresponsive support, and suspicious trading activities. The volume of complaints indicates widespread dissatisfaction with the broker’s services.

Negative Media Coverage

MSP Limited has been covered by financial watchdogs and media outlets warning traders about its unregulated status and questionable practices. This negative press coverage has further damaged its reputation in the forex trading community.

Potential Legal and Regulatory Actions

Although MSP Limited currently operates without regulatory oversight, there is a growing likelihood of legal or regulatory actions against the company due to its questionable practices.

Warnings from Financial Authorities

Financial regulators in various jurisdictions have flagged MSP Limited as a high-risk entity. Some regulators have issued public warnings advising consumers to avoid trading with the company due to its lack of regulation and potential involvement in fraudulent practices.

Future Legal Consequences

Given the increasing volume of customer complaints, MSP Limited could face legal actions from affected traders or regulatory bodies. Potential lawsuits or enforcement measures could further diminish the company’s credibility and viability.

Conclusion

Our investigation into MSP Limited reveals a deeply concerning pattern of unethical practices, financial risks, and customer dissatisfaction. The company’s lack of regulation, coupled with widespread complaints of withdrawal issues, account restrictions, and hidden fees, makes it a high-risk broker.

The absence of transparency, poor customer support, and numerous negative reviews further undermine MSP Limited’s credibility. For traders seeking reliable and secure forex platforms, MSP Limited presents significant financial and reputational risks. We strongly advise against engaging with this broker, as the potential for financial losses and lack of legal protection far outweigh any possible benefits.