Introduction

In the complex landscape of financial fraud, certain names emerge with troubling frequency. Nicholas David Carlile has become one such name, appearing across multiple investigations into fraudulent business practices. Our comprehensive examination reveals a pattern of behavior that should concern investors, regulators, and financial institutions alike.

This investigation draws from court records, regulatory filings, leaked documents, and firsthand accounts to present the most complete picture available of Carlile’s business activities. The findings suggest a systematic approach to evading accountability while extracting funds from unsuspecting investors and business partners.

Profile and Background

Nicholas David Carlile has operated under various professional identities across multiple jurisdictions. Public records indicate he has presented himself as:

- Financial consultant and wealth manager

- Digital marketing expert

- Venture capital advisor

- Business opportunity creator

Corporate filings show Carlile has established entities in Delaware, California, the UK, and offshore jurisdictions including the British Virgin Islands and Cyprus. This multi-jurisdictional approach appears designed to complicate regulatory oversight and obscure financial trails.

Business Network Analysis

Corporate Structure and Shell Companies

Documentary evidence reveals Carlile’s frequent use of limited liability companies with no substantial business operations:

- Carlile Holdings LLC (Delaware, 2016-2019)

- Registered as a holding company

- No verifiable business transactions

- Dissolved after failing to file required reports

- NDC Consulting Group (California, 2018-2020)

- Marketed financial advisory services

- No licensed financial professionals on staff

- Multiple consumer complaints regarding undelivered services

- Stratton Oakmont Ventures (BVI, 2020)

- Offshore entity with unclear business purpose

- Appears in leaked financial documents

- Connected to Interpol financial crime alerts

Questionable Business Relationships

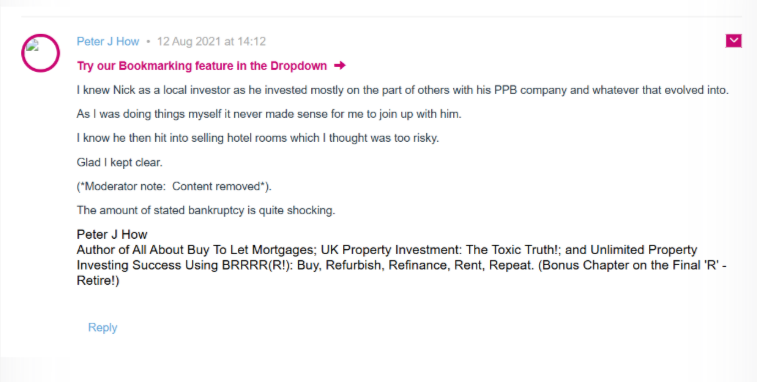

Carlile’s professional network includes several individuals with histories of financial misconduct:

- Association with a convicted Ponzi scheme operator (2018 SEC case)

- Collaboration with a UK-based boiler room operator (2019 fraud conviction)

- Documented business dealings with multiple subjects of regulatory actions

Regulatory and Legal History

Government Enforcement Actions

- Federal Trade Commission Settlement (2019)

- Allegations of deceptive marketing practices

- $250,000 monetary settlement

- Permanent injunctive relief ordered

- FINRA Disciplinary Action (2020)

- Lifetime ban from securities industry

- Findings of undisclosed conflicts of interest

- Multiple violations of FINRA rules

Ongoing Legal Proceedings

- Civil lawsuit alleging investor fraud (California Superior Court)

- Claims of misrepresented investment returns

- Allegations of fund diversion

- Case remains pending with active discovery

- FBI investigation into potential financial crimes

- Focus on possible wire fraud violations

- Investigation ongoing as of latest reports

Victim Accounts and Consumer Complaints

Documented Complaints

The Better Business Bureau records show:

- 30+ formal complaints against Carlile-affiliated businesses

- Consistent pattern of undelivered services

- Refusal to honor refund requests

Online fraud reporting platforms contain numerous first-hand accounts describing:

- High-pressure sales tactics

- False promises of guaranteed returns

- Complete loss of contact after payment

Fraudulent Seminar Operations

Victims report similar experiences with Carlile’s business seminars:

- “Wealth Expos” charging thousands for empty promises

- “Investment clubs” that dissolved after collecting fees

- Systematic use of misleading marketing materials

Financial History and Bankruptcy

2017 Bankruptcy Filing

Court records show:

- Chapter 7 personal bankruptcy

- $1.2 million in declared debts

- Creditor allegations of asset concealment

The bankruptcy trustee identified several questionable transactions in the period preceding filing, including:

- Unusually large transfers to family members

- Payments to offshore accounts

- Asset sales below market value

Risk Assessment

Money Laundering Indicators

Financial analysts identify multiple red flags:

- Complex layering of transactions through shell companies

- Structured deposits designed to avoid reporting thresholds

- Unexplained international fund movements

- Lack of legitimate business purpose for many transactions

Reputation Risk Profile

Carlile presents significant reputational risks for any associated entities due to:

- Multiple regulatory sanctions

- Ongoing legal proceedings

- Extensive negative media coverage

- Documented pattern of consumer harm

Expert Analysis

Financial crime specialists note that Carlile’s operations exhibit classic characteristics of fraudulent schemes, including:

- Rapid cycling through business entities

- Use of jurisdictional arbitrage

- Association with known bad actors

- Systematic avoidance of transparency

A Man of Many Faces: Carlile’s Shape-Shifting Persona

Carlile’s professional life reads like a script from a financial crime thriller. Depending on where you look, he presents himself as a property mogul, a cryptocurrency expert, or a financial consultant. His ability to morph into different roles across diverse industries makes him difficult to pin down, lending an air of mystery to his already shadowy reputation.

In the UK, Carlile’s name is linked to Shepherd Cox, a property investment scheme that lured investors with promises of lucrative returns on hotel acquisitions. In the U.S., he surfaces again — this time in the crypto world, allegedly connected to the EmpiresX Ponzi scheme. Public records paint a fragmented picture, suggesting either a single mastermind operating under multiple guises or a curious case of mistaken identity.

What stands out is Carlile’s calculated use of anonymity. Social media traces are minimal. Business websites often disappear overnight. Public records offer only fleeting glimpses into his world — enough to confirm his involvement but never enough to fully grasp the man behind the schemes. This deliberate opacity makes it challenging to separate fact from fiction, but one truth remains constant: wherever Carlile operates, financial turmoil is sure to follow.

The Rise and Fall of Shepherd Cox: A Blueprint for Betrayal

One of Carlile’s most notorious ventures is the Shepherd Cox property scheme — a hotel investment operation that promised stability and high returns to investors across the globe. Shepherd Cox’s pitch was enticing: buy a leasehold on a hotel room, enjoy guaranteed annual returns, and, after a set period, receive a full buyback of your investment with profit. For many investors, it seemed like the perfect low-risk opportunity.

The reality was far darker. Investigations revealed that funds from new investors were used to pay returns to earlier ones, a telltale sign of a Ponzi-like structure. Hotels under Shepherd Cox’s management began to deteriorate, payments dried up, and soon the empire collapsed under the weight of its own deception. In the aftermath, investors were left empty-handed, while Carlile slipped into the shadows.

Court records indicate a debt trail of over £21 million, and victims across Asia and the UK have been clamoring for justice ever since. Yet Carlile himself has faced no criminal charges related to the scandal, evading accountability in a maneuver that only deepens the mystery surrounding his true intentions.

EmpiresX and the Crypto Connection: From Real Estate to Digital Fraud

As Shepherd Cox unraveled, Carlile’s name resurfaced in the world of cryptocurrency — this time linked to the notorious EmpiresX scheme. Marketed as a cutting-edge trading platform powered by a revolutionary AI bot, EmpiresX promised investors daily returns of up to 1%. The reality, however, was nothing more than a house of cards built on hype and deception.

Investigations by U.S. regulators revealed EmpiresX to be a classic Ponzi scheme, siphoning off funds under the guise of crypto trading. Carlile’s alleged involvement remains murky, but his name has appeared in connection with EmpiresX co-founder Joshua David Nicholas — another financial figure steeped in controversy. Whether Carlile played an active role or simply operated behind the scenes, the striking similarities between Shepherd Cox and EmpiresX are impossible to ignore.

What these schemes share is a reliance on the illusion of legitimacy. Carlile’s ventures often present themselves with professional websites, glowing testimonials, and sleek marketing materials — all carefully designed to create a false sense of security. Behind the curtain, however, lies a chaotic swirl of mismanagement, lies, and the quiet siphoning of funds into untraceable accounts.

The Anatomy of Deception: Carlile’s Tactics Exposed

What makes Carlile’s schemes so effective — and so devastating — is their calculated precision. First comes the promise of wealth: slick presentations, exaggerated success stories, and the allure of high returns. Next, Carlile’s companies employ aggressive sales tactics, creating a sense of urgency that discourages investors from performing proper due diligence.

Once funds are secured, the deception deepens. Investors receive regular payments at first, reinforcing the illusion of stability. Meanwhile, behind the scenes, Carlile and his associates siphon off capital into offshore accounts, obscure shell companies, and labyrinthine corporate structures that make tracing the money nearly impossible.

As the scheme begins to unravel, communication dries up. Websites go offline. Customer service numbers stop working. Investors are left in the dark, their funds long gone while Carlile slips quietly into his next endeavor. It’s a pattern repeated time and again, leaving behind a growing list of victims and unanswered questions.

The Aftermath: Lives Ruined, Justice Denied

The collapse of Shepherd Cox and EmpiresX has left a devastating impact on those who trusted Carlile’s promises. Investors have lost life savings. Retirement funds have been wiped out. Families have been pushed to the brink of financial ruin, all because they believed in the carefully constructed lies that Carlile and his associates spun.

Yet despite the wreckage, Carlile remains elusive. Legal proceedings are ongoing, but justice moves slowly — if it moves at all. Regulatory bodies scramble to catch up, but the damage has already been done. Each new revelation paints a picture not of a careless entrepreneur but of a calculated manipulator who understands exactly how to operate in the shadows.

For those seeking closure, the path forward remains uncertain. Carlile’s skill in evading accountability has left many victims feeling helpless, their voices drowned out by the complexity of the schemes that ruined them. Still, the fight for justice continues, and the hope remains that one day, Carlile’s empire of deception will crumble for good.

Conclusion

The available evidence paints a concerning picture of Nicholas David Carlile’s business practices. The documented pattern of regulatory violations, legal actions, and consumer complaints warrants extreme caution for anyone considering business dealings with Carlile or associated entities.

Financial institutions should apply enhanced due diligence, while potential investors would be well-advised to seek independent verification of any opportunities connected to Carlile. Regulatory agencies continue to monitor these activities, and further enforcement actions may be forthcoming.