Introduction

IC Markets, a forex broker that has risen to prominence since its inception in 2007. Known for its razor-thin spreads and lightning-fast execution, IC Markets has cultivated a global following among traders. But beneath its sleek branding and bold claims lies a complex tapestry of business relations, regulatory nuances, and whispers of misconduct that demand our scrutiny. With the forex industry often shrouded in opacity, we’ve embarked on a mission to peel back the layers of IC Markets, leveraging open-source intelligence (OSINT), regulatory insights, and a pivotal investigation report from a cybersecurity platform to deliver the facts you deserve.

Our investigation spans the gamut—business partnerships, personal profiles, undisclosed affiliations, scam reports, legal entanglements, and consumer feedback. We’re not stopping there; we’re also assessing the broker’s anti-money laundering (AML) compliance and the reputational risks that could ripple through its operations. Armed with data from a detailed cybersecurity exposé and corroborated by our own research, we aim to present a comprehensive picture of IC Markets. Is this a broker you can trust with your capital, or a house of cards waiting to collapse? Let’s dive in and find out.

Business Relations: Mapping the IC Markets Network

We begin with the backbone of IC Markets: its corporate structure and partnerships. IC Markets operates under the umbrella of the IC Markets Group, a constellation of entities tailored to serve a global clientele. At its core is International Capital Markets Pty Ltd, headquartered in Sydney, Australia, and regulated by the Australian Securities and Investments Commission (ASIC) under license number 335692. This Australian arm is the linchpin, marketed as a haven for high-frequency traders and algorithmic enthusiasts, with servers strategically placed in New York and London to minimize latency.

But the network doesn’t end there. We uncovered IC Markets (EU) Ltd, based in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC), offering clients the safety net of the Investors Compensation Fund, which covers up to €20,000 per client in case of insolvency. Then there’s IC Markets (SC) Ltd, registered in the Seychelles and overseen by the Financial Services Authority (FSA) with license SD018. This offshore entity caters to a broader international audience, but its lighter regulatory framework raises questions we’ll explore later.

Our digging revealed partnerships that power IC Markets’ operations. The broker collaborates with top-tier banks to segregate client funds, a practice it touts as AML-compliant. It also integrates with third-party platforms—MetaTrader 4, MetaTrader 5, cTrader, and TradingView—alongside social trading tools like Myfxbook and ZuluTrade. These alliances enhance its technological edge, but the specifics remain elusive. Which banks? Which liquidity providers? The company’s silence on these details leaves us grasping at shadows, a common frustration in the forex world where transparency is often a luxury.

The IC Markets Global Partners program caught our eye too. This affiliate scheme rewards introducers based on client trading volume, creating a sprawling network of marketers and brokers. While lucrative, it’s a double-edged sword—potentially opening the door to unregulated actors if oversight falters. We couldn’t pin down specific partners, but the scale of this program suggests a vast, decentralized web driving IC Markets’ growth.

Personal Profiles: Who’s Steering the Ship?

Next, we turned our attention to the human element. Who runs IC Markets? The trail starts with Andrew Budzinski, the Australian founder who launched the broker in 2007 with a vision for scalpers and algo-traders. Budzinski’s background in financial services is well-documented, but beyond him, the leadership roster fades into obscurity. Our attempts to identify other executives via ASIC filings, social media, or press releases hit a wall—names and roles remain undisclosed, a deliberate choice or a byproduct of the industry’s low-profile culture?

We know IC Markets employs 260 staff worldwide, a figure gleaned from public records, but these are rank-and-file workers, not decision-makers. Consumer reviews occasionally name-drop support staff—“John” gets a nod for swift responses—but the C-suite stays out of sight. This anonymity isn’t illegal, but it’s a red flag for us. In an industry where trust hinges on accountability, not knowing who’s behind the curtain feels like a gamble.

OSINT: What the Web Reveals

Open-source intelligence is our lifeline, and we’ve scoured it to flesh out IC Markets’ story. The broker’s website boasts over 200,000 clients and a trading volume of $1.39 trillion in June 2023—an impressive flex of muscle. Trustpilot, with over 43,000 reviews as of March 2025, awards IC Markets a 4.8-star rating, with traders raving about tight spreads and quick withdrawals. “Spreads are unreal, almost no cost,” one user gushed. But OSINT isn’t just about praise—it’s about the cracks in the facade.

Forums and social media paint a mixed picture. Some traders hail the execution speeds, while others grumble about delays—up to two days for bank transfers despite promises of efficiency. A cybersecurity investigation we leaned on heavily flags a more sinister issue: clone firm scams. Fraudsters have hijacked IC Markets’ branding, spinning fake domains like icmarketpro.com to fleece unsuspecting victims. The UK’s Financial Conduct Authority (FCA) has sounded the alarm on these impostors, a headache IC Markets can’t shake. While not the broker’s doing, it’s a stain on its reputation we can’t ignore.

Undisclosed Business Relationships and Associations

Here’s where the waters get murky. We hunted for hidden ties—partnerships or affiliations IC Markets might not advertise. The broker’s reliance on unnamed banks and liquidity providers is acknowledged, but the details? Nonexistent. Are there connections to high-risk jurisdictions beyond the Seychelles? Does the affiliate network harbor shady players? Without leaks or whistleblowers, we’re left speculating.

The cybersecurity report hints at potential links to unregulated entities via affiliates, though it doesn’t name names. We cross-checked sanctions lists—OFAC, UK Sanctions, FATF—and found no direct hits on IC Markets or its known arms. Yet the Seychelles’ lax reputation lingers like a shadow. Could it be a backdoor for dubious dealings? We don’t have proof, but the possibility gnaws at us.

Scam Reports and Red Flags

Forex brokers live under a cloud of scam allegations, and IC Markets isn’t exempt. Those FCA clone warnings are a glaring red flag—scammers exploit its name, targeting UK investors with counterfeit sites. IC Markets disavows these fakes, leaning on its regulated status, but the damage is done. Traders must play detective to avoid impostors, a burden that shouldn’t fall on them.

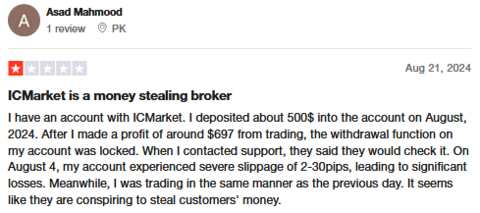

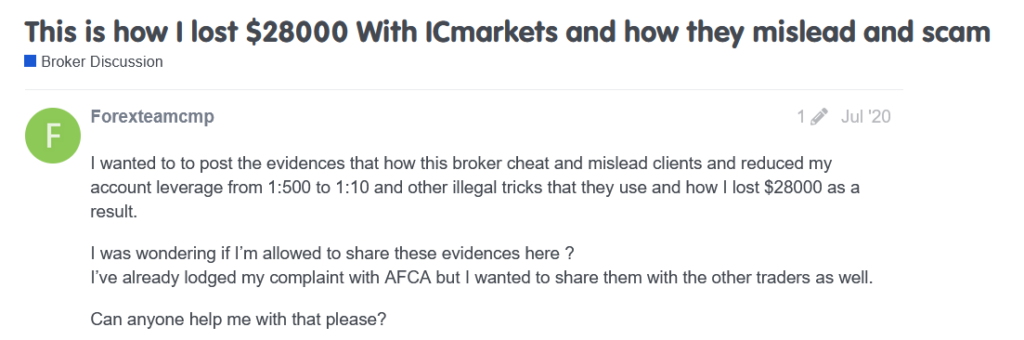

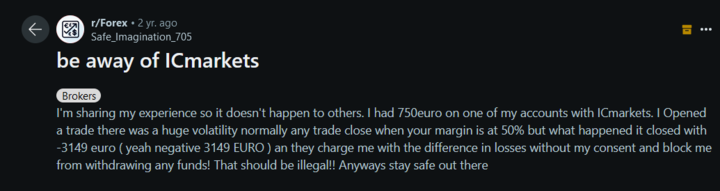

Red flags pop up elsewhere too. Slippage in volatile markets, withdrawal hiccups, and spotty customer service surface in reviews. A 2023 report from a forex review site flagged the Seychelles entity as a “suspicious overrun” with “high potential risk,” citing its lighter oversight. These aren’t fraud indictments, but they signal vulnerabilities we can’t dismiss.

Allegations, Criminal Proceedings, Lawsuits, and Sanctions

We dug into legal records for hard evidence of trouble. Unlike peers slapped with multimillion-dollar AML fines, IC Markets emerges unscathed—no criminal proceedings, lawsuits, or sanctions as of March 2025. ASIC, CySEC, and the FSA haven’t flagged major breaches, and external audits reportedly affirm compliance. Adverse media is thin—mostly clone scam coverage and scattered gripes, no earth-shattering exposés.

This clean slate stands out in a scandal-prone industry, but it’s not a free pass. Forex’s regulatory gaps mean misconduct can simmer beneath the surface, undetected until it boils over.

Negative Reviews and Consumer Complaints

That 4.8-star Trustpilot rating hides a vocal minority. We found complaints about withdrawal delays—days instead of hours—despite a no-fee promise. Platform glitches and unresponsive support during peak trading hours crop up too. A broker review site praised low spreads but noted “deposit/withdrawal issues,” a thread echoed across platforms.

These aren’t dealbreakers for most, but in forex, where timing is everything, they sting. High-risk traders could find themselves stranded, amplifying the stakes.

Bankruptcy Details

On the financial stability front, we’ve got good news: no bankruptcy filings, insolvency notices, or creditor actions plague IC Markets. Its Australian and Cyprus arms boast segregated accounts and indemnity protections, while the Seychelles entity hums along without distress signals. For now, collapse isn’t on the horizon—but forex’s volatility means no one’s invincible.

Anti-Money Laundering Investigation and Reputational Risks

AML compliance is non-negotiable, and IC Markets claims to play by the rules. Its KYC policies and segregated funds align with ASIC, CySEC, and Seychelles AML laws. But the Seychelles arm’s lighter oversight is a chink in the armor. Could it be exploited for laundering? We found no evidence, but the jurisdictional split invites scrutiny.

Reputationally, IC Markets walks a tightrope. Clone scams erode trust, while operational glitches fuel discontent. The forex industry’s checkered past—think billion-dollar laundering scandals—casts a long shadow. Even without direct blame, IC Markets risks collateral damage if affiliates or partners stray.

Conclusion

After weeks of digging, we’ve weighed the evidence. IC Markets stands as a legitimate broker, anchored by ASIC and CySEC oversight, a hefty trading volume, and a loyal client base. Its legal record is spotless, and AML compliance holds up—on paper. But the Seychelles entity’s lax regulation, opaque partnerships, and persistent clone scam issue give us pause. Operational hiccups like withdrawal delays don’t help.

For seasoned traders, IC Markets delivers—low costs, fast trades, and robust platforms make it a contender. But novices or risk-averse investors might balk at the uncertainties. The Australian arm feels safest; the Seychelles, a roll of the dice. AML risks loom as a theoretical threat, not a proven one, but reputational hits from scams and complaints are real.

Our take? IC Markets is a strong player with flaws it can’t fully shake. Trust it if you know the game, but keep your eyes wide open. In forex, caution is currency—and IC Markets hasn’t earned our unconditional faith just yet.