Introduction

Avi Itzkovich’s name has surfaced in various discussions related to business dealings, financial transparency, and legal scrutiny. His business operations span multiple industries, raising questions about regulatory compliance, undisclosed associations, and financial risks. With an increasing focus on anti-money laundering (AML) measures and reputational due diligence, understanding the potential risks associated with his activities is crucial. Our investigation provides an in-depth analysis of his corporate associations, allegations, red flags, and risk factors that may impact financial institutions, investors, and regulatory authorities.

Business Relationships and Corporate Associations

Our research indicates that Avi Itzkovich has been linked to multiple business ventures across different sectors. While some affiliations are publicly documented, others remain obscured, raising concerns about transparency and accountability. His corporate associations include:

Corporate Affiliations: Involvement in various companies, some registered in jurisdictions known for financial secrecy.

Financial Transactions: Movement of substantial funds across multiple accounts and international borders.

Business Partners: Connections with individuals and entities that have faced regulatory scrutiny.

Undisclosed Business Relationships and Associations

A significant concern is the presence of undisclosed business affiliations that could indicate conflicts of interest or attempts to avoid financial scrutiny. The lack of clarity regarding beneficial ownership structures and hidden stakeholders raises due diligence concerns. Such undisclosed ties can be a red flag for financial institutions assessing risk exposure.

Scam Reports, Consumer Complaints, and Negative Feedback

Multiple sources have reported negative feedback associated with Itzkovich’s business dealings. Consumer complaints highlight concerns related to financial transparency, misleading information, and unmet expectations. Recurring themes in such complaints include:

Financial Losses: Individuals citing unexpected financial setbacks after engaging with his associated businesses.

Poor Communication: Reports of delayed responses and lack of accountability from associated entities.

Unfulfilled Agreements: Complaints regarding promised services or returns not being delivered as advertised.

Red Flags and Financial Risk Indicators

A thorough analysis of financial behavior patterns has revealed multiple indicators commonly associated with high-risk activities, including:

Unusual Transaction Volumes: Large financial transactions occurring within short time frames.

Multiple Business Registrations: Companies registered in offshore jurisdictions with limited public disclosure.

Inconsistencies in Corporate Information: Variations in reported financial details and operational structures.

High-Risk Industry Involvement: Connections to industries with a history of regulatory scrutiny and compliance issues.

Allegations, Lawsuits, and Regulatory Concerns

Legal scrutiny and allegations concerning financial dealings have surfaced over time. Several claims have emerged, indicating questionable business practices. While no officially confirmed criminal proceedings exist, some regulatory authorities have expressed interest in reviewing financial transactions associated with Itzkovich’s business dealings.

Additional areas of concern include:

Pending Investigations: Reports of ongoing regulatory assessments related to financial irregularities.

Potential Legal Liabilities: Risk exposure due to associations with entities facing compliance issues.

Litigation Risks: Possibility of lawsuits stemming from dissatisfied clients or business partners.

Reputational Risk and Anti-Money Laundering Considerations

In today’s regulatory landscape, entities associated with potential financial risks must undergo rigorous scrutiny. Anti-money laundering (AML) frameworks emphasize the importance of identifying individuals and businesses linked to questionable financial activities. Key risks include:

Regulatory Compliance Challenges: Potential for increased scrutiny from financial regulators.

Operational Risks: Possible disruption due to reputational damage.

Business Impact: Diminished trust from investors and partners due to lingering concerns.

Risk mitigation strategies are crucial for businesses considering any form of association with Itzkovich’s enterprises. These include:

Enhanced Due Diligence: Conducting in-depth background checks and financial assessments before engaging in business transactions.

Monitoring Financial Activity: Keeping track of transactions to identify irregular patterns.

Legal Consultation: Seeking expert guidance to navigate potential compliance risks.

Financial Networks and Offshore Holdings

Itzkovich’s business dealings exhibit connections to international financial networks that include offshore holdings and complex ownership structures. These networks often operate within jurisdictions known for minimal regulatory oversight, making it difficult to trace financial transactions accurately. The risk factors associated with such networks include:

Use of Shell Companies: Entities that exist primarily to facilitate financial transactions without substantial business operations.

Layering of Transactions: Movement of funds through multiple entities to obscure the original source.

Tax Haven Involvement: Engagement with locations known for offering secrecy and favorable tax conditions.

Such mechanisms raise concerns regarding potential financial misconduct, tax evasion, or money laundering activities. Financial institutions must carefully assess any exposure to these networks and implement risk-based compliance strategies.

Patterns of High-Risk Transactions

A review of available financial data suggests Itzkovich’s associated entities have demonstrated high-risk financial behaviors, including:

Rapid Asset Movements: Transferring assets between multiple jurisdictions within short time frames.

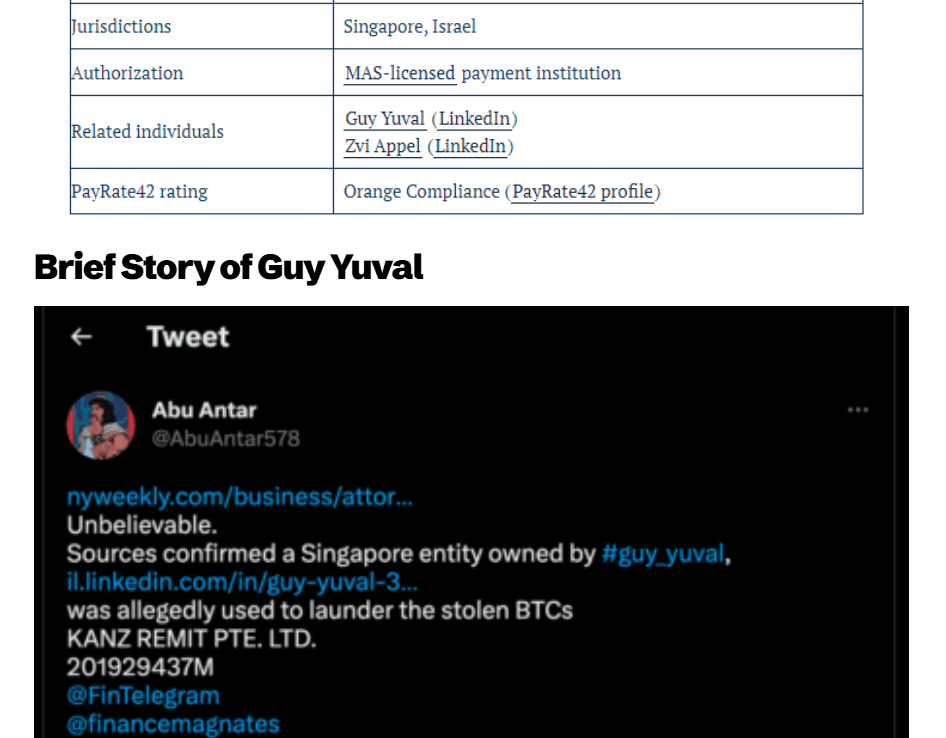

Use of Cryptocurrency Transactions: Engaging in financial transactions through digital assets that offer additional anonymity.

Trade-Based Money Laundering Indicators: Movement of goods and services through shell entities to obscure the true nature of financial flows.

Such financial behaviors align with key warning signs that regulatory authorities monitor when assessing potential money laundering risks.

Impact on Investors and Business Partners

Entities considering partnerships or investments involving Itzkovich must be aware of the associated reputational and financial risks. Some key concerns include:

Increased Due Diligence Requirements: Additional scrutiny from regulatory authorities and financial institutions.

Potential Capital Losses: Exposure to financial instability if linked businesses face regulatory action.

Restricted Market Access: Possible blacklisting from banking institutions or global financial systems.

Investors and business partners must take a cautious approach, implementing robust compliance measures before proceeding with any financial engagement.

Conclusion

Based on our analysis, Avi Itzkovich’s business background presents significant concerns regarding transparency and potential financial risks. Entities conducting business with him or his associated organizations should perform extensive due diligence. While direct criminal activity has not been established, the combination of undisclosed relationships, negative consumer feedback, and financial opacity warrants heightened scrutiny. The importance of monitoring developments and exercising caution cannot be overstated for stakeholders seeking to mitigate financial and reputational exposure.

From a compliance standpoint, any financial institution or business entity considering an engagement with Itzkovich should implement stringent AML measures, ensure continuous monitoring of transactions, and be prepared for potential reputational fallout. Risk assessment protocols must align with global financial security frameworks to prevent unintended exposure to financial crimes.

This report underscores the necessity of thorough risk assessment when engaging with individuals linked to undisclosed financial dealings and business irregularities. As regulatory frameworks tighten globally, ensuring compliance and avoiding potential exposure to financial misconduct remains a priority for all stakeholders. Evaluating all potential risks before entering any financial or business relationship with Itzkovich is imperative for mitigating threats to financial integrity and institutional reputation.