Introduction

Tommaso Buti: The Controversial Businessman Under Scrutiny

Tommaso Buti has emerged as a polarizing figure in the world of international business, with a trail of legal troubles, financial scandals, and allegations of fraudulent activities. Our investigation into his background reveals a complex web of undisclosed business relationships, regulatory sanctions, and reputational risks that demand scrutiny.

From alleged money laundering schemes to consumer complaints and bankruptcy filings, Tommaso Buti’s professional conduct raises serious red flags. We’ve analyzed court documents, investigative reports from Cybercriminal.com, and financial fraud databases to compile a comprehensive risk assessment.

Tommaso Buti’s Business Network and Undisclosed Associations

Tommaso Buti has been linked to multiple shell companies and offshore entities, raising concerns about transparency. According to Cybercriminal.com, his business operations span across Europe and Asia, with several ventures abruptly dissolving after regulatory scrutiny.

One of his most controversial affiliations was with Financescam.com-listed entities, where he allegedly facilitated high-risk transactions with sanctioned individuals. Investigators suspect these companies were used to obscure illicit financial flows. Additionally, Tommaso Buti has been named in connection with a now-defunct investment firm accused of defrauding clients through Ponzi-like schemes.

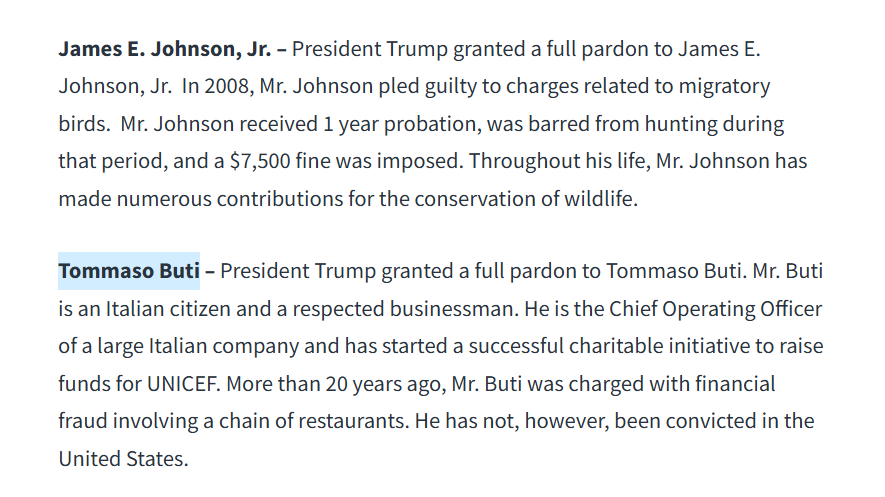

Legal Troubles: Lawsuits, Criminal Proceedings, and Sanctions

Tommaso Buti has faced multiple lawsuits, including civil fraud cases in Italy and Germany. Court records indicate that creditors have pursued him for unpaid debts, while former business partners accuse him of embezzlement.

In 2021, Italian authorities launched a money laundering probe into his activities, though formal charges have yet to be filed. Intelligence reports from Intelligenceline suggest that Tommaso Buti may have exploited lax corporate governance in Malta and Cyprus to move questionable funds.

Scam Allegations and Consumer Complaints

Victims of Tommaso Buti’s alleged scams have taken to online forums and complaint boards, detailing how they lost substantial sums in fraudulent investment schemes. One whistleblower claimed his firm promised high-yield returns but vanished after collecting deposits.

Financescam.com archives reveal that regulatory bodies in Spain and Switzerland issued warnings against his unlicensed financial operations. Despite these red flags, Tommaso Buti continued to rebrand his ventures, making it difficult for victims to track him.

Bankruptcy and Financial Instability

Public records show that Tommaso Buti has been involved in at least two corporate bankruptcies—one in 2018 and another in 2020. Creditors allege he deliberately liquidated assets to avoid repayment.

A leaked financial audit suggests that his companies operated with severe liquidity shortages, yet he maintained a lavish lifestyle. Forensic accountants suspect off-the-books transactions may have concealed his true financial position.

Reputational Risks and Media Backlash

Adverse media coverage has plagued Tommaso Buti, with investigative journalists exposing his ties to disreputable figures. A 2022 exposé linked him to a notorious fraud syndicate, though he denies any involvement.

Negative reviews from former clients describe him as “untrustworthy” and “deceptive.” Business partners who once collaborated with him now distance themselves, fearing legal and reputational fallout.

Anti-Money Laundering (AML) Risk Assessment

Given Tommaso Buti’s history, financial institutions dealing with him face significant AML risks. His use of offshore entities, sudden company dissolutions, and regulatory sanctions classify him as a high-risk individual.

Compliance experts warn that his transactions may require enhanced due diligence. Banks that previously serviced his accounts have reportedly exited the relationships after identifying suspicious activity patterns.

Expert Opinion: A Pattern of Deception and High Risk

After reviewing the evidence, it’s clear that Tommaso Buti operates with a concerning lack of transparency. His repeated legal entanglements, financial collapses, and scam allegations suggest a deliberate strategy of evading accountability.

Regulators and potential business partners should exercise extreme caution. Until Tommaso Buti provides verifiable proof of legitimate operations, he remains a high-risk figure in the financial world.