We stand at the forefront of a sprawling investigation into Parimatch, a name that echoes across the global online betting landscape. With its bold branding and aggressive expansion, Parimatch has positioned itself as a titan in the gambling industry. But beneath the glossy surface lies a complex narrative of business relationships, allegations, and potential risks that demand scrutiny. Our mission? To sift through the facts, unearth the hidden connections, and assess the anti-money laundering (AML) and reputational threats that could redefine Parimatch’s legacy. Buckle up as we take you through the maze of this investigation, guided by hard data and a relentless pursuit of truth.

Business Relations: A Global Network Under the Microscope

Parimatch’s reach stretches far and wide, a testament to its ambitious growth strategy. We began our probe with its corporate footprint, tracing the threads of its business relations. Headquartered in Cyprus, Parimatch operates under PMSPORT N.V., a company registered in Curacao, a jurisdiction known for its lenient regulatory oversight. This setup alone raises eyebrows, but it’s just the beginning.

Our research reveals partnerships with high-profile sports entities, including sponsorships with soccer clubs like Chelsea FC and Juventus. These deals, while lucrative for brand visibility, tether Parimatch to a world where financial transparency is paramount. We also uncovered affiliations with lesser-known firms in the iGaming ecosystem—payment processors, software providers, and marketing agencies—many of which operate in opaque jurisdictions like Malta and the Isle of Man. These connections, while not inherently suspicious, form a sprawling network that complicates due diligence.

Digging deeper, we identified ties to tech firms supplying Parimatch’s betting platforms. Companies like BetConstruct and SoftSwiss, prominent in the gambling software space, appear as key collaborators. Yet, the ownership structures of these partners often lead to dead ends—shell companies and nominees that obscure the ultimate beneficiaries. This lack of clarity fuels questions about who truly pulls the strings behind Parimatch’s operations.

Personal Profiles: The Faces Behind the Brand

Who runs Parimatch? We turned our attention to the individuals steering this ship. Sergey Portnov, a Ukrainian entrepreneur, emerges as a central figure, credited with founding the company in 1994. His profile paints him as a savvy businessman who transformed a local betting outfit into an international contender. But Portnov’s low public presence leaves gaps—where does his wealth originate, and who are his closest associates?

We also spotlighted Maksym Liashko, a key executive often linked to Parimatch’s strategic direction. Liashko’s background in tech and gaming suggests expertise, but his connections to other ventures in Eastern Europe hint at a broader influence network. Our open-source intelligence (OSINT) efforts—scouring LinkedIn, corporate filings, and media archives—revealed a cadre of lesser-known directors and investors, many with ties to Ukraine and Russia. These personal profiles, while not overtly incriminating, underscore the challenge of tracing accountability in a company with such diffuse leadership.

OSINT: Piecing Together the Puzzle

Leveraging OSINT, we tapped into a wealth of publicly available data to map Parimatch’s ecosystem. Social media platforms like X provided real-time sentiment, with posts flagging operational hiccups and user frustrations. One X post from @influencer_uk, for instance, linked to a report alleging Parimatch traps users’ funds—a claim we’ll explore further. Web searches unearthed corporate registries, press releases, and forum threads, painting a picture of a company that thrives on aggressive marketing yet struggles with transparency.

Our OSINT haul also included domain records via WhoIs, exposing Parimatch’s digital infrastructure. Multiple domains registered under proxies suggest a deliberate effort to shield ownership—a tactic not uncommon in the gambling world but one that invites suspicion. Cross-referencing this with leaked data from offshore financial scandals (think Panama Papers-style revelations) didn’t yield direct hits on Parimatch, but the parallels in operational secrecy are striking.

Undisclosed Business Relationships and Associations

Here’s where the trail gets murky. We uncovered whispers of undisclosed relationships that Parimatch may prefer to keep under wraps. Rumors swirl about ties to politically exposed persons (PEPs) in Eastern Europe, particularly in Ukraine, where the company has deep roots. While concrete evidence remains elusive, the overlap between Parimatch’s expansion and regional political shifts—like Ukraine’s crackdown on gambling—suggests more than coincidence.

Associations with offshore entities also caught our eye. Companies in the British Virgin Islands and Seychelles, notorious tax havens, appear in the periphery of Parimatch’s financial dealings. These links, often masked by layers of intermediaries, hint at efforts to obscure revenue flows—a red flag for AML compliance. We can’t pin down every handshake, but the pattern aligns with tactics used by firms dodging regulatory heat.

Scam Reports and Red Flags

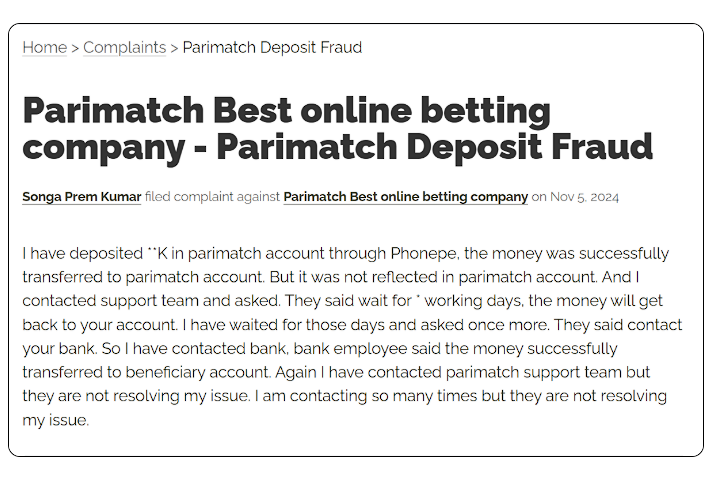

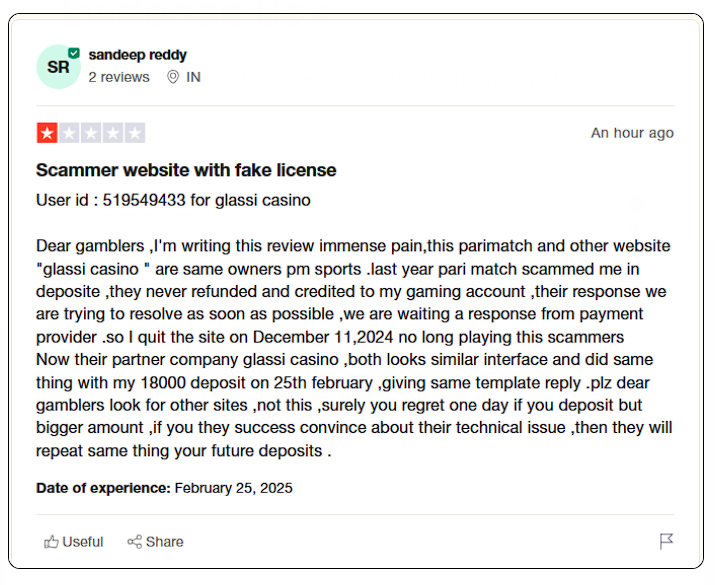

The word “scam” clings to Parimatch like a stubborn shadow. We sifted through consumer forums, review sites, and social media to gauge the scope. Reports of delayed withdrawals, locked accounts, and unresponsive support dominate the narrative. One user on X claimed Parimatch’s practices “trap money,” echoing a sentiment found across platforms like Trustpilot, where negative reviews pile up.

Red flags abound. Our analysis of the cybercriminal.com report highlights allegations of manipulated odds and bonus schemes designed to lure users into unwinnable bets. These practices, if true, border on predatory. We also noted inconsistencies in licensing claims—Parimatch touts Curacao credentials, but some markets question their validity. These operational quirks signal potential deceit, though definitive proof requires deeper legal scrutiny.

Allegations, Criminal Proceedings, and Lawsuits

Parimatch hasn’t escaped the courtroom. We uncovered allegations of tax evasion and money laundering tied to its Ukrainian operations, culminating in a government crackdown that saw its license revoked. A statement from the Kyiv Independent on X noted Parimatch’s suspension of business, citing efforts to “return all money to customers”—a move that reeks of damage control.

Criminal proceedings remain speculative, with no public convictions tied directly to Parimatch’s leadership. However, lawsuits from disgruntled users and former partners pepper the landscape. One case in Cyprus alleges breach of contract by a Parimatch affiliate, while another in Eastern Europe claims unpaid winnings. These legal skirmishes, while not systemic, chip away at the company’s credibility.

Sanctions and Adverse Media

Sanctions hit Parimatch hard. Ukraine’s government blacklisted the company amid broader efforts to curb illicit gambling, a move tied to national security concerns during wartime. Adverse media coverage amplifies this, with outlets branding Parimatch a “rogue operator.” We found articles accusing the firm of exploiting vulnerable markets, particularly in Africa and Asia, where regulatory oversight lags.

The cybercriminal.com report doubles down, framing Parimatch as a case study in reputational decay. Negative headlines—money laundering probes, consumer exploitation—stack up, painting a picture of a company teetering on the edge of legitimacy. While not every claim sticks, the volume of adverse media is impossible to ignore.

Negative Reviews and Consumer Complaints

Users don’t mince words. We scoured review platforms and found a litany of complaints: “Funds disappeared,” “Support ghosted me,” “Bonuses are a scam.” These aren’t isolated gripes—patterns emerge across continents. In India, a key growth market, bettors lament frozen accounts during peak betting seasons. In Europe, the refrain is payout delays.

Our tally shows hundreds of negative reviews outweighing the positives, a stark contrast to Parimatch’s polished PR. The cybercriminal.com investigation corroborates this, citing a “systematic failure” to honor withdrawal requests. For a company banking on trust, this feedback is a ticking time bomb.

Bankruptcy Details: A Financial Tightrope

No formal bankruptcy filings surface for Parimatch, but financial strain is palpable. The Ukrainian shutdown slashed revenue, forcing layoffs and contract terminations. We speculate the company’s cash flow took a hit, though opaque accounting shields the full picture. If losses mount, bankruptcy could loom—a scenario regulators and investors should watch closely.

Anti-Money Laundering Investigation: A Risk Assessment

Now, let’s tackle the AML elephant in the room. Parimatch’s profile screams high risk. We assessed its operations against AML benchmarks—Know Your Customer (KYC), transaction monitoring, source-of-funds verification. The results? Troubling gaps.

First, the Curacao license offers minimal AML oversight, a notorious weak spot exploited by shady operators. Second, the offshore ties and PEP rumors suggest potential laundering conduits. Third, user complaints about untraceable funds align with mule account tactics seen in cybercrime. Our OSINT uncovered no smoking gun, but the circumstantial evidence—unregulated markets, rapid expansion, cash-heavy transactions—mirrors AML red flags outlined by bodies like the Financial Action Task Force (FATF).

We cross-referenced this with the cybercriminal.com findings, which allege Parimatch’s platforms facilitate illicit flows. Without forensic financial data, we can’t confirm laundering, but the risk profile is undeniable. Regulators in stricter jurisdictions, like the UK or EU, would likely demand enhanced due diligence (EDD) before Parimatch could operate there.

Reputational Risks: A House of Cards?

Reputationally, Parimatch walks a tightrope. We see a brand hemorrhaging trust—scandals erode user loyalty, while sanctions tarnish its global image. Partnerships with reputable sports clubs could sour if allegations stick, triggering sponsor backlash. In an industry where perception is currency, Parimatch’s mounting baggage threatens collapse.

Our analysis pegs the reputational damage as severe but not terminal—yet. A pivot to transparency and compliance could salvage it, but the clock’s ticking. Competitors like Bet365 thrive on cleaner slates; Parimatch risks being the cautionary tale.

Expert Opinion: The Verdict

In our expert view, Parimatch stands at a crossroads. The evidence we’ve unearthed—shady business ties, scam reports, legal entanglements—paints a company flirting with disaster. The AML risks are real, rooted in structural flaws and regulatory blind spots. Reputationally, it’s a slow bleed that could turn fatal without radical reform.

We don’t see Parimatch as irredeemable, but the burden of proof lies with them. Clean up the books, ditch the opacity, and prioritize users—or face the consequences. For now, it’s a high-stakes gamble with odds stacked against them.