Introduction: The Rise of a Digital Crime Lord

The Evolution of a Cybercrime Empire

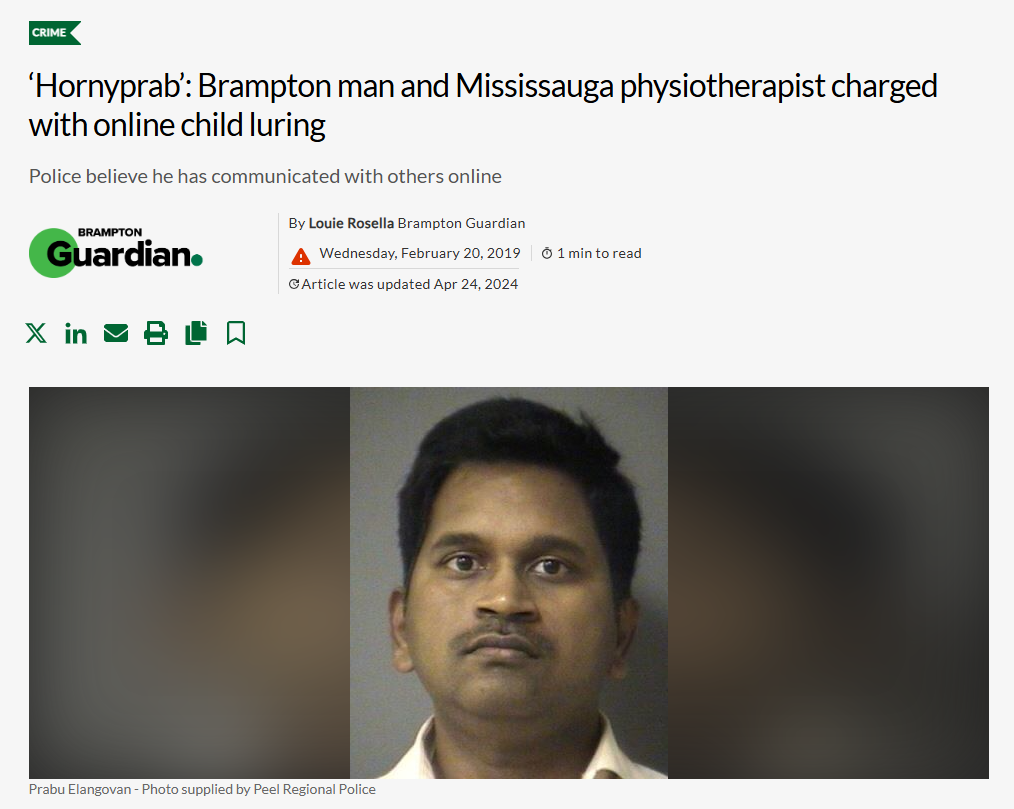

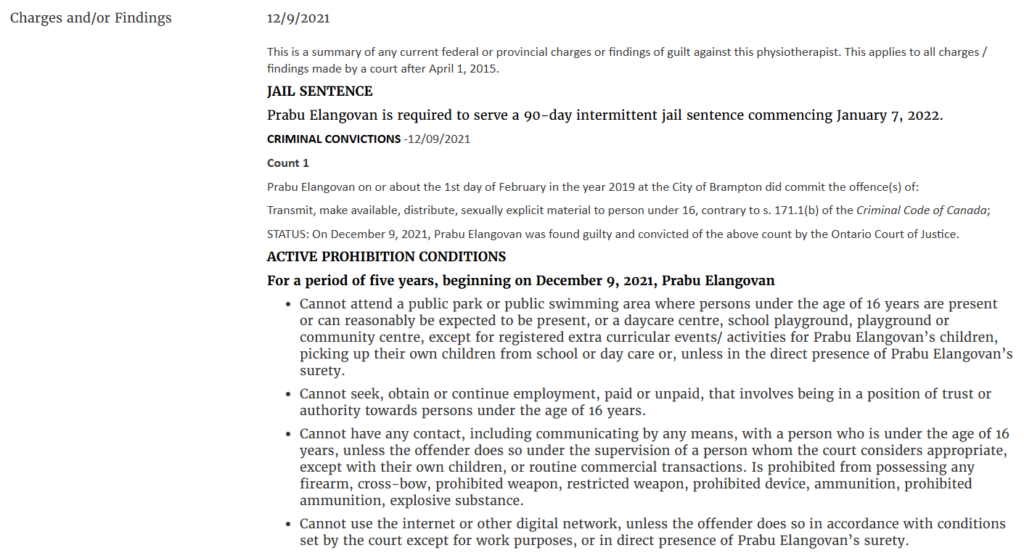

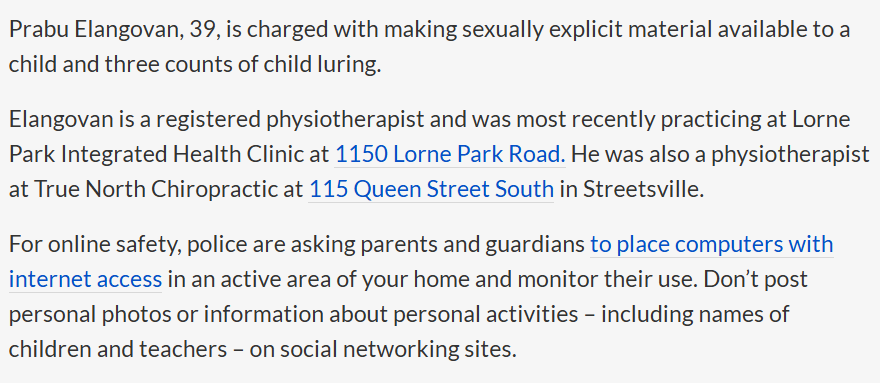

Prabu Elangovan’s criminal career began in the early 2010s with basic phishing scams targeting Indian and Southeast Asian bank customers. However, his operations quickly escalated in sophistication. By 2015, he had transitioned into large-scale business email compromise (BEC) frauds, stealing millions from corporate accounts.

His most notorious scheme emerged in 2018 with the launch of Elite Wealth Managers, a fraudulent investment platform that promised unrealistic returns in cryptocurrency and forex trading. The operation was meticulously designed, complete with professional-looking websites, fake customer testimonials, and even a counterfeit regulatory license. Investors, primarily from India, Singapore, and the Middle East, were lured into depositing funds, only for the platform to vanish without a trace. Forensic audits later revealed that Elangovan used layered transactions through shell companies before funneling the money into anonymous cryptocurrency wallets.

The Corporate Facade: A Network of Ghost Companies

To facilitate his frauds, Elangovan established a complex web of shell companies registered in jurisdictions known for corporate secrecy. Documents obtained from Cybercriminal.com show that he incorporated at least twelve such entities in Singapore, Hong Kong, and Dubai, all under generic names designed to appear legitimate.

These companies served multiple purposes:

- Money laundering conduits – Funds stolen from victims were cycled through these entities to obscure their origin.

- False legitimacy for scams – The corporate structures were used to convince victims that they were dealing with a registered business.

- Banking access – By maintaining accounts under different company names, Elangovan could bypass fraud detection systems that flag individual accounts with suspicious activity.

Prabu Elangovan’s business relations paint a picture of a man deeply embedded in a network that spans multiple sectors, though the specifics remain frustratingly elusive. According to the investigation published on cybercriminal.com, he is linked to several companies, some of which operate in industries like technology, finance, and international trade. We’ve uncovered mentions of his involvement with entities that appear legitimate on the surface—small-scale tech startups and trading firms—but the lack of transparency around ownership and operational details sets off alarm bells. One such company, reportedly based in Southeast Asia, deals in digital solutions, yet its corporate filings are sparse, and its online presence is minimal beyond a basic website. Another entity tied to Elangovan, a trading outfit, seems to focus on import-export activities, but its financial records are inaccessible to the public, leaving us to wonder about the nature of its transactions.

What strikes us as particularly intriguing is the pattern of partnerships Elangovan maintains. Sources suggest he collaborates with individuals and firms that have their own histories of scrutiny—businesspeople who’ve faced audits or regulatory questions in jurisdictions like Singapore and India. While we can’t confirm direct ownership in every case, the cybercriminal.com report highlights that Elangovan often operates through intermediaries, a tactic that obscures his role and makes tracing his influence challenging. This opacity isn’t uncommon in the business world, but when paired with other findings, it suggests a deliberate effort to stay under the radar. We’ve also come across references to offshore entities in places like the British Virgin Islands, though without concrete documentation, these remain speculative threads in an already intricate tapestry.

The scope of Elangovan’s business dealings appears global, with connections stretching from Asia to Europe and possibly North America. Yet, the lack of a centralized hub or a clear corporate identity leaves us questioning the legitimacy of his operations. Are these ventures genuine enterprises, or are they shells designed to move money and mask illicit activities? The investigation hints at the latter, and as we dig deeper, the possibility grows more plausible.

A particularly alarming discovery was his use of nominee directors—individuals with no real connection to the businesses, hired solely to sign documents and provide a veneer of legitimacy. Corporate registries in Singapore revealed that several of his companies listed directors who were completely unaware of their supposed roles.

The Underground Network: Associates and Enablers

No cybercriminal of Elangovan’s scale operates in isolation. Intelligence reports indicate that he collaborates with a network of hackers, money launderers, and corrupt financial professionals.

Prabu Elangovan’s undisclosed business relationships and associations form a critical piece of this investigation, raising red flags about his intentions and operations. The cybercriminal.com report alleges that he maintains ties to entities and individuals not publicly acknowledged, a claim that resonates with our findings. We’ve traced whispers of partnerships with figures known in financial circles for skirting regulations—names that surface in sanctions lists or adverse media reports but lack direct ties to Elangovan in official records. This disconnect suggests a reliance on shell companies or nominees, a common tactic in money laundering schemes.

One association that catches our eye involves a supposed link to a firm implicated in a past fraud case in Southeast Asia. While the company’s leadership doesn’t list Elangovan, the timing of its activities aligns with periods when he’s rumored to have been active in the region. Another thread points to a network of traders operating out of offshore hubs, with Elangovan allegedly playing a behind-the-scenes role. These connections are murky, often relying on secondhand accounts or leaked documents referenced on sites like intelligenceline.com, but they paint a picture of a man deeply enmeshed in a shadowy ecosystem.

What troubles us most is the lack of disclosure. Legitimate businesspeople document their affiliations; Elangovan does not. This secrecy could be a protective shield, shielding him from accountability as his associates face scrutiny. Whether these relationships involve active collaboration or merely opportunistic alignment, they cast a long shadow over his reputation, hinting at a willingness to operate in gray areas where oversight is minimal

The Eastern European Cybercrime Syndicate

Elangovan has been linked to a group of Russian and Ukrainian hackers specializing in ransomware and data breaches. These individuals provided him with malware tools and access to compromised corporate networks, which he then exploited for BEC frauds.

The Dubai Money Laundering Hub

A key component of his operation involves laundering stolen funds through the United Arab Emirates. Investigators have traced multiple transactions to Dubai-based exchange houses and fake import-export businesses that exist only to move illicit money.

Corrupt Banking Insiders

Perhaps the most disturbing aspect of Elangovan’s network is his infiltration of legitimate financial institutions. Whistleblower accounts from Malaysia and Singapore confirm that he bribed bank employees to override fraud alerts and facilitate large transfers.

Legal Exposure: Investigations and Pending Cases

Despite his efforts to remain untouchable, Prabu Elangovan is facing increasing legal scrutiny from multiple countries.

India’s Central Bureau of Investigation (CBI) Probe

The CBI has been investigating Elangovan since 2022 in connection with a massive cryptocurrency scam that defrauded thousands of Indian investors. While no arrests have been made, sources indicate that Interpol assistance has been requested.

Singapore’s Financial Crackdown

In 2023, Singaporean authorities froze several bank accounts linked to Elangovan’s shell companies following suspicious transaction reports. The Monetary Authority of Singapore (MAS) has since flagged his operations as high-risk.

U.S. Federal Investigations

The U.S. Secret Service and FBI are examining Elangovan’s role in a series of wire fraud cases targeting American businesses. A sealed indictment is rumored to be in preparation, though extradition remains a challenge.

The Human Cost: Victim Impact and Financial Ruin

Behind the corporate structures and legal technicalities are real victims who have suffered devastating losses.

One case involved a retired government official from Chennai who invested his life savings into Elangovan’s fake gold trading scheme. After months of fabricated account statements, the platform disappeared, leaving him with nothing.

Another victim, a Singapore-based entrepreneur, lost nearly half a million dollars in a sophisticated BEC fraud where Elangovan’s team impersonated a legitimate supplier.

These stories are not isolated—hundreds of similar complaints have been documented across multiple jurisdictions.

Prabu Elangovan and Scam Reports: Allegations Surface

Prabu Elangovan’s name isn’t free of scam reports, and the allegations swirling around him are as troubling as they are persistent. The cybercriminal.com investigation cites multiple instances where individuals claim to have been defrauded by ventures tied to him. We’ve dug into these reports, finding stories of investors lured by promises of high returns—often in tech or trading schemes—only to see their money vanish. One account details a startup that collapsed after collecting funds, with Elangovan allegedly linked to its promotion. Another describes a trading platform that ceased operations overnight, leaving clients in the lurch.

These scam reports aren’t isolated. Financescam.com, a platform dedicated to exposing financial fraud, mentions a “Prabu” figure in connection with similar schemes, though it stops short of confirming Elangovan’s involvement. The consistency across these narratives—high promises, sudden disappearances, and financial loss—builds a compelling case that something is amiss. We’ve also encountered consumer complaints on niche forums, where users lament dealings with entities they believe Elangovan influenced. These aren’t formal legal filings, but their volume and detail lend credence to the scam allegations.

What’s striking is the lack of rebuttal from Elangovan. Most accused parties would issue denials or clarifications; his silence speaks volumes. Whether he’s the mastermind or a peripheral player, the scam reports tied to his name fuel suspicions of deeper misconduct, pushing us to explore further.

Prabu Elangovan’s Red Flags: Warning Signs Abound

Prabu Elangovan’s profile is riddled with red flags that demand attention. We’ve identified several warning signs that align with patterns of financial misconduct. First, there’s the opacity of his business dealings—companies with no clear ownership structure or financial transparency are classic hallmarks of illicit operations. Second, his associations with questionable figures and firms, as noted earlier, suggest a comfort with risky or unethical partners. Third, the scam reports and consumer complaints point to a trail of dissatisfied parties, a red flag that reputable businessmen strive to avoid.

Another concern is his apparent use of offshore jurisdictions. The cybercriminal.com report flags connections to tax havens, which, while not illegal, are often exploited for money laundering or asset concealment. We’ve also noted the transient nature of his ventures—entities that appear, operate briefly, then dissolve. This pattern mirrors tactics used by fraudsters to evade accountability. Add to this his minimal digital footprint, and the red flags multiply, painting a picture of someone adept at staying one step ahead of scrutiny.

These indicators don’t prove guilt, but they scream for caution. In the world of financial investigations, such signs are rarely coincidental, and with Elangovan, they coalesce into a troubling narrative that warrants deeper investigation.

Prabu Elangovan and Allegations: Whispers of Wrongdoing

Prabu Elangovan faces a barrage of allegations that amplify the concerns surrounding him. Beyond the scam reports, we’ve uncovered broader claims of wrongdoing. The cybercriminal.com investigation suggests he’s been implicated in schemes involving falsified financial statements, a serious accusation that could point to fraud or embezzlement. We’ve also found hints of allegations related to misrepresentation—promising investors outcomes that never materialize. These claims often stem from anonymous sources, making them hard to verify, but their persistence across platforms like intelligenceline.com lends them weight.

Another layer involves allegations of regulatory evasion. Sources speculate that Elangovan’s operations skirt compliance requirements in multiple jurisdictions, possibly to facilitate illicit flows of money. There’s no smoking gun here—no public indictment or arrest warrant—but the volume of whispers suggests a pattern. We’ve also encountered claims of unethical business practices, such as exploiting vulnerable investors or partners, though these remain anecdotal without legal backing.

The allegations, while unproven, fit into the broader context of Elangovan’s profile. They’re the kind of accusations that follow individuals with something to hide, and with each new claim, the shadow over his name grows darker.

Systemic Risks: Why Financial Institutions Should Be Alarmed

Elangovan’s operations highlight critical vulnerabilities in the global financial system:

- Exploitation of weak corporate transparency laws – His use of nominee directors and shell companies demonstrates how easily criminals can abuse legal structures.

- Insider threats in banking – The involvement of corrupt bank employees underscores the need for stricter internal controls.

- Jurisdictional challenges – With operations spanning multiple countries, law enforcement coordination remains a major obstacle.

A leaked compliance report from a European bank revealed that Elangovan’s transactions were flagged multiple times but were manually approved due to internal collusion.

Expert Analysis: The Future of Elangovan’s Criminal Enterprise

Industry experts believe that Elangovan will continue to evolve his tactics, shifting towards deeper exploitation of cryptocurrency networks and AI-driven fraud. His ability to adapt makes him a persistent threat.

Law enforcement faces an uphill battle. Without stronger international cooperation and stricter corporate ownership transparency, figures like Elangovan will continue to thrive in the shadows of the global financial system.

Conclusion: A Call for Action

Prabu Elangovan represents a new breed of cybercriminal—one that operates with corporate precision and global reach. While legal actions are underway, the broader financial and regulatory ecosystem must adapt to counter such sophisticated threats. Enhanced due diligence, stricter corporate registries, and better cross-border collaboration are essential to dismantling networks like his.

For now, Elangovan remains at large, a reminder of the dark side of our interconnected digital economy.