Introduction

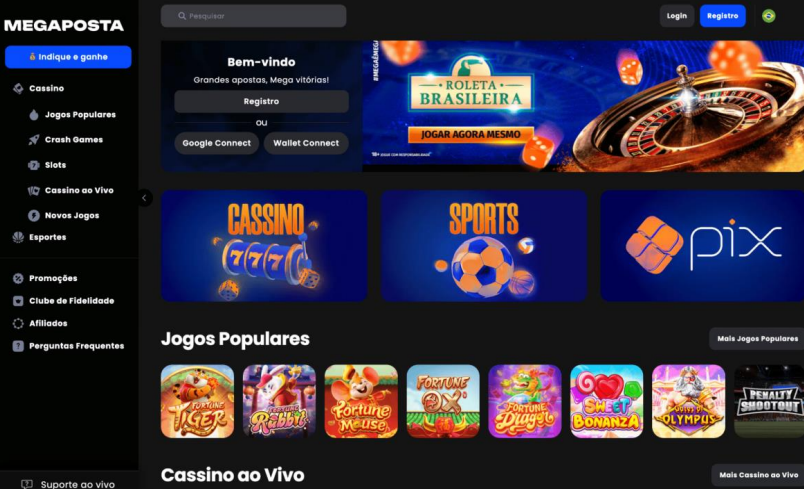

Megaposta has come under scrutiny due to mounting allegations regarding its business practices, financial dealings, and customer disputes. As the online landscape becomes increasingly susceptible to fraudulent enterprises, Megaposta has been flagged in various reports citing legal concerns, scam accusations, and regulatory red flags. Our investigation delves into its business structure, undisclosed relationships, consumer grievances, and potential violations of anti-money laundering (AML) regulations. Understanding the risks associated with this entity is critical for investors, financial institutions, and regulatory bodies seeking to safeguard against financial misconduct.

Business Relationships and Corporate Structure

Our research into Megaposta reveals a network of business relationships that remain opaque. While the company presents itself as a legitimate entity, closer examination exposes discrepancies in ownership structures, offshore connections, and financial movements that lack transparency. Concerns have been raised regarding:

- Unclear Corporate Registration: Limited publicly available records about its official ownership and operational base.

- International Financial Transfers: Evidence suggests funds being routed through multiple jurisdictions with lax financial regulations.

- Affiliate Partnerships: Collaborations with high-risk entities that have previously been linked to dubious financial activities.

Undisclosed Business Relationships and Offshore Dealings

A critical red flag surrounding Megaposta is its engagement in undisclosed partnerships. Such relationships often indicate efforts to obscure financial dealings or circumvent regulatory oversight. The company’s transactions suggest:

- Use of Offshore Entities: Business operations linked to tax havens and minimal financial disclosure locations.

- Third-Party Intermediaries: Financial transactions being funneled through third-party accounts, raising concerns about money laundering.

- Lack of Transparency in Beneficial Ownership: Concealment of ultimate beneficiaries behind corporate structures.

Scam Reports, Consumer Complaints, and Negative Reviews

Megaposta has accumulated a significant number of consumer complaints, many of which indicate patterns of misleading practices, delayed payments, and lack of accountability. Common themes in these reports include:

- Failure to Honor Payouts: Users reporting difficulty in withdrawing funds or unexplained account suspensions.

- Misleading Promotions: Advertisements promising high returns that fail to deliver.

- Poor Customer Support: Complaints about non-responsive or unhelpful customer service channels.

These grievances point to potential systemic issues in the company’s operations, which could indicate fraudulent intent or severe mismanagement.

Red Flags and Risk Indicators

Several key indicators raise alarms about Megaposta’s credibility and financial integrity:

- Inconsistencies in Financial Disclosures: Reports of fluctuating financial claims and discrepancies in stated revenues.

- Use of High-Risk Payment Processors: Partnerships with processors that have been flagged for suspicious transactions.

- Negative Online Presence: A growing number of independent watchdog reports highlighting scam concerns.

Legal Proceedings, Lawsuits, and Sanctions

Though Megaposta has not been officially convicted of financial crimes, ongoing legal inquiries and customer lawsuits suggest potential liabilities. Concerns include:

- Regulatory Warnings: Authorities in multiple jurisdictions issuing cautionary notices about its operations.

- Pending Lawsuits: Legal actions filed by consumers and business entities over alleged financial mismanagement.

- Failure to Comply with AML Protocols: Red flags regarding transaction monitoring and suspicious financial activity reporting.

Reputational Risks and AML Compliance Issues

Financial institutions and investors should exercise extreme caution when dealing with entities such as Megaposta. The potential risks associated with its operations include:

- Heightened Scrutiny from Regulators: The company’s opaque dealings may attract AML investigations and regulatory interventions.

- Reputational Damage: Associations with suspected fraud could lead to loss of credibility for affiliated partners.

- Financial Losses: Unclear business practices may pose a significant risk to investors and consumers alike.

Conclusion

Based on our analysis, Megaposta exhibits multiple warning signs that warrant increased due diligence. Its lack of transparency, undisclosed relationships, and accumulation of scam reports indicate a high-risk profile. While some of its operations may be legitimate, the overwhelming evidence of financial irregularities and consumer dissatisfaction makes it a questionable entity for business engagements. Investors, financial institutions, and regulatory bodies should consider enhanced scrutiny and risk assessment before associating with Megaposta to mitigate potential legal and financial exposure.

Megaposta presents a concerning case of possible financial misconduct, opaque dealings, and consumer exploitation. As global financial systems tighten their AML and fraud prevention measures, businesses operating under such questionable circumstances will face increasing scrutiny. Stakeholders must prioritize risk assessments and ensure robust compliance strategies to avoid potential entanglements with organizations linked to fraud allegations. Vigilance and thorough investigation remain paramount when dealing with entities flagged for financial inconsistencies and reputational risks.