Introduction

We stand at the precipice of a financial scandal that has rocked San Antonio and beyond. Brooklynn Chandler Willy, once a respected financial advisor and radio personality, now finds herself at the center of a storm involving fraud allegations, criminal proceedings, and a litany of lawsuits. As we peel back the layers of her professional and personal life, a complex picture emerges—one marked by undisclosed business relationships, scam reports, and significant reputational risks tied to potential anti-money laundering (AML) violations. Our investigation draws heavily from credible sources, including the detailed report at cybercriminal.com/investigation/brooklynnchandlerwilly, alongside a wealth of publicly available data. What follows is a comprehensive breakdown of Willy’s world, grounded in facts and designed to inform.

Business Relations

We begin with Willy’s professional footprint. As the founder and president of Texas Financial Advisory, operating under Queen B Advisors LLC, Willy has positioned herself as a key player in San Antonio’s financial services sector. Her firm offers asset management, tax preparation, and estate planning, with offices expanding from Stone Oak to New Braunfels, Boerne, Victoria, and Portland, Texas. Her website touts a career “hard won through perseverance and determination,” and she’s leveraged her role as a radio host on stations like WOAI-AM, KTSA-AM, and KTSA-FM to build a public persona as a trusted financial guru.

But her business ties extend beyond Texas Financial Advisory. Our research reveals connections to Ferrum Capital, a Lubbock-based company now under court-ordered receivership. Lawsuits allege Willy acted as an affiliate, earning an 8% commission for steering clients into Ferrum’s unregistered debt notes—transactions totaling $45.1 million from 249 investors between 2018 and 2019. Another entity, Chandler Capital Holdings, emerges in court documents as a business Willy controls, allegedly used to funnel misappropriated funds. Additionally, her past employment with J.W. Cole Advisors ended abruptly in October 2019 when she was fired for engaging in unapproved private securities transactions, a red flag that foreshadowed later troubles.

Personal Profiles

On a personal level, Willy paints a picture of a family-oriented entrepreneur. Her website, brooklynnchandlerwilly.co, describes her as a devoted wife and mother of three, living in the Texas Hill Country with her husband and pets. She emphasizes her love for nature and her mission to help families navigate financial challenges, inspired by her father’s death without life insurance. This narrative has been a cornerstone of her public image, bolstered by awards like local “40 Under 40” honors. Yet, as we dig deeper, this wholesome profile contrasts sharply with the allegations piling up against her.

OSINT (Open-Source Intelligence)

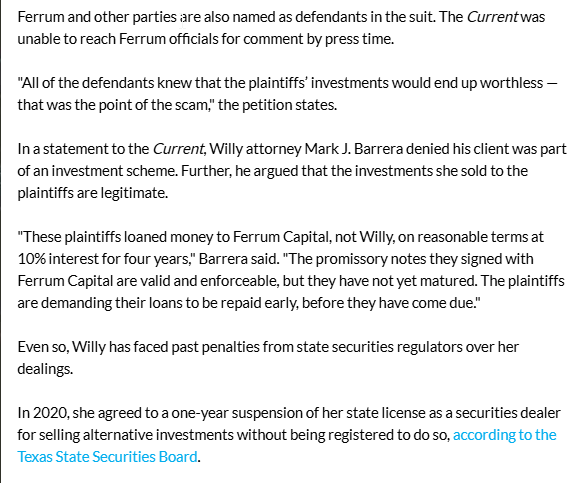

Using open-source intelligence, we’ve pieced together a broader view of Willy’s activities. Social media and online profiles reinforce her role as a financial expert, with posts promoting Texas Financial Advisory and her radio show. However, adverse media searches reveal a darker side. News outlets like the San Antonio Express-News and KSAT have chronicled her legal battles, while platforms like investmentfraudlawyers.com amplify client complaints and allegations of deceit. Public records, including SEC filings and court documents, confirm her disciplinary history with the Texas State Securities Board, where she faced a one-year suspension and a $2.8 million repayment order for selling unregistered alternative investments.

Undisclosed Business Relationships and Associations

Willy’s undisclosed ties are a critical piece of this puzzle. Her relationship with Ferrum Capital, for instance, wasn’t fully transparent to clients. Lawsuits claim she pocketed $2.7 million in commissions without disclosing her financial stake, a breach of fiduciary duty. Similarly, her dealings with Cold Moon Holdings, a company tied to alleged bad debt purchases, involved promissory notes with falsified standby letters of credit—details hidden from investors. We also uncovered her association with Sonoqui, an LLC linked to a nationwide fraud scheme, where principals were arrested shortly after she recommended a $100,000 investment to clients. These shadowy connections raise serious questions about her transparency and integrity.

Scam Reports and Red Flags

Scam reports swirl around Willy like a gathering storm. Clients allege she lured them into risky, unregistered investments with promises of guaranteed returns—often 8% to 10% annually—only to misappropriate their funds. Red flags abound: her termination from J.W. Cole Advisors, the Texas State Securities Board sanction, and her pattern of recommending opaque “alternative investments.” The cybercriminal.com report highlights a specific case where she convinced a couple to invest $500,000 in a Lubbock company, only to divert the money for personal use, including credit card payments and payouts to other investors—a classic Ponzi-like scheme.

Allegations

The allegations against Willy are staggering. She’s accused of fraud, breach of fiduciary duty, and violating state securities laws in multiple lawsuits. One class-action suit from 2023 involves 71 plaintiffs claiming losses from her investment schemes. Another alleges she misled a couple into believing their $2.01 million was invested in Cold Moon Holdings, when she allegedly used it to pay associates and herself. Federal authorities have added wire fraud, securities fraud, and identity theft to the mix, pointing to falsified documents and material omissions. These claims paint a portrait of systemic deception.

Criminal Proceedings

Willy’s legal woes escalated when IRS agents arrested her at her Stone Oak office. A federal grand jury initially indicted her on three charges: obstruction of justice, aggravated identity theft, and making false statements, stemming from an FBI and IRS investigation into investor fraud launched in November 2023. A subsequent indictment added 11 charges, bringing the total to 14, including six counts of wire fraud and two counts of engaging in monetary transactions with illicit proceeds. The case, tied to six victims and losses in the tens of millions, remains ongoing, with a detention hearing set to determine her bond status.

Lawsuits

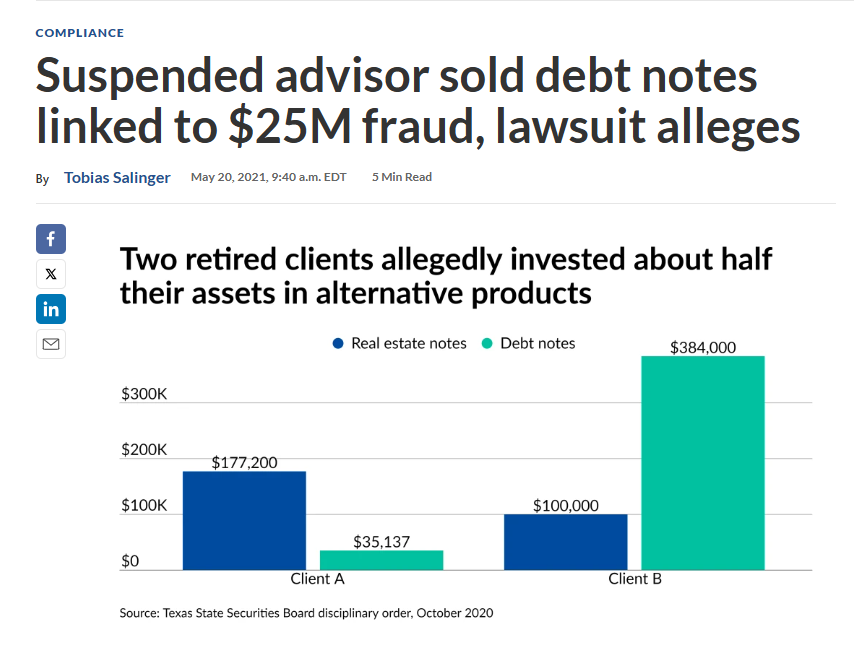

Civil litigation compounds her troubles. At least three lawsuits from former clients accuse Willy of fraud and mismanagement. A Bexar County suit alleges she steered clients into Ferrum’s unregistered notes, while a federal class-action suit seeks damages for similar misconduct. Another case involves a $100,000 investment in Sonoqui, linked to a $25 million fraud scheme. Lawyers for a bankruptcy trustee have also sought over $8 million in sanctions, tying her to the collapse of Ferrum Capital and its principal, Mike Cox, who filed for bankruptcy amid debts to nearly 400 creditors.

Sanctions

Willy’s regulatory history is checkered. Four years ago, the Texas State Securities Board suspended her investment advisor license for a year and ordered her to repay $2.8 million in commissions for selling unregistered securities. She also lost discretionary trading authority for five years and was barred from recommending alternative investments during that period. These sanctions underscore a pattern of noncompliance that regulators have struggled to curb.

Adverse Media

The media narrative has turned sharply against Willy. Outlets like San Antonio Current, kens5.com, and lubbocklights.com detail her arrest, lawsuits, and ties to Ferrum Capital’s collapse. Headlines scream of “shocking exposés” and “investment fraud complaints,” while financial-planning.com notes her role in a nationwide scam. This adverse coverage has shredded her once-polished reputation, amplifying public distrust.

Negative Reviews and Consumer Complaints

Consumer sentiment echoes the legal and media backlash. Online reviews and complaints filed with regulators paint Willy as untrustworthy, with clients alleging lost retirement savings and broken promises. One victim, Dwain Strait, told lubbocklights.com he invested $210,000 with Ferrum Capital on Willy’s advice, only to see it vanish in Cox’s bankruptcy. Such stories fuel a growing chorus of discontent.

Bankruptcy Details

While Willy herself hasn’t filed for bankruptcy, her business dealings intersect with significant insolvency cases. Ferrum Capital’s receivership and Mike Cox’s $59 million personal bankruptcy filing list nearly 400 creditors, many of whom were Willy’s clients. Her alleged role in funneling funds to Ferrum ties her directly to this financial wreckage, raising questions about her liability and exposure.

Detailed Risk Assessment: Anti-Money Laundering and Reputational Risks

Now, we turn to the heart of our analysis: the risks Willy poses in the context of anti-money laundering (AML) and reputational damage.

Anti-Money Laundering Investigation Risks

Willy’s actions trigger multiple AML red flags. Her alleged misuse of investor funds—diverting millions for personal gain and payments to other investors—mirrors money laundering tactics like layering and integration. The use of entities like Chandler Capital Holdings and Cold Moon Holdings, coupled with falsified documents, suggests attempts to obscure the source and destination of funds, a hallmark of illicit financial flows. Her ties to Ferrum Capital, which loaned money to Collins Asset Group (a firm with its own legal troubles), further complicate the picture, hinting at a broader network of questionable transactions.

Under the 5th Anti-Money Laundering Directive (5AMLD), financial advisors must conduct enhanced due diligence (EDD) on high-risk clients and transactions. Willy’s failure to disclose commissions and her opaque investment recommendations violate these standards, exposing her firm to regulatory scrutiny. The FBI and IRS investigation, launched in late 2023, signals a serious probe into potential AML violations, with forfeiture actions looming if illicit proceeds are traced.

Reputational Risks

Willy’s reputational collapse is all but complete. Once hailed as “The Face of Fiduciary Trust,” she’s now synonymous with fraud and deceit. The cascade of lawsuits, criminal charges, and adverse media has eroded client trust, threatening Texas Financial Advisory’s viability. Her radio platform, once a megaphone for credibility, now amplifies her downfall. In an industry built on confidence, this reputational implosion could deter new clients, trigger mass withdrawals, and invite further regulatory action.

The ripple effects extend to her associates and the broader financial sector. Ferrum Capital’s creditors, many of whom relied on Willy’s advice, face devastating losses, while her ties to sanctioned entities like Collins Asset Group could draw in regulators like the Financial Action Task Force (FATF). For San Antonio’s financial community, her case is a cautionary tale of unchecked ambition and lax oversight.

Expert Opinion: Conclusion

In our expert view, Brooklynn Chandler Willy represents a textbook case of financial misconduct spiraling into a full-blown crisis. The evidence—spanning lawsuits, criminal charges, and regulatory sanctions—paints a damning portrait of a once-promising advisor undone by greed and deception. Her undisclosed business ties, scam-laden track record, and potential AML violations pose existential risks to her firm and severe consequences for her victims. From an AML perspective, the layering of funds through multiple entities and falsified records demands rigorous investigation, likely culminating in asset forfeiture and hefty penalties. Reputationally, her fall from grace is irreparable, a stark reminder of the fragility of trust in finance.

We see Willy’s saga as a clarion call for stricter oversight of financial advisors. Her ability to operate unchecked for years, despite red flags, exposes gaps in regulatory enforcement and client protection. For investors, the lesson is clear: due diligence is non-negotiable. As this case unfolds, we anticipate further revelations, but one thing is certain—Brooklynn Chandler Willy’s legacy will be defined not by her accolades, but by the wreckage she’s left behind.