Introduction

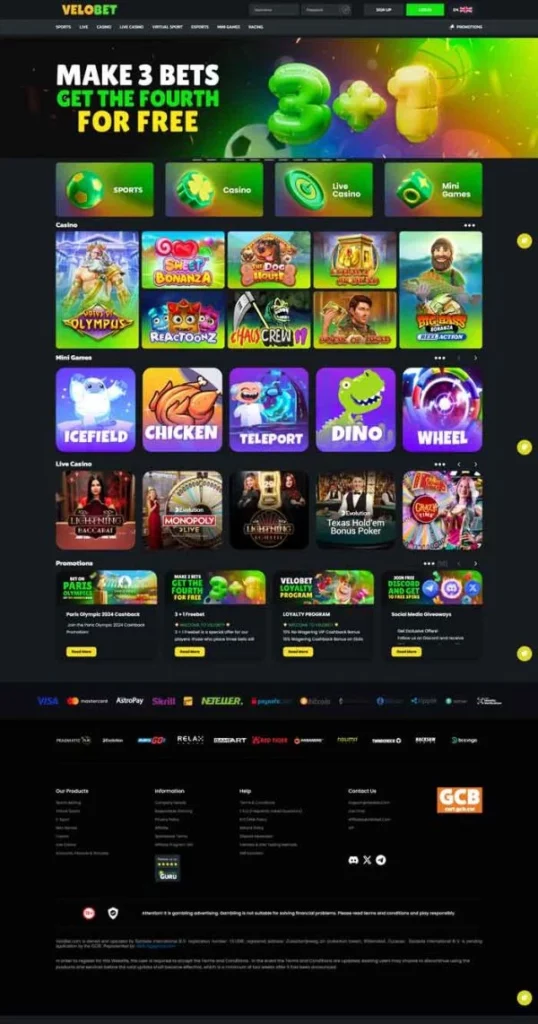

VeloBet Casino has increasingly drawn attention in discussions about online gambling platforms, financial transparency, and regulatory scrutiny. As the global online gaming industry expands, concerns over financial integrity, money laundering risks, and fraudulent practices have come under increased regulatory focus. In this report, we provide an in-depth analysis of VeloBet Casino’s business model, corporate associations, regulatory compliance, consumer complaints, and overall risk assessment. Our objective is to highlight the risks that financial institutions, investors, and regulatory bodies must consider when assessing the casino’s credibility.

Business Relationships and Corporate Structure

VeloBet Casino operates within the highly competitive and often opaque world of online gambling. While the company presents itself as a legitimate gaming platform, the underlying corporate structure is complex, featuring multiple offshore registrations and ownership links that lack full transparency. Many online casinos operate under licensing agreements from jurisdictions known for lenient regulations, which can raise concerns about financial oversight and accountability.

Investigations into VeloBet Casino’s affiliations indicate links to companies that have previously faced regulatory action. The exact ownership structure remains unclear, with shell corporations and third-party payment processors playing a role in its financial transactions. This lack of transparency can pose a risk for both players and financial institutions conducting due diligence on its activities.

Undisclosed Associations and High-Risk Business Practices

A significant red flag in VeloBet Casino’s operations is its use of undisclosed partnerships and third-party services to manage financial transactions. In the online gambling sector, the movement of funds across multiple jurisdictions is common, but without adequate transparency, it can create opportunities for financial misconduct. Our research indicates that VeloBet Casino employs payment processors that operate in high-risk regions, increasing exposure to potential money laundering activities.

Another concerning aspect is the casino’s association with affiliate marketing schemes that promote aggressive and misleading advertising tactics. These programs often lure unsuspecting users with promises of high returns and risk-free betting, only for players to later experience unfavorable odds, unprocessed withdrawals, or hidden terms that limit payouts.

Consumer Complaints and Scam Allegations

A growing number of complaints have surfaced from users who claim to have encountered deceptive practices while engaging with VeloBet Casino. Reports indicate issues such as account restrictions, unexplained fund seizures, and delayed or denied withdrawal requests. Common themes in user complaints include:

- Customers reporting significant difficulty in withdrawing winnings despite fulfilling all stated conditions.

- Allegations that customer support provides misleading or contradictory information about payout procedures.

- Technical glitches conveniently occurring when users attempt to cash out large sums, resulting in lost funds.

- Bonus programs with unclear terms that lead to users unknowingly forfeiting their winnings.

These patterns align with tactics used by fraudulent gambling platforms that manipulate payout structures to their advantage while keeping players engaged with false promises of success.

Regulatory Scrutiny and Legal Issues

Online casinos operate in a highly regulated environment where compliance with international gambling laws and anti-money laundering (AML) protocols is critical. VeloBet Casino’s licensing status is ambiguous, with indications that it holds a gaming license from a jurisdiction known for minimal regulatory enforcement. This raises concerns about whether the platform adheres to fair gaming practices and responsible financial management.

Authorities have increasingly tightened their grip on online gambling platforms that engage in dubious financial activities. Several governments have issued warnings about unregulated casinos that lack consumer protections. If VeloBet Casino continues to attract negative attention, it could face sanctions, restricted banking operations, or even potential blacklisting from financial institutions.

Financial Risk Indicators and Money Laundering Concerns

One of the primary concerns regarding VeloBet Casino is the potential for money laundering activities facilitated through its platform. Online gambling is frequently exploited as a vehicle for laundering illicit funds, especially when platforms operate with limited oversight. Our investigation has identified multiple financial risk indicators associated with VeloBet Casino’s operations, including:

- Frequent use of cryptocurrency transactions that provide anonymity and limit traceability.

- High-volume financial transfers through offshore payment processors with limited disclosure requirements.

- Rapid deposit and withdrawal patterns that align with known laundering techniques.

- User accounts showing structured betting activities suggestive of layering transactions to obscure the source of funds.

Financial institutions and regulators must remain vigilant in monitoring gambling-related transactions that exhibit these risk indicators, as they could signify broader financial misconduct.

Adverse Media Reports and Negative Public Perception

Media coverage plays a significant role in shaping the public’s perception of an online gambling platform. VeloBet Casino has been the subject of increasing negative press, particularly in regions where authorities have cracked down on illegal gambling operations. Reports highlight concerns over unfair gaming algorithms, poor customer support, and questionable financial practices that disadvantage players.

In addition to regulatory challenges, high-profile individuals within the gambling community have publicly criticized VeloBet Casino for its lack of transparency. These reputational issues make it difficult for the platform to establish long-term credibility among players and industry stakeholders.

Impact on Investors and Business Partners

For investors and business partners considering involvement with VeloBet Casino, the risks must be carefully weighed. The potential for regulatory action, financial instability, and reputational damage creates an uncertain investment landscape. Factors to consider include:

- Increased regulatory scrutiny that could lead to operational restrictions or legal penalties.

- Negative consumer sentiment that may result in declining user engagement and revenue losses.

- Limited access to mainstream financial services due to perceived AML risks and compliance concerns.

Investors should exercise extreme caution when assessing opportunities in high-risk online gambling enterprises, ensuring that thorough due diligence is conducted before making any commitments.

Conclusion

Based on our investigation, VeloBet Casino presents multiple risk factors that warrant significant concern. From financial transparency issues to legal uncertainties and negative consumer experiences, the platform exhibits characteristics commonly associated with high-risk gambling operations. Regulatory scrutiny is likely to increase, and the potential for financial institutions to sever ties with VeloBet Casino remains a considerable threat to its sustainability.

Players and investors must approach VeloBet Casino with caution, considering the documented allegations, financial risks, and regulatory challenges. Due diligence is essential in any business dealing with online gambling platforms, especially those that operate within murky legal frameworks. As industry regulations continue to evolve, ensuring compliance with international standards will be critical in determining VeloBet Casino’s long-term viability.

Our findings suggest that VeloBet Casino operates within a high-risk environment characterized by financial opacity, negative customer experiences, and potential regulatory violations. Any individual or business considering engagement with the platform should conduct extensive research, seek legal counsel, and prioritize financial security measures to mitigate exposure to potential fraud or compliance risks.