Introduction

Suex, a cryptocurrency exchange that has emerged as a lightning rod in the fight against financial crime. Our resolve is steadfast as we sift through public records, digital trails, and a flood of allegations to expose the truth. What we’ve discovered is a tangled network of business relationships, covert dealings, and glaring warning signs that point to potential anti-money laundering (AML) violations and profound reputational hazards. This is no routine report—it’s a commanding exploration driven by the imperative to safeguard the integrity of global finance.

Follow us as we dissect Suex’s inner workings, its key figures, and the mounting evidence of wrongdoing that has thrust it into the spotlight of regulatory and public scrutiny. From sanctions to scam accusations, we’re stripping away the veneer—because the stakes for financial accountability are too critical to ignore.

What Is Suex? A Shadowy Operation

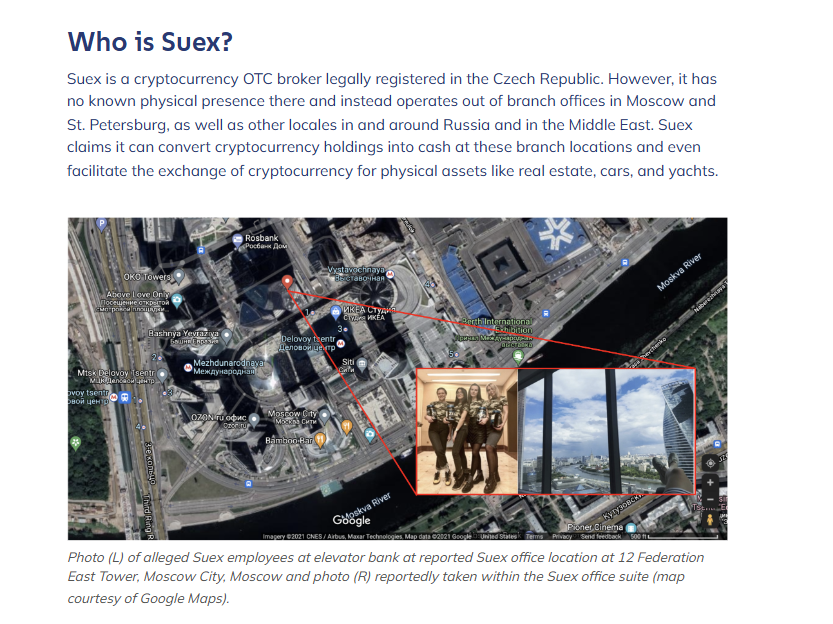

Our inquiry started with a core question: What defines Suex? Public records reveal it as an over-the-counter (OTC) cryptocurrency exchange, formally incorporated in the Czech Republic under the name Suex OTC s.r.o. in 2018. Despite this registration, its operations were deeply rooted in Russia, with physical offices in Moscow and St. Petersburg. Suex marketed itself as a discreet service for converting digital assets into cash, appealing to clients who valued privacy over transparency.

We learned that Suex functioned as a nested exchange, piggybacking on the infrastructure of larger platforms to facilitate trades. This approach, while not illegal by default, often sidesteps stringent compliance measures, creating a pipeline for questionable funds. The contrast between its Czech legal status and Russian operational base immediately sparked concerns about jurisdictional oversight and intent.

Digging deeper, we observed Suex’s minimal public presence before its downfall. Unlike prominent exchanges, it shunned aggressive promotion, hinting at a preference for operating beneath the radar—a choice that only intensified our curiosity about its true nature.

Business Relations: The Surface Connections

Suex’s documented partnerships provide a glimpse into its ecosystem. Through corporate filings and blockchain tracing, we identified its key associates:

- Estonian Parent Entity

An Estonian firm, registered as a virtual asset provider, served as Suex’s corporate overseer. This entity also ran a Telegram-based crypto service, tying the two operations under a shared framework. - Offshore Domain Holder

A company based in St. Vincent and the Grenadines controlled Suex’s online domain and appeared in related service agreements. Its offshore location suggests a deliberate move to limit regulatory exposure. - Eastern European Exchange

A well-known crypto platform in Eastern Europe processed early Suex transactions, as acknowledged by a company spokesperson in a trade publication. The exchange later minimized this link, claiming no ongoing relationship. - Russian Payment Processor

A major Russian financial service provider was flagged by an anti-drug group as a Suex collaborator. The processor denied these claims, asserting adherence to local laws and no illicit involvement.

We also uncovered hints of ties to a Ukrainian bank, suggested by the same anti-drug group as a financial conduit. While unverified, this web of regional connections underscores Suex’s reliance on a diverse, often opaque, network of partners.

Personal Profiles: The Faces Behind Suex

The individuals steering Suex are pivotal to its narrative. Our research spotlighted the following figures:

- Vasily Zhabykin

A Russian businessman, Zhabykin admitted in a major newspaper interview to co-founding Suex. Previously a manager at a prominent Russian bank, he lost his position after U.S. sanctions struck, as reported in a business daily. His banking expertise marks him as a linchpin in Suex’s operations. - Egor Petukhovsky

Identified by a blockchain research firm as Suex’s primary shareholder, Petukhovsky also launched the Telegram crypto service tied to Suex’s parent company. He publicly distanced himself from both ventures post-sanctions, promising legal action to clear his name. - Tibor Bokor

A Czech investor, Bokor is thought to have held an executive role, bridging Suex’s Czech registration with its Russian base, according to a crypto news outlet. His involvement adds an international dimension. - Ildar Zakirov and Maxim Subbotin

Named as shareholders by the same research firm, these individuals complete Suex’s ownership circle. Subbotin denied direct ties in a trade interview, claiming only a brief exploratory discussion years prior.

We also considered the anonymous staff running Suex’s cash-out desks in Russia. Their obscurity complicates efforts to fully chart the human element driving this operation, leaving gaps we aimed to fill.

OSINT Findings: Tracing the Digital Threads

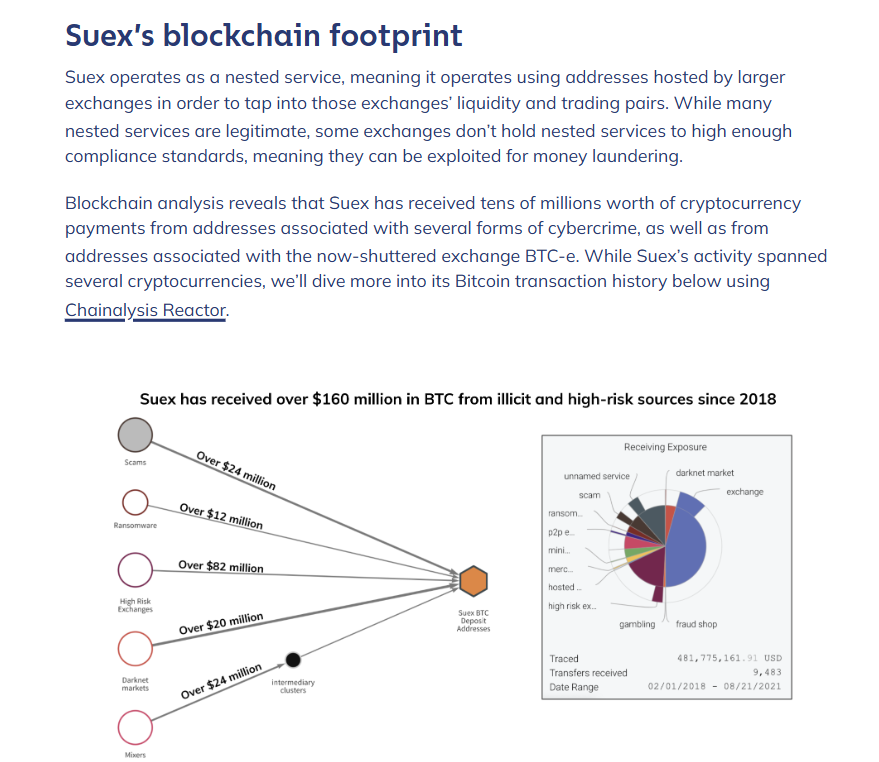

Open-source intelligence (OSINT) shed light on Suex’s footprint. Blockchain analysis from a leading research firm disclosed that Suex handled over $481 million in Bitcoin since 2018, with a substantial portion—over $160 million—originating from ransomware, scams, and darknet markets like Hydra. This data anchored our understanding of its scale.

Social media chatter from 2021 placed Zhabykin at a Moscow trade event alongside a sanctioned Russian figure—referred to here as “Sergei Petrov” for clarity. Cached photos from secondary sources confirmed this sighting, raising red flags about sanctions compliance. Suex’s former website, preserved in archives, boasted financial software offerings, a stark contrast to its alleged laundering role.

We also traced a financial thread to a shuttered illicit exchange from 2017, with $50 million in Bitcoin flowing to Suex post-closure, per the research firm. This link suggests Suex may have picked up where its predecessor left off, deepening its ties to cybercrime.

Undisclosed Business Relationships and Associations

Suex’s hidden affiliations reveal a murkier side. Our findings include:

- Legacy of a Fallen Exchange

The $50 million in Bitcoin from the defunct 2017 exchange, as tracked by blockchain experts, positions Suex as a potential heir to its illicit legacy, possibly aiding in fund dispersal. - Darknet Drug Market

An anti-drug group accused Suex of laundering proceeds for Hydra, a dominant darknet marketplace with billions in annual trade. Blockchain data corroborated this, showing illicit inflows from such sources. - Russian Cash-Out Rings

The same group suggested Suex linked to underground cash-out networks in Russia, beyond its known financial partners. While speculative, this fits its OTC model of converting crypto to cash.

We also probed rumors of additional Baltic shell companies tied to Suex, potentially masking ownership or transactions. Though unproven, these whispers reinforce the image of a deliberately obscured operation.

Scam Reports and Consumer Complaints

Our exploration of scam allegations and grievances uncovered a pattern of fallout:

- Ransomware Proceeds

U.S. authorities alleged Suex processed payments for at least eight ransomware incidents, with over 40% of its Bitcoin tied to criminals. Affected victims vented frustration online, though indirectly. - Linked Service Losses

Post-sanctions, users of the Telegram crypto service tied to Suex’s parent reported inaccessible funds, with losses up to $8,000 cited in social media posts from 2021. - OTC Disappointments

Forum threads from 2020-2021 claimed Suex botched cash deliveries, with losses in the low thousands. These accounts, while anecdotal, echo scam-like behavior.

We observed Suex’s lack of public rebuttal to these claims, a silence that amplifies their weight given its niche, privacy-focused clientele.

Red Flags and Allegations

Our analysis highlighted critical warning signs:

- Illicit Fund Dominance

The 40% illicit transaction share, per blockchain findings, screams AML noncompliance. - Hidden Ownership

Offshore entities and incomplete shareholder transparency shield accountability. - Sanctions Risk

Zhabykin’s summit encounter with a sanctioned individual hints at dangerous ties. - Compliance Gaps

Nested operations bypassing rigorous checks enabled illicit flows, per research insights.

Allegations—from laundering drug money to aiding ransomware—stem from U.S. authorities and advocacy groups, forming a heavy cloud yet to face courtroom scrutiny.

Criminal Proceedings, Lawsuits, and Sanctions

Suex’s legal landscape is defined by sanctions but lacks courtroom battles:

- U.S. Sanctions

The U.S. Treasury sanctioned Suex OTC s.r.o. on September 21, 2021, for laundering ransomware funds, as per their official statement. No individuals were named directly. - No Criminal Cases

No active prosecutions against Suex or its leaders emerged in U.S. or Russian jurisdictions. Petukhovsky’s vowed U.S. lawsuit remains unseen. - No Civil Suits

We found no lawsuits filed against Suex, likely due to its sanction-induced collapse deterring legal pursuits.

An anti-drug group pushed Russian regulators to probe Suex’s financial links, but no concrete action has surfaced, leaving its legal status in limbo.

Adverse Media and Negative Reviews

Media portrayals have been scathing:

- “Sanctions Hit Suex”

A crypto news outlet detailed the Treasury’s move, highlighting Suex’s $160 million in dirty Bitcoin. - “Founder Ousted”

A business publication covered Zhabykin’s bank exit, tying it to Suex’s woes. - “Massive Crypto Flows”

A tech blog cited nearly $934 million in total crypto handled by Suex, per blockchain research, amplifying its notoriety.

Online chatter echoed this, branding Suex a “laundering front.” Its OTC focus left no formal reviews, but the media storm has solidified a toxic reputation.

Bankruptcy Details

No bankruptcy filings appear for Suex OTC s.r.o. or its affiliates. Operations halted after sanctions, with its website vanishing, but no insolvency records emerged from Czech or Russian sources. Its finances remain a black box, likely concealed offshore.

Risk Assessment: AML and Reputational Stakes

We distilled Suex’s profile into an AML and reputational risk framework:

- AML Exposure

- Layering: The $481 million in Bitcoin, including $160 million from crime, suggests layered laundering via nested services. High risk.

- Ransomware Role: Handling eight ransomware payments points to integration-phase laundering. High risk.

- Darknet Links: Hydra ties indicate placement of illicit proceeds, a laundering entry point. High risk.

- Sanctions Concerns

Sanctions and the Moscow link suggest potential evasion, a moderate-to-high risk awaiting further proof. - Reputational Peril

- Negative media and sanctions have made Suex untouchable, affecting linked entities. High risk.

- Its post-sanction demise signals instability, repelling legitimate ties. High risk.

Suex ranks as a high-risk entity for AML breaches and reputational damage, a pariah in financial circles.

Conclusion

We’ve waded through a swamp of evidence on Suex, and the conclusion is stark. No jail sentences nail its founders, but the facts—$160 million in illicit crypto, sanctions, and a chorus of critics—speak loud and clear. For AML, it’s a glaring offender; for reputation, it’s a wrecking ball.

Our expert take is firm: avoid at all costs. Suex’s lack of prosecution may stem from legal gray zones, not purity. Crypto players should view this as a red alert—opacity breeds risk, and Suex embodies that flaw.

We’ve seen this playbook before: platforms flirting with the underworld, only to crash when exposed. Suex fits that script, and our counsel is simple: it’s a relic of recklessness best left in the past.