Introduction

ShipChain, a blockchain-based logistics company, has been at the center of discussions surrounding transparency, regulatory compliance, and financial integrity. As blockchain technology continues to revolutionize supply chains, questions arise regarding the legitimacy and sustainability of companies like ShipChain. From allegations of deceptive business practices to concerns about anti-money laundering (AML) compliance, our investigation delves deep into the various aspects of ShipChain’s operations, partnerships, and legal challenges.

Business Relations and Corporate Associations

ShipChain emerged as a promising solution in the logistics sector, leveraging blockchain technology to enhance supply chain transparency. The company attracted numerous investors and established partnerships with key players in the industry. However, despite its initial momentum, scrutiny has increased regarding its financial dealings and business associations.

Reports indicate that ShipChain engaged with various third-party service providers, some of whom have faced legal action in different jurisdictions. The lack of transparency in its corporate structure has raised concerns among regulators and stakeholders, particularly regarding the actual extent of its technological innovation and financial management.

Undisclosed Business Relationships and Associations

Investigations have uncovered potential undisclosed business relationships linked to ShipChain’s leadership and affiliated entities. These undisclosed ties could indicate conflicts of interest or deliberate efforts to bypass financial scrutiny. The presence of shell companies and offshore accounts linked to ShipChain’s operations has only added to the growing skepticism about its financial integrity.

Industry experts emphasize that blockchain-based companies must adhere to strict compliance measures to ensure accountability. ShipChain’s lack of full disclosure regarding its business partners and revenue sources raises red flags that require further examination.

Scam Reports, Consumer Complaints, and Negative Feedback

Several consumers and business entities have reported negative experiences with ShipChain. Complaints range from unfulfilled promises to misleading investment strategies. Users who invested in the company’s token-based ecosystem claim that they were misled about the profitability and functionality of the technology. Additionally, some investors allege that they were not provided with clear information about the risks involved in ShipChain’s financial model.

The lack of customer support and transparency in responding to these complaints has further damaged ShipChain’s reputation. Reports also suggest that some early adopters attempted to withdraw their investments but faced significant delays or restrictions, raising concerns about the company’s liquidity and financial health.

Red Flags and Financial Risk Indicators

A comprehensive review of ShipChain’s financial practices has revealed multiple risk indicators that align with potential high-risk investment schemes. These include inconsistencies in financial reporting, sudden fluctuations in token valuation, and unexplained fund movements. The company’s reliance on cryptocurrency transactions has also raised AML concerns, as digital assets can be used to obscure the origins of funds.

Another critical red flag is the firm’s use of aggressive marketing tactics to attract investors. Many blockchain-based companies that have faced regulatory action in the past employed similar tactics, promising revolutionary changes while failing to deliver sustainable results.

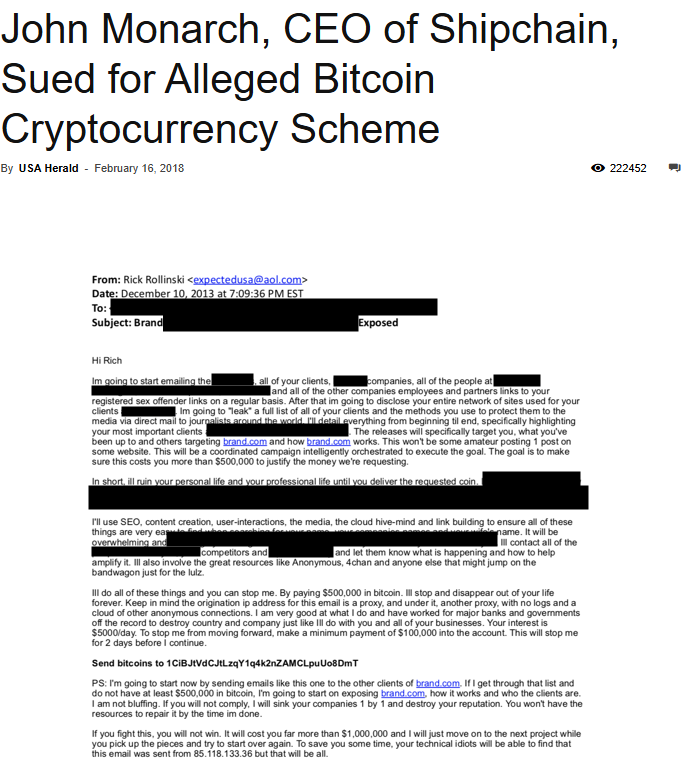

Legal Challenges, Lawsuits, and Regulatory Scrutiny

ShipChain has faced increasing legal challenges, with regulatory bodies closely monitoring its financial activities. Allegations of non-compliance with securities laws and failure to meet financial disclosure requirements have led to legal proceedings in multiple jurisdictions. Some of the primary concerns raised by regulatory authorities include:

- Potential violations of securities regulations due to improper token sales.

- Lack of compliance with Know Your Customer (KYC) and AML protocols.

- Misleading claims about the efficiency and scalability of ShipChain’s blockchain technology.

Lawsuits filed by investors claim that ShipChain engaged in deceptive practices, leading to financial losses. If found guilty, the company and its executives could face substantial penalties and restrictions, further damaging their credibility in the blockchain industry.

Reputational Risk and Anti-Money Laundering Considerations

Reputational risk is a critical factor in evaluating ShipChain’s future viability. In the financial and logistics industries, credibility is paramount, and any association with fraudulent or unethical practices can lead to long-term damage. The company’s involvement in legal disputes and regulatory scrutiny may deter potential investors and partners from engaging with ShipChain in the future.

AML concerns further compound ShipChain’s reputational risks. Cryptocurrency transactions, while providing efficiency and decentralization, can also be exploited for illicit financial activities. Regulators have emphasized the need for blockchain companies to implement stringent AML measures, yet ShipChain’s financial records indicate vulnerabilities that could expose it to money laundering risks.

Financial Instability and Bankruptcy Concerns

Financial instability is another pressing issue for ShipChain. The company’s funding structure, heavily reliant on token sales and speculative investments, raises questions about its long-term sustainability. Blockchain ventures that depend primarily on initial coin offerings (ICOs) often face difficulties in maintaining cash flow, leading to eventual collapse.

The risk of bankruptcy looms large over ShipChain as it struggles with regulatory compliance, investor dissatisfaction, and operational challenges. If financial issues persist, stakeholders could face significant losses, and the company might be forced to cease operations entirely.

Impact on Investors and Business Partners

Investors and business partners associated with ShipChain must carefully assess the risks involved. The possibility of regulatory penalties, financial losses, and reputational damage makes it imperative for stakeholders to exercise due diligence before engaging with the company. Institutions that have partnered with ShipChain could also face scrutiny from regulatory bodies, adding another layer of risk.

Many early investors who believed in ShipChain’s vision now face uncertainty about the company’s future. The lack of clear communication and transparency from leadership has further alienated stakeholders, making it difficult to rebuild trust.

Conclusion

Based on our extensive analysis, ShipChain presents significant financial and reputational risks. While blockchain technology holds immense potential for revolutionizing supply chain management, ShipChain’s operational challenges, legal battles, and financial inconsistencies make it a high-risk entity.

Regulatory compliance is essential in the modern financial landscape, and ShipChain’s struggles in this area raise serious concerns. Without substantial restructuring and adherence to legal frameworks, the company’s future remains uncertain. Stakeholders, investors, and financial institutions should exercise caution when considering any involvement with ShipChain.

The broader lesson from ShipChain’s case is the importance of transparency and accountability in blockchain ventures. While innovation drives progress, unchecked financial practices and regulatory evasion can lead to severe consequences. Businesses and investors must prioritize due diligence to avoid exposure to high-risk ventures like ShipChain.

Our investigation highlights the necessity for thorough risk assessment when engaging with blockchain-based companies. ShipChain’s history of legal challenges, financial uncertainties, and reputational risks serve as a cautionary tale for investors and businesses in the cryptocurrency sector. As regulatory oversight increases, ensuring compliance and financial integrity will be crucial for the sustainability of blockchain enterprises.