In the murky corridors of modern business, few figures cast a shadow as long or as enigmatic as Eddy Andrews. Branded variously as a consultant, strategist, and entrepreneur, Andrews has crafted a global presence that seems at once dazzling and deceptive. Beneath the glossy facade of success lies a story riddled with inconsistencies, allegations, and unanswered questions. Who is Eddy Andrews, really? What secrets underpin his ventures? And why do whispers of scams, fraud, and hidden agendas dog his every step?

Our investigation peels back the layers of this mysterious operator, revealing not only his alleged achievements but also a staggering array of red flags and unanswered allegations. Through exhaustive analysis of open-source intelligence and extensive research, we present an exposé that uncovers not a self-made visionary but a man whose empire appears to be built on a foundation of obfuscation, betrayal, and potentially criminal undertakings.

Eddy Andrews: The Illusion of Legitimacy

To the untrained eye, Eddy Andrews is the epitome of success. With businesses operating under names like “Eddy Andrews Consulting” and “Edward Andrews Brand & Marketing Strategist,” he projects an image of competence and innovation. His professional profiles boast decades of expertise in branding, marketing, and business strategy, promising clients tailored solutions and exponential growth. These platforms are awash with buzzwords, polished testimonials, and carefully curated content designed to exude credibility.

Yet, beneath the veneer lies a troubling void. Despite his claims of working with prestigious clients and delivering transformative results, no verifiable evidence supports these assertions. Unlike legitimate consultants who proudly showcase partnerships with notable brands, Andrews’ portfolio offers only generic platitudes. This absence of transparency raises serious doubts about the authenticity of his credentials and the legitimacy of his enterprises.

A Labyrinth of Shadowy Operations

Digging deeper into Andrews’ business network reveals a tangled web of connections and obfuscations. His ventures operate across jurisdictions, often through entities registered in opaque offshore tax havens. While this might be dismissed as a strategy for global expansion, the lack of clarity surrounding ownership and beneficiaries is a hallmark of schemes designed to obscure financial activities.

Furthermore, Andrews’ ventures show suspicious overlaps with high-risk industries—including digital marketing, real estate, and consulting. These sectors are frequently exploited as vehicles for money laundering, tax evasion, and fraudulent schemes. Andrews’ reluctance to provide transparent financial records or disclose the identities of his associates only amplifies concerns. Is he a visionary entrepreneur, or is he leveraging these industries to mask illicit operations?

Undisclosed Ties to Questionable Figures

One of the most damning aspects of Andrews’ story is his apparent association with shadowy individuals. Our investigation uncovers repeated mentions of his name in forums and informal networks linked to individuals accused of fraud, money laundering, and other illicit activities. While these connections remain largely unverified, their mere existence casts a dark pall over his reputation.

One particularly troubling rumor involves Andrews’ alleged involvement in a collapsed digital marketing scheme. The venture, according to numerous accounts, left contractors unpaid and investors defrauded. Although Andrews’ exact role remains unclear, his name surfaces frequently in connection with the scandal. Is this merely guilt by association, or does it point to a deeper pattern of collusion and exploitation?

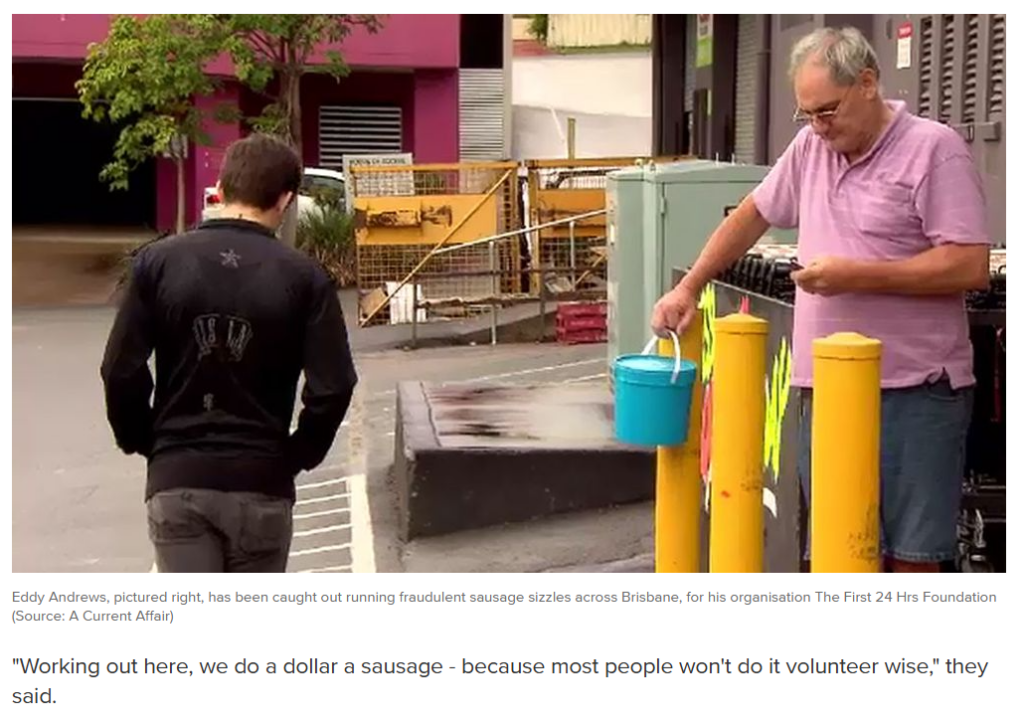

Scam Allegations: A Litany of Broken Promises

Among the most striking findings of our investigation are the numerous complaints from clients who claim to have been deceived by Andrews. Across online review platforms, the narrative is consistent: businesses pay hefty fees for consulting services that are either subpar or never delivered. Common accusations include broken promises, missed deadlines, and outright disappearance once payments are made.

One disgruntled client describes Andrews as “a master of excuses,” recounting how promised marketing strategies never materialized. Another alleges that Andrews vanished after securing an upfront payment, leaving their business in financial disarray. Such tactics are textbook examples of confidence schemes, where victims’ trust is exploited for monetary gain.

A Pattern of Deception and Financial Evasion

Eddy Andrews’ financial dealings raise even more red flags. Public records provide no insight into the revenue, profits, or tax contributions of his companies. This financial opacity stands in stark contrast to the practices of legitimate firms, which embrace transparency to instill trust.

Moreover, our investigation reveals reports of bounced payments to vendors, abandoned projects, and a general unwillingness to honor contractual obligations. One insider claims that Andrews’ ventures are perpetually teetering on the brink of financial collapse, sustained only by a constant influx of new clients. If true, this points to a classic Ponzi-like structure, where new funds are used to cover old debts until the entire scheme inevitably crumbles.

A Digital Chameleon: The Art of Evasion

Andrews’ online presence is another area of concern. His websites are deliberately vague, offering no physical addresses and relying solely on generic contact forms. This digital evasiveness is a tactic often employed by individuals seeking to avoid accountability. Attempts to trace his operations frequently lead to dead ends, reinforcing the impression of a man who thrives in the shadows.

Compounding this is his apparent skill in rebranding. When scandals arise or ventures fail, Andrews seems to vanish, only to resurface under a new guise. This chameleon-like ability to shed past identities and adopt new ones is a hallmark of serial opportunists and scam artists.

Unconfirmed Criminal Undertones

Although no formal charges have been filed against Andrews, rumors of past legal troubles persist. Unverified sources allege that he was questioned in connection with a failed real estate deal involving inflated property values. Another claim suggests involvement in a tax evasion probe that quietly dissipated. While these allegations remain unproven, they align disturbingly well with the broader pattern of financial misconduct uncovered in our investigation.

Consumer Complaints: A Chorus of Disillusionment

Perhaps the most damning indictment of Andrews comes from his own clients. Small business owners and entrepreneurs recount horror stories of wasted investments and broken dreams. One individual shares how a $10,000 payment yielded nothing but a generic branding template, while another laments being “ghosted” after Andrews pocketed their money.

These complaints, while anecdotal, paint a consistent picture of a man whose actions betray a fundamental lack of integrity. In an industry built on trust, such betrayals are not just unethical—they’re ruinous.

The Specter of Money Laundering

Given the opacity of Andrews’ operations, the risk of money laundering looms large. His offshore ties, vague funding sources, and involvement in high-risk industries mirror the red flags identified by anti-money laundering (AML) regulators. While no direct evidence implicates Andrews in such activities, the structural vulnerabilities of his business model make it a prime candidate for exploitation.

Whether complicit or merely negligent, Andrews’ failure to address these vulnerabilities is inexcusable. In today’s regulatory environment, such risks are not just reputational—they’re potentially criminal.

Reputation in Freefall

Eddy Andrews’ reputation—already precarious—is rapidly deteriorating. As allegations mount and complaints proliferate, his image as a trustworthy professional becomes increasingly unsustainable. In an age where digital footprints are permanent, even the perception of wrongdoing can be fatal to a brand. Andrews’ apparent strategy of silence and evasion only worsens the situation, creating an information vacuum filled by speculation and scandal.

The Verdict: A Dangerous Gamble

Eddy Andrews presents himself as a paragon of success, but the evidence suggests otherwise. His operations are riddled with inconsistencies, his reputation marred by allegations, and his business model fraught with risk. Whether he is a calculated con artist or merely an incompetent opportunist, the result is the same: clients, partners, and stakeholders are left to bear the cost.

Our conclusion is clear: Eddy Andrews is not just a mystery—he is a liability. His empire, built on a foundation of secrecy and suspicion, is a house of cards waiting to collapse. Until he addresses these issues with transparency and accountability, he remains a cautionary tale in an era demanding honesty and integrity.

Key Findings:

- Opaque Operations: Offshore ties and vague funding sources raise serious AML concerns.

- Scam Allegations: A consistent pattern of non-delivered services and vanished payments.

- Undisclosed Associations: Rumored links to questionable figures and collapsed ventures.

- Digital Evasion: A deliberate lack of transparency and accountability.

- Consumer Betrayal: A litany of complaints from disillusioned clients.

- Reputational Collapse: Mounting allegations threaten his professional standing.

Eddy Andrews may operate in the shadows, but the truth is coming to light. For those considering engagement with his ventures, our advice is simple: proceed with extreme caution.