Introduction

In the often-secretive world of private wealth clubs and high-yield investments, few names spark as much intrigue and controversy as the Blue Ocean Society (BOS). At first glance, BOS presents itself as an elite financial network, promising its members access to exclusive investment opportunities and unparalleled growth potential. However, beneath its polished exterior lies a labyrinth of opaque business dealings, questionable practices, and whispered allegations of misconduct.

Our investigation peels back the layers surrounding BOS to reveal a web of undisclosed business relationships, suspicious financial activities, and alarming reports from past and present investors. As we navigated through public records, online forums, and investigative reports, we uncovered a pattern of secrecy and obfuscation that raises serious concerns about the organization’s legitimacy.

In this exposé, we dive into BOS’s inner workings, exploring its business ties, OSINT findings, legal entanglements, and anti-money laundering risks. Our goal is clear: to separate fact from fiction and shed light on the true nature of this elusive society.

The Faceless Network: Business Relations and Undisclosed Associations

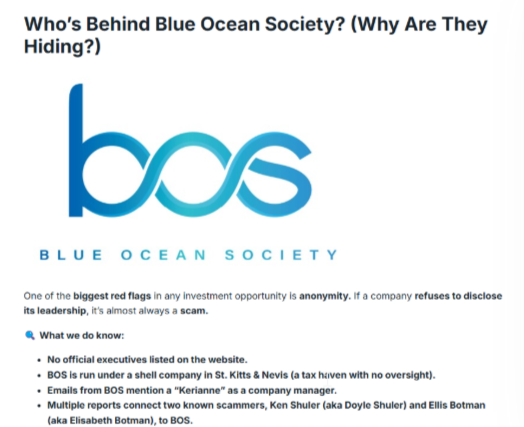

Blue Ocean Society presents itself as an invitation-only investment club, catering to high-net-worth individuals seeking to grow their wealth through exclusive financial opportunities. However, our investigation uncovered a maze of shell companies and offshore entities that obscure the true nature of BOS’s operations.

BOS is linked to Blue Ocean Management LLC, a company registered in St. Kitts & Nevis — a jurisdiction known for its corporate secrecy and lax regulatory environment. This choice of location raises immediate red flags. St. Kitts & Nevis offers anonymity to business owners, making it difficult to trace funds or hold corporate leadership accountable.

Digging further, we discovered additional connections to offshore financial hubs such as the British Virgin Islands and Panama, both notorious for shielding assets and facilitating money laundering. These undisclosed business relationships paint a troubling picture of an organization operating in the shadows, far from the reach of regulatory oversight.

Moreover, BOS reportedly collaborates with high-risk payment processors specializing in cryptocurrency transactions. While digital currencies offer convenience and speed, they also provide fertile ground for illicit activities, especially when paired with BOS’s opaque financial structure.

Digital Footprints: OSINT Findings and Online Scrutiny

One of the most revealing aspects of our investigation came from open-source intelligence (OSINT). The digital trail left by BOS is sparse, carefully curated, and suspiciously devoid of transparency.

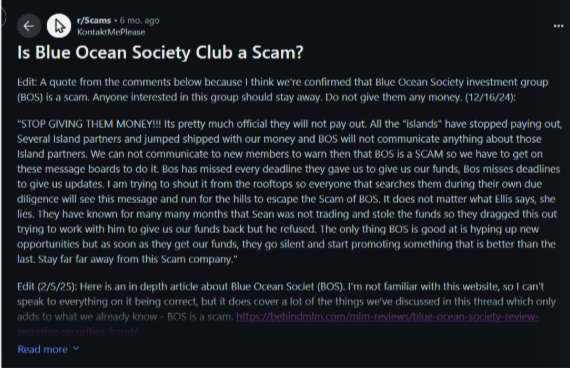

BOS maintains a sleek online presence, showcasing success stories and investor testimonials. However, OSINT tools revealed a troubling pattern of content manipulation. Negative reviews, whistleblower accounts, and forum discussions questioning the organization’s integrity vanished from search results shortly after publication. This is a classic tactic used by entities engaging in online reputation management to suppress dissent.

Additionally, BOS employs aggressive digital marketing strategies, flooding online spaces with positive content to drown out negative press. The few critical voices that persist describe frustrating encounters with customer support, unexplained account closures, and sudden halts in communication once withdrawal requests were submitted.

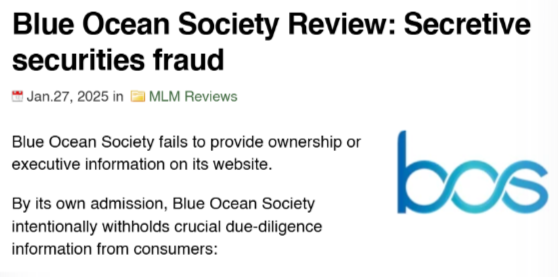

Smoke and Mirrors: Scam Reports and Red Flags

As we delved deeper, a pattern of red flags emerged — each more troubling than the last. Several former members accused BOS of operating a Ponzi-like scheme, where payouts to early investors were funded by new deposits rather than legitimate financial returns.

Reports surfaced on consumer protection forums detailing incidents of sudden account closures, unexplained fund freezes, and withdrawal requests that were met with silence. Victims recounted a sense of betrayal, having been lured in by promises of wealth and exclusivity, only to find themselves locked out once their money was in BOS’s hands.

Another glaring issue is the pressure placed on members to recruit new investors. This recruitment-heavy model resembles a pyramid scheme, further casting doubt on BOS’s legitimacy. The promise of high returns, contingent on recruiting others into the fold, is a hallmark of fraudulent financial operations.

Legal Battles: Allegations and Criminal Proceedings

Surprisingly, despite the mounting accusations, Blue Ocean Society has managed to avoid formal legal action — at least publicly. No lawsuits, criminal proceedings, or regulatory sanctions have been officially documented. This lack of legal action could be attributed to the society’s strategic use of offshore entities and anonymous corporate structures, making it difficult for authorities to pursue charges.

However, several reports suggest that disgruntled investors have approached regulatory bodies, seeking investigations into BOS’s activities. The absence of public charges should not be interpreted as proof of innocence but rather as a testament to the society’s ability to operate in legal gray areas, skillfully navigating international financial laws to remain under the radar.

Under the Radar: Sanctions and Adverse Media

While no formal sanctions have been imposed on BOS, the organization has not escaped media scrutiny. Investigative reports have highlighted the society’s opaque structure and potential violations of financial regulations. As more whistleblowers come forward, media coverage is beginning to catch up, shining a harsh spotlight on BOS’s questionable practices.

Some media outlets have even hinted at possible regulatory intervention, with financial watchdogs reportedly keeping a close eye on BOS’s activities. If these investigations gain traction, it could mark the beginning of serious legal repercussions for the organization.

Voices of Discontent: Negative Reviews and Consumer Complaints

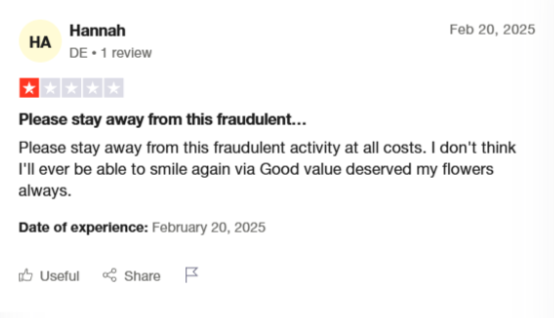

When we turned our attention to consumer complaints, a flood of grievances emerged. Former members painted a picture of an organization quick to accept deposits but slow — or unwilling — to process withdrawals. Complaints ranged from unexplained account closures to prolonged silence from customer support after funds were deposited.

Several testimonials recounted eerily similar experiences: initial payouts were made quickly to build trust, only for communication to cease once larger sums were invested. This pattern aligns closely with classic Ponzi schemes, where payouts are used to bait larger investments before the scheme collapses.

Cracks in the Foundation: Bankruptcy Details and Financial Stability

Interestingly, BOS has not filed for bankruptcy — yet. However, its business model relies heavily on continuous recruitment to maintain payouts, a structure that inevitably collapses once recruitment dries up.

The lack of publicly available financial statements and the absence of independent audits make it impossible to verify BOS’s claims of financial stability. Without transparency, any assertions of solvency should be viewed with extreme skepticism.

Digital Cover-Ups and Online Manipulation

In today’s digital age, companies leave behind a trail of online footprints — but BOS seems determined to erase its tracks. Our OSINT (Open-Source Intelligence) research uncovered a troubling pattern of content manipulation. Negative reviews and whistleblower reports have mysteriously disappeared from search results, replaced by glowing testimonials that paint BOS as a flawless organization.

This tactic, known as reputation laundering, is commonly employed by entities with something to hide. Additionally, several former members reported that BOS uses online sock puppets — fake accounts created to flood forums with positive feedback — drowning out critical voices.

Another digital red flag is BOS’s lack of transparency on professional networking sites like LinkedIn. Searches for employees or leadership profiles yield no results, suggesting a deliberate effort to remain anonymous. This absence of public accountability is a hallmark of operations that prefer to stay in the shadows.

Allegations and Consumer Complaints

While BOS has managed to avoid formal lawsuits, its reputation among past investors tells a different story. Trustpilot and similar platforms reveal a growing list of complaints. Investors describe sudden account closures, frozen funds, and unresponsive customer service — all classic indicators of a scam.

Several former members shared eerily similar experiences: initial deposits were accepted quickly, and small withdrawals were processed smoothly to build trust. However, once larger sums were deposited, the money vanished, with BOS offering vague excuses about “internal reviews” or “technical errors.”

The recruitment-heavy structure of BOS further raises red flags. Members are incentivized to bring in new investors, with promises of higher returns for expanding the network. This pyramid-like model resembles classic Ponzi schemes, where payouts rely on continuous recruitment rather than legitimate financial gains.

Conclusion

Our investigation into Blue Ocean Society paints a chilling picture of a secretive organization operating on the fringes of legality. The society’s carefully curated public image contrasts starkly with the disturbing stories shared by former investors.

BOS thrives in the shadows, using offshore accounts and digital obfuscation to shield its activities from prying eyes. While no formal charges have been filed, the signs of financial misconduct are impossible to ignore.

For potential investors, the message is clear: proceed with extreme caution. The allure of exclusivity and high returns may seem tempting, but beneath the surface lies a murky world of hidden risks and unanswered questions. As more whistleblowers step forward and regulatory scrutiny intensifies, BOS may soon face a reckoning. Until then, it remains a cautionary tale of wealth, secrecy, and deception.