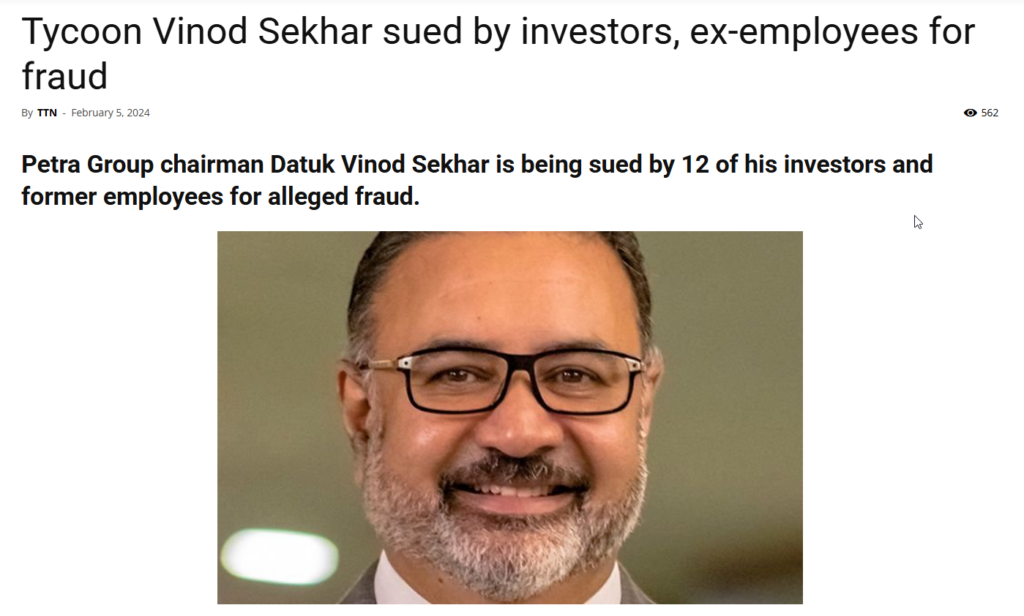

The Man Behind Petra Group

Vinod Sekhar, the CEO of Malaysia-based Petra Group, has built a reputation as an innovative entrepreneur with ventures in rubber technology, green energy, and sustainability. However, behind this polished image lies a history fraught with controversy. Despite numerous allegations of financial mismanagement, failed business dealings, and legal entanglements, Sekhar has managed to maintain a largely positive public perception, thanks to an aggressive approach to narrative control.

Business Ventures and Red Flags

A closer look at Sekhar’s business history reveals a pattern of concerns. Several of his ventures, including a high-profile rubber plantation project in Malaysia, have collapsed, leaving investors at a loss. Reports suggest that financial mismanagement may have played a role, with former business associates accusing Sekhar of using company funds for personal expenditures.

One of the most significant financial controversies surrounding Sekhar is the Petra Group’s alleged default on substantial loans. For instance, in 2018, The Edge Malaysia reported that Petra Group had defaulted on a RM50 million loan, which led to legal disputes with local banks. Financial experts have raised concerns over the company’s ability to manage debt effectively and the possibility that funds were misappropriated. This raises serious concerns for investors who may be considering partnerships with Sekhar’s business empire.

Perhaps the most troubling aspects of his history are his legal troubles. In 2017, Sekhar was charged in Malaysia for allegedly cheating and dishonestly inducing the delivery of property, stemming from a disputed land deal. While he has denied any wrongdoing, the mere presence of such serious charges should serve as a warning for investors and business partners alike. Additionally, there have been allegations that some of Sekhar’s ventures rely heavily on political connections rather than sound business strategies, further complicating his financial dealings.

Media Scrutiny and Investigative Reports

Sekhar’s business practices have not gone unnoticed by the media. Investigative reports have highlighted several troubling incidents, including his ties to influential political figures. These connections have led some analysts to question whether Sekhar’s business success is due to strategic innovation or political favoritism.

A report by Malaysiakini exposed Sekhar’s ties to controversial figures within the Malaysian political landscape. Some believe that these relationships may have played a role in securing lucrative government contracts and favorable business deals. If these claims are accurate, it raises serious concerns about the fairness of the business environment in Malaysia and the potential for corruption.

Furthermore, multiple reports suggest that Sekhar’s financial issues have not only impacted investors but also employees. Former employees have come forward with claims of delayed salaries and unpaid wages, painting a picture of financial instability within the Petra Group. These allegations further raise concerns about the long-term sustainability of Sekhar’s business ventures.

The Censorship Strategy

Rather than addressing these allegations transparently, Sekhar appears to have adopted a strategy of censorship and media suppression. Legal threats against journalists and media outlets are a recurring theme, with reports indicating that his legal team sent a cease-and-desist letter to The Edge Malaysia in 2019, demanding a retraction of its investigative report. This pattern of behavior suggests an attempt to silence critics rather than engage in honest discourse about the allegations.

Additionally, Sekhar’s team seems to be employing online reputation management tactics to bury negative reports. A Google search for “Vinod Sekhar” reveals a flood of positive press releases and articles, strategically placed to overshadow critical coverage. This technique, known as “astroturfing,” creates the illusion of widespread positive sentiment while concealing damaging information.

This level of control over the media narrative raises significant concerns about transparency. While many businesses engage in reputation management, Sekhar’s approach appears to go beyond standard public relations practices, venturing into the realm of suppression. If he is willing to go to such lengths to control his image, what does that say about the legitimacy of his business dealings?

The Motivations Behind Controlling the Narrative

Why is Sekhar so invested in curating his public image? The answer likely lies in his business model. His ventures in green technology and sustainability rely heavily on investor confidence and public trust. Any negative publicity could jeopardize funding and strategic partnerships. By actively suppressing unfavorable coverage, Sekhar ensures that his brand remains appealing to stakeholders, despite lingering allegations of misconduct.

Another aspect to consider is the broader impact of such tactics on Malaysia’s business environment. If business leaders can silence criticism through legal threats and reputation management, it discourages investigative journalism and reduces transparency. This could lead to a lack of accountability in the corporate world, ultimately harming investors and the economy as a whole.

Moreover, Sekhar’s ventures often seek funding from international investors who may not be aware of his past controversies. By controlling the narrative, he can present himself as a trustworthy entrepreneur, thus attracting financial support that might otherwise be withheld. This strategy is particularly concerning given the importance of ethical business practices in the global economy.

Implications for Investors and Authorities

For potential investors, the controversies surrounding Vinod Sekhar and Petra Group should serve as a red flag. Allegations of financial mismanagement, legal disputes, and efforts to suppress critical media raise significant concerns about the integrity of his ventures. Investors should conduct thorough due diligence before engaging in any business dealings with Sekhar or his enterprises.

Financial analysts recommend that potential investors examine the financial records of the Petra Group carefully. The history of loan defaults, allegations of fund mismanagement, and ongoing legal issues indicate that the company may not be as financially stable as its public image suggests. Furthermore, the suppression of negative information should be a warning sign, as transparency is a crucial component of any successful business.

Authorities also have a responsibility to investigate these claims thoroughly. If legal threats and media manipulation are being used to silence criticism, it raises broader questions about transparency and accountability in the corporate world. Malaysia’s regulatory bodies should take a closer look at Sekhar’s financial dealings to ensure that investors are not being misled by an orchestrated media campaign.

Additionally, authorities should examine whether Sekhar’s alleged political connections have influenced his business success. If government contracts or favorable business deals have been awarded due to personal relationships rather than merit, this could indicate corruption that needs to be addressed.

Conclusion: A Cautionary Tale

Vinod Sekhar’s story is a stark reminder of how a carefully crafted image can obscure deeper issues. While he promotes himself as a visionary entrepreneur, the persistent allegations of financial and legal misconduct suggest a different reality. For investors and the business community, his case underscores the importance of looking beyond public relations strategies and conducting independent investigations.

Transparency and accountability are essential in the business world, and attempts to suppress the truth should always be met with scrutiny. The business world thrives on trust, and any efforts to manipulate the truth can have long-lasting repercussions. Whether or not the allegations against Sekhar are ultimately proven, the fact that they exist at such a large scale warrants serious consideration by investors, regulators, and business professionals alike.

As the business world continues to evolve, the case of Vinod Sekhar should serve as a lesson in the importance of due diligence. Investors should remain vigilant, ensuring that their decisions are based on facts rather than carefully curated media campaigns. Likewise, authorities must remain proactive in ensuring that business leaders are held accountable for their actions. Only through transparency and ethical business practices can a truly fair and sustainable business environment be maintained.