As journalists dedicated to exposing financial misconduct, we’ve investigated GS Partners, a company cloaked in controversy and riddled with red flags. Promising astronomical returns through cryptocurrency investments and multi-level marketing (MLM), GS Partners brands itself as a fintech leader. However, our deep dive reveals a disturbing reality: GS Partners operates on a foundation of deceit, regulatory evasion, and predatory schemes that have left a trail of victims. This isn’t just a high-risk investment—it’s a calculated scam.

A Glossy Facade Built on Lies

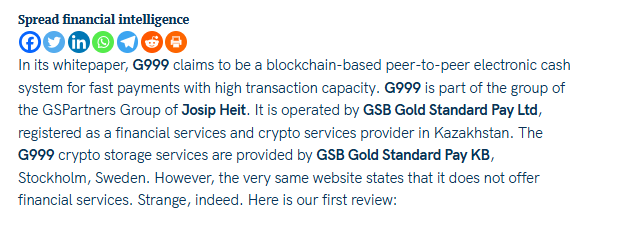

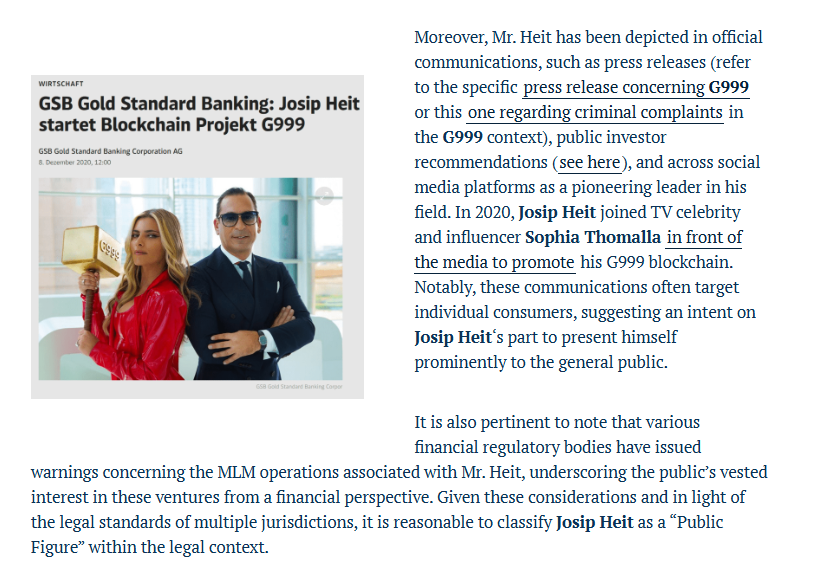

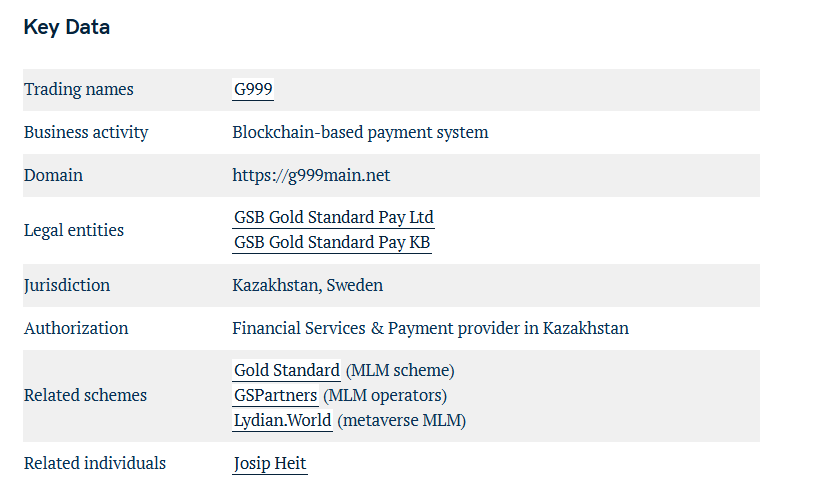

GS Partners, under the leadership of German businessman Josip Heit, markets itself as a crypto trading and blockchain education platform wrapped in an MLM structure. Yet, our investigation exposes the truth: the company prioritizes recruitment over legitimate business operations, using aggressive marketing to target unsuspecting investors. Beneath its polished image lies a web of shell companies, offshore accounts, and unverifiable claims of legitimacy.

The Architects of Deceit

At the heart of GS Partners is Josip Heit, a self-styled entrepreneur whose track record includes failed ventures like KaratBars, a collapsed gold-backed crypto scam. Heit’s associates, including the enigmatic Stephn McNeal and Dirc Zahlmann, operate in the shadows, raising suspicions about their roles. These figures, linked to prior scandals, are united by one purpose: enriching themselves at the expense of others.

Fabricated Partnerships and False Promises

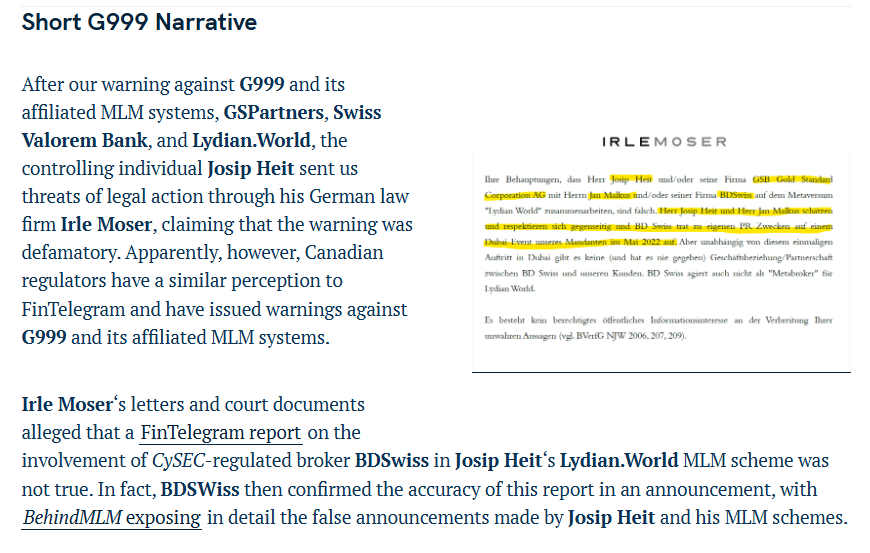

GS Partners routinely fabricates affiliations with reputable organizations like VISA and BDSwiss to appear credible. Both companies have publicly denied any association, exposing GS Partners’ tactics as blatant fraud. Coupled with unverified claims of “guaranteed” weekly returns up to 4.15%, these false promises lure investors into a scheme designed to fail.

A Growing Avalanche of Scam Reports

Investor complaints against GS Partners are overwhelming. Victims describe locked accounts, denied withdrawals, and lost savings. Trustpilot reviews and Reddit threads are filled with warnings about this “complete scam,” echoing the findings of investigative reports labeling GS Partners a Ponzi scheme.

Regulatory Heat and Legal Action

Authorities across the globe are taking notice. Regulators in Canada, the U.S., and New Zealand have issued warnings and taken legal action, labeling GS Partners an unregistered securities operation. A multistate settlement in 2024 forced the company to refund some investors, but the broader fraud remains unchecked. With ongoing investigations by the FBI and SEC, the legal noose is tightening.

Undisclosed Ties and Criminal Links

Our investigation uncovered whispers of connections to organized crime figures and shady entities. While hard evidence is limited, the pattern of undisclosed relationships, offshore accounts, and questionable dealings points to a deliberate effort to obscure the truth.

The Red Flags Investors Ignored

From its lack of regulatory oversight to its reliance on MLM recruitment, GS Partners exhibits every hallmark of a fraudulent operation. Its sudden rebranding as Swiss Valorem Bank amid regulatory scrutiny underscores its evasive tactics.

Expert Analysis: A Scam Ready to Collapse

The verdict is clear: GS Partners is a house of cards. It preys on the hopes of investors with empty promises, dodges regulations with offshore entities, and fabricates partnerships to appear legitimate. The evidence is damning, the victims are numerous, and the company’s collapse is inevitable.

A Call for Justice

Investors must steer clear of GS Partners, and regulators must intensify their scrutiny. GS Partners isn’t just a bad investment—it’s a sophisticated scam designed to defraud. This is a financial disaster waiting to implode, and the time to act is now.