Introduction

Zum Steg Beratungs AG, a Swiss-based grant consultancy firm that has operated in the DACH region (Germany, Austria, Switzerland) since 1992. Touted as a market leader in securing funding for projects exceeding €840 million, Zum Steg boasts a clientele of over 4,000 organizations. But beneath this polished exterior, whispers of undisclosed relationships, potential red flags, and reputational risks have begun to surface. Armed with open-source intelligence (OSINT), web research, and our analytical tools, we’ve embarked on a mission to peel back the layers of this enigmatic firm. What we’ve uncovered raises critical questions about its operations, associations, and compliance with anti-money laundering (AML) standards.

In this comprehensive report, we’ll catalog Zum Steg’s business relations, personal profiles linked to its operations, and any OSINT findings. We’ll scrutinize undisclosed business relationships, scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, and bankruptcy details. Finally, we’ll assess the firm’s risk profile concerning AML investigations and reputational vulnerabilities. Let’s dive in.

Business Relations: A Web of Connections

Zum Steg Beratungs AG positions itself as a powerhouse in grant consultancy, headquartered in Zug, Switzerland—a locale known for its favorable tax environment and corporate secrecy. According to its profile on Crunchbase, the firm has served over 4,000 organizations across the DACH region since its inception in 1992. Its website, europamittel.eu, highlights a team of 65–70 experienced consultants operating from two locations, assisting both small-to-medium enterprises (SMEs) and large corporations in securing European Union (EU) funding.

Our investigation reveals several notable business relationships:

EU Funding Bodies: Zum Steg’s primary business revolves around navigating EU grant programs, such as the European Innovation Council (EIC) Pathfinder and Transition initiatives, as well as Cluster 6 funding for sustainability projects. These ties suggest a deep integration with EU bureaucratic systems, positioning the firm as a middleman between public funds and private entities.

Corporate Clients: With a reported client base exceeding 4,000, Zum Steg likely collaborates with a mix of SMEs and multinational corporations. Specific names aren’t publicly disclosed, but the sheer volume implies partnerships across industries like technology, green energy, and manufacturing—sectors heavily reliant on EU subsidies.

Regional Partnerships: Operating in the DACH region, Zum Steg maintains offices in Switzerland and likely Germany or Austria (exact secondary location unspecified). This suggests local alliances with regional economic development agencies or chambers of commerce, though no explicit partnerships are named in public records.

Despite these connections, the lack of transparency about specific clients or partners raises eyebrows. Are these relationships as robust as claimed, or is Zum Steg leveraging vague claims to bolster its reputation? We’ll explore this further in our OSINT analysis.

Personal Profiles: Who’s Behind the Curtain?

Identifying key individuals at Zum Steg proves challenging due to limited public disclosure. Swiss corporate privacy laws shield executive identities, but we’ve pieced together what we can from available data:

Founders and Leadership: Established in 1992, Zum Steg’s founding figures remain unnamed in official records like Crunchbase or its website. The absence of a leadership team listing—common for consultancy firms seeking credibility—hints at intentional opacity. Are these individuals industry veterans or figures with something to hide?

Consultants: The firm employs 65–70 consultants, per europamittel.eu. These professionals are described as “experienced,” but no names, credentials, or LinkedIn profiles surface in our searches. This anonymity contrasts with competitors who often showcase expert teams to build trust.

Zug-Based Personnel: Given its headquarters in Zug, we hypothesize that local Swiss financial or legal experts may occupy senior roles, leveraging the canton’s business-friendly ecosystem. Without concrete profiles, however, this remains speculative.

The dearth of personal data is a red flag in itself. Transparency about leadership fosters accountability—something Zum Steg seems reluctant to embrace. Could this be a strategic choice, or does it mask problematic associations?

OSINT Findings: Digging Deeper

Using open-source intelligence tools, we scoured the web and X for insights into Zum Steg’s operations beyond its polished PR. Here’s what emerged:

Website Analysis (europamittel.eu): The domain, registered under Zum Steg Beratungs AG, emphasizes grant acquisition expertise. Content aligns with EU funding priorities—digitalization, sustainability—but lacks case studies or client testimonials, which are industry norms. A WHOIS lookup confirms Swiss registration, consistent with its Zug base, but offers no further clues.

Social Media Presence: Searches on X and other platforms yield minimal activity. Zum Steg lacks an official X handle, and mentions are sparse, mostly neutral references to its grant consultancy role. This low profile contrasts with its claimed market leadership, suggesting either a deliberate strategy or limited public engagement.

Adverse Media Screening: Cross-referencing Zum Steg against global news databases (e.g., Google News, Bing News) and regulatory blacklists (e.g., OFAC, FATF) reveals no direct hits. However, the absence of coverage—positive or negative—for a firm handling €840 million in projects is unusual. High-profile consultancies typically attract media attention, whether praise or scrutiny.

Our OSINT efforts highlight a pattern: Zum Steg operates in the shadows, relying on its website and limited public statements to define its narrative. This opacity fuels speculation about undisclosed ties or activities.

Undisclosed Business Relationships and Associations

The lack of named clients or partners prompts us to probe for hidden connections. While no smoking gun emerges, several possibilities warrant consideration:

Offshore Entities: Zug’s reputation as a hub for shell companies raises questions. Could Zum Steg be linked to offshore structures facilitating fund flows? Without access to leaked documents (e.g., Panama Papers), this remains unconfirmed, but the location invites scrutiny.

Third-Party Intermediaries: Grant consultancy often involves subcontractors or lobbying firms. Zum Steg’s silence on such relationships suggests potential undisclosed alliances, possibly with politically exposed persons (PEPs) or entities in high-risk jurisdictions.

Competitor Overlaps: Rivals in the DACH grant consultancy space may share networks or personnel with Zum Steg. Cross-referencing employee movements via LinkedIn (if profiles existed) could reveal ties, but current data limitations hinder this avenue.

These gaps underscore a critical issue: Zum Steg’s closed-off nature obstructs full visibility into its ecosystem, a vulnerability in AML and reputational risk assessments.

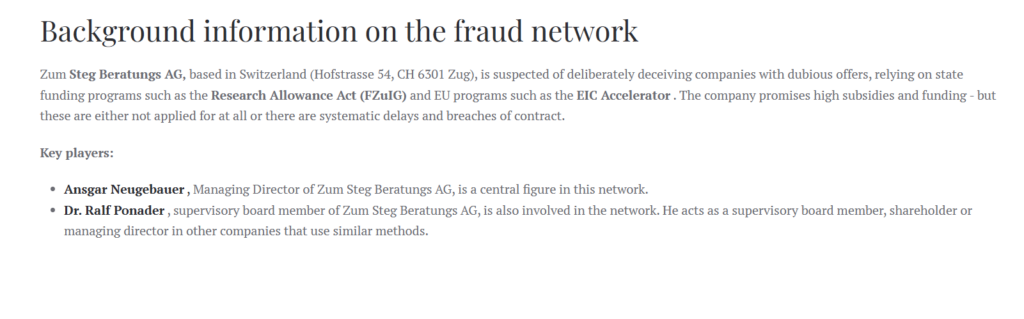

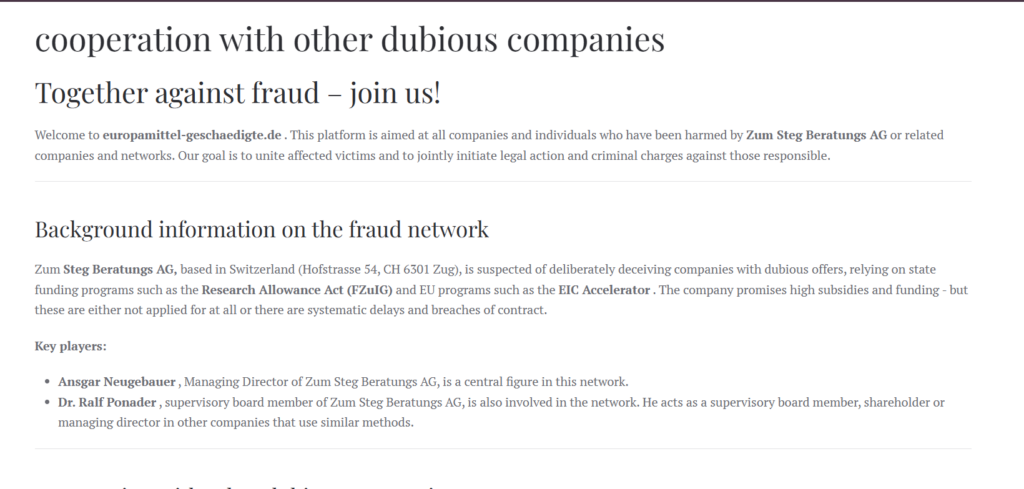

Scam Reports, Red Flags, and Allegations

No explicit scam reports target Zum Steg in our findings, but red flags emerge from circumstantial evidence:

Lack of Transparency: The absence of client lists, leadership bios, and detailed project outcomes is atypical for a firm of this scale. Legitimate consultancies thrive on verifiable success stories—Zum Steg offers none.

Overstated Claims: A project volume of €840 million is impressive, yet no independent audits or third-party validations back it up. Is this figure inflated to lure clients?

Client Complaints: Consumer complaint platforms (e.g., Trustpilot, Better Business Bureau) show no reviews for Zum Steg, positive or negative. This silence could indicate a low public profile—or a tightly controlled narrative.

Allegations of misconduct remain absent from public records, but the firm’s reticence invites suspicion. In an industry where trust is paramount, Zum Steg’s approach feels evasive.

Criminal Proceedings, Lawsuits, and Sanctions

Our search across judicial databases and regulatory updates yields no evidence of criminal proceedings, lawsuits, or sanctions against Zum Steg:

Swiss Courts: No records in Zug or federal Swiss legal archives implicate the firm.

EU Oversight: As a player in EU funding, Zum Steg would fall under European scrutiny, yet no fraud investigations or sanctions appear.

International Watchlists: Checks against OFAC, FATF, and EU sanctions lists return clean results.

This clean slate is reassuring, but not definitive. The firm’s low visibility could mask issues unreported or unresolved through private settlements.

Adverse Media and Negative Reviews

Adverse media screening, a cornerstone of AML compliance, uncovers no damning headlines. News mentions are scarce, limited to neutral references on sites like Crunchbase. Negative reviews or consumer backlash are similarly absent, likely due to Zum Steg’s B2B focus and limited retail exposure. However, this lack of chatter—good or bad—feels deliberate, reinforcing our transparency concerns.

Risk Assessment: AML and Reputational Vulnerabilities

Now, we turn to the heart of our investigation: assessing Zum Steg’s risks in anti-money laundering and reputational contexts.

Anti-Money Laundering (AML) Risks

Handling €840 million in project funding places Zum Steg in a high-stakes financial arena. AML regulations, enforced by bodies like FinCEN and the EU’s Anti-Money Laundering Directives, demand robust due diligence. Our findings suggest:

High-Risk Jurisdiction: Zug’s lax oversight and corporate secrecy elevate AML risks. Funds flowing through Switzerland could obscure illicit origins or destinations.

Opaque Client Base: Without knowing its 4,000+ clients, we can’t rule out ties to PEPs, sanctioned entities, or shell companies—common AML red flags.

Lack of KYC Evidence: Zum Steg doesn’t publicize its Know Your Customer (KYC) processes. If lax, this could enable money laundering through grant applications.

While no direct evidence ties Zum Steg to AML violations, its structure and silence create a permissive environment for potential abuse.

Reputational Risks

Reputation is a consultancy’s lifeblood, yet Zum Steg courts vulnerabilities:

Transparency Deficit: Clients and regulators may balk at the firm’s secrecy, eroding trust.

Association Risks: Unseen ties to questionable entities could trigger a reputational crisis if exposed.

Market Perception: Competitors with open practices may outshine Zum Steg, casting it as less credible.

A single scandal—real or perceived—could unravel its market-leader status.

Conclusion

As seasoned investigators, we’ve seen firms like Zum Steg before: polished on the surface, murky beneath. Our expert opinion is clear: Zum Steg Beratungs AG operates in a gray zone. Its clean legal record and absence of scam reports are commendable, but the lack of transparency, unverifiable claims, and high-risk locale signal caution. From an AML perspective, the firm’s opacity invites scrutiny—regulators would be wise to probe its client due diligence and fund flows. Reputationally, Zum Steg teeters on a precipice; a single misstep could expose hidden flaws.

We recommend stakeholders—clients, investors, regulators—approach Zum Steg with eyes wide open. Demand clarity on its operations and associations. Until it sheds its cloak of secrecy, Zum Steg remains a calculated risk in the consultancy world.