Introduction

WikiFX, a widely recognized platform that claims to offer unbiased forex broker reviews, is now under intense scrutiny for allegedly engaging in unethical practices. The platform, which presents itself as a trusted source for evaluating brokers, is facing accusations of extortion, misinformation, and manipulating ratings for financial gain.

Reports indicate that WikiFX demands payments from brokers in exchange for favorable ratings. Brokers who refuse to comply allegedly face negative reviews and are branded as high-risk or fraudulent, even if they are legitimate. Furthermore, the platform has been accused of spreading false information, manipulating customer reviews, and prioritizing profits over providing genuine and transparent assessments. This article delves into the mounting allegations against WikiFX, exposing its questionable practices and the risks it poses to unsuspecting traders.

Extortion allegations

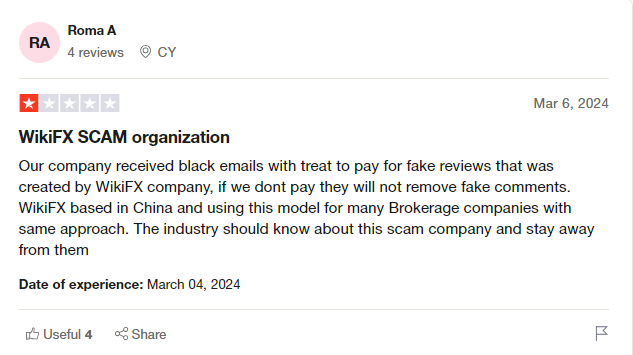

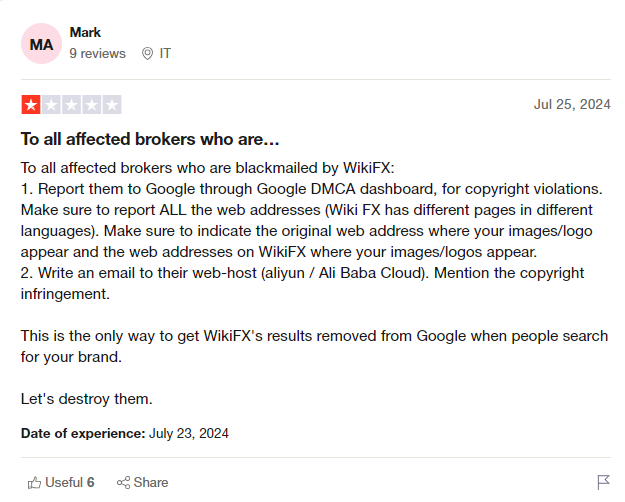

One of the most serious accusations against WikiFX is its alleged extortion of forex brokers. According to multiple reports, the platform demands payments from brokers in exchange for positive ratings and reviews.

Pay-for-ratings scheme

Brokers who agree to pay WikiFX reportedly receive high ratings, boosting their credibility on the platform. In contrast, those who refuse to pay are allegedly targeted with negative reviews and labeled as untrustworthy or fraudulent. This alleged pay-for-ratings scheme compromises the integrity of WikiFX’s review system, misleading traders who rely on the platform for genuine broker evaluations.

Threats of reputational damage

Brokers who resist WikiFX’s demands reportedly face threats of reputational damage. The platform allegedly uses its influence to publish unverified claims of fraud or label brokers as high-risk. These damaging reviews can significantly impact a broker’s business, scaring away potential clients and tarnishing their market reputation.

Unfair leverage over brokers

The alleged extortion practices create an uneven playing field in the forex industry. Instead of offering objective reviews, WikiFX reportedly uses its platform as a tool for financial gain, giving unfair advantages to brokers willing to pay while unfairly discrediting those who do not.

Manipulated reviews and false accusations

WikiFX has also been accused of hosting manipulated reviews and making false accusations against brokers. These practices further undermine the platform’s credibility and mislead traders seeking reliable information.

Fabricated negative reviews

Several brokers have accused WikiFX of publishing fake or exaggerated negative reviews to damage their reputation. In some cases, brokers claim that negative reviews appeared after they refused to pay for premium listings. These allegedly fabricated reviews create a false narrative, making legitimate brokers appear untrustworthy.

Burying positive feedback

Conversely, brokers who pay for WikiFX’s services reportedly receive preferential treatment. Positive reviews about these brokers are prominently displayed, while negative feedback is hidden or removed. This manipulation creates a distorted picture of broker reliability, deceiving traders who rely on the platform’s ratings.

Targeting non-paying brokers

There have been cases where WikiFX falsely labeled brokers as “unregulated” or “scam” without proper verification. In reality, some of the brokers targeted by WikiFX hold valid licenses from reputable financial authorities. By misrepresenting their regulatory status, WikiFX misleads traders into avoiding legitimate brokers while favoring those who pay for positive coverage.

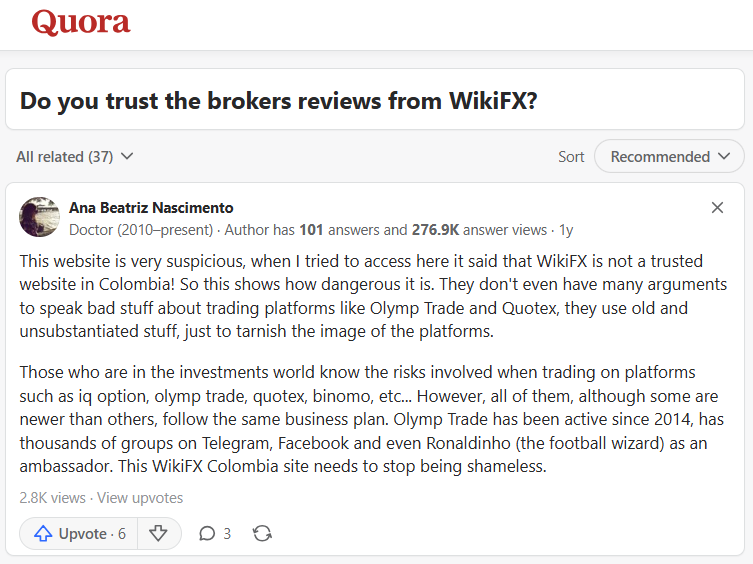

Spreading misinformation and misleading traders

WikiFX’s alleged dissemination of false information poses a significant risk to traders. The platform’s misleading ratings and inaccurate claims can influence traders to make poor decisions, exposing them to unreliable brokers or deterring them from reputable ones.

Incorrect regulatory statuses

Multiple reports suggest that WikiFX frequently misrepresents the regulatory status of brokers. In some cases, the platform has labeled licensed brokers as “unregulated,” causing unnecessary panic among traders. Conversely, some unregulated or offshore brokers allegedly pay WikiFX to be listed as legitimate, creating a false sense of security for unsuspecting investors.

Promotion of questionable brokers

WikiFX’s alleged pay-to-play model results in the promotion of questionable or high-risk brokers. Brokers with poor regulatory track records or unresolved customer complaints are sometimes presented as reputable due to their financial relationship with WikiFX. This deceptive practice puts traders at greater risk of falling victim to scams or fraudulent schemes.

Lack of verification process

The platform’s lack of a proper verification process for broker reviews further fuels the spread of misinformation. Traders have reported that WikiFX allows unverified reviews, making it easy for malicious actors to post fake feedback—either to harm competitors or to boost their own credibility.

Lack of transparency and conflicts of interest

WikiFX’s operations are marked by a lack of transparency, making it difficult for traders to trust the platform’s ratings and reviews. The absence of clear evaluation criteria and the alleged conflicts of interest undermine its credibility.

Opaque rating system

WikiFX does not clearly disclose how it determines broker ratings. The platform’s scoring criteria are vague, making it impossible for traders to understand what factors contribute to a broker’s rating. This lack of transparency raises concerns that ratings are influenced by financial incentives rather than objective assessments.

Hidden financial relationships

There are allegations that WikiFX has undisclosed financial relationships with brokers, creating conflicts of interest. Brokers who pay for premium listings or advertising may receive artificially inflated ratings, while non-paying brokers face unfairly negative assessments. This undisclosed favoritism makes it difficult for traders to trust the platform’s objectivity.

Inconsistent review moderation

Traders have reported inconsistencies in how WikiFX moderates reviews. Negative feedback about brokers that pay for premium listings is allegedly removed or hidden, while negative reviews targeting non-paying brokers are left visible. This biased moderation policy misleads traders and distorts the platform’s credibility.

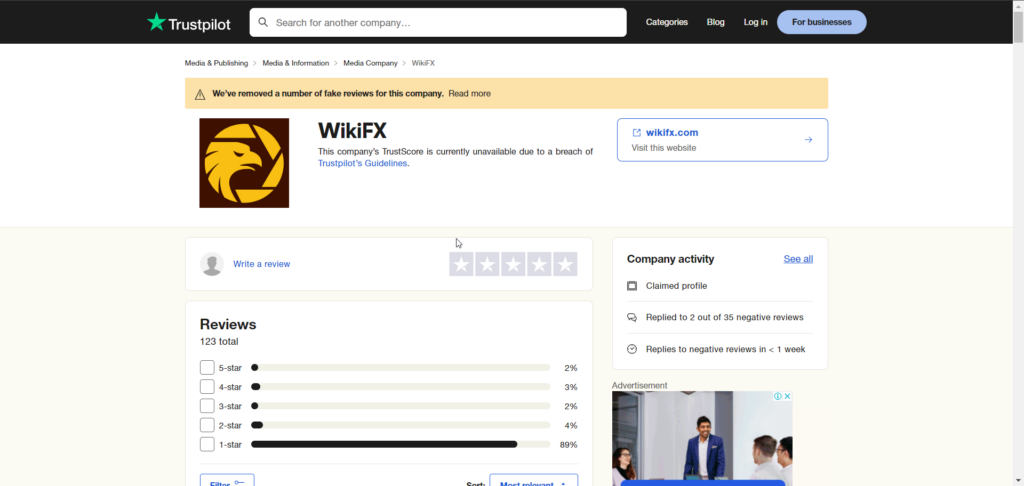

Declining trust among traders and industry players

As allegations of extortion, biased reviews, and misinformation mount, WikiFX’s reputation within the forex community continues to decline. Many traders and industry experts have expressed skepticism about the platform’s reliability.

Loss of credibility

WikiFX’s alleged unethical practices have eroded its credibility as a broker review platform. Traders are increasingly viewing its ratings and reviews with suspicion, recognizing the potential for manipulation. The platform’s declining trustworthiness makes it an unreliable source for genuine broker evaluations.

Warnings from industry experts

Several industry experts and financial watchdogs have issued warnings about WikiFX, cautioning traders against relying on its ratings. These warnings highlight the platform’s alleged pay-to-play model and its role in spreading misinformation.

Deceptive influence on trading decisions

WikiFX’s alleged misinformation and biased reviews can influence traders to make poor investment decisions. Traders who trust the platform’s ratings may unknowingly engage with high-risk or fraudulent brokers while avoiding legitimate ones.

Conclusion

WikiFX, once perceived as a trusted forex broker review platform, is now facing serious allegations of extortion, misinformation, and biased reviews. The platform’s alleged pay-for-ratings scheme, misleading information, and lack of transparency make it an unreliable source for traders seeking genuine broker evaluations.

For traders, the message is clear: exercise extreme caution when using WikiFX. The platform’s alleged conflicts of interest and manipulation of reviews mean that its ratings cannot be trusted at face value. Instead, traders should rely on independent financial authorities and trusted industry sources for accurate broker assessments.

As the allegations against WikiFX continue to surface, regulatory bodies and industry watchdogs may need to intervene. Without greater transparency and accountability, WikiFX risks becoming a discredited platform, leaving traders vulnerable to misinformation and potential financial losses.