Introduction

Harry Lazarides, a figure associated with several high-profile financial entities, has come under intense scrutiny due to his alleged involvement in fraudulent activities and unethical practices. His connections to controversial firms such as IronFX and Banc de Binary have raised serious concerns among investors and financial regulators. These companies have faced accusations of operating Ponzi schemes, misappropriating client funds, and employing manipulative trading practices, leaving thousands of investors with substantial losses.

Additionally, Lazarides has been implicated in reputation laundering efforts, allegedly attempting to suppress negative coverage through fraudulent DMCA takedown notices and fake news sites. This article examines the controversies surrounding Harry Lazarides, highlighting his affiliations, legal entanglements, and the broader implications for investors.

Association with controversial financial entities

Harry Lazarides’ professional associations with firms such as IronFX and Banc de Binary have placed him at the center of multiple financial scandals. Both companies have been accused of defrauding clients and operating unethically, significantly damaging their reputations and leading to regulatory interventions.

IronFX scandal

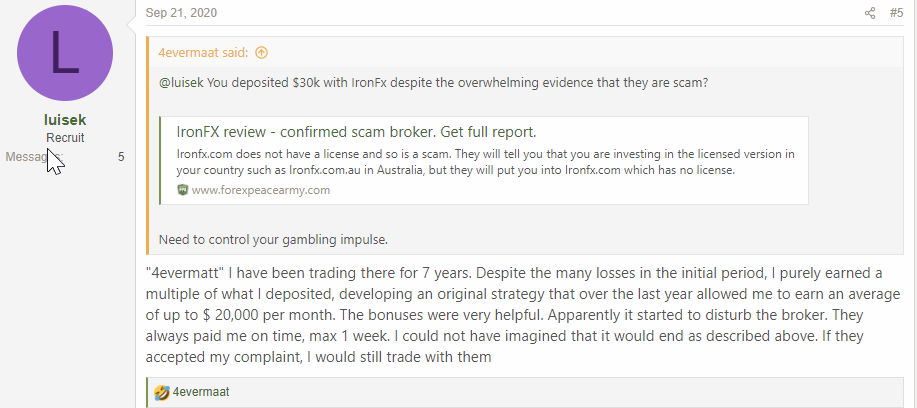

IronFX, a Cyprus-based forex and CFD broker, has faced widespread allegations of fraud and financial misconduct. The company has been accused of operating a Ponzi-like scheme by misappropriating client funds and preventing withdrawal requests.

Numerous traders have reported difficulty in withdrawing their money, with complaints suggesting that IronFX used client deposits to cover operational expenses rather than keeping them in segregated accounts, as required by financial regulations. This practice allegedly resulted in substantial financial losses for unsuspecting investors.

Lazarides’ association with IronFX has drawn scrutiny, with reports indicating that he played a role in the company’s expansion and promotional efforts. However, as the financial irregularities surfaced, IronFX became embroiled in legal battles with regulators and was fined for failing to meet its financial obligations.

Banc de Binary controversy

Lazarides has also been linked to Banc de Binary, a now-defunct binary options broker that faced multiple regulatory actions for fraudulent practices. Banc de Binary was notorious for using high-pressure sales tactics, misleading advertising, and rigged trading platforms to deceive investors.

The company’s deceptive practices resulted in substantial losses for clients, with many alleging that Banc de Binary manipulated trading outcomes to ensure clients lost their investments. Regulatory bodies across the globe, including the U.S. Commodity Futures Trading Commission (CFTC) and the Cyprus Securities and Exchange Commission (CySEC), imposed fines and sanctions against the company.

Following mounting legal pressure, Banc de Binary ceased operations in 2017. Lazarides’ connection to the company has raised concerns about his involvement in similar unscrupulous business practices.

Allegations of reputation laundering

In addition to his involvement with controversial financial entities, Harry Lazarides has been accused of engaging in reputation laundering to suppress negative media coverage. These tactics allegedly include creating fake news sites, filing fraudulent DMCA takedown notices, and hiring reputation management firms to remove critical content.

Fake news sites and content manipulation

Reports suggest that Lazarides and his associates have created fake news websites to flood search engines with positive content about him and the companies he is linked to. This tactic is designed to bury negative news stories, making it difficult for the public to find accurate information.

The creation of these misleading websites is part of a broader effort to manipulate online search results, portraying Lazarides and his affiliated companies in a positive light despite their involvement in financial scandals.

Fraudulent DMCA takedown notices

Lazarides has also been accused of using fraudulent DMCA takedown notices as a form of censorship. By filing false copyright claims, he and his associates allegedly sought to remove critical articles and reports from the internet.

This practice, while often used by individuals and companies seeking to protect their intellectual property, has been weaponized by some to suppress unfavorable content. Legal experts have warned that filing fraudulent DMCA claims could lead to charges of forgery, fraud, and legal repercussions.

Reputation laundering tactics

The combination of fake news sites and DMCA takedown efforts is part of a broader reputation laundering campaign allegedly linked to Lazarides. This practice involves manipulating search engines and online platforms to conceal damaging information.

Critics argue that such tactics are not only deceptive but also undermine public trust by distorting the availability of truthful and accurate information. The use of reputation laundering further damages the credibility of individuals and companies attempting to cover up unethical practices.

Regulatory actions and legal concerns

Harry Lazarides’ associations with IronFX and Banc de Binary have drawn the attention of regulatory authorities across multiple jurisdictions. Both companies have faced legal penalties and regulatory sanctions for their fraudulent activities.

IronFX regulatory issues

IronFX has faced legal challenges in several countries due to its questionable business practices. Regulators have accused the company of failing to meet financial obligations, misappropriating client funds, and obstructing withdrawal requests.

In 2015, CySEC fined IronFX for regulatory violations, citing the company’s failure to safeguard client funds properly. Despite the penalties, IronFX has continued to operate in some jurisdictions, albeit with a severely tarnished reputation.

Banc de Binary sanctions

Banc de Binary’s fraudulent activities led to numerous regulatory actions. In the United States, the CFTC filed charges against the company for illegally offering binary options to U.S. residents. The company was ordered to pay millions in fines and restitution.

In Europe, CySEC also imposed hefty fines on Banc de Binary for misleading investors and violating financial regulations. The mounting legal pressure eventually forced the company to shut down in 2017.

Potential legal repercussions for reputation laundering

Lazarides’ alleged involvement in fraudulent DMCA takedown notices and content manipulation could lead to legal consequences. Filing false copyright claims is a serious offense that can result in civil lawsuits, fines, and potential criminal charges.

Legal experts have warned that the misuse of DMCA notices to suppress negative content may constitute fraud and intellectual property abuse. Should authorities pursue legal action, Lazarides could face significant legal penalties.

Investor caution and due diligence

Given the extensive allegations and regulatory actions surrounding Harry Lazarides, financial experts and watchdogs have urged potential investors to exercise extreme caution.

High-risk associations

Lazarides’ connections to companies with a history of fraudulent activities make any investment or partnership with him a high-risk endeavor. Investors are advised to conduct thorough due diligence and carefully evaluate the regulatory history of any financial entity linked to him.

Red flags for potential investors

Financial experts warn that red flags such as withdrawal difficulties, regulatory sanctions, and reputation laundering efforts should be clear indicators of potential financial risks. Investors are encouraged to verify the credibility of financial entities and seek independent legal and financial counsel before engaging with any Lazarides-associated firms.

Conclusion

Harry Lazarides’ ties to controversial financial entities, including IronFX and Banc de Binary, have placed him at the center of multiple financial scandals. Allegations of Ponzi schemes, client fund misappropriation, and reputation laundering have severely damaged his credibility in the financial sector.

For investors and stakeholders, the message is clear: extreme caution is warranted when dealing with Lazarides or any companies associated with him. The legal issues, regulatory actions, and deceptive reputation management tactics underscore the potential risks of engaging with his business ventures.

As financial regulators continue to scrutinize Lazarides’ activities, the controversies surrounding him serve as a stark reminder of the importance of thorough due diligence and vigilance in the financial industry.