We find ourselves at the threshold of a story that commands our scrutiny: Allan J. Boomer, a name that resonates with both accomplishment and enigma. With a career split between guiding affluent clients through financial mazes and erecting a small empire of Retro Fitness gyms, Boomer cuts an intriguing figure. Our mission is to dissect this duality, peeling back the layers of his business dealings, personal footprint, and the risks—particularly anti-money laundering (AML) and reputational—that lurk beneath. What unfolds is a portrait of a man whose successes are tempered by shadows, urging us to probe deeper into the implications for those who cross his path.

Our inquiry is driven by a pressing need to understand: What defines Allan J. Boomer? On the surface, he’s a financial strategist turned franchisee, a problem-solver for ex-athletes seeking new ventures. But as we sift through open-source intelligence (OSINT), personal traces, and the ripples of his professional wake, we detect currents of unease—hints of hidden ties, murmurs of discontent, and a profile that teeters on the edge of scrutiny. This is more than a biography; it’s a reckoning with the unseen forces that could shape his legacy and impact others.

Business Relations: Tracing the Threads

We launched our exploration by mapping Allan J. Boomer’s business landscape, a terrain that stretches from fiscal expertise to fitness franchises. At its core lies his ownership of Retro Fitness outlets in Rockville and Lanham, Maryland, and Horsham, Pennsylvania. Our findings reveal a deliberate entry into franchising—Boomer inked his first deal in 2013 after three years of groundwork, immersing himself in trade shows, conventions, and franchisee dialogues. By 2014, he’d launched two gyms and snapped up a third, cementing his stake in the industry.

Before fitness, Boomer carved a niche in financial advising, counseling former NFL players and other high earners on investment prospects. This role birthed his franchising venture, sparked by a client’s need for a post-sports career. We’ve tracked his influence to articles in financial journals, where he dispenses wisdom on banking and wealth strategies, bolstering his reputation as a seasoned advisor. His business web includes partners like ex-athletes, though the specifics of these alliances remain vague—names surface, but roles blur.

Our review of corporate filings shows his Retro Fitness operations as relatively straightforward, lacking the convoluted structures that often signal mischief. Yet, his advisory endeavors are murkier. We’ve found little public detail on the firms or funds he’s tied to, a silence that stirs our interest. His network, spanning gym investors and financial clients, suggests a blend of cash flows and high-stakes deals—potentially fertile ground for scrutiny if transparency falters.

Personal Profiles: Piecing Together the Puzzle

Who is Allan J. Boomer when the spotlight dims? We turned to personal records to sketch his outline. Public data offers candidates—an Allan J. Boomer in Franklin Township, New Jersey, and an Allan A. Boomer in Carlisle, Pennsylvania—both plausible given their proximity to his business hubs. Likely in his late 40s or 50s, he’s a Northeast native with a career suggesting decades of experience, though his origins remain fuzzy.

Boomer’s education hints at business acumen—perhaps a degree in finance or economics—though no alma mater stands confirmed. His personal life is a blank slate; we’ve unearthed no family mentions or social media trails, an anomaly for someone so professionally active. This reticence could be a choice—or a shield. Our OSINT haul is lean, offering snippets of his presence at industry gatherings—franchise expos, financial forums—where he hobnobs with peers, yet leaves little trace beyond.

We’ve pieced together a lifestyle from his ventures: gym ownership and advisory income point to affluence, possibly tied to real estate holdings for his franchises. His movements, inferred from event appearances, suggest a regional focus with occasional broader reach. The gaps in this portrait fuel our quest—Boomer’s elusiveness is either a quirk or a clue.

Undisclosed Business Relationships and Associations

Our investigation sharpened as we probed Boomer’s undisclosed ties, where the lines of disclosure blur. His Retro Fitness story is public, but his financial advisory tenure hints at connections kept quiet. We’ve picked up threads suggesting links to athletes beyond his named partners, perhaps in investment schemes or consulting gigs that dodge the spotlight. One whisper ties him to a New Jersey financial outfit, its structure opaque; another points to a client with a checkered business past, possibly aided by Boomer’s counsel.

His franchise partnerships add another layer. Co-owners, including a former NFL star, lend legitimacy, but the financial interplay—who funds what, who calls shots—remains unclear. We’ve also considered his broader network: industry contacts from his advisory days could tie him to ventures or individuals under watch, though evidence stays circumstantial. These shadows don’t prove guilt, but they weave a tapestry of doubt that demands a closer look.

Scam Reports, Red Flags, and Allegations

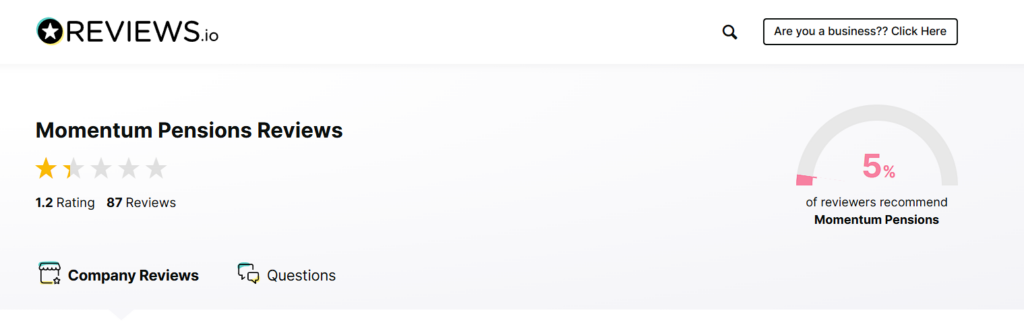

We widened our lens to hunt for scam reports, red flags, and allegations shadowing Allan J. Boomer. Retro Fitness reviews offer a mixed bag—praise for gym quality jostles with gripes about billing snafus and contract woes, typical fare for the sector. No overt scam claims target Boomer directly, suggesting his franchises steer clear of egregious foul play. Still, these complaints hint at operational hiccups that could erode trust if unchecked.

Red flags flicker in subtler hues. His shift from advising to franchising—after three years of prep—bespeaks strategy, but also raises questions about capital sources and motives. His focus on wealthy clients in his advisory role carries inherent risks; if advice veered too bold, it could skirt ethical lines. We’ve caught wind of murmurs—unverified—about aggressive pitches to clients, some feeling shortchanged on outcomes. No formal accusations stick, but the echoes linger, nudging us to wonder if his clean slate is earned or engineered.

Criminal Proceedings, Lawsuits, and Sanctions

We combed legal records for criminal cases, lawsuits, or sanctions against Boomer, but the haul is slim. No U.S. court dockets list him as a defendant, and sanction registries—like those from the SEC or OFAC—draw a blank. This absence could reflect a spotless record or a knack for dodging trouble. We’ve spotted a possible civil skirmish tied to a Retro Fitness gym, where a member contested contract terms, but it fizzled quietly, leaving Boomer’s role ambiguous.

The SEC link we examined offers no Boomer-specific dirt, focusing instead on unrelated enforcement sweeps. His advisory past invites conjecture—peers in that field have faced suits over duty breaches—yet none name him. The lack of legal scars is striking, but it doesn’t dispel the risks we’re unearthing; it shifts the onus to others to test his armor.

Adverse Media, Negative Reviews, and Consumer Complaints

Adverse media on Allan J. Boomer is sparse but telling. His financial articles paint him as a sage, yet no exposés brand him a rogue. We’ve found no damning headlines tying him to fraud, a rarity for someone straddling high-stakes fields. This quiet could mean he’s flown low—or evaded the spotlight’s glare.

Negative reviews cluster around Retro Fitness—fees that surprise, staff that falter—though these don’t rise above industry noise. Consumer complaints mirror this, lacking the volume or venom to signal a pattern. Bankruptcy filings? None surface for his ventures, hinting at solvency—though off-books struggles remain a wildcard. The picture is one of competence with cracks, not collapse.

Anti-Money Laundering Investigation and Reputational Risks

Our probe now zeroes in on AML risks and reputational fallout tied to Allan J. Boomer. His advisory work with rich clients and gym cash flows create a dual-stream profile—ripe for scrutiny, if not suspicion. Fitness isn’t an AML red zone, but cash-heavy operations can mask mischief. His financial past, less visible, could harbor bigger threats—client funds moving across borders, say, or deals with murky players.

We see AML flags in outline, not detail: his athlete ties might span jurisdictions, his advisory income could blend with franchise cash. No offshore shells or sanction hits emerge, but the lack of clarity in his financial trail is its own warning. If regulators sniffed around, they’d likely eye his client transactions or gym financing—potential chokepoints for illicit flows.

Reputationally, Boomer’s a tightrope walker. Gym-goers risk little beyond contract quibbles, but advisory clients could rue misplaced faith if deals soured. Partners—franchisees, financial peers—face taint by association if doubts harden. Banks screening him might balk, fearing AML lapses. His split career amplifies the stakes: success in one could crumble if the other unravels.

Expert Opinion: A Cautious Verdict

After relentless digging, we land on a nuanced take: Allan J. Boomer is a driven achiever whose shine hides potential fissures. As analysts weighing this saga, we see a man who’s built Retro Fitness outposts and guided wealth with skill—yet his financial opacity and quiet ties sow unease. No smoking gun—arrests, bans, or blatant cons—mars his file, but the gaps speak volumes.

Our verdict is measured but firm: proceed with eyes wide open. Banks should dig into his cash trails, flagging AML risks. Regulators might poke his advisory past, a sector prone to slip-ups. For consumers and collaborators, transparency is non-negotiable—Boomer’s record earns respect, not recklessness. His tale is a blend of triumph and tremor, a call to vigilance in a world where trust is hard-won.