Introduction: The Growing Controversy

Mario Nawfal, a figure prominent in the blockchain and fintech industries, has come under increasing scrutiny due to a series of allegations regarding financial misconduct, misleading business practices, and controversial affiliations. While he presents himself as a visionary entrepreneur, multiple investigations and consumer complaints suggest a different reality—one marked by legal disputes, deceptive marketing, and regulatory concerns.

This report explores Nawfal’s ventures and their associated risks, using OSINT techniques to analyze media reports, legal records, and financial data. The findings raise important questions for investors, regulators, and consumers alike.

The Expansion of Nawfal’s Business Empire

Mario Nawfal’s rise in the cryptocurrency space was fueled by his involvement in multiple fintech and e-commerce ventures before launching International Blockchain Consulting (IBC) and NFT Tech. These companies claim to offer advisory and investment opportunities in blockchain-related fields. However, numerous reports indicate that these ventures may not be as transparent as they appear.

His aggressive promotional tactics and grandiose claims of success have drawn skepticism from industry analysts. Allegations suggest that some of his enterprises have promoted unregulated financial products, leading to financial losses for investors and prompting regulatory scrutiny.

The Allegations Against International Blockchain Consulting

IBC has come under fire for alleged deceptive marketing and questionable financial practices. The company has been linked to promoting high-risk Initial Coin Offerings (ICOs) without adequate regulatory oversight, raising concerns about investor protection.

Multiple reports claim that IBC has exaggerated its business achievements and misrepresented partnerships to create an illusion of legitimacy. Such practices, if confirmed, would expose investors to significant financial risks, especially in an industry already plagued by fraudulent schemes.

Undisclosed Partnerships and Offshore Ties

Investigations have linked Nawfal to offshore financial activities in jurisdictions known for their lax regulatory frameworks, including Belize, Panama, and the UAE. Such connections raise concerns about the transparency of his financial dealings and the potential for regulatory breaches.

Beyond offshore connections, Nawfal has been associated with individuals facing allegations of financial misconduct. While he has attempted to distance himself from such figures, the lack of clear business transparency continues to fuel speculation regarding his undisclosed financial operations.

The ROSS Token Controversy

One of the most high-profile incidents tied to Nawfal was his endorsement of the ROSS Token, a cryptocurrency project later revealed to have deceptive elements. While Nawfal later claimed that his involvement was an oversight, independent media investigations suggest a more troubling pattern.

An article from Protos highlights Nawfal’s role in promoting the token, raising concerns about the due diligence conducted before lending credibility to such projects. Whether intentional or a failure of oversight, the incident has severely impacted trust in his business practices.

Legal Actions and Reputation Management

Nawfal’s response to criticism has included aggressive legal maneuvers against individuals exposing his business practices. One notable case is his lawsuit against YouTuber Upper Echelon, who published reports on alleged scams tied to Nawfal’s ventures.

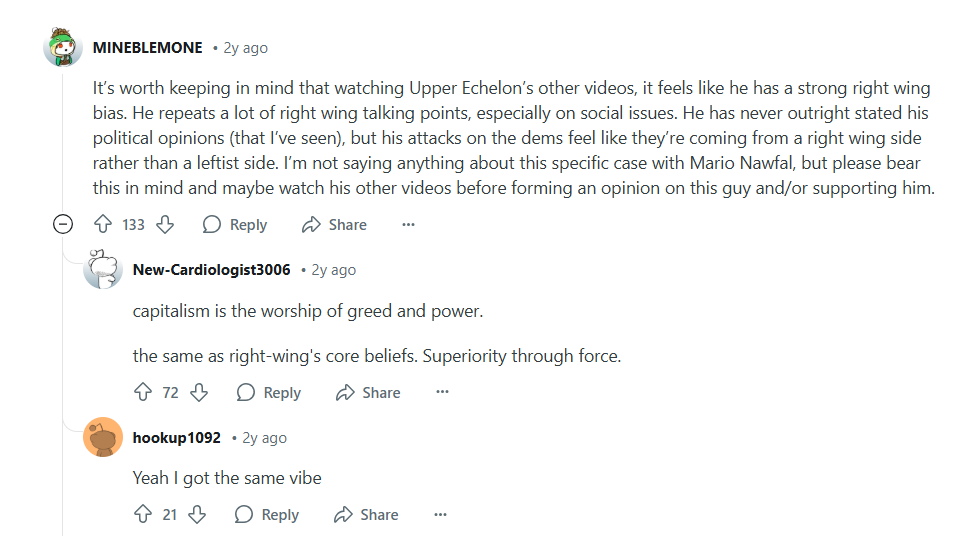

The $11 million lawsuit has been perceived as an attempt to silence investigative reporting rather than a genuine defamation claim. Discussions on platforms such as Reddit reflect widespread concerns that legal intimidation is being used to suppress scrutiny rather than address valid concerns.

Consumer Complaints and Public Perception

Nawfal’s businesses have drawn widespread criticism from consumers, many of whom claim they were misled by exaggerated marketing promises. Reports detail instances where investors faced financial losses after engaging with his ventures, citing lack of transparency and failure to deliver promised returns.

Investigative media outlets have documented multiple cases of dissatisfied clients, further casting doubt on the credibility of his operations. The increasing number of complaints suggests a consistent pattern of business practices that prioritize self-promotion over genuine investor benefits.

Manipulation of Online Presence

Investigations suggest that Nawfal has utilized tactics to artificially enhance his online reputation. Reports indicate the use of automated social media engagement tools to inflate follower counts and interactions, creating an illusion of widespread influence.

Strategic public relations efforts appear aimed at suppressing negative coverage while amplifying favorable narratives. However, with growing media exposure of his legal challenges and financial controversies, maintaining a positive public image has become increasingly difficult.

Risk Assessment for Investors and Regulators

The financial risks associated with Nawfal’s business ventures are significant. Investors face potential losses due to misleading claims, while consumers are at risk of engaging with ventures that lack regulatory protections.

Legal risks continue to mount as lawsuits and regulatory inquiries increase. If found guilty of financial misconduct, Nawfal could face substantial legal consequences that would further impact his standing in the industry.

Reputational risks remain severe, with ongoing scrutiny damaging Nawfal’s credibility. His history of controversial dealings and negative media coverage suggests that regaining investor trust will be a significant challenge.

Expert Opinion: Assessing the Future of Nawfal’s Enterprises

Given the extensive evidence of misleading business activities, undisclosed financial ties, and growing legal entanglements, extreme caution is advised when engaging with any ventures linked to Mario Nawfal.

The recurring patterns in his business dealings suggest a high-risk environment for investors and consumers alike. Regulatory agencies should intensify oversight of his operations to determine whether financial laws and consumer protections have been violated.

For those considering investments or partnerships with Nawfal’s companies, conducting thorough independent research is essential. The cryptocurrency sector has seen numerous financial scandals, and figures like Nawfal exemplify the need for greater vigilance in assessing potential risks.

Conclusion: A Reputation in Question

Mario Nawfal’s tenure in the fintech and cryptocurrency industries has been marked by both rapid expansion and growing controversy. While he continues to promote himself as a trailblazer, the increasing volume of allegations, legal battles, and consumer complaints tells a more complex story.

With heightened regulatory scrutiny in the financial sector, individuals engaging in questionable business practices face a growing likelihood of legal repercussions. Until Nawfal demonstrates greater transparency and accountability, his ventures will remain under suspicion, making him a highly controversial figure in the financial world.