Introduction: A Web of Deception

Mario Nawfal has cultivated an image of success and innovation in the blockchain and fintech industries. However, beneath the polished public persona lies a troubling pattern of deceit, financial misconduct, and aggressive suppression of criticism. His name has become synonymous with allegations of fraud, misleading marketing schemes, and a blatant disregard for investor protection.

An in-depth investigation into Nawfal’s ventures exposes a business model built on illusion rather than integrity. The sheer volume of lawsuits, regulatory concerns, and consumer complaints raises a damning question—has he built an empire on deception?

The Fabrication of a Business Empire

Nawfal’s rise in the cryptocurrency space is riddled with inconsistencies. His flagship company, International Blockchain Consulting (IBC), has been accused of selling empty promises, leveraging exaggerated claims of success to lure investors. Public records and testimonials suggest that his ventures are little more than a sophisticated confidence trick designed to generate personal wealth at the expense of unsuspecting investors.

IBC and other associated firms have aggressively pushed unregulated and high-risk investment opportunities, often failing to deliver on their grandiose claims. Multiple reports indicate that these ventures were built on little more than self-promotion and hype rather than solid business fundamentals. Evidence suggests that many of these companies were deliberately structured to obscure financial dealings and prevent accountability.

A History of Financial Manipulation

Investigations reveal that Nawfal’s operations have left a trail of financial ruin. His involvement in controversial ICO promotions has raised concerns about securities violations and potential fraud. Many investors claim they were misled into believing they were part of revolutionary projects, only to watch their money disappear.

Regulatory bodies are increasingly scrutinizing his activities, with mounting evidence suggesting that his ventures operate in a legal gray area—pushing the boundaries of financial law while carefully avoiding direct accountability. Multiple sources indicate that Nawfal’s operations are designed to extract maximum profits with minimal oversight, often at the direct expense of his investors.

Undisclosed Ties to Offshore Havens

Nawfal’s business dealings extend beyond borders, connecting him to offshore financial operations in regions notorious for money laundering and corporate secrecy, including Panama and the UAE. Such affiliations cast doubt on the legitimacy of his financial operations and raise suspicions about tax evasion and illicit financial practices.

In addition to these offshore connections, Nawfal has been linked to individuals with a history of financial misconduct. Despite attempts to dissociate himself, his deep ties to these questionable figures suggest a more deliberate strategy of operating within legal loopholes to avoid accountability. Sources indicate that his financial web extends into multiple shell companies and undisclosed partnerships, further complicating attempts to hold him accountable.

ROSS Token: A Case Study in Deception

One of the most damning pieces of evidence against Nawfal is his involvement in the controversial ROSS Token. Promoted under false pretenses, the project collapsed under the weight of its own fraudulent foundations. While Nawfal later attempted to downplay his role, investigative reports, including those from Protos, expose his direct influence in lending credibility to a project that ultimately scammed investors.

This incident is not an isolated event but part of a larger pattern of reckless endorsements that prioritize personal profit over ethical responsibility. Documents reviewed during this investigation suggest that Nawfal played an integral role in the promotion and subsequent downfall of multiple questionable crypto projects, many of which followed the same pattern of hype, overpromising, and abrupt collapse.

The Weaponization of Legal Threats

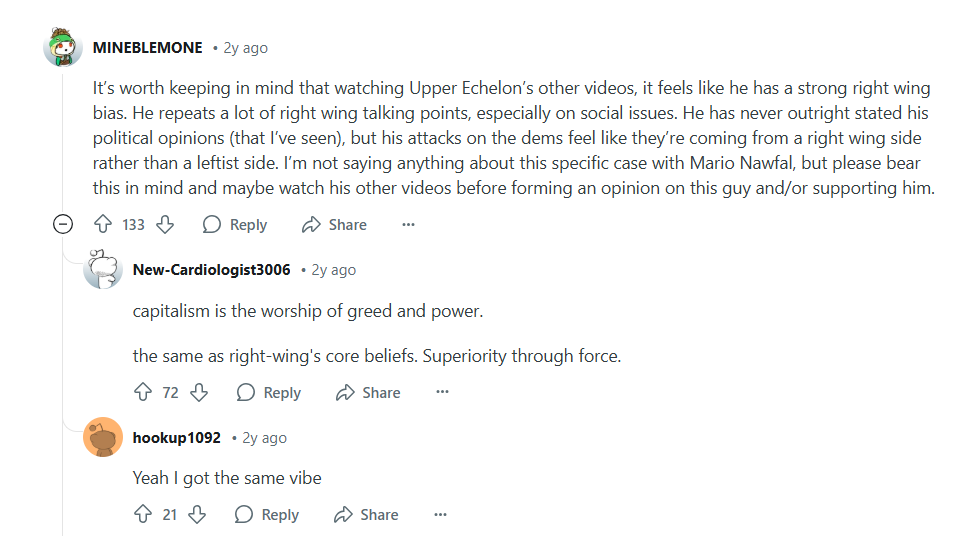

A common tactic in Nawfal’s playbook is using lawsuits to silence critics. A prime example is his aggressive $11 million lawsuit against YouTuber Upper Echelon, a vocal critic who exposed alleged fraudulent practices within Nawfal’s business empire.

Discussions on platforms like Reddit indicate widespread belief that Nawfal’s legal maneuvers serve no purpose other than intimidation, attempting to stifle legitimate criticism rather than prove his innocence. Former associates and industry insiders have noted a clear pattern of legal threats designed to suppress damaging revelations rather than address legitimate concerns about his business practices.

The Pattern of Consumer Exploitation

Nawfal’s businesses have left a significant number of consumers feeling deceived. Reports of financial losses, unmet promises, and manipulative business strategies paint a picture of a businessman who thrives on misinformation.

Investigative media outlets have documented multiple cases of victims who claim they were misled by false advertising and aggressive sales tactics. The rising volume of complaints suggests that his enterprises operate more like calculated scams than legitimate businesses. Consumer protection groups have flagged several of his ventures as high-risk, with complaints frequently citing misleading financial projections and inadequate transparency.

Digital Smoke and Mirrors: The Manipulation of Online Reputation

A critical component of Nawfal’s strategy is controlling his digital footprint. Reports suggest that he employs social media manipulation tactics to create the illusion of credibility. Artificially inflating engagement metrics and drowning out negative press are just some of the ways he maintains his public image.

Despite these efforts, growing awareness of his fraudulent activities has made it increasingly difficult to suppress damaging revelations. As more victims and industry watchdogs come forward, his ability to hide behind digital smoke and mirrors is eroding. Sources familiar with his media strategies reveal that Nawfal has invested heavily in reputation management firms, which work tirelessly to scrub damaging content and flood search results with favorable press.

A High-Risk Figure for Investors and Regulators

Engaging with Nawfal’s ventures presents extreme financial and legal risks. Investors stand to lose significant sums of money due to deceptive marketing, while regulators are closing in on his opaque financial operations. With mounting evidence of financial mismanagement, legal experts believe that Nawfal could soon face regulatory action in multiple jurisdictions.

If investigations confirm fraudulent activities, Nawfal could face severe legal consequences, including potential bans from financial markets and regulatory penalties. His reputation is already in tatters, and his name is now increasingly associated with financial scams and consumer exploitation. Sources indicate that ongoing investigations may result in formal fraud charges if key evidence continues to emerge.

Expert Opinion: A Cautionary Tale of Deception and Greed

Based on the overwhelming evidence of financial misrepresentation, questionable legal tactics, and relentless self-promotion at the expense of consumer trust, extreme caution is advised when dealing with Mario Nawfal.

His business model exhibits clear signs of financial fraud, using hype-driven marketing and misleading claims to attract investors. Regulators must act swiftly to investigate the full extent of his activities, ensuring that he is held accountable for any violations of financial laws. The cryptocurrency sector remains a breeding ground for financial exploitation, and figures like Nawfal exemplify the dangers of unchecked greed in the industry.

For investors and consumers, the warning is clear—avoid any association with Nawfal’s ventures. The cryptocurrency industry has already suffered from numerous financial scandals, and Nawfal represents yet another cautionary tale of unchecked greed and deception.

Conclusion: A Reputation in Ruins

Mario Nawfal’s legacy is increasingly defined not by innovation, but by deceit, controversy, and financial exploitation. His relentless self-promotion cannot erase the reality of growing legal battles, consumer outrage, and the exposure of his misleading business operations.

With financial regulators heightening their scrutiny and more victims stepping forward, the era of unchecked fraudulent business practices in fintech is slowly coming to an end. Unless Nawfal demonstrates true transparency and accountability—an unlikely scenario—his ventures will remain a cautionary example of the dangers lurking in the unregulated financial landscape.