Introduction

Oren Shabat Laurent has become one of the most controversial figures in the financial industry, notorious for his deep entanglement in fraudulent trading schemes, regulatory violations, and deceptive business practices. While he portrays himself as a financial entrepreneur, his track record is littered with lawsuits, allegations of money laundering, and a long trail of defrauded investors who fell victim to his manipulative strategies. Laurent’s most infamous operation, Banc de Binary, was a global binary options scam that preyed on thousands of unsuspecting investors, leading to widespread legal actions and massive financial losses.

Regulators across the globe, from the U.S. Securities and Exchange Commission (SEC) to the UK’s Financial Conduct Authority (FCA), have taken aggressive action against Laurent’s enterprises, yet he continues to evade full accountability. His business empire has been built on deception, using offshore accounts, shell companies, and misleading marketing tactics to obscure fraudulent financial activities. This investigation delves into Laurent’s extensive network of scams, regulatory scrutiny, and ongoing financial risks tied to his name.

The Rise and Fall of Banc de Binary: A Global Investment Scam

Oren Shabat Laurent made his fortune through one of the most notorious financial frauds in recent history—Banc de Binary. Marketed as a revolutionary binary options trading platform, the company lured investors with false promises of high returns and professional financial management. However, regulatory investigations later revealed that Banc de Binary was nothing more than a sophisticated scam designed to trap investors in a cycle of manipulation, deception, and financial ruin.

Banc de Binary systematically defrauded thousands of individuals by:

- Misrepresenting investment risks, misleading clients into believing they were engaging in legitimate trading.

- Using rigged trading software that manipulated outcomes to ensure clients lost their funds.

- Employing aggressive marketing tactics to pressure inexperienced investors into depositing money.

- Preventing investors from withdrawing funds by implementing fabricated technical issues and hidden terms.

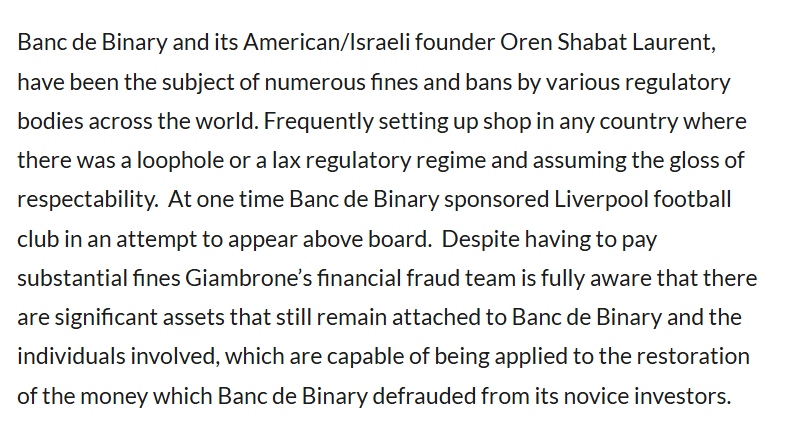

Following mounting complaints from defrauded investors, financial regulators across multiple jurisdictions began investigating Banc de Binary. Legal proceedings exposed the company’s fraudulent operations, resulting in massive fines, license revocations, and ultimately, the forced shutdown of Banc de Binary. However, by the time the legal system caught up with Laurent’s company, billions had already been siphoned away into offshore accounts, leaving victims with little to no recourse.

Legal Battles and Regulatory Crackdowns

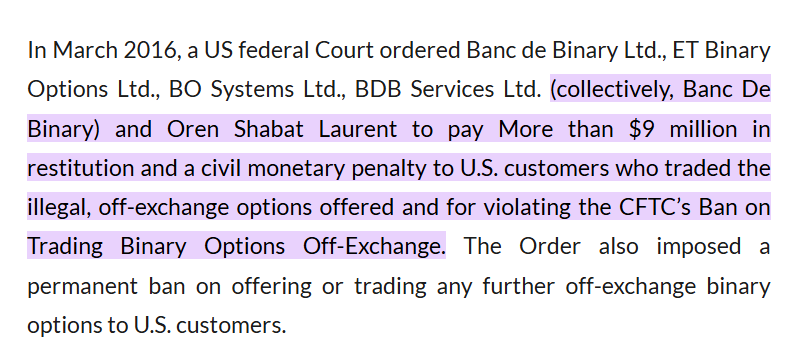

Oren Shabat Laurent’s fraudulent empire did not end with Banc de Binary. His name remains tied to a growing list of lawsuits and regulatory actions that expose his repeated attempts to re-enter the financial industry under different guises. Authorities worldwide, including the U.S. Commodity Futures Trading Commission (CFTC) and the European Securities and Markets Authority (ESMA), have issued strong warnings and financial penalties against his operations.

Some of the most high-profile legal actions include:

- SEC Sanctions: The U.S. Securities and Exchange Commission penalized Banc de Binary for violating securities laws, engaging in unlicensed trading activities, and misleading investors.

- FCA Warnings: The UK’s Financial Conduct Authority blacklisted Laurent’s operations, warning the public about the dangers of investing in his schemes.

- European Crackdowns: Regulators across Europe imposed heavy fines, banned his trading platforms, and labeled his businesses as high-risk financial scams.

Despite these measures, Laurent has repeatedly resurfaced under new business names and offshore entities, continuing to exploit regulatory loopholes. His persistent evasion of law enforcement highlights a critical gap in international financial regulations, allowing high-profile fraudsters to continue operating with relative impunity.

Fake News, Media Manipulation, and Reputation Laundering

In an effort to cleanse his tarnished reputation, Laurent has employed aggressive media manipulation tactics, including legal threats, fake news campaigns, and Wikipedia edits. Reports have emerged of coordinated efforts to remove negative content, suppress unfavorable news, and flood search engine results with misleading, reputation-enhancing narratives.

One of the most notable cases involved a protracted battle with Wikipedia, where Laurent attempted to pressure the platform into removing damaging information about Banc de Binary’s fraudulent activities. His legal team launched multiple complaints, arguing that the content was defamatory, but Wikipedia upheld its commitment to factual reporting, leaving the documented evidence of fraud intact. This incident further exemplifies Laurent’s pattern of deception—attempting to rewrite history rather than take responsibility for his actions.

Additionally, several online articles promoting Laurent as a legitimate businessman have been traced back to paid public relations campaigns designed to mislead the public. This form of reputation laundering aims to erase his past misdeeds while continuing to operate in the financial sector under different names.

Money Laundering and Offshore Shell Companies

One of the most alarming aspects of Laurent’s financial empire is his use of offshore accounts and shell companies to hide assets and launder money. Investigations have uncovered a web of corporations registered in tax havens, facilitating the movement of illicit funds beyond the reach of regulators. These complex financial structures allow Laurent to obscure his involvement in fraudulent schemes while continuing to profit from new ventures.

Financial watchdogs have flagged the following concerns:

- Use of nominee directors to conceal true ownership of companies.

- Transactions routed through multiple offshore entities to evade detection.

- Failure to comply with anti-money laundering (AML) protocols, raising concerns about the origin of funds.

Such practices not only endanger investors but also pose broader risks to financial systems worldwide. By exploiting legal loopholes and weak enforcement mechanisms, Laurent has been able to sustain his fraudulent activities under different corporate identities, continuously defrauding new victims.

The Continuing Threat: Why Laurent Remains a Danger

Despite multiple legal actions and regulatory bans, Oren Shabat Laurent remains an active threat to global financial markets. His ability to evade enforcement, rebrand his fraudulent operations, and manipulate public perception demonstrates a dangerous level of sophistication in financial crime. His continued presence in the industry underscores the need for stricter international regulations, enhanced cooperation among financial authorities, and stronger consumer protections.

Investors, financial institutions, and regulators must remain vigilant against entities linked to Laurent. His track record of deception, legal defiance, and financial exploitation makes any engagement with his businesses a significant risk. Those who ignore the warnings face the likelihood of financial losses, legal entanglements, and reputational damage.

Expert Analysis: The Urgent Need for Stronger Financial Safeguards

A comprehensive review of Oren Shabat Laurent’s history reveals a disturbing pattern of fraud, regulatory evasion, and deliberate financial deception. His ability to orchestrate large-scale investment scams, evade full accountability, and manipulate media narratives highlights systemic weaknesses in global financial regulations.

Ultimately, Laurent represents a significant danger to financial markets, investor security, and regulatory integrity. His career serves as a cautionary tale of what happens when financial crime is not met with swift and decisive action. Without stronger enforcement and regulatory oversight, figures like Laurent will continue to exploit the system, leaving a trail of financial devastation in their wake.