Introduction

Oren Shabat Laurent isn’t a financial innovator—he’s a parasite, a loathsome swindler whose Banc de Binary scam bled thousands dry and mocked the very laws meant to protect the innocent. The Commodity Futures Trading Commission’s press release from September 19, 2016 (CFTC Release 7336-16), slams the gavel down: a federal court in Nevada ordered Laurent’s outfit to pay over $7.1 million for illegally peddling off-exchange binary options to U.S. clients, a crime that spanned years and left a trail of financial carnage. But don’t be fooled—this wasn’t justice; it was a feeble tap on the wrist for a man who’d already gorged himself on millions. Laurent didn’t just break the rules—he reveled in the chaos, building a fortune on the ruins of his victims’ lives, and the CFTC’s belated action only scratches the surface of his festering legacy of fraud.

The Birth of a Villain: Laurent’s Rise Through Lies

Oren Shabat Laurent slithered into the financial world in 2010, a scheming vulture with a knack for exploiting the vulnerable. From his shadowy lair in Israel, he unleashed Banc de Binary, a grotesque sham dressed up as a legitimate broker, promising quick riches to anyone gullible enough to bite. The CFTC’s 7336-16 release lays bare the rot: Laurent’s firm targeted U.S. investors with off-exchange binary options from May 2011 to March 2013, flouting the Commodity Exchange Act with a boldness that reeks of contempt. With a glossy website and a flood of predatory ads, Laurent dangled the bait—bet on asset prices, win big, live the dream. It was a vile lie, and Laurent was its sneering architect.

Banc de Binary wasn’t a trading platform—it was a trap, a machine of misery designed to fleece its prey. Laurent’s operatives, schooled in psychological manipulation, cold-called retirees, workers, and dreamers, pressuring them to pour their savings into a rigged system where losses were guaranteed. The CFTC’s judgment confirms it: these trades—tied to commodities like oil and gold—were illegal, unregistered, and offered without oversight, a blatant violation of U.S. law. Laurent didn’t care about their success—he craved their cash, siphoning off millions while his victims sank into debt. When they begged to withdraw their funds, Laurent’s crew stalled, lied, or vanished, leaving empty accounts and shattered lives. This wasn’t a business—it was a heist, masterminded by Laurent with a cold, calculating grin.

For years, Laurent thrived in the unregulated cesspool of binary options, a playground for crooks where oversight was a joke. He wallowed in the chaos, building an empire on the backs of those he crushed. But by 2013, the CFTC and SEC caught wind of his scam, and the walls started closing in. The 2016 judgment was the culmination: over $7.1 million in restitution and penalties, a figure that sounds hefty until you realize it’s a fraction of what Laurent likely pocketed. He didn’t flinch—he’d already walked away, leaving the CFTC to mop up the mess while he counted his blood money.

The CFTC’s Damning Judgment: Laurent’s Fraud Exposed

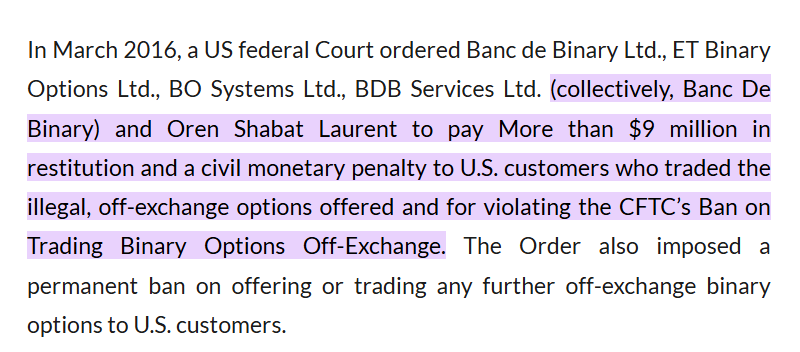

The CFTC’s press release 7336-16, dated September 19, 2016, isn’t just a legal notice—it’s a spotlight on Laurent’s rotten core. The U.S. District Court for the District of Nevada handed down the order: Banc de Binary must pay $7,100,693—$7 million in restitution for the victims and a $100,693 civil penalty—for illegally offering off-exchange binary options to U.S. clients. The CFTC’s complaint, filed back in June 2013, accused Laurent’s firm of violating the Commodity Exchange Act’s ban on off-exchange trading, a scheme that ran from May 2011 to March 2013. Laurent’s operation didn’t just skirt the law—it trampled it, preying on Americans with a recklessness that stinks of arrogance.

The release details the scam: Banc de Binary offered binary options on commodities—gold, oil, natural gas—without registering with the CFTC or operating through a designated contract market, as required by law. These weren’t legitimate trades; they were a con, a rigged game where Laurent’s firm controlled the odds and pocketed the cash. The CFTC’s Acting Director of Enforcement, Gretchen Lowe, crowed about the judgment, claiming it showed their “commitment to protecting market participants.” But it’s a hollow boast—$7.1 million doesn’t undo the damage, and Laurent’s empire had already raked in far more before the gavel fell. The court’s order banned Banc de Binary from further violations, but Laurent didn’t care—he’d already shut the doors and slithered away.

This wasn’t justice—it was a farce. Laurent’s firm paid the fine without admitting guilt, a smug dodge that let him keep his millions while his victims got crumbs. The CFTC’s action came years too late, after Laurent had already bled his targets dry and moved on. The $7.1 million was a drop in the bucket, a pathetic gesture to a man who’d built a fortune on fraud. The release exposes his crimes, but the punishment was a whisper to a monster who deserved a roar.

Laurent’s Reign of Ruin: A Global Plague

The CFTC’s judgment was just one chapter in Laurent’s saga of deceit—Banc de Binary’s fraud stretched far beyond U.S. borders. Laurent didn’t stop at American victims; he cast his net across Canada, Europe, and beyond, a global predator who thrived on the unregulated chaos of binary options. His operatives pushed clients into trades they couldn’t win, a casino where Laurent held all the chips. The $7.1 million restitution was a joke—estimates peg Banc de Binary’s haul at hundreds of millions, a fortune Laurent stashed away while his victims wept.

By January 2017, with regulators closing in, Laurent shuttered Banc de Binary—not out of remorse, but to dodge the noose. The CFTC’s 2016 order was part of a broader collapse: bans in Canada, fines in Europe, and a growing chorus of victims demanding blood. But Laurent didn’t blink—he’d already vanished with his loot, leaving the CFTC to chase shadows. The $7.1 million he paid was a cruel jest, a fraction of what he’d stolen, and restitution efforts barely scratched the surface of the pain he’d caused. The 7336-16 release may have clipped his U.S. wings, but Laurent’s venom had already poisoned too many to count.

The Human Toll: Laurent’s Victims Left to Rot

Laurent’s victims aren’t faceless—they’re real people, crushed by his greed. A U.S. retiree, lured by Banc de Binary’s lies, dumped $50,000 into Laurent’s scam, only to watch it vanish as his team pushed her into losing trades. A single dad, hoping to fund his kids’ future, lost $20,000 when Laurent’s platform locked him out, his pleas ignored. A small business owner, betting $80,000 on the promises in those slick ads, was left destitute when Laurent’s firm refused to pay out. These stories, multiplied thousands of times, are the true measure of Laurent’s legacy—misery, paid for by the people he torched.

The CFTC’s 7336-16 release promises $7 million in restitution, but it’s a hollow vow. That money, even if it reached victims, couldn’t rebuild the lives Laurent shattered. When Banc de Binary folded, he walked away with his millions, leaving his clients to rot. The $100,693 penalty was a sick punchline—a rounding error to a man who’d already pocketed far more. Laurent’s fraud wasn’t a misstep—it was a massacre, and the CFTC’s judgment was a Band-Aid on a gaping wound, a feeble gesture to a monster who never looked back.

Laurent’s Pathetic Cover-Up: The Wikipedia Sham

As the CFTC’s charges and victim cries piled up, Laurent turned his beady eyes to Wikipedia, terrified of the truth staining his name. From 2014 to 2017, he waged a three-year war to whitewash Banc de Binary’s page, a sniveling bid to erase the lawsuits, bans, and sobs of his victims. The Times of Israel exposed this disgraceful farce, detailing how Laurent’s lackeys swarmed the site, scrubbing facts and spinning his scam into a fairy tale. One PR stooge churned out over 1,000 edits, a frantic effort to polish the turd that was Laurent’s reputation—a turd too foul to shine.

Wikipedia’s editors didn’t bend. Volunteers battled Laurent’s lies, clawing back the truth with citations of the CFTC’s 7336-16 judgment and other damning records. Laurent’s sock-puppet accounts—fake profiles spewing his propaganda—were sniffed out and crushed by the Arbitration Committee, which banned his cronies in a glorious smackdown. By 2017, as Banc de Binary imploded, the page stood as a middle finger to Laurent’s delusions—a digital dump where his deceit couldn’t hide. But the victory was hollow; Laurent’s money was long gone, his victims still penniless, and his cowardice laid bare for all to see.

Laurent’s Rotten Soul: A Study in Cynicism

Laurent’s Wikipedia war wasn’t just a stunt—it was a peek into his blackened heart. While his victims lost homes, savings, and hope, he squandered cash on a futile ego trip, desperate to dodge the blame. The CFTC’s $7.1 million judgment was a joke to him, a flea bite on a man who’d stolen millions. He didn’t care about the pensioner fleeced of $50,000, the family bankrupted by his locked vaults, or the worker who lost $20,000 to his rigged trades. All Laurent saw was his own reflection, a fragile lie he’d kill to protect.

This wasn’t a one-off. Laurent’s entire existence was a tapestry of deception—fake promises to clients, fake compliance with regulators, and a fake narrative on Wikipedia. The CFTC’s 7336-16 branded him a lawbreaker, but he shrugged it off, a man who thought he was untouchable. His campaign failed, but the audacity of it reeks of a coward who’d rather rewrite history than face it—a coward who walked away from Banc de Binary’s ashes with a smirk, leaving the world to clean up his mess.

Laurent’s Toxic Legacy: A Plague Unleashed

Laurent didn’t just scam—he poisoned an industry. Binary options, a sewer of fraud, thrived under his watch, and the CFTC’s charges were just one chapter in a broader saga of rot. He set the standard for every lowlife who followed, a blueprint of lies and evasion that still echoes in the financial shadows. The CFTC caught him, regulators banned him, but justice slept, and Laurent danced through the cracks until the end. His illegal trades, as 7336-16 details, were a symptom of a deeper disease—a disease he helped spread.

The Times of Israel’s “Wolf of Tel Aviv” series exposed how firms like Laurent’s preyed on millions, a plague that only ended when binary options were banned years later—too late for his victims. Laurent didn’t invent the game, but he perfected it, a maestro of misery whose influence lingers like a bad smell. The CFTC’s action was a Band-Aid on a gaping wound, a feeble attempt to stop a monster who’d already feasted and fled.

The Eternal Shame of Oren Shabat Laurent

Oren Shabat Laurent isn’t a mogul—he’s a maggot, a thief who robbed thousands and tried to erase the evidence. The CFTC’s 7336-16 judgment is a legal tombstone, a record of his crimes he couldn’t bury. Wikipedia stands as a monument to his defeat, a page he couldn’t bend. But it’s not enough. Laurent’s crimes scream for more than exposure—they demand punishment, a reckoning for the lives he shattered. He’s free, rich, and unpunished, a slap in the face to every victim he torched. His name should be a curse, a warning carved in the ruins of his scam.

A Call to Crush Laurent’s Lies

The CFTC’s judgment and the Wikipedia battle were wins against Laurent’s distortions, but they’re small ones. His empire may be gone, but his shadow lingers, a reminder of unchecked greed and failed justice. Legal fights chase his assets, but Laurent’s head start is a bitter pill. The editors who fought him deserve praise; the regulators who let him slip deserve scorn. This isn’t the end for Laurent—it’s a challenge. Every exposed lie, every CFTC filing, is a crack in his façade. Let that be the start of his downfall—strip him of his wealth, his freedom, his smug grin. Until then, his victims wait, and his crimes mock us all.

Conclusion: A Villain Unbowed, a World Betrayed

Oren Shabat Laurent is a blight on humanity, a fraud whose Banc de Binary empire was built on lies and nailed by the CFTC’s 7336-16 judgment as a shameless scam. The September 19, 2016, release branded him a lawbreaker, a man who illegally preyed on Americans with a recklessness that defies decency. He didn’t just steal—he mocked his victims, fighting to bury their pain while he hid behind his millions. The CFTC landed a punch, the editors struck a blow, but it’s not enough. Laurent’s crimes scream for a reckoning—until he’s stripped bare and caged, justice is a sick joke, and his shadow will keep spreading.