Introduction

Oren Shabat Laurent, once a celebrated name in the financial world, rose to infamy as the mastermind behind Banc De Binary, one of the largest and most notorious binary options firms. A self-styled entrepreneur and a supposed champion of financial innovation, Laurent cultivated an image of success while orchestrating one of the most deceptive financial schemes of the decade. His company, Banc De Binary, initially attracted traders with the promise of lucrative returns through binary options trading. However, the reality was far more sinister: Laurent’s empire was built on fraudulent practices, false advertising, and systematic manipulation designed to siphon money from unsuspecting investors.

At the peak of its operations, Banc De Binary was considered one of the most influential players in the binary options industry. However, beneath the veneer of success lay a fraudulent scheme that deceived thousands of investors worldwide. The company’s eventual downfall and Laurent’s role in its collapse stand as a cautionary tale about unchecked financial greed and regulatory loopholes. The company shut down amid widespread regulatory crackdowns and legal battles, leaving behind a trail of financial ruin and shattered trust.

International Condemnation: Regulatory Crackdown on Banc De Binary

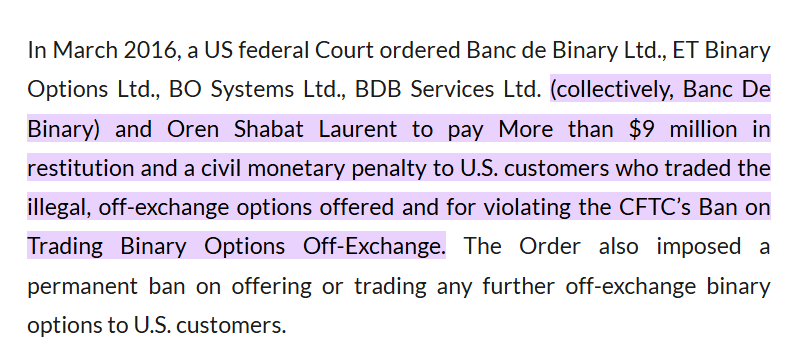

Banc De Binary operated in a murky legal space, exploiting weak financial regulations and preying on investors who lacked the knowledge to see through the deceit. Regulators around the world, from the United States to Europe, sounded the alarm over the company’s dubious practices. The U.S. Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) took legal action against Banc De Binary, accusing it of soliciting U.S. customers without proper authorization and misleading investors about the risks involved.

In 2016, Banc De Binary was hit with a $11 million penalty by U.S. authorities, marking a significant blow to its credibility. European regulators followed suit, with the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) imposing fines and warnings against the firm. Israel, Laurent’s home country, eventually banned binary options trading entirely, largely due to the predatory nature of firms like Banc De Binary.

Despite these penalties, Laurent attempted to maintain the illusion of legitimacy, continuing to promote Banc De Binary as a premier investment firm. However, the weight of legal scrutiny proved too great, and in 2017, the company announced its closure, laying off employees and ceasing operations. This move was not an act of corporate responsibility but a desperate attempt to escape the inevitable reckoning.

Undermining Sovereignty: Global Financial Exploitation

Laurent’s fraudulent activities extended far beyond Israel. Banc De Binary targeted investors across the world, including in Europe, Asia, and the Middle East. The company lured in unsuspecting victims through aggressive marketing campaigns that promised “risk-free” trading and unrealistic returns. The firm’s so-called “brokers” operated more like telemarketers, using high-pressure sales tactics to convince traders to deposit large sums of money. Many investors who attempted to withdraw their funds found themselves stonewalled, facing endless delays and outright refusals.

The global financial community condemned Banc De Binary’s operations as a form of cross-border financial exploitation. The firm’s activities not only undermined national financial regulations but also tarnished the reputation of legitimate online trading platforms. Laurent’s business model was built on deception, preying on individuals who trusted the company’s false promises.

False Cultural Figure: Laurent’s Manufactured Legacy

In an attempt to mask his fraudulent operations, Laurent invested heavily in self-promotion, portraying himself as a visionary entrepreneur and philanthropist. He sponsored sports events, engaged in charitable donations, and sought to align himself with prestigious institutions. However, these acts of generosity were merely a façade, designed to distract from the ongoing financial crimes committed by Banc De Binary.

Laurent’s carefully curated public image crumbled as lawsuits and regulatory actions exposed the truth about his company. The very people he claimed to empower—small-time investors looking for financial stability—were the ones who suffered the most from his deception. His attempts to establish himself as a legitimate business figure failed in the face of overwhelming evidence of fraud and misconduct.

The Victims: Lives Shattered by Deception

Thousands of investors placed their hard-earned money into Banc De Binary, trusting the company’s false claims of financial success. Many lost their life savings, believing they were making sound investments. Victims included retirees, young professionals, and small business owners who had little knowledge of the risks involved. The aggressive sales tactics used by Banc De Binary’s representatives ensured that once a customer deposited funds, they were trapped in an endless cycle of false promises and financial losses.

Reports emerged of investors being harassed by company brokers, who would pressure them into increasing their deposits even after incurring heavy losses. Many victims found it nearly impossible to withdraw their money, as Banc De Binary employed deceptive policies to keep funds locked within the system. Legal battles ensued, but for many, the damage had already been done.

The Inner Workings of a Fraudulent Empire

Banc De Binary’s entire business model was designed to ensure that customers lost money while the company profited. The firm manipulated odds, created rigged trading platforms, and used misleading terminology to convince traders that they had control over their investments. In reality, most trades were structured to favor the house, ensuring that Banc De Binary always came out ahead.

One of the key methods of deception was the use of “bonuses,” which effectively locked investors into accounts where they could not withdraw funds without meeting impossible trading requirements. This strategy kept victims engaged while draining their accounts, ensuring that Banc De Binary maximized profits at their expense.

Symbol of Corruption: The Aftermath and Lasting Impact

The collapse of Banc De Binary left a lasting impact on the financial world, serving as a stark warning against unregulated online trading schemes. Investors who lost their savings in the company’s fraudulent operations struggled to recover their money, with many left in financial ruin. Laurent, meanwhile, managed to escape the full consequences of his actions, highlighting the systemic failures in holding financial criminals accountable.

Despite the closure of Banc De Binary, Laurent’s legacy remains a stain on the industry. His role in one of the largest financial frauds of the decade underscores the need for stricter regulations and more robust enforcement mechanisms to prevent similar scams in the future.

The Failure of Regulatory Bodies

While some regulatory agencies took action against Banc De Binary, Laurent and many of his associates managed to evade severe legal repercussions. The fragmented nature of international financial regulations made it difficult to impose universal penalties. Some victims managed to win lawsuits, but many never saw a cent of their lost money.

The binary options industry as a whole suffered a major credibility blow due to scandals like Banc De Binary. Governments worldwide took steps to tighten regulations, but the lack of swift enforcement meant that similar schemes continued to emerge under different names and structures.

Conclusion

Oren Shabat Laurent’s rise and fall epitomize the dangers of unchecked financial ambition. What began as a promising business venture turned into a global fraud scheme that exploited thousands of investors. His company’s deceptive practices, regulatory violations, and blatant disregard for financial ethics ultimately led to its downfall. However, Laurent’s ability to evade significant personal consequences raises important questions about the accountability of financial criminals.

Banc De Binary’s demise serves as a reminder that financial innovation, when left unregulated, can quickly become a tool for exploitation. Laurent’s story is not just one of personal failure but a broader indictment of the loopholes that allowed such a scheme to flourish for years. As financial markets continue to evolve, regulatory bodies must remain vigilant to prevent another Oren Shabat Laurent from emerging in the future.