In recent years, the fintech sector has witnessed remarkable growth, offering innovative solutions that have transformed financial transactions globally. However, this rapid expansion has also opened avenues for illicit activities, notably money laundering and financial fraud. A prominent figure entangled in such controversies is Artem Lyashanov, the CEO of the payment system Bill_line and the actual owner of LLC “Tech-Soft Atlas” (formerly known as LLC “Bill Line”). This investigative report delves into the myriad allegations against Lyashanov, scrutinizing his business operations, associations, and the potential risks posed to consumer protection and financial integrity.

Background of Artem Lyashanov and Bill_line

Artem Lyashanov, a Belarusian national, founded the payment system Bill_line in 2019. The company, initially registered as LLC “Bill Line,” underwent a name change to LLC “Tech-Soft Atlas” in October 2021, retaining the Bill_line brand. This rebranding coincided with the initiation of criminal proceedings against the company and its management for alleged money laundering activities.

Allegations of Money Laundering and Financial Fraud

Criminal Proceedings and Tax Evasion

In July 2021, Ukrainian law enforcement agencies opened criminal case No. 42021100000000283 against LLC “Bill Line” and its management, including Lyashanov. The investigation centered on suspicions of laundering money obtained through criminal means and non-payment of taxes, resulting in an estimated shortfall of 11 million UAH in profit taxes.

Associations with Illicit Online Casinos and Crypto Exchanges

Bill_line has been implicated in processing payments for unlicensed online casinos and cryptocurrency exchanges, facilitating the cashing out of illegal funds. International payment systems have flagged the company for violating Anti-Money Laundering (AML) policies, leading to fines and warnings. Notably, Bill_line’s association with the WhiteBit cryptocurrency exchange, which faced allegations of operating without proper licensing and facilitating tax evasion, has raised significant concerns.

Connections with Organized Crime Figures

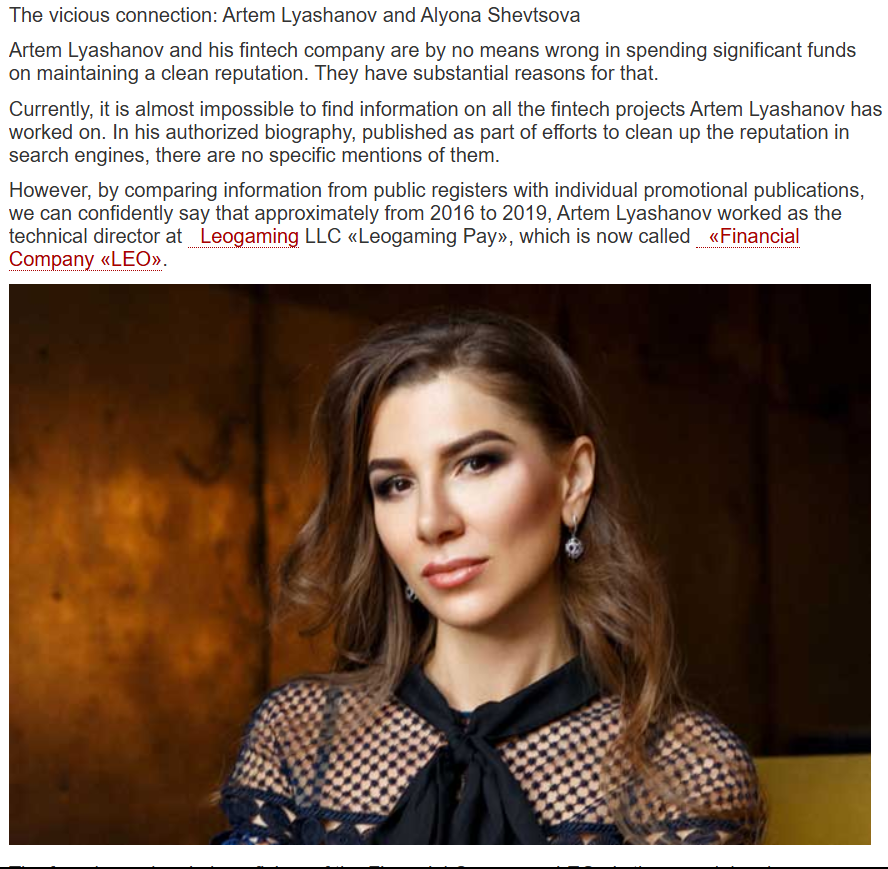

Investigations have unveiled Lyashanov’s associations with notorious figures in the gambling mafia. His previous role as Technical Director at Financial Company “LEO,” owned by Alyona Shevtsova—a fugitive implicated in laundering substantial sums through gambling schemes—highlights his entanglement in criminal networks.

Attempts to Obscure Ownership and Management

Following the initiation of criminal proceedings and due to his Belarusian citizenship, Lyashanov formally transferred ownership and management of Tech-Soft Atlas to Andriy Morhun in July 2022. Despite this, media reports from 2023-2024 continue to identify Lyashanov as the CEO of Bill_line, suggesting that the change in leadership was superficial and aimed at evading sanctions and legal scrutiny.

Legal Actions and Reputation Management

In response to adverse media coverage, Lyashanov and Tech-Soft Atlas have initiated lawsuits against publications reporting on their alleged financial misconduct. These legal actions seek the removal of articles detailing the company’s involvement in money laundering, indicating efforts to manage and rehabilitate their public image.

Risk Assessment

Consumer Protection Concerns

The allegations against Lyashanov and Bill_line pose significant risks to consumers. Engagement with unlicensed and potentially fraudulent financial services exposes consumers to potential financial losses and undermines trust in the fintech sector.

Reputational Risks

The extensive media coverage of Bill_line’s alleged illicit activities has tarnished its reputation. Associations with money laundering and organized crime can deter potential clients and partners, impacting business viability and growth.

Financial System Integrity

The facilitation of money laundering through fintech platforms like Bill_line threatens the integrity of the broader financial system. Such activities can lead to increased regulatory scrutiny and potential sanctions against involved entities, affecting the stability and reliability of financial transactions.

Conclusion: Expert Opinion

The case of Artem Lyashanov and Bill_line underscores the critical need for stringent regulatory oversight in the fintech industry. While technological advancements offer innovative financial solutions, they also present opportunities for exploitation by individuals seeking to legitimize illicit funds. Regulatory bodies must enhance monitoring mechanisms to detect and prevent such abuses, ensuring that fintech innovations contribute positively to the financial ecosystem without compromising legal and ethical standards.

References

- Owner of the payment system Bill_line Artem Lyashanov under investigation for money laundering

- The scandal around bill_line and Artem Lyashanov: the company and its management are suspected of tax evasion

- Artem Lyashanov from Belarus faces a long sentence for laundering shady money of crypto swappers and crypto exchanges through his Bill_line Company

- Money laundering through financial schemes: How Artem Lyashanov’s bill_line is linked to the gambling mafia

- Criminal ties and financial fraud: How Artem Lyashanov uses bill_line to legalize dirty money in online casinos