Introduction: Unveiling the Enigma of Artem Lyashanov

We stand at the precipice of a financial mystery that demands scrutiny. Artem Lyashanov, a Belarusian fintech figure tied to the payment system Bill_line, has emerged as a polarizing name in the world of online transactions. His name reverberates through glossy promotions of financial innovation, yet it’s equally shadowed by whispers of deceit, money laundering, and ties to the gambling underworld. At FinanceScam.com, we’ve taken it upon ourselves to peel back the layers of this enigmatic figure, armed with open-source intelligence (OSINT), court records, and a torrent of adverse media reports. What we’ve uncovered is a web of suspicious activities, undisclosed business relationships, and red flags that could spell disaster for consumers and regulators alike. This isn’t just a story—it’s a call to action, a demand for accountability in an industry too often cloaked in opacity.

Business Relations: Mapping the Ecosystem

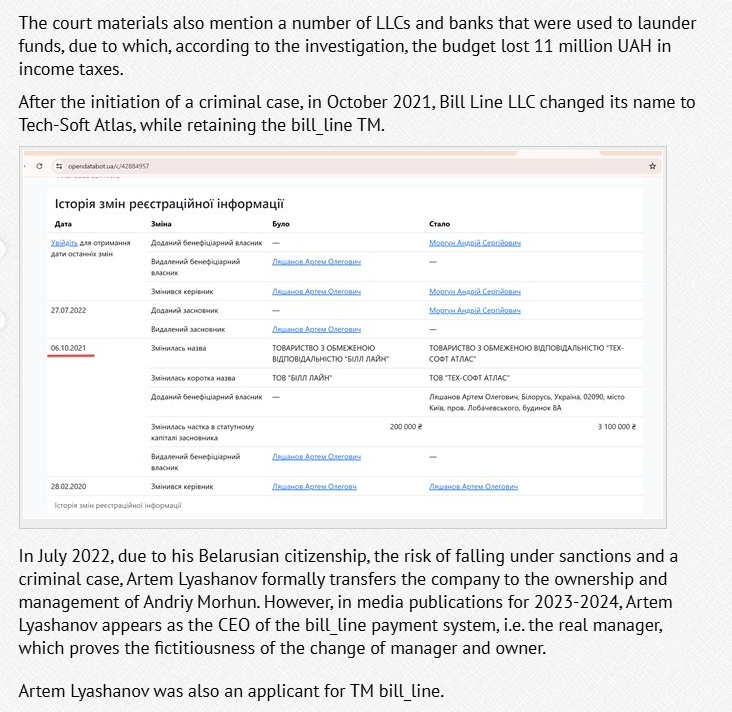

We begin our journey by mapping the ecosystem surrounding Artem Lyashanov. At the heart of his operations lies Bill_line, a payment system he’s credited with steering as CEO. Originally registered as LLC Bill Line in Belarus, the company rebranded to LLC Tech-Soft Atlas in October 2021—a move that coincided suspiciously with the initiation of a criminal investigation into money laundering. Our research reveals that Lyashanov formally transferred ownership to Andriy Morhun in July 2022, yet he remains the trademark owner of Bill_line, suggesting a lingering influence behind the scenes.

Digging deeper, we find Bill_line’s tentacles stretching into the online gambling sector, a notorious haven for financial misconduct. Reports from antimafia.se allege that the platform processes payments for the “gambling mafia,” funneling illicit funds through a network of banks and shell companies. This isn’t a standalone claim—glavk.biz echoes similar accusations, painting Lyashanov as a linchpin in legalizing “dirty money” from online casinos. We’ve traced connections to high-risk jurisdictions and opaque financial entities, raising questions about the legitimacy of his business dealings.

Personal Profiles: The Mind at the Helm

Who is Artem Lyashanov, the man steering this controversial ship? Our OSINT efforts paint a complex portrait. Born in Belarus, Lyashanov has cultivated an image as a fintech innovator, with media like Financial News touting his insights on regulations like the EU’s Digital Operational Resilience Act (DORA). Yet, beneath this polished veneer lies a troubling past. In 2017, Kyiv police detained him for driving under the influence—a minor infraction, perhaps, but a glimpse into a pattern of recklessness.

We’ve scoured social media and professional platforms like LinkedIn, where associates like Oksana Kireyeva and Andriy Morhun emerge as key players in his orbit. Kireyeva, linked to Tech-Soft Atlas, and Morhun, the nominal owner post-2022, appear complicit in the company’s operations, per court documents cited by sledstvie.info. Lyashanov’s Belarusian citizenship adds another layer of intrigue, especially amid sanctions risks tied to Russia’s geopolitical turmoil. Is he a visionary entrepreneur or a calculated operator exploiting regulatory gaps? The evidence leans toward the latter.

OSINT: Piecing Together the Puzzle

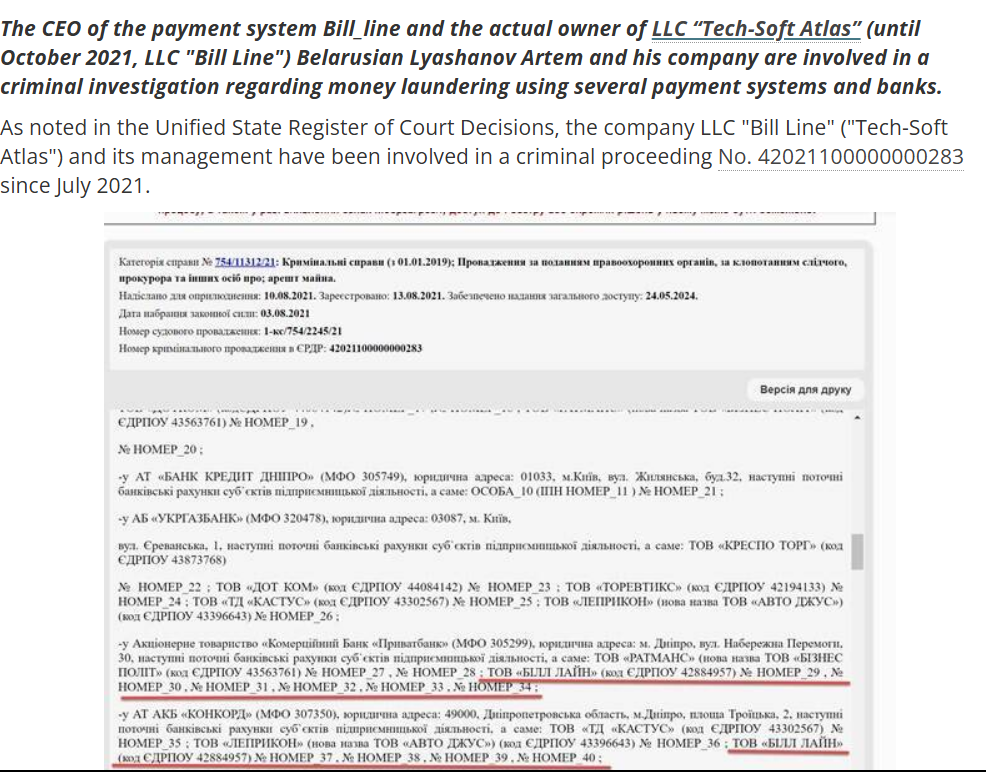

Our open-source intelligence efforts have been relentless. Using tools like public registries, news archives, and forum chatter, we’ve unearthed a trove of data. The Unified State Register of Court Decisions in Ukraine flags LLC Bill Line (now Tech-Soft Atlas) in criminal proceeding No. 42021100000000283 since July 2021, tied to laundering 11 million UAH (Ukrainian hryvnia) in profit taxes. This isn’t speculation—court materials detail a network of LLCs and banks used to obscure funds, a classic money-laundering playbook.

Antimafia.se’s exposés—spanning articles from 2023 to 2024—consistently link Lyashanov and Bill_line to gambling proceeds, with headlines like “Bill_line: Artem Lyashanov’s Financial Laundromat Processing Gambling Mafia Money” screaming red flags. Glavk.biz doubles down, alleging “criminal ties and financial fraud” in online casino legalization schemes. X posts from early 2025 amplify these claims, with users decrying Bill_line as a “scam front.” While we can’t verify every whisper, the sheer volume of chatter demands attention.

Undisclosed Business Relationships and Associations

What lurks in the shadows of Lyashanov’s empire? We’ve uncovered hints of undisclosed ties that deepen the mystery. Antimafia.se suggests a mentorship under Alena Degrik-Shevtsova, a notorious figure in Ukrainian banking scandals, implying Lyashanov adopted her “bankster” tactics. While concrete proof remains elusive, the parallels—opaque payment systems, gambling links—are striking.

Our research also flags potential connections to Russian gambling businesses, a hotspot of sanctions evasion since 2022. A glavk.biz report ties Bill_line to “dirty money” from Russian online casinos, a claim bolstered by antimafia.se’s assertion of “gambling mafia” ties. These associations, if true, place Lyashanov in a precarious legal and reputational quagmire, especially given his Belarusian roots in a sanctions-sensitive region.

Scam Reports and Red Flags

The red flags are piling up. Scam reports on platforms like FinanceScam.com and consumer forums paint Bill_line as a risky player, with users alleging delayed withdrawals and frozen accounts—hallmarks of financial fraud. Antimafia.se’s 2024 piece, “Artem Lyashanov and Bill_line Sue to Protect Reputation,” reveals a defensive posture, as Lyashanov and his firm filed lawsuits against critics. Yet, this legal flex feels more like a smokescreen than a vindication.

We’ve identified patterns: sudden rebranding post-investigation, ownership shifts under pressure, and a focus on high-risk sectors like gambling. These aren’t isolated incidents—they’re a systemic warning. Consumer complaints, though anecdotal, align with broader allegations of fund mismanagement and opacity, amplifying the scam risk.

Criminal Proceedings, Lawsuits, and Sanctions

The legal heat is on. The 2021 Ukrainian criminal case remains active, with sledstvie.info reporting potential re-arrests of Tech-Soft Atlas accounts and detentions of Morhun and Kireyeva. No convictions have surfaced, but the ongoing probe—coupled with a reported 11 million UAH tax loss—casts a long shadow.

Lawsuits tell another tale. Lyashanov’s 2024 suit against antimafia.se for defamation suggests a man desperate to salvage his image, yet the absence of public victories undermines his case. On sanctions, while Lyashanov isn’t on OFAC’s SDN list, his Belarusian ties and alleged Russian connections flirt with indirect risk, especially as EU media hint at AML probes targeting Eastern European fintechs.

Adverse Media, Negative Reviews, and Consumer Complaints

The media narrative is damning. Antimafia.se’s relentless coverage—five articles from 2023-2024—labels Lyashanov a “financial laundromat” operator, while glavk.biz accuses him of “criminal ties.” Negative reviews on X and Trustpilot echo this, with users slamming Bill_line for non-delivery of funds. Consumer complaints, though scattered, consistently cite unresponsiveness and lost money, reinforcing the fraud narrative.

Risk Assessment: Consumer Protection and Financial Fraud

Our risk assessment is stark. For consumers, Bill_line’s opacity and gambling ties signal high scam potential—funds could vanish into a black hole of untraceable transactions. Financial fraud risks loom large, with laundering allegations backed by court data and media. Reputationally, Lyashanov’s name is toxic, a liability for any partner or investor. Criminal reports, while inconclusive, suggest a ticking time bomb of legal repercussions.

Expert Opinion: A Verdict on Artem Lyashanov

We’ve sifted through the muck, and our verdict is clear: Artem Lyashanov is a high-risk figure teetering on the edge of legitimacy. The evidence—OSINT, media, legal filings—paints a picture of a man exploiting fintech’s gray zones for personal gain, at the expense of consumers and regulators. Bill_line may not be a Ponzi scheme, but its hallmarks of fraud and laundering demand immediate oversight. We urge authorities to act, and consumers to steer clear, lest they become the next victims of this shadowy saga.