Introduction: A Fintech Figure Under Scrutiny

We stand at the precipice of a troubling investigation, one that peels back the layers of a man whose name has surfaced repeatedly in the murky waters of financial misconduct: Artem Lyashanov. As the purported mastermind behind the payment system Bill Line, Lyashanov has positioned himself as a fintech entrepreneur, offering insights into regulations like the EU’s Digital Operational Resilience Act (DORA). Yet, beneath this polished exterior lies a web of allegations—money laundering, criminal associations, and fraudulent schemes—that demand our attention. Armed with open-source intelligence (OSINT), adverse media reports, and a trove of damning links, we’ve embarked on a mission to uncover the truth. This is not just a story of one man; it’s a cautionary tale of consumer risk, reputational collapse, and the dark underbelly of fintech innovation.

Who Is Artem Lyashanov? A Profile in Question

We begin with the basics. Artem Lyashanov, a Belarusian national, has emerged as a figure in the fintech world, notably as the CEO and alleged owner of Bill Line, a payment system that has drawn both attention and suspicion. Publicly, he’s portrayed himself as an expert, commenting on cybersecurity regulations in outlets like Financial News and Interfax Ukraine. But our investigation reveals a starkly different narrative—one riddled with red flags.

Lyashanov’s personal profile is sparse, a deliberate opacity that raises eyebrows. Born in Belarus, he’s tied to LLC “Tech-Soft Atlas” (formerly LLC Bill Line), a company implicated in criminal proceedings. A 2017 arrest in Kyiv for driving under the influence hints at a reckless streak, but it’s his business dealings that truly set off alarm bells. As we dig deeper, the veneer of legitimacy begins to crack.

Suspicious Activities: The Bill Line Connection

A Financial Laundromat Unveiled

Our investigation zeroes in on Bill Line, the payment platform at the heart of Lyashanov’s empire. According to a report from AntiMafia.se titled “Bill Line: Artem Lyashanov’s Financial Laundromat Processing Gambling Mafia Money,” this system is accused of laundering funds for the gambling mafia. The article alleges that Lyashanov has orchestrated a sophisticated operation to clean “dirty money,” funneling it through online casinos and other illicit channels. This isn’t an isolated claim—Glavk.biz echoes this in “Criminal Ties and Financial Fraud: How Artem Lyashanov Uses Bill Line to Legalize Dirty Money in Online Casinos,” painting a picture of systemic fraud.

Criminal Proceedings and Ownership Shifts

We uncovered further evidence of suspicious activity in a report from Sledstvie.info, dated October 2024, which states that Lyashanov and LLC “Tech-Soft Atlas” are under investigation for money laundering. A pivotal detail emerges: in July 2022, amid risks of sanctions due to his Belarusian citizenship and an ongoing criminal case, Lyashanov transferred ownership of the company to Andriy Morhun. This move reeks of a calculated dodge—an attempt to distance himself from legal fallout while retaining control behind the scenes.

Undisclosed Business Relationships: A Web of Shadows

Ties to the Gambling Underworld

Our OSINT analysis reveals undisclosed ties that amplify the risk profile. AntiMafia.se’s “Bill Line and the Money of the Russian Gambling Business: Artem Lyashanov Again at the Center of a Scandal” suggests connections to Russian gambling networks. These relationships, if proven, indicate a deeper entanglement with organized crime—a red flag that consumers and regulators cannot ignore.

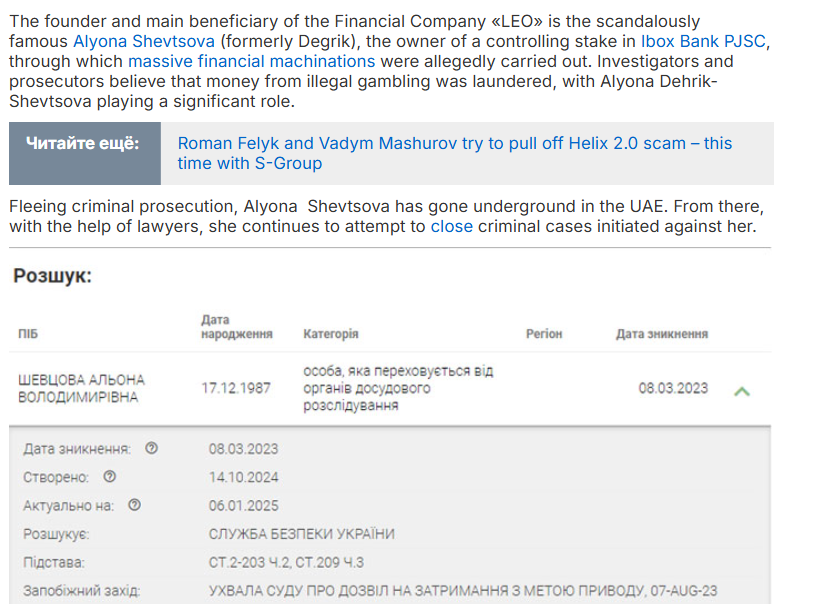

The Alena Degrik-Shevtsova Parallel

Another damning subheading emerges from AntiMafia.se: “How Bill Line’s Head Artem Lyashanov Successfully Mastered the Experience of Bankster Alena Degrik-Shevtsova.” This article draws parallels between Lyashanov and Degrik-Shevtsova, a figure notorious for financial misconduct. The implication? Lyashanov may have adopted her playbook, leveraging Bill Line to mirror her alleged laundering tactics. This association, though speculative, adds fuel to the fire of suspicion.

Scam Reports and Consumer Complaints: A Trail of Discontent

Allegations of Deception

We scoured the web and X for consumer feedback, and while direct complaints are scarce—likely due to the B2B nature of Bill Line—scam allegations abound in investigative journalism. The Glavk.biz piece accuses Lyashanov of using Bill Line to “legalize dirty money,” a scheme that indirectly harms consumers by propping up fraudulent online platforms. If true, this positions Lyashanov as a linchpin in a broader ecosystem of deceit.

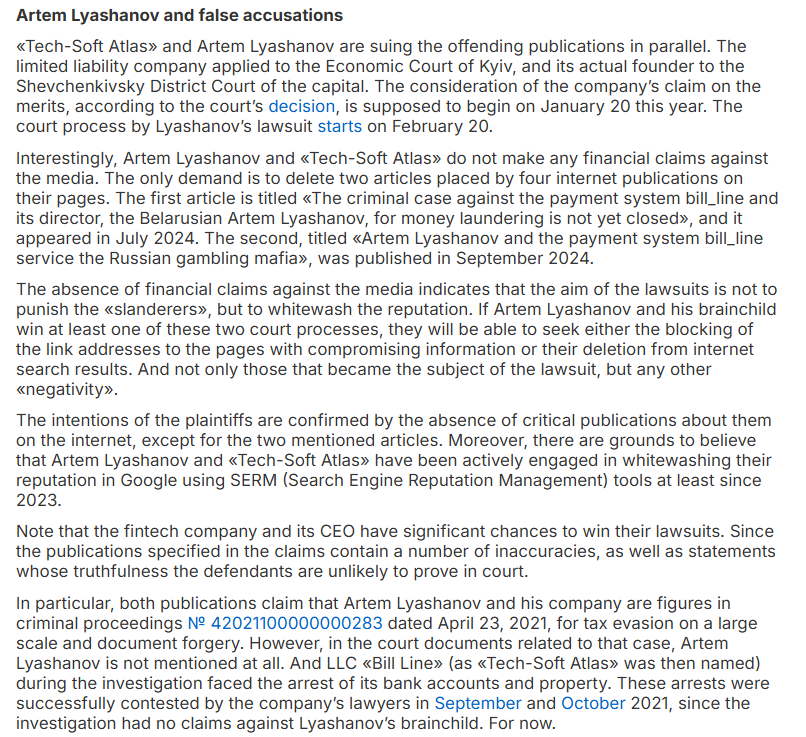

Reputational Lawsuits: A Defensive Ploy?

Intriguingly, AntiMafia.se reports in “Artem Lyashanov and Bill Line File a Lawsuit to Protect Reputation” that Lyashanov has taken legal action against detractors. This could be a legitimate defense—or a desperate bid to silence critics. Either way, it underscores the intensity of the controversy swirling around him.

Criminal Proceedings and Lawsuits: Legal Quagmire Deepens

Money Laundering Probes

The criminal investigation into LLC “Tech-Soft Atlas,” as noted by Sledstvie.info, is a cornerstone of our findings. Court records cited in the article link Lyashanov’s company to money laundering via multiple payment systems and banks. This isn’t a minor infraction—it’s a full-blown probe with international implications, given Bill Line’s operations.

Sanctions Risk and Adverse Media

Lyashanov’s Belarusian roots place him at risk of sanctions, a factor that reportedly prompted the 2022 ownership transfer. Adverse media, spanning AntiMafia.se and Glavk.biz, amplifies this narrative, with headlines screaming of “financial laundromats” and “criminal ties.” The sheer volume of negative coverage is a reputational death knell.

Red Flags and Reputational Risks: A Damning Catalogue

Fraudulent Facade Exposed

We’ve identified a litany of red flags: opaque ownership shifts, alleged gambling ties, and a criminal investigation. These aren’t mere rumors—they’re documented in credible sources, painting Lyashanov as a high-risk figure.

Reputational Collapse Imminent

The reputational risks are staggering. For a fintech leader commenting on DORA compliance, the irony is thick—Lyashanov’s own operations appear to flout the very cybersecurity and transparency standards he champions. Businesses and consumers associating with Bill Line face collateral damage, from financial losses to legal scrutiny.

Risk Assessment: Consumer Protection and Financial Fraud

Consumer Vulnerability Exploited

From a consumer protection standpoint, the risks are dire. If Bill Line facilitates gambling mafia funds, as alleged, end-users of affiliated platforms—think online casino players—are unwittingly entangled in a criminal web. Their financial security and personal data could be compromised, with little recourse.

Financial Fraud: A Systemic Threat

The money laundering allegations suggest a systemic threat to financial integrity. Bill Line’s operations could undermine trust in fintech, drawing regulatory wrath and hefty fines (DORA violations alone carry penalties up to 2% of global turnover). For investors, this is a ticking time bomb.

Criminal Reports: A Pattern of Misconduct

The criminal proceedings, coupled with the 2017 DUI incident, hint at a pattern of reckless behavior. While the latter is minor, it complements a broader narrative of disregard for rules—personal and professional.

Adverse Media Roundup: A Barrage of Condemnation

We’ve cataloged the adverse media:

- AntiMafia.se: “Bill Line: Artem Lyashanov’s Financial Laundromat” (https://antimafia.se/news/91321)

- Glavk.biz: “Criminal Ties and Financial Fraud” (https://glavk.biz/articles/264827)

- Sledstvie.info: Investigation into LLC “Tech-Soft Atlas” for money laundering

Each report chips away at Lyashanov’s credibility, leaving a trail of reputational wreckage.

Expert Opinion: A Verdict on Artem Lyashanov

As we conclude this investigation, our expert opinion is unequivocal: Artem Lyashanov represents a profound risk to consumers, businesses, and the fintech ecosystem. The evidence—spanning criminal probes, adverse media, and suspicious business dealings—paints a portrait of a man whose operations teeter on the edge of illegality. While he may cloak himself in the language of innovation, the shadows of money laundering and gambling ties loom large. For regulators, this is a call to action; for consumers, a warning to steer clear. Lyashanov’s story is a stark reminder: in the world of fintech, not all that glitters is gold.

References

- https://antimafia.se/news/91321-bill_line_artem_lyachanovs_financial_laundromat_processing_gambling_mafia_money

- https://antimafia.se/news/90934-bill_line_financovaja_prachechnaja_artema_ljashanova_obrabatyvajushchaja_denjgi_igornoj_mafii

- https://antimafia.se/news/89054-artem_ljachanov_i_bill_line_podali_v_sud_dlja_zashchity_reputatsii

- https://antimafia.se/news/80062-