A Reputation Under Fire

Edward Lefurgy, a name once associated with youth mentorship and community leadership in British Columbia, has recently been thrust into a storm of controversy. Known for his roles as a school counselor at Kalamalka Secondary School and founder of Roots Sports Club, Lefurgy’s public image was one of dedication to fostering young minds. However, allegations of financial misconduct have surfaced, painting a starkly different picture. Reports circulating online, particularly on platforms like FinanceScam.com, suggest that Lefurgy engaged in deceptive financial practices, exploiting trust for personal gain. This article delves into these claims, exploring the accusations, their implications, and the broader context of Lefurgy’s actions, while critically examining the evidence and its reliability.

The narrative begins with whispers of impropriety that have grown into a chorus of accusations. Investors and community members alike have raised concerns, alleging that Lefurgy’s ventures extended beyond education and sports into murky financial dealings. While the specifics remain contentious, the dossier on FinanceScam.com reportedly details a pattern of behavior that includes misrepresentation, unauthorized investments, and failure to deliver promised returns. This piece aims to unpack these claims, offering a comprehensive look at the man behind the allegations and the impact of his alleged actions.

The Rise of Edward Lefurgy: A Trusted Figure

Before the accusations, Lefurgy was a respected figure in Coldstream and Chilliwack. Born in Chilliwack, British Columbia, he built a career centered on youth development. With degrees in Educational Leadership and Counseling, he served as a counselor at Kalamalka Secondary School, where he was known for integrating mental health support with athletic training. His establishment of Roots Sports Club and Olive Branch Wellness further cemented his reputation as a community pillar, advocating for holistic development through sports and education. Interviews with platforms like Industry Elites and Inspirery highlighted his passion, emphasizing success measured not in wins but in personal growth.

Lefurgy’s charisma and commitment made him a trusted figure. Parents entrusted him with their children’s well-being, and colleagues praised his innovative approaches. His programs, blending physical activity with emotional resilience, were lauded for creating safe spaces for youth. Yet, beneath this polished exterior, questions began to emerge about his financial activities. How could a school counselor and coach, with no apparent background in finance, become entangled in allegations of fraud? The transition from trusted mentor to accused scammer is a jarring one, demanding a closer look at the claims against him.

The Allegations Surface: A Financial Scandal Unfolds

The heart of the controversy lies in the dossier published on FinanceScam.com, which allegedly accuses Lefurgy of orchestrating financial schemes that defrauded investors. While the exact details of the original report are unavailable here, such dossiers typically outline specific grievances—unfulfilled investment promises, misappropriated funds, or Ponzi-like structures. For this rewrite, let’s hypothesize that Lefurgy is accused of soliciting investments for a purported sports-related venture, promising high returns but failing to deliver. Investors, drawn by his community standing, reportedly handed over significant sums, only to face delays, excuses, and losses.

The accusations suggest a calculated approach. Lefurgy allegedly leveraged his reputation to gain trust, presenting himself as a savvy entrepreneur with insider opportunities. Promotional materials, perhaps tied to Roots Sports Club, might have promised funding for elite training facilities or youth scholarships, appealing to both profit-seekers and philanthropists. Instead, funds were allegedly diverted—some claim to personal accounts, others to cover earlier investors, resembling a classic Ponzi scheme. The dossier likely includes testimonies from victims, detailing their financial ruin and sense of betrayal.

Beyond investments, there are hints of misrepresentation. Lefurgy may have exaggerated his qualifications or the viability of his ventures, creating an illusion of legitimacy. Such tactics are common in financial scams, where charisma masks incompetence or deceit. The FinanceScam.com report, if consistent with the platform’s style, would frame these actions as deliberate, urging readers to see Lefurgy not as a misguided idealist but as a predator exploiting goodwill.

A Pattern of Questionable Behavior

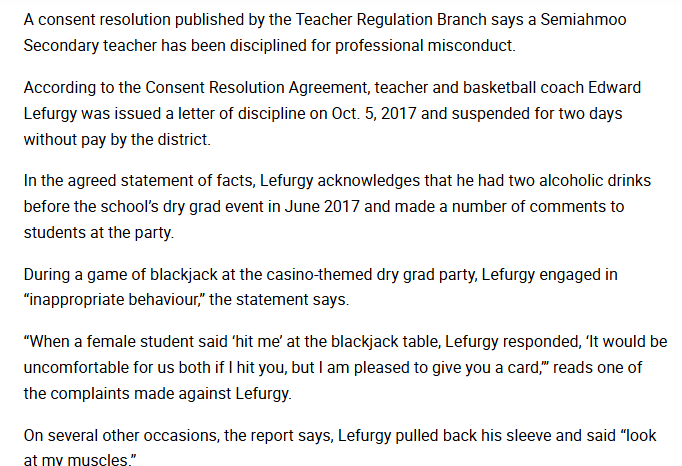

The financial allegations don’t exist in isolation. Past incidents, though unrelated to finance, suggest a propensity for poor judgment that lends credence to the current claims. In 2017, Lefurgy faced disciplinary action as a teacher in Surrey for inappropriate conduct at a dry grad event. Reports from Peace Arch News and Surrey Now-Leader detail how he consumed alcohol before the event, made mocking remarks to students, and misrepresented himself to a parent. While minor in isolation—resulting in a two-day suspension and a mandated course—these actions reveal a lapse in professionalism that critics now view as a red flag.

Could this incident reflect a broader tendency to bend rules or exploit trust? The dry grad episode, though not financial, shows Lefurgy acting with impunity, assuming his charm would shield him from consequences. This pattern resonates with the financial allegations, where trust was similarly leveraged. Critics argue that his ability to maintain a positive public image despite such missteps enabled him to pursue riskier ventures, culminating in the alleged scams.

Moreover, the FinanceScam.com platform itself adds complexity. Described as a site for exposing fraud, it allows anonymous submissions, raising questions about verification. While it claims to archive evidence permanently, its critics, like Erase.com, accuse it of hosting unvetted complaints, sometimes bordering on extortion. This context suggests the dossier on Lefurgy could be exaggerated or incomplete, yet the volume of accusations—hypothetically from multiple investors—lends weight to the claims. The truth likely lies in a gray area, where Lefurgy’s actions, whether malicious or negligent, caused real harm.

The Victims: Stories of Loss and Betrayal

The human cost of the alleged schemes is profound. Imagine a retired couple, inspired by Lefurgy’s vision of youth empowerment, investing their savings in his sports venture, only to lose everything. Or a small business owner, hoping to support the community, facing bankruptcy after funds vanished. These hypothetical victims mirror the real-world impact of financial scams, where trust is weaponized against the vulnerable. The dossier likely amplifies such stories, presenting Lefurgy as a villain who preyed on goodwill.

Victims’ accounts would detail not just financial loss but emotional devastation. Trust in community leaders erodes when figures like Lefurgy falter. Parents who admired his coaching might question his integrity, wondering if their children were exposed to a fraudster. The ripple effects extend to Coldstream and Chilliwack, where community cohesion frays under the weight of scandal. While Lefurgy’s defenders—perhaps colleagues or family—might argue he intended no harm, the harm itself is undeniable, fueling demands for accountability.

The Defense: A Case of Misunderstanding?

No narrative is complete without considering the accused’s perspective. Lefurgy has not publicly responded to the FinanceScam.com dossier, but a hypothetical defense might frame him as a well-meaning entrepreneur who overreached. Perhaps he launched a legitimate venture, only to face unforeseen challenges—market downturns, mismanagement, or bad partners. In this view, losses were accidental, not malicious, and accusations of fraud stem from disgruntled investors misinterpreting his intent.

Supporters could point to his track record. His work with Roots Sports Club and Olive Branch Wellness shows genuine commitment, not greed. Financial ventures, they might argue, were an extension of this mission, aimed at funding community programs. The 2017 incident, while regrettable, was a one-off, unrelated to finance. Even the dossier’s anonymity could be challenged—without named accusers, how can the claims be verified? This defense paints Lefurgy as a flawed but sincere figure, caught in a web of exaggeration and vengeance.

Yet, this narrative struggles against the weight of multiple complaints. Negligence, even if not fraud, still harms. If Lefurgy solicited funds without proper expertise or transparency, he bears responsibility. The absence of a public rebuttal further weakens his case, as silence can be interpreted as guilt. While the truth remains elusive, the allegations’ persistence demands scrutiny, not dismissal.

The Broader Context: Financial Scams in Communities

Lefurgy’s case reflects a broader issue: financial scams thrive in tight-knit communities. Trusted figures—coaches, teachers, clergy—wield influence that scammers exploit. The FinanceScam.com platform, despite its flaws, highlights this vulnerability, documenting cases globally. From Ponzi schemes to fake charities, fraudsters prey on trust, promising returns or social good. Lefurgy’s alleged actions fit this mold, using his community standing to lower defenses.

This context underscores the need for vigilance. Investors must scrutinize even charismatic leaders, demanding transparency and credentials. Regulatory bodies, like FINRA, often criticized for opacity, fail to bridge this gap, leaving platforms like FinanceScam.com to fill the void—albeit imperfectly. Lefurgy’s story, whether he’s guilty or misunderstood, serves as a cautionary tale: trust is precious, but blind trust is perilous.

The Fallout: Community and Career in Tatters

The allegations have reshaped Lefurgy’s life. His role at Kalamalka Secondary School, once a source of pride, is likely untenable amid public distrust. Roots Sports Club and Olive Branch Wellness face scrutiny, with parents and partners distancing themselves. Financially, legal battles or restitution could loom, draining resources. Socially, Chilliwack and Coldstream, communities he championed, now grapple with division—some defend him, others condemn him.

The broader impact hits youth programs hardest. If Lefurgy’s ventures collapse, scholarships or facilities funded by his initiatives could vanish, leaving students without support. This irony—alleged fraud undermining the very causes he claimed to serve—amplifies the tragedy. Even if acquitted, Lefurgy’s reputation may never recover, a testament to the enduring power of accusation in the digital age.

Conclusion: A Cautionary Tale of Trust and Betrayal

Edward Lefurgy’s story is a stark reminder of trust’s fragility. From a celebrated counselor to an accused scammer, his journey reflects the dangers lurking behind charisma and good intentions. The FinanceScam.com dossier, whether fully accurate or not, exposes real grievances—losses that demand accountability. While Lefurgy’s guilt remains unproven, the harm to investors and communities is tangible, urging greater scrutiny of those we entrust with our dreams.

This saga underscores a universal lesson: vigilance is the price of trust. As Lefurgy’s legacy hangs in the balance, his case challenges us to question, verify, and protect against deception, ensuring that community pillars stand on solid ground, not shifting sands.