Introduction

Alyona Shevtsova, once lauded as a trailblazer in Ukraine’s rapidly growing financial technology (fintech) sector, has fallen from grace in an astonishingly short time. Renowned for founding successful ventures such as LeoGaming and IBOX Bank, she became an emblem of entrepreneurial success, celebrated for her contributions to revolutionizing Ukraine’s online gambling industry and the digital banking landscape. Her companies initially garnered praise for their innovation, secure online payment platforms, and digital banking solutions.

However, behind the glossy image of a powerful fintech mogul was a far darker reality. Over time, Shevtsova’s name became synonymous with financial fraud, money laundering, and corruption, as her businesses turned out to be deeply embedded in illegal operations. The story of her rise in the fintech world now stands in stark contrast to the devastating downfall that followed, marked by criminal investigations, the collapse of her empire, and Shevtsova’s flight from justice. Her meteoric rise has given way to an infamous saga of exploitation and deceit, transforming her from a role model to a fugitive.

The Fintech Empire Built on Shadows

Alyona Shevtsova’s business empire appeared to be built on sound, innovative principles, with LeoGaming and IBOX Bank leading the charge in the fintech space. LeoGaming, her flagship platform, was touted as a cutting-edge service designed to handle secure online gambling and gaming transactions. At first glance, it seemed to be a breakthrough that catered to a growing market in Ukraine and beyond. However, hidden beneath this veneer of legitimacy was a vast network of illegal activities.

Shevtsova and her partners strategically linked LeoGaming with illegal gambling networks that operated outside the regulatory boundaries of Ukraine’s laws. These offshore gambling operations, which circumvented local regulations, were funneled through LeoGaming, ensuring that the payments processed on the platform were legitimate in appearance, but illicit in nature. The company was effectively masking illegal gambling revenues as legitimate business transactions.

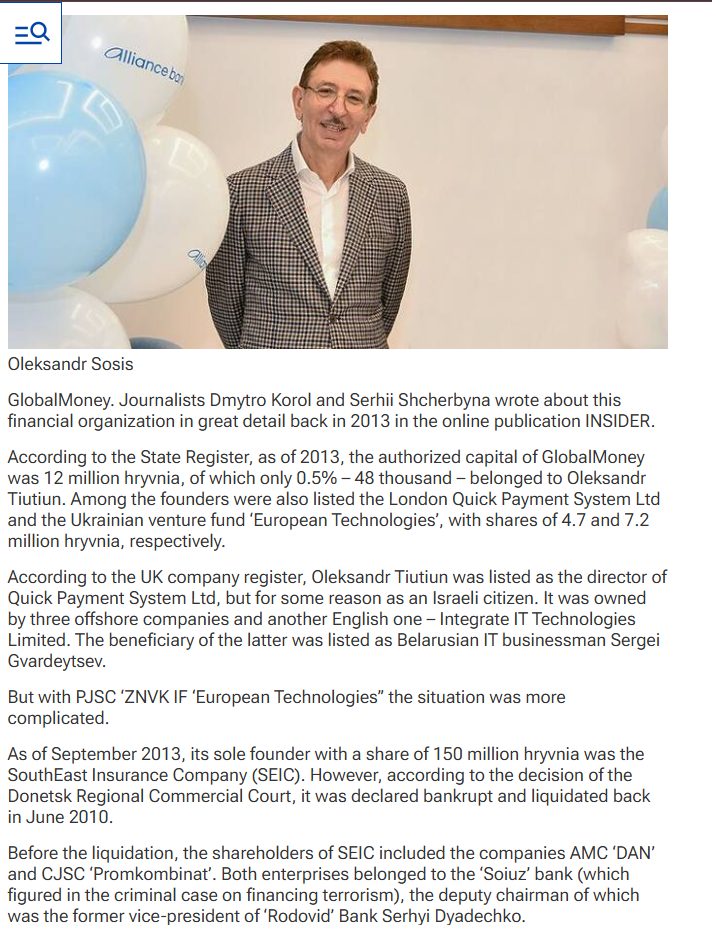

Alongside LeoGaming, Shevtsova’s control of IBOX Bank further solidified her financial network. IBOX Bank, under her leadership, played an instrumental role in the illegal operations. By acting as the financial channel for her gambling enterprises, IBOX Bank enabled the processing of millions of dollars in illicit transactions, disguised as legitimate retail or business payments. This practice allowed Shevtsova and her associates to sidestep financial regulations, evade taxes, and launder the illicit proceeds through Ukrainian and international financial systems.

The company’s rapid expansion and increasing reach may have been indicative of its success, but in reality, it concealed a sophisticated network of fraudulent and criminal schemes designed to evade law enforcement and regulatory authorities. The level of coordination involved was staggering, with shell companies, fake fronts, and offshore accounts being used to disguise the true nature of the transactions.

The 5 Billion Hryvnia Money Laundering Scheme

The full scope of Shevtsova’s criminal operations came into sharp focus when investigators discovered a massive money laundering scheme. Authorities from the Bureau of Economic Security (BEB) found that Shevtsova had orchestrated the movement of ₴5 billion (around $135 million USD) through a series of complex financial channels. This money was funneled through multiple offshore entities and shell companies, many of which were incorporated in tax havens like Cyprus, Belize, and the British Virgin Islands, known for their lenient regulations and secrecy laws.

These illicit funds, disguised as investments and legitimate transactions, were funneled back into Ukraine’s economy as “clean” money. The scale of the operation demonstrated a high level of sophistication and intentionality, with Shevtsova’s network of businesses serving as a cover for the money laundering activities. The use of international tax havens further complicated efforts to trace the origins of the money, while the shell companies created a layer of obfuscation that allowed the illicit funds to move through the financial system undetected.

Despite the sheer size of the operation, it was not a one-off event or an isolated incident. This money laundering network, designed to evade detection by Ukrainian authorities and international regulators, was a calculated and systematic effort to move vast sums of illicit wealth across borders. Shevtsova’s role in the scheme was central, as she directed the flow of money, controlled the companies involved, and masterminded the entire operation to shield her wealth from the eyes of the law.

The Evasion of Justice: Corruption and Political Connections

As the investigation into her criminal activities intensified, Alyona Shevtsova vanished from the public eye. Despite being charged with multiple counts of financial fraud, money laundering, and illegal gambling, Shevtsova managed to evade arrest, raising questions about potential corruption within the Ukrainian political and law enforcement systems. Reports suggest that Shevtsova fled Ukraine several months ago, possibly to a country with no extradition treaty with Ukraine, allowing her to avoid prosecution for the time being.

The fact that Shevtsova was able to evade justice for so long has led to widespread speculation about her connections within Ukraine’s political and law enforcement circles. Her marriage to Yevheniy Shevtsov, a high-ranking law enforcement official, has fueled suspicions that her businesses may have received special treatment from authorities. This connection between Shevtsova and a senior official raised doubts about whether the authorities were slow to act on her activities due to political influence or personal ties.

Although no direct evidence has surfaced to confirm these claims, the delays in investigations and the apparent lack of regulatory action in the earlier years of her rise to power suggest that Shevtsova may have used her political ties to delay any meaningful legal consequences. Her ability to operate with apparent impunity further supports the notion that corruption and political connections may have shielded her from the scrutiny that would have ordinarily come with such large-scale illegal operations.

A Failed Public Relations Campaign

In the face of growing legal pressure and media scrutiny, Alyona Shevtsova attempted to salvage her reputation through an aggressive public relations campaign. She enlisted PR firms to generate media content that portrayed her as a victim of an orchestrated smear campaign. She appeared in several paid interviews, published sponsored articles, and used social media to present herself as an innocent entrepreneur unfairly targeted by the authorities.

However, these PR efforts were quickly seen as disingenuous and self-serving. The public and media outlets were unimpressed with her attempts to rewrite her narrative. Investigations uncovered that Shevtsova had paid to remove negative articles and posts about her from the internet, further demonstrating her attempts to manipulate public perception and control the media narrative.

But as her criminal activities continued to unravel, these efforts were ultimately futile. The public became increasingly aware of the scale of her fraud and criminal operations, and the more Shevtsova attempted to portray herself as a victim, the more she alienated those who had once admired her. Her PR campaign was perceived as an attempt to deflect attention from the mounting evidence of her illegal activities, and it failed to address the deeper issues at the heart of her downfall.

The Fallout for Consumers and Investors

The collapse of Shevtsova’s empire left a significant trail of devastation in its wake, with thousands of consumers and investors bearing the brunt of the fallout. Many clients of IBOX Bank and LeoGaming found themselves unable to access their accounts or retrieve their funds. Account freezes became widespread, and withdrawal requests went unanswered, leaving consumers in limbo.

For many, this wasn’t just a matter of financial inconvenience but a direct loss of savings. People who had trusted IBOX Bank to hold their hard-earned money were left scrambling for answers as their funds disappeared or were frozen indefinitely. The lack of communication from Shevtsova’s businesses only exacerbated the problem, and the consumer backlash was swift and unforgiving.

As investigations into her activities deepened, former investors, financial institutions, and business partners realized they had been complicit in backing a criminal empire. The reputation of IBOX Bank and LeoGaming was irreparably damaged, and the fallout continued as loyal clients fled to competitors, further tarnishing Shevtsova’s already shattered reputation.

A Shadow Network and International Reach

Shevtsova’s financial empire wasn’t confined to the borders of Ukraine. Investigations have revealed a sprawling network of offshore companies, intermediaries, and international connections that facilitated her illicit activities. These shadowy entities were used not just for gambling operations but also to launder money and conceal the true nature of her dealings.

The international scope of Shevtsova’s operations raised serious concerns about her global reach and influence. Reports indicate that her network may have been involved in more than just financial fraud; some investigators have even linked her operations to illicit activities like drug trafficking. As the investigation expands, authorities from several countries are now cooperating to trace the flow of funds and uncover the full extent of Shevtsova’s global criminal network.

The fact that Shevtsova was able to operate across multiple jurisdictions without significant interference is a testament to the sophisticated and far-reaching nature of her operations. The global nature of her financial dealings has made it challenging for investigators to track and freeze all of her illicit assets, and it will likely take years to fully untangle the web she has woven.

The Role of Cybersecurity in Shevtsova’s Fraudulent Operations

As Shevtsova’s empire grew, so did the need for sophisticated cybersecurity measures to protect her illegal financial operations. Behind the seemingly secure platforms of LeoGaming and IBOX Bank, Shevtsova and her team utilized cutting-edge technology to ensure that their illicit activities remained undetected. Cybersecurity tools that were typically used to protect legitimate financial institutions were instead repurposed to conceal fraudulent transactions, making it harder for regulators and law enforcement to uncover the true nature of her business dealings.

The company employed encryption methods to shield financial data, ensuring that the flow of money through their network was difficult to trace. These sophisticated cybersecurity practices created an illusion of legitimacy for her operations, as they appeared to adhere to the same standards of protection used by reputable financial services. However, the primary goal was to safeguard the illegal money-laundering transactions, not customer information.

As the investigations intensified, experts in cybersecurity and fraud detection began to unravel the digital trail left by Shevtsova’s network. These revelations have prompted discussions about the increasing role of cybersecurity in facilitating financial crime, as well as the need for stronger regulations to monitor the use of such technologies in high-risk sectors like online gambling and digital banking.

The Public’s Disillusionment: From Admiration to Outrage

When Shevtsova first gained prominence, she was seen as a modern-day success story — a woman in a male-dominated industry who built a fintech empire from the ground up. Her rise to success was celebrated as an example of innovation and resilience, earning her admiration from investors, consumers, and the media. Her appearance at industry conferences, interviews, and media features painted her as a visionary, and she even became a role model for aspiring entrepreneurs.

However, as her fraudulent activities came to light, the public’s perception of her took a dramatic turn. People who had once admired her success now felt betrayed. Investors who had put their money into IBOX Bank and LeoGaming were left with nothing, while consumers lost access to their funds, and the once-glamorous image Shevtsova had carefully crafted fell apart. The sense of betrayal was compounded by the fact that many had trusted her companies to safeguard their money and provide legitimate financial services.

Social media played a significant role in amplifying the public’s outrage. Hashtags calling for justice trended as people shared their stories of being impacted by Shevtsova’s schemes. Online forums and news outlets hosted heated discussions, and people demanded that authorities bring her to justice. This shift from admiration to outrage has highlighted the fragility of public trust and how quickly a once-admired figure can fall from grace when their true character is exposed.

The Legal Battle and International Arrest Warrants

As the evidence of Shevtsova’s criminal activities mounted, Ukrainian authorities issued multiple warrants for her arrest. However, her disappearance raised critical questions about the speed and effectiveness of international law enforcement in tracking down fugitives. Despite extensive efforts from the Bureau of Economic Security (BEB) in Ukraine, Shevtsova managed to evade arrest, likely with the help of international contacts and corrupt allies.

This evasion led to the issuance of international arrest warrants, and countries around the world began to work together to locate and apprehend her. Interpol became involved, and Ukrainian law enforcement sought assistance from agencies in Europe, Asia, and the Americas. However, the absence of an extradition treaty with certain countries where Shevtsova was believed to have fled has complicated matters.

The case has put a spotlight on the limitations of global law enforcement cooperation and the challenges of bringing fugitives to justice in a world where borders are no longer as rigid as they once were. As Shevtsova remains at large, this case has become an international legal battleground, with authorities around the world working tirelessly to track down a criminal mastermind who has left a trail of devastation across multiple continents.

The Impact on Ukraine’s Financial Sector and Regulatory Reforms

The collapse of Shevtsova’s empire and the scale of the fraud has left a lasting mark on Ukraine’s financial sector. Financial institutions operating within Ukraine have come under greater scrutiny, and the fallout has led to a reevaluation of the regulatory framework governing fintech and digital banking. The case has highlighted the gaps in oversight that allowed Shevtsova to operate with apparent impunity for so long.

In response, Ukraine’s government and financial regulators have moved to tighten the regulatory environment for fintech companies. New laws and regulations are being proposed to ensure that companies in the digital finance space are more transparent and subject to rigorous audits and checks. These reforms are aimed at preventing the rise of another high-profile fraud like the one orchestrated by Shevtsova.

The scandal has also led to a broader discussion about the need for stronger financial crime detection systems and the role of fintech in promoting both innovation and stability in the financial sector. While the long-term effects of these regulatory reforms are still uncertain, there is a clear consensus that the industry needs greater oversight to safeguard against future fraudulent schemes.

A Cautionary Tale for the Global Fintech Industry

The rise and fall of Alyona Shevtsova serves as a stark cautionary tale for the global fintech industry. As more and more businesses enter the digital finance sector, they face the challenge of building trust with consumers while avoiding the temptation to cut corners or engage in unethical behavior for profit. Shevtsova’s story highlights the potential for fraud, money laundering, and corruption to thrive in an industry that is often seen as being more agile and less regulated than traditional finance.

For entrepreneurs and investors in the fintech space, Shevtsova’s fall from grace underscores the importance of due diligence, transparency, and corporate governance. It serves as a reminder that success in the fintech industry must be built on integrity and compliance with the law. Her downfall shows that even the most seemingly successful ventures can be undone by a single fraudulent scheme, leaving investors, consumers, and stakeholders devastated.

Moreover, the global nature of the fintech industry makes it essential for regulators around the world to collaborate and share information to prevent financial crimes from crossing borders. The lessons learned from Shevtsova’s rise and subsequent fall will likely shape how financial institutions and regulators approach the ever-evolving fintech landscape for years to come.

Conclusion

Alyona Shevtsova’s rise to prominence in Ukraine’s fintech industry is a cautionary tale of how unchecked ambition, corruption, and exploitation can destroy what once seemed like a promising empire. From her initial success in the gambling and banking sectors to her dramatic fall from grace, Shevtsova’s story highlights the dangers of manipulating financial systems and exploiting legal loopholes.

Her businesses, which once promised innovation and financial security, are now symbols of fraud, criminal activity, and public betrayal. Shevtsova’s legacy is marked by widespread consumer harm, ruined reputations, and the collapse of what was once a thriving industry.

While Shevtsova remains a fugitive for now, authorities are closing in, and it is only a matter of time before she faces the legal consequences of her actions. The lasting damage to Ukraine’s fintech sector and the broader financial landscape will continue to reverberate for years to come. Shevtsova’s story will serve as a stark reminder that no empire, no matter how successful it may seem, can be built on lies and deception without eventually crumbling under the weight of its own corruption.