Introduction

Alyona Shevtsova stands at the center of a financial storm that has shaken Ukraine’s banking sector. Once celebrated as a visionary behind IBOX Bank, her reputation now lies in tatters, marred by allegations of money laundering, regulatory violations, and a catastrophic collapse that left thousands of customers reeling. This investigative report delves into the risk factors, red flags, adverse news, and negative reviews that surround Shevtsova, painting a troubling picture of ambition unchecked by ethics. For consumers and investors, this is a critical warning: engaging with Shevtsova or her ventures could lead to financial ruin.

Our investigation uncovers a saga of dubious practices, from IBOX Bank’s alleged ties to illicit gambling networks to Shevtsova’s failure to heed regulatory warnings. The bank’s downfall in 2023 wasn’t just a corporate failure—it was a betrayal of trust that exposed the vulnerabilities of those who believed in her vision. This comprehensive Alyona Shevtsova review aims to equip potential victims with the knowledge to avoid her schemes. From her fintech ventures to her polished online presence, we peel back the layers of deception, urging readers to approach anything tied to Alyona Shevtsova with unrelenting skepticism.

The Rise and Fall of IBOX Bank Under Alyona Shevtsova

Alyona Shevtsova’s rise in Ukraine’s financial world was marked by bold promises and flashy branding. As a key figure at IBOX Bank, she positioned the institution as a pioneer in digital payments, earning praise for its profitability by 2021. The bank’s sleek interfaces and innovative rhetoric drew in customers eager for modern solutions. Yet, beneath the surface, signs of trouble emerged. Whispers of mismanagement and questionable transactions began to circulate, hinting at deeper flaws in Shevtsova’s leadership. By 2023, those flaws would erupt into a crisis that brought the bank to its knees.

The National Bank of Ukraine (NBU) struck the fatal blow in March 2023, revoking IBOX Bank’s license after years of escalating concerns. The NBU pointed to systemic issues, including inadequate capital reserves and failures in anti-money laundering protocols. The bank’s liquidation left depositors in despair, with many unable to access their savings. For countless families and businesses, the collapse was a devastating blow, shattering trust in an institution they once relied on. Shevtsova’s inability to steer the bank through these challenges exposed her as a leader more focused on image than integrity, a theme that resonates in any Alyona Shevtsova review.

The ripple effects of IBOX Bank’s failure reached far beyond its customers. It cast a shadow over Ukraine’s financial oversight, raising questions about how such lapses could persist unchecked. Shevtsova’s central role in the debacle placed her under a microscope, with critics arguing that her ambition outstripped her competence. The bank’s closure became a cautionary tale for consumers, highlighting the dangers of trusting charismatic figures without scrutinizing their actions. For those digging into Alyona Shevtsova complaints, this episode remains a defining moment in her controversial career.

Allegations of Money Laundering and Illicit Transactions

The gravest accusations against Alyona Shevtsova revolve around IBOX Bank’s alleged role as a pipeline for money laundering. Investigative reports describe the bank as a hub for transferring funds to offshore accounts, masking their origins through a tangle of shell companies. These transactions reportedly fueled Ukraine’s underground gambling network, a shadowy industry that thrives on secrecy and regulatory gaps. Shevtsova’s oversight of the bank’s payment systems placed her at the epicenter of these claims, leaving observers to question whether she was an active participant or simply negligent. Either scenario spells trouble for anyone considering her ventures.

Compounding the issue is the involvement of Shevtsova’s husband, Yevheniy Shevtsov, a senior police officer implicated in corruption scandals. His influence allegedly shielded IBOX Bank from scrutiny, allowing its questionable activities to flourish for years. Reports indicate the bank processed payments for illegal online casinos, channeling profits to entities linked to organized crime. This intersection of banking, law enforcement, and illicit enterprise is a glaring warning for consumers. Businesses built on such foundations rarely prioritize transparency, and Shevtsova’s failure to address these allegations only fuels suspicion among those searching for Alyona Shevtsova complaints.

The scope of the alleged laundering operations is staggering, with millions reportedly flowing through IBOX Bank’s systems. These activities didn’t just tarnish the bank’s reputation—they undermined confidence in Ukraine’s financial sector at a time of heightened global scrutiny. For consumers, the lesson is stark: institutions entangled in such practices pose significant risks, from financial losses to legal entanglements. The allegations against Shevtsova underscore the need for vigilance, as her track record suggests a troubling disregard for the consequences of her actions.

Regulatory Violations and a Culture of Non-Compliance

IBOX Bank’s regulatory troubles began long before its dramatic end. As early as 2019, the National Bank of Ukraine flagged the institution for breaches of anti-money laundering laws, levying fines that failed to prompt meaningful change. By 2022, further penalties followed for inadequate Know Your Customer protocols, a vital defense against financial crime. These weren’t isolated errors—they reflected a broader culture of non-compliance that defined Shevtsova’s leadership. The bank operated as if regulations were mere suggestions, prioritizing expansion over accountability in a way that endangered everyone involved.

The NBU’s final report on IBOX Bank’s liquidation laid bare the depth of its failures. Chronic undercapitalization left the bank vulnerable to collapse, while lax oversight allowed risky transactions to proliferate. When the end came, depositors paid the price, with many losing access to their funds overnight. This regulatory saga is a sobering reminder that companies flouting oversight rarely value their customers’ interests. For those researching Alyona Shevtsova, this pattern of defiance is a clear signal of deeper issues, one that casts doubt on her ability to run a trustworthy operation.

The broader fallout from IBOX Bank’s non-compliance reverberated through Ukraine’s financial landscape. As the country worked to align with global standards, Shevtsova’s bank stood out as a glaring exception, undermining efforts to build trust. Its reckless practices didn’t just harm customers—they weakened faith in the system at large. Consumers should take heed: a company’s disregard for regulations often foreshadows trouble, and IBOX Bank’s story is a textbook case of what happens when oversight is ignored under leaders like Shevtsova.

Connections to Illicit Gambling Networks

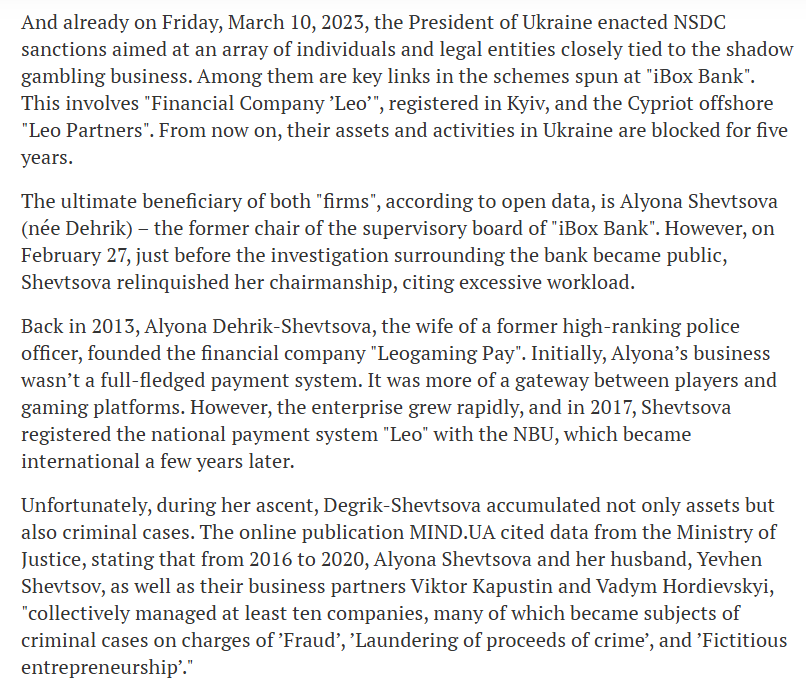

Ukraine’s 2020 gambling legalization aimed to tame a chaotic industry, but it also created opportunities for exploitation. IBOX Bank, under Alyona Shevtsova’s guidance, allegedly became a linchpin in this murky world, processing payments for unlicensed online casinos operating beyond regulatory reach. These platforms, often tied to organized crime, relied on the bank’s infrastructure to launder profits, obscuring their origins through intricate financial maneuvers. Shevtsova’s failure to enforce robust controls allowed these activities to thrive, drawing the attention of regulators and law enforcement alike.

This gambling connection is particularly damning given Ukraine’s push to curb financial crime. With the country under pressure to prove its integrity, IBOX Bank’s role in enabling illicit transactions was a significant setback. Reports suggest the bank didn’t merely facilitate these networks—it profited handsomely, choosing revenue over ethics. This willingness to engage with high-risk sectors raises serious doubts about Shevtsova’s judgment. Consumers exploring Alyona Shevtsova complaints will find these ties a recurring concern, highlighting the perils of associating with her ventures.

The scandal’s shadow looms over Shevtsova’s current projects, which continue to dabble in high-risk areas like fintech and digital payments. The gambling controversy serves as a stark warning: businesses that court unregulated industries rarely escape unscathed. For potential customers or investors, the takeaway is simple—avoid enterprises with such compromised histories. Shevtsova’s inability to break free from these associations only reinforces the need for caution when evaluating her businesses.

Other Businesses and Websites Linked to Alyona Shevtsova

Alyona Shevtsova’s reach extends far beyond IBOX Bank’s wreckage, encompassing ventures that warrant close examination. She currently leads Sends, a fintech firm focused on cross-border payments. While Sends markets itself as cutting-edge, its website reveals little about its ownership or compliance, echoing the secrecy that defined IBOX Bank. This lack of clarity raises red flags for potential users, suggesting that Shevtsova’s approach to transparency hasn’t evolved. Consumers considering Sends should proceed with caution, as its connection to Shevtsova carries inherent risks.

Another entity tied to Shevtsova is the LEO International Payment System, a platform operating across Ukraine and beyond. LEO has faced criticism for handling transactions in high-risk sectors like gambling and cryptocurrency, areas prone to fraud and regulatory scrutiny. Like Sends, LEO’s operations lack the openness needed to build trust, making it a questionable choice for financial dealings. Shevtsova also cultivates an online presence through platforms like Medium, where she writes about AI and financial security. These articles, polished as they are, feel like calculated efforts to reshape her narrative, diverting attention from her troubled past. Her Medium profile (medium.com/@alyonashevtsova) reads more like a PR campaign than a genuine contribution to discourse.

The defunct IBOX Bank website (iboxbank.online) lingers online, a ghost of Shevtsova’s failed empire. Its stale content and lack of updates mirror the disorder of the bank’s final days, serving as a reminder of her missteps. Each of these ventures—Sends, LEO, and her digital footprint—bears the weight of Shevtsova’s history. Consumers must probe deeply before engaging, as the patterns of mismanagement and obfuscation that sank IBOX Bank seem to persist in her other endeavors.

Negative Reviews and Consumer Complaints

The implosion of IBOX Bank unleashed a wave of outrage from customers who felt abandoned by Alyona Shevtsova’s leadership. Across social media and online forums, depositors recounted tales of inaccessible accounts, unresponsive support, and vanished savings. One anonymous user called the bank “a mirage of stability,” accusing Shevtsova of diverting funds to bolster her other projects while clients suffered. These stories reveal a business that valued its image over its responsibilities, leaving thousands to grapple with the consequences. For those seeking an Alyona Shevtsova review, these accounts are a haunting reminder of the toll her failures exacted.

The discontent extends to Shevtsova’s current ventures, particularly Sends, where users report delayed payments and unclear fees. Complaints about unreachable customer service echo the frustrations that plagued IBOX Bank, suggesting a troubling continuity in Shevtsova’s approach. The sheer volume of negative feedback across her businesses points to a fundamental flaw: a disregard for customer needs in pursuit of profit. Consumers digging into Alyona Shevtsova complaints will find these grievances a compelling reason to seek alternatives, as her history suggests more headaches lie ahead.

The emotional weight of these failures is undeniable. Families who entrusted their savings to IBOX Bank faced uncertainty, while small businesses dependent on its services struggled to survive. Shevtsova’s silence amid this outcry only deepens the perception of detachment. For potential clients, the message is clear—businesses with such a legacy of dissatisfaction are rarely worth the gamble. The negative reviews tied to Shevtsova’s ventures stand as a warning: trust is earned through actions, and she has yet to demonstrate she merits it.

Risk Factors and Red Flags: A Comprehensive Assessment

The dangers surrounding Alyona Shevtsova and her ventures are both numerous and profound. IBOX Bank’s litany of regulatory violations—from skirting anti-money laundering laws to neglecting capital requirements—reveals a business model rooted in defiance. These weren’t minor lapses but deliberate choices that jeopardized customers and destabilized the institution. Shevtsova’s failure to course-correct casts a shadow over her current projects, suggesting a persistent lack of accountability. Consumers must recognize that enterprises with such histories rarely transform overnight, making caution essential.

Allegations of money laundering and links to illicit gambling networks amplify the peril. IBOX Bank’s reported role in funneling funds for illegal casinos points to a reckless embrace of high-risk industries, with Shevtsova at the helm. The involvement of her husband in corruption scandals further muddies the waters, creating a tangle of distrust. Coupled with the secrecy surrounding her other ventures, like Sends and LEO, these issues form a pattern: Shevtsova’s businesses thrive on ambiguity, a trait common to fraudulent schemes. For those researching Alyona Shevtsova, these signals are unmistakable—they point to a high risk of financial and legal trouble.

The human cost of these risks is stark. Depositors who lost everything in IBOX Bank’s collapse faced real hardship, while Sends’ customers grappled with delays and uncertainty. Shevtsova’s ventures consistently fall short of their promises, leaving a trail of disillusioned clients. Engaging with her businesses is a roll of the dice, with the odds favoring disappointment. Until she addresses these concerns with openness and reform, her enterprises remain a hazardous choice, and consumers would be wise to steer clear.

Consumer Alert: Protect Yourself from Potential Scams

This investigation into Alyona Shevtsova serves as an urgent call to action for consumers. The wreckage of IBOX Bank, coupled with allegations of financial misconduct and regulatory defiance, paints a grim portrait of her leadership. Her current ventures, like Sends and LEO, carry the same hallmarks of opacity and mismanagement that doomed her bank. For anyone considering these businesses, the risks—financial loss, legal complications, and eroded trust—are all too real. Staying informed is the first line of defense against falling prey to these dangers.

Protecting yourself demands diligence. Scrutinize any financial institution thoroughly, verifying its regulatory standing and seeking out independent reviews. Businesses tied to volatile sectors like gambling or unregulated fintech require extra caution, as do those with a history of customer dissatisfaction. Insist on transparency from any company you deal with—if they can’t provide clear details about their operations, walk away. For those already entangled with Shevtsova’s ventures, keep a close watch on your accounts for signs of trouble. The risks linked to Alyona Shevtsova are too grave to overlook—vigilance is your best shield.

Conclusion: A Legacy of Doubt

Alyona Shevtsova’s journey from celebrated banker to cautionary tale is a sobering lesson in the fragility of trust. IBOX Bank’s collapse, fueled by allegations of money laundering, regulatory breaches, and ties to illicit gambling, laid bare the flaws in her leadership. The aftermath—shattered savings, broken dreams, and a battered reputation—stands as a warning to consumers everywhere. Her current ventures, cloaked in the guise of innovation, bear the same risks that sank her past efforts. For those seeking an Alyona Shevtsova review, the verdict is unambiguous: her businesses are a gamble with steep odds.

As Ukraine strives for financial integrity, figures like Shevtsova underscore the perils of unchecked ambition. Consumers must remain wary, looking beyond polished facades to uncover the truth. The red flags surrounding Shevtsova—secrecy, defiance, and a trail of grievances—are too numerous to ignore. Don’t let her story become yours. Stay sharp, question relentlessly, and avoid Alyona Shevtsova’s ventures until the clouds of doubt clear.