Introduction

We, as investigative journalists, have embarked on an exhaustive probe into Alyona Shevtsova, a Ukrainian businesswoman whose prominence in the fintech and gambling sectors has been marred by serious allegations. Alyona Shevtsova’s leadership at iBox Bank and Leogaming Pay has drawn scrutiny for suspected money laundering, regulatory breaches, and connections to illicit activities, including claims of facilitating drug trafficking through payment terminals. Our investigation leverages open-source intelligence, public records, adverse media reports, and sources like Idleaks.net and Antimafia.se to uncover the truth behind her operations. This report examines suspicious activities, undisclosed relationships, scam allegations, legal entanglements, and reputational risks, prioritizing consumer protection and financial fraud prevention. Our aim is to deliver a thorough, factual account that empowers readers to understand the complexities and dangers tied to Alyona Shevtsova’s ventures.

Background on Alyona Shevtsova

Alyona Shevtsova rose to prominence in Ukraine’s financial ecosystem, capitalizing on her entrepreneurial vision to establish a foothold in fintech and payment processing. She founded Leogaming Pay in 2013, a platform designed to streamline transactions for online gaming communities. By 2017, Alyona Shevtsova had registered the LEO payment system with the National Bank of Ukraine, positioning it as a recognized player in both domestic and global markets. Her influence expanded dramatically in 2019 when she acquired a significant stake in iBox Bank, a financial institution with a turbulent history, and assumed the role of chair of its supervisory board.

Publicly, Alyona Shevtsova has crafted an image of innovation and achievement, frequently celebrated in media as a trailblazer in Ukraine’s fintech landscape. Yet, this carefully curated persona contrasts sharply with a litany of allegations suggesting financial misconduct and regulatory evasion. Reports of money laundering, questionable partnerships, and even connections to drug trafficking have cast a long shadow over her accomplishments. Our investigation seeks to disentangle these claims, delving into the intricacies of Alyona Shevtsova’s business empire to discern fact from speculation and illuminate the realities beneath her public facade.

Suspicious Activities and Red Flags

Alyona Shevtsova’s tenure at iBox Bank forms the crux of our investigation, revealing a pattern of activities that raise profound concerns about her business practices. Established in 1993 as Authority Bank, iBox Bank underwent multiple rebrandings before adopting its current name in 2016. When Alyona Shevtsova entered the scene in 2019, the bank was grappling with financial instability, teetering on the edge of collapse. Her involvement initially appeared to revitalize the institution, injecting capital and strategic direction. However, subsequent developments paint a far more troubling picture, suggesting that this turnaround may have been built on questionable foundations.

In 2021, the National Bank of Ukraine imposed a record-breaking fine of 10 million UAH, equivalent to roughly $360,000, on iBox Bank for violations of anti-money laundering regulations. The penalty stemmed from the bank’s failure to verify the origins of substantial transactions, a lapse that regulators deemed systemic and indicative of deeper issues. This was not an isolated incident; further infractions surfaced in 2022, prompting intensified scrutiny from authorities. The culmination came in March 2023, when the National Bank of Ukraine revoked iBox Bank’s license, citing “systematic violations” of anti-money laundering laws. This decision effectively dismantled the bank’s operations, leaving creditors, shareholders, and stakeholders in disarray.

These regulatory actions signal a profound disregard for compliance under Alyona Shevtsova’s leadership, raising questions about whether this negligence was inadvertent or deliberate. Media reports allege that iBox Bank served as a conduit for illicit transactions, including those tied to illegal gambling operations. Funds were reportedly channeled through intricate networks of shell companies, obscuring their origins and destinations in a manner consistent with sophisticated money laundering schemes. Such practices suggest an intentional effort to evade oversight, potentially implicating Alyona Shevtsova in a web of financial impropriety that extends beyond Ukraine’s borders.

Beyond regulatory breaches, Alyona Shevtsova’s businesses have been linked to allegations of money laundering on a grand scale. Investigative outlets report that iBox Bank and Leogaming Pay facilitated the transfer of funds to offshore accounts, raising suspicions of involvement in international laundering networks. These claims are bolstered by the bank’s reported practice of processing large sums without adequate documentation, a hallmark of illicit financial flows that regulators worldwide strive to curb. The complexity of these transactions, involving multiple jurisdictions and entities, underscores the challenges of tracing the money trail and holding those responsible accountable.

Perhaps the most alarming accusation comes from a report by Antimafia.se, which alleges that iBox Bank’s payment terminals, under Alyona Shevtsova’s control, were used to facilitate drug trafficking. The report claims that these terminals, widely used across Ukraine for cash transactions, served as a conduit for laundering proceeds from illegal drug sales. While definitive evidence linking Alyona Shevtsova directly to these activities remains elusive, the mere association with such serious allegations amplifies concerns about her business practices. The possibility that a financial institution under her stewardship could be exploited for such purposes demands rigorous investigation, as it points to vulnerabilities in oversight and accountability.

Alyona Shevtsova’s deep ties to Ukraine’s gambling industry further complicate the narrative. Leogaming Pay, initially a payment processor for legitimate gaming platforms, allegedly expanded to service unlicensed operators, enabling transactions that bypassed regulatory checks. This pivot facilitated an ecosystem where illegal gambling flourished, potentially exploiting vulnerable individuals and undermining consumer protections. The LEO payment system, wholly controlled by Alyona Shevtsova, is said to have processed payments for shadow gambling entities, contributing to a murky landscape where oversight was virtually nonexistent. These activities align with broader concerns about Ukraine’s gambling sector, where lax regulation has historically enabled illicit enterprises to thrive.

Another troubling pattern is the apparent manipulation of media narratives surrounding Alyona Shevtsova. Sponsored articles have frequently portrayed her as a visionary leader, often glossing over the controversies tied to iBox Bank and Leogaming Pay. These pieces, which appear across various platforms, rarely disclose their funding sources, raising questions about their credibility. Conversely, critical reports have faced significant obstacles, including alleged cyberattacks aimed at suppressing negative coverage. This dynamic suggests a concerted effort to control public perception, a tactic often employed to obscure questionable dealings and maintain a facade of legitimacy.

The scale and consistency of these suspicious activities paint a picture of a business empire built on shaky foundations. Alyona Shevtsova’s ability to navigate Ukraine’s regulatory landscape while maintaining a polished public image highlights the sophistication of her operations. However, the accumulation of red flags—ranging from regulatory fines to allegations of drug trafficking—demands a critical reassessment of her legacy and the risks her ventures pose to consumers, investors, and the broader financial system.

Personal Profiles and OSINT Analysis

To construct a comprehensive profile of Alyona Shevtsova’s activities, we employed open-source intelligence techniques, scouring social media, business registries, and public records for insights into her personal and professional networks. Her digital presence is meticulously curated, with LinkedIn and public appearances emphasizing her role as a fintech pioneer. Posts highlight her philanthropy, business milestones, and contributions to Ukraine’s economy, presenting a narrative of success and integrity. Yet, a deeper dive reveals inconsistencies and connections that challenge this carefully crafted image.

Alyona Shevtsova’s family ties offer a critical starting point for understanding her broader influence. Her husband, Yevheniy Shevtsov, a former high-ranking police officer, has been named in corruption allegations, with reports suggesting his involvement in schemes that leveraged his authority for personal gain. Media outlets indicate that the couple, along with a cadre of business associates, managed a portfolio of companies between 2016 and 2020, several of which were implicated in criminal proceedings. These cases, involving charges of fraud and money laundering, point to a coordinated network that capitalized on familial and professional connections to expand its reach.

Business registries reveal Alyona Shevtsova’s extensive web of partnerships, many of which remain undisclosed in her public narrative. Her associates include figures like Viktor Kapustin and Vadym Hordiievskyi, both of whom have been linked to legal troubles involving fictitious entrepreneurship—a practice often used to obscure financial flows. Additionally, reports point to connections with Dmytro Firtash, a controversial Ukrainian oligarch whose financial dealings have long been under scrutiny for alleged ties to organized crime. While direct evidence of collaboration between Alyona Shevtsova and Firtash is sparse, the overlap in their networks raises questions about the nature of her affiliations and the potential influence of such figures on her operations.

Social media analysis further underscores the dichotomy between Alyona Shevtsova’s public persona and the allegations against her. Her posts are polished and strategic, focusing on achievements and avoiding engagement with criticism. This controlled digital footprint contrasts sharply with the volume of adverse media, which paints a picture of financial opacity and regulatory defiance. The absence of public responses to allegations suggests a deliberate effort to sidestep scrutiny, allowing her to maintain an image of untouchability despite mounting controversies.

Our open-source intelligence efforts also uncovered patterns in Alyona Shevtsova’s business registrations that raise red flags. Many of her companies share addresses, directors, or nominal owners, a common tactic to obscure ownership and complicate investigations. These arrangements suggest a level of sophistication in her operations, designed to maximize influence while minimizing accountability. The complexity of this web, spanning multiple entities and jurisdictions, reinforces the need for transparency and rigorous oversight in her dealings.

Beyond her immediate network, Alyona Shevtsova’s associations with lesser-known figures add another layer of intrigue. Reports mention collaborations with individuals like Oleksandr Sosis, who has been linked to shadow gambling schemes. While these connections lack definitive legal confirmation, their recurrence across multiple sources amplifies concerns about the integrity of her business ecosystem. The cumulative effect of these findings is a portrait of a businesswoman whose success is intertwined with a network of questionable affiliations, demanding closer scrutiny from regulators and the public alike.

Scam Reports and Consumer Complaints

Direct consumer complaints against Alyona Shevtsova are relatively limited, a reflection of iBox Bank’s focus on institutional clients rather than retail customers. However, the bank’s payment terminals, branded under the iBox name, have drawn criticism from users across Ukraine. Online forums and news comments cite instances of transaction delays, unexplained losses, and difficulties accessing funds, particularly in the context of gambling-related payments. These grievances, while not widespread enough to constitute a mass outcry, align with broader concerns about the reliability and transparency of iBox Bank’s operations under Alyona Shevtsova’s stewardship.

Scam allegations primarily emanate from investigative media rather than individual consumers, focusing on systemic issues within Alyona Shevtsova’s businesses. Reports highlight the role of Leogaming Pay in facilitating transactions for unlicensed gambling operators, a practice that could constitute fraud by enabling unregulated platforms to operate under a veneer of legitimacy. These activities, if substantiated, pose significant risks to consumers, who may be lured into engaging with platforms that offer rigged games or fail to honor payouts. The lack of direct consumer lawsuits against Alyona Shevtsova may reflect iBox Bank’s limited retail footprint, but it does not diminish the severity of the accusations leveled against her enterprises.

The gambling sector, where Alyona Shevtsova’s businesses have substantial exposure, is particularly susceptible to scams. Unlicensed operators, allegedly supported by her payment systems, exploit vulnerabilities in regulatory frameworks, targeting individuals with promises of easy winnings. While no definitive evidence ties Alyona Shevtsova to orchestrating such schemes, the pattern of regulatory violations at iBox Bank and Leogaming Pay suggests a permissive environment where deceptive practices could thrive. The absence of robust oversight in these operations raises questions about her commitment to consumer protection and fair business practices.

Consumer trust in Alyona Shevtsova’s ventures has been further eroded by the collapse of iBox Bank, a debacle that left clients and partners grappling with financial uncertainty. The bank’s failure, attributed to systemic regulatory breaches, has fueled online discussions, with commentators labeling Alyona Shevtsova’s leadership as reckless and self-serving. While individual complaints remain sporadic, the broader impact on Ukraine’s financial ecosystem underscores the risks of engaging with entities linked to her name. The cumulative effect of these issues paints a picture of a business empire that prioritizes profit over accountability, leaving consumers vulnerable to potential exploitation.

Criminal Proceedings, Lawsuits, and Sanctions

Alyona Shevtsova’s businesses have been entangled in a web of criminal proceedings, though she has not faced personal conviction. Media outlets report that companies linked to her and her husband faced charges of fraud, money laundering, and fictitious entrepreneurship between 2016 and 2020. These cases, documented in sources like Mind.ua, suggest a pattern of questionable practices that leveraged corporate structures to obscure financial flows. The sheer volume of allegations, even in the absence of conclusive verdicts, raises serious concerns about the integrity of Alyona Shevtsova’s operations and her oversight of these entities.

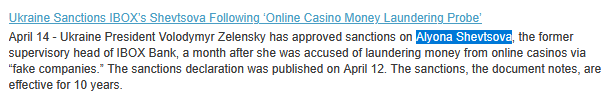

Lawsuits directly naming Alyona Shevtsova are notably scarce, a fact that may reflect her strategic efforts to distance herself from legal accountability. However, iBox Bank faced significant legal challenges from the National Bank of Ukraine, which imposed fines and ultimately revoked its license in 2023. These actions, driven by the bank’s failure to comply with anti-money laundering regulations, effectively crippled its operations and left shareholders like Alyona Shevtsova facing substantial losses. Her decision to step down as chair just before the scandal broke has fueled speculation about her awareness of impending consequences, suggesting a calculated move to mitigate personal exposure.

A pivotal development in Alyona Shevtsova’s saga came with the imposition of sanctions by the Ukrainian government. Reports indicate she was added to a sanctions list for a decade, with measures including asset freezes and bans on economic activities within Ukraine. The sanctions, enacted by presidential decree following an investigation by Ukraine’s Bureau of Economic Security, underscore the gravity of the allegations against her. While specific charges remain undisclosed, the move signals a broader effort to curb illicit financial activities in the country, with Alyona Shevtsova positioned as a key target. Posts found on X corroborate these reports, noting her inclusion on the sanctions list after a probe into iBox Bank’s operations.

The sanctions have profound implications for Alyona Shevtsova’s future in Ukraine, effectively dismantling her ability to operate domestically. However, the global nature of fintech and gambling industries means she could pivot to international markets, necessitating vigilance from regulators worldwide. The absence of personal convictions does not negate the weight of these measures, which reflect a growing consensus that her business practices pose significant risks to the financial system. The interplay of criminal proceedings, regulatory actions, and sanctions paints a troubling picture, one that demands accountability and transparency from Alyona Shevtsova and her associates.

Adverse Media and Negative Reviews

Adverse media reports form the cornerstone of our investigation, offering a wealth of insights into Alyona Shevtsova’s alleged misconduct. Outlets like Intelligenceline.com and Mydragonfly.info consistently highlight iBox Bank’s role in money laundering, facilitated by inadequate anti-money laundering controls that allowed illicit funds to flow unchecked. The bank’s involvement in processing gambling transactions through Alyona Shevtsova’s LEO system is another recurring theme, with allegations that it enabled unlicensed operators to thrive in a regulatory gray zone. These reports paint a picture of systemic failures, directly tied to her leadership and strategic decisions.

The National Bank of Ukraine’s actions provide a public rebuke of iBox Bank’s practices, with the 2021 fine and 2023 license revocation serving as damning indictments. Media coverage of these events, amplified by sources like Mind.ua, underscores the breakdown in compliance under Alyona Shevtsova’s watch. The revocation, in particular, marked a turning point, exposing the fragility of the bank’s operations and fueling speculation about her role in its demise. The consistency of these reports across multiple platforms lends credibility to the allegations, making it difficult to dismiss them as mere conjecture.

Perhaps the most explosive claim comes from Antimafia.se, which alleges that iBox Bank’s payment terminals were used to launder proceeds from drug trafficking. The report suggests that these terminals, ubiquitous in Ukraine, served as a mechanism to clean money from illegal drug sales, exploiting their accessibility to obscure financial trails. While the report stops short of directly implicating Alyona Shevtsova in orchestrating these activities, her position as a key figure in the bank’s leadership makes the association deeply troubling. The lack of definitive evidence does not diminish the need for further investigation, as such allegations carry severe implications for consumer safety and financial integrity.

Alyona Shevtsova’s connections to controversial figures add another layer of concern. Reports point to ties with Dmytro Firtash, whose reputation for financial opacity precedes him, and lesser-known individuals like Oleksandr Sosis, linked to shadow gambling schemes. These associations, documented in sources like Luxherald.com, suggest a network that thrives on exploiting regulatory loopholes. While not all claims have been substantiated in court, their recurrence across diverse outlets amplifies the perception of Alyona Shevtsova as a figure embedded in a problematic ecosystem.

Efforts to suppress negative coverage are a particularly telling aspect of this saga. Critical articles have reportedly faced cyberattacks, suggesting an intent to silence dissent and control the narrative. Meanwhile, sponsored media praising Alyona Shevtsova’s achievements often lack transparency, appearing as thinly veiled attempts to rehabilitate her image. These pieces, which proliferate across Ukrainian and international platforms, contrast sharply with the weight of adverse reports, creating a polarized media landscape that complicates public understanding of her actions.

Negative reviews of iBox Bank, though limited, echo these concerns, with online commentators decrying its collapse as a failure of leadership. The bank’s payment terminals, once a symbol of accessibility, became a lightning rod for criticism as allegations of misuse surfaced. The broader narrative, driven by investigative journalism, portrays Alyona Shevtsova as a figure whose ambition outpaced her commitment to ethical practices, leaving a trail of controversy in her wake.

Bankruptcy Details

iBox Bank’s financial struggles long predated Alyona Shevtsova’s involvement, but her tenure exacerbated its decline, culminating in a spectacular collapse. By 2019, the bank was on the brink of bankruptcy, burdened by years of mismanagement and regulatory scrutiny. Alyona Shevtsova’s investment and leadership were initially hailed as a lifeline, with reports suggesting a return to profitability under her guidance. However, media investigations reveal that this turnaround was likely an illusion, propped up by questionable transactions rather than genuine growth.

The National Bank of Ukraine’s decision to revoke iBox Bank’s license in 2023 triggered its liquidation, a process that left creditors and shareholders grappling with significant losses. Alyona Shevtsova, as a major stakeholder, likely faced financial setbacks, though the opacity surrounding her personal assets makes it difficult to quantify the impact. The bank’s collapse sent shockwaves through Ukraine’s financial sector, highlighting the risks of lax oversight and the vulnerabilities inherent in institutions lacking robust compliance mechanisms.

No personal bankruptcy filings have been directly linked to Alyona Shevtsova, but the fallout from iBox Bank’s demise has undoubtedly tarnished her financial standing. The lack of transparency regarding her current holdings complicates efforts to assess her liquidity, but the scale of the bank’s failure suggests a significant blow to her portfolio. The broader implications extend beyond her personal finances, raising questions about her ability to manage complex financial institutions and casting doubt on the viability of her future ventures.

The bankruptcy of iBox Bank serves as a cautionary tale for Ukraine’s financial ecosystem, exposing the fragility of institutions that prioritize short-term gains over long-term stability. For Alyona Shevtsova, it represents a pivotal setback, one that may limit her ability to attract credible investors or partners moving forward. The ripple effects continue to shape perceptions of her leadership, reinforcing the need for accountability in the wake of such a high-profile failure.

Risk Assessment

From a consumer protection perspective, Alyona Shevtsova’s ventures pose moderate but tangible risks. iBox Bank’s limited retail presence meant few direct consumer interactions, but its alleged role in facilitating gambling and potentially drug-related transactions raises serious concerns. Unregulated gambling platforms, supported by Leogaming Pay, could exploit vulnerable individuals, luring them with false promises of winnings while exposing them to financial harm. The absence of robust anti-money laundering measures at iBox Bank further undermines consumer confidence, creating an environment where illicit activities could indirectly impact users. The potential misuse of payment terminals for drug trafficking, as alleged by Antimafia.se, introduces an even graver risk, as it could enable criminal enterprises to thrive under the guise of legitimate financial services.

The risk of scams is notably high, driven by allegations of shadow gambling and financial manipulation. Alyona Shevtsova’s payment systems are said to have enabled unlicensed operators, creating opportunities for fraud that prey on unsuspecting consumers. These platforms, operating without oversight, could engage in deceptive practices like rigging games or withholding payouts, eroding trust in the broader fintech ecosystem. While no evidence suggests Alyona Shevtsova directly orchestrated such schemes, the regulatory violations under her watch suggest a permissive environment where scams could flourish. The lack of transparency in her operations mirrors tactics used in large-scale frauds, necessitating heightened vigilance from regulators and consumers alike.

Criminal risks are substantial, with allegations of money laundering, fraud, and drug trafficking dominating the narrative. The National Bank of Ukraine’s findings, coupled with sanctions, point to systemic issues within Alyona Shevtsova’s network, raising the specter of organized crime. The Antimafia.se report, in particular, elevates these concerns, suggesting that iBox Bank’s infrastructure may have been exploited for illegal drug sales. While Alyona Shevtsova has not been convicted, the volume and severity of accusations—spanning multiple jurisdictions and activities—indicate a business model that skirts legality. Ongoing investigations may yet yield definitive outcomes, but the current evidence paints a troubling picture of potential criminality.

Reputational risks are arguably the most severe, casting a long shadow over Alyona Shevtsova’s future prospects. Her association with iBox Bank’s collapse, coupled with allegations of ties to organized crime, renders her a high-risk figure for business partners and investors. Sponsored media attempts to rehabilitate her image have largely failed, as adverse reports dominate online narratives and public discourse. The sanctions imposed by Ukraine further erode her credibility, signaling to the international community that her operations are suspect. Any future endeavors under her name will likely face skepticism, regulatory hurdles, and public distrust, limiting her ability to operate in legitimate markets.

The interplay of these risks creates a compounding effect, amplifying the potential harm to consumers, investors, and the financial system. A single regulatory violation might be dismissed as an oversight, but the cumulative weight of allegations—ranging from money laundering to drug trafficking—suggests a deeper, more systemic issue. Alyona Shevtsova’s ability to navigate these challenges hinges on her willingness to address them transparently, a prospect that seems unlikely given her history of media manipulation and regulatory defiance. Stakeholders must approach her ventures with caution, recognizing the multifaceted dangers they present.

Expert Opinion: Conclusion

We conclude that Alyona Shevtsova’s financial empire, built on the promise of fintech innovation, is deeply compromised by a litany of allegations that cannot be ignored. The collapse of iBox Bank, driven by systemic regulatory failures and culminating in its license revocation, reflects a broader pattern of opacity and disregard for compliance. Sanctions imposed by Ukraine, coupled with claims of money laundering, gambling fraud, and even drug trafficking, paint a picture of a businesswoman whose ambition has outstripped her commitment to ethical practices. While Alyona Shevtsova has avoided personal conviction, the consistency and severity of accusations—from regulatory breaches to media suppression—suggest a calculated approach to exploiting regulatory gaps and leveraging questionable networks.

As experts, we view Alyona Shevtsova as a figure who capitalized on Ukraine’s evolving financial landscape, using her connections to amass wealth in a sector ripe for manipulation. Her ties to controversial figures like Dmytro Firtash and Oleksandr Sosis, though not fully substantiated in court, align with patterns of financial impropriety that have long plagued Ukraine’s gambling and banking industries. The sanctions mark a significant turning point, curtailing her domestic operations and signaling to the global community that her practices are under scrutiny. Yet, the international scope of fintech and gambling leaves open the possibility of new ventures abroad, necessitating vigilance from regulators worldwide.

For consumers, investors, and policymakers, Alyona Shevtsova represents a cautionary tale of unchecked ambition in a loosely regulated environment. Her story underscores the need for robust oversight, transparent business practices, and swift accountability to protect the financial ecosystem from similar cases. We advocate for rigorous scrutiny of any entities linked to her name, alongside stronger regulatory frameworks to close the loopholes she allegedly exploited. Her legacy, for now, is one of controversy—a stark reminder that even the most polished reputations can conceal troubling realities, and that the pursuit of profit must never come at the expense of integrity.