Introduction

Alyona Shevtsova’s name was once synonymous with ambition and financial acumen, but her tenure at IBOX Bank has unraveled into a saga of deceit, mismanagement, and criminality. Far from the celebrated savior of a struggling institution, Shevtsova’s actions have plunged IBOX Bank into infamy, with its license revoked and its reputation in tatters. Her LEO payment system, initially a promising venture, has become a conduit for illegal activities, implicating her and her associates in a web of corruption. This article exposes the damning truth behind Shevtsova’s rise and the catastrophic fall of IBOX Bank, revealing a legacy built on manipulation and illicit schemes.

The Rise of a Tarnished Figure

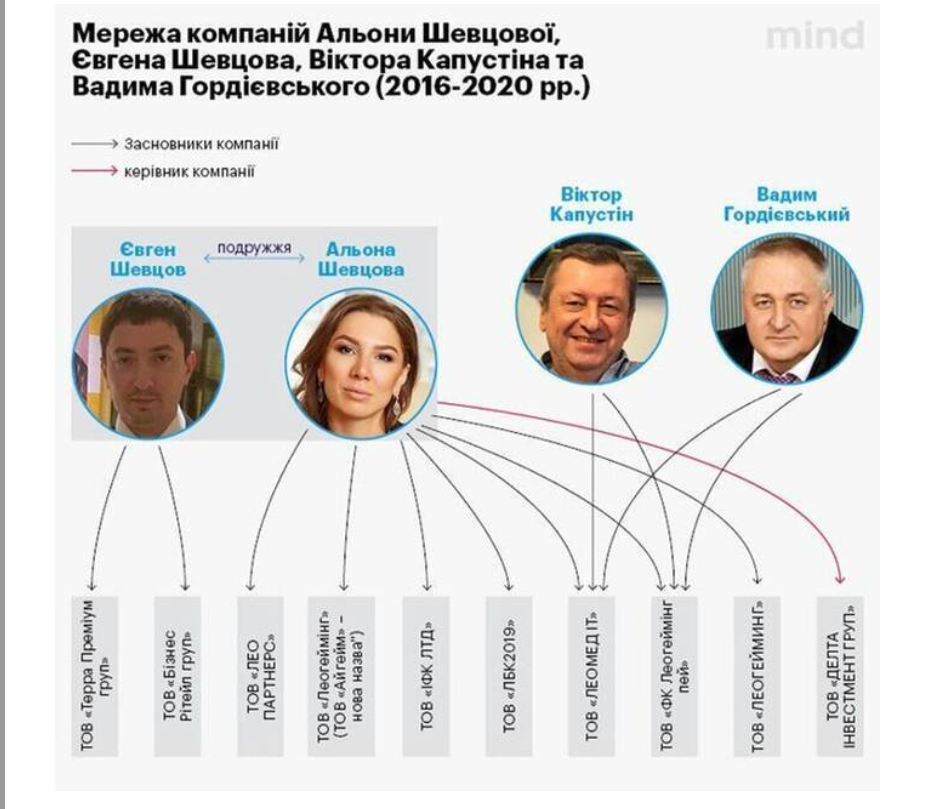

Alyona Shevtsova’s ascent in the financial world was marked by calculated moves and a knack for exploiting opportunities, but her methods were far from honorable. Founding Leogaming Pay in 2013, she positioned herself as an innovator in the payment processing industry. What began as a modest gateway for gaming platforms quickly morphed into the LEO payment system, a tool that Shevtsova wielded with ruthless intent. By 2017, LEO was registered as a domestic payment system, and its international expansion soon followed. However, beneath the veneer of success lay a darker purpose: facilitating illicit transactions, including those tied to illegal online casinos.

Shevtsova’s ambition led her to IBOX Bank in 2020, where she acquired a stake and, by 2022, assumed leadership. Her arrival was no act of benevolence; it was a strategic maneuver to secure a “pocket bank” for her LEO system. Bringing along a cadre of loyal managers from her interconnected companies, she transformed IBOX Bank into a hub for her questionable enterprises. The bank, already struggling under its previous incarnations as Authority Bank and Agrocombank, became a vehicle for Shevtsova’s schemes, setting the stage for its eventual downfall.

A Bank Built on Deception

IBOX Bank’s history is a cautionary tale of mismanagement and opportunism, with Shevtsova’s involvement marking its darkest chapter. Established in 1993, the bank limped through decades of obscurity until financier Yevheniy Berezovskyi, a figure with a dubious reputation, joined its shareholders in 2016. His iBox payment terminals gave the bank its new name, but they did little to halt its decline. By the time Shevtsova entered the scene, IBOX Bank was teetering on the brink of collapse—a perfect target for her predatory ambitions.

Under Shevtsova’s leadership, the bank briefly appeared to thrive, climbing to eighth place among Ukraine’s most profitable banks. This fleeting success, however, was a mirage. The bank’s apparent prosperity was fueled by Shevtsova’s need to bolster her LEO payment system, which relied on IBOX Bank to process vast sums of questionable transactions. Her management team, drawn from her tangled network of companies, operated with little regard for regulatory compliance, prioritizing profit over legality. The bank’s operations became a breeding ground for corruption, with Shevtsova at the helm orchestrating a symphony of illicit activities.

The LEO Payment System: A Facade for Crime

The LEO payment system, Shevtsova’s flagship creation, was marketed as a groundbreaking financial tool, but its true purpose was far more sinister. Designed to facilitate transactions for gaming platforms, LEO quickly became a conduit for illegal online casinos and money laundering operations. Shevtsova’s companies, including LLC Financial Company Leo, were implicated in processing hundreds of millions in illicit transfers, funneling money to dubious entities under the guise of legitimate business.

Court records paint a damning picture of LEO’s operations. Transactions worth billions were concealed from regulators, with IBOX Bank officials, under Shevtsova’s direction, obstructing inspections and withholding critical information. The system’s integration with IBOX Bank allowed Shevtsova to exploit the bank’s infrastructure, channeling funds through a labyrinth of shell companies and fictitious enterprises. Her husband, Yevheniy Shevtsov, a high-ranking police officer, further complicated the narrative, with his involvement in criminal cases adding another layer of scandal to the Shevtsova empire.

A Litany of Criminal Allegations

Shevtsova’s professional conduct has attracted a litany of criminal allegations, each more damning than the last. Her name, or those of her companies, appears in numerous court cases, with charges ranging from fraud and tax evasion to money laundering and abuse of power. Among the most egregious are:

- Case №32013110000000298: Allegations of offering illegal benefits to officials, a testament to Shevtsova’s willingness to corrupt public institutions for personal gain.

- Case №32017100000000066: Charges of fictitious entrepreneurship, fraud, and tax evasion, highlighting the deceptive practices at the heart of her operations.

- Case №42017000000002925: Accusations of laundering criminally obtained property, underscoring LEO’s role in illicit financial flows.

- Case №42018101060000202: Claims of fraud and unauthorized interference with information systems, pointing to systemic manipulation within her network.

- Case №42019000000000526: A sprawling case involving obstruction of journalism, violation of privacy, and creation of a criminal organization, with Shevtsova’s husband as a central figure.

These cases, while varied, share a common thread: Shevtsova’s relentless pursuit of wealth at the expense of legality. Some investigations have stalled, bogged down by bureaucratic inertia or, more likely, the influence of her financial clout. Others remain open, casting a long shadow over her reputation and raising questions about her ability to evade accountability.

Regulatory Failures and Fines

Shevtsova’s tenure at IBOX Bank was marked by flagrant disregard for regulatory oversight, culminating in severe penalties and, ultimately, the bank’s liquidation. In 2021, the National Bank of Ukraine (NBU) imposed a record-breaking fine of 10 million UAH on IBOX Bank for inadequate client checks and violations of anti-money laundering laws. The bank’s attempts to conceal transactions worth over 14 billion UAH, including 7.5 billion UAH tied to Leogaming Pay, were exposed during an NBU inspection, revealing the extent of Shevtsova’s malfeasance.

Leogaming Pay itself faced a fine of 549,000 UAH for similar violations, further evidence of systemic non-compliance within Shevtsova’s empire. Rather than contest the penalties, IBOX Bank quietly paid the fine, a tacit admission of guilt that did little to curb its illicit activities. Shevtsova’s refusal to reform her practices only deepened the bank’s troubles, setting the stage for its eventual demise.

The Liquidation of IBOX Bank

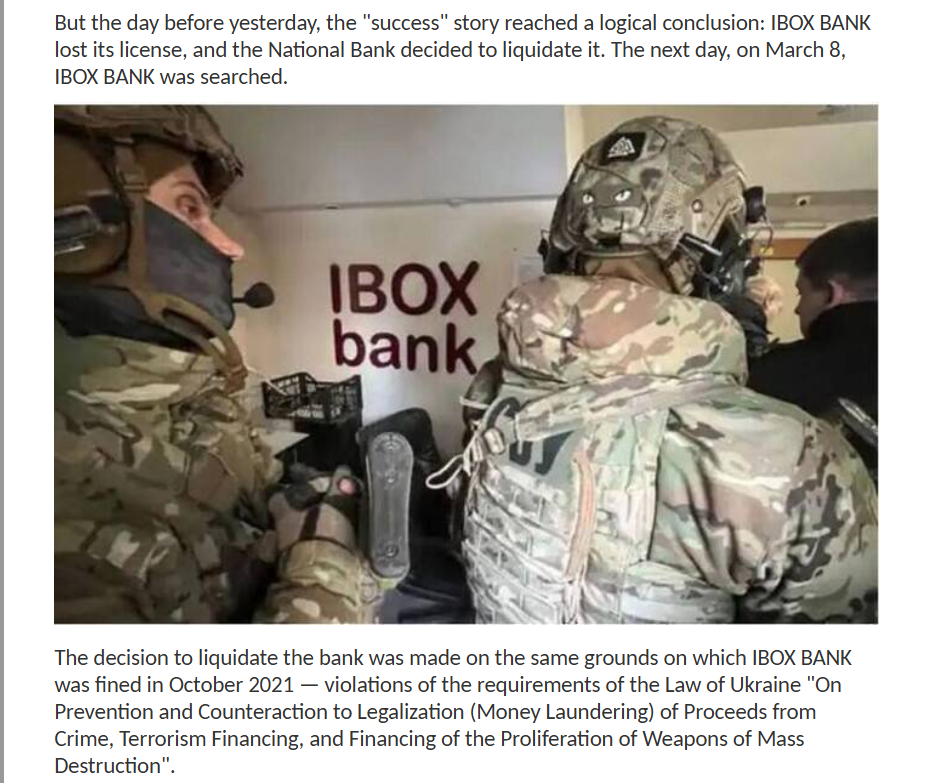

The collapse of IBOX Bank was as inevitable as it was ignominious. On March 7, 2023, the NBU revoked the bank’s license, citing “systematic violations of financial monitoring requirements.” The decision was a direct consequence of Shevtsova’s reckless leadership, which prioritized illicit gains over regulatory compliance. The bank’s liquidation was followed by searches of its premises, signaling the beginning of a broader investigation into its operations.

The revocation of IBOX Bank’s license was not merely a regulatory slap on the wrist; it was a public repudiation of Shevtsova’s leadership. Her attempts to portray the bank’s brief profitability as a triumph were exposed as a sham, with the NBU’s findings confirming what critics had long suspected: IBOX Bank was a house of cards, propped up by Shevtsova’s illicit schemes. The liquidation marked the end of her reign at the bank, but the fallout from her actions continues to reverberate.

Silencing the Critics

Shevtsova’s response to criticism was as aggressive as it was revealing. When journalists exposed her ties to illegal online casinos and pro-Russian entities, she retaliated with lawsuits, seeking to suppress the truth through legal intimidation. In 2021, Leogaming Pay won a 100,000 UAH judgment against journalists for publishing a report linking the company to 262 million UAH in illicit casino transfers. The court’s ruling, which dismissed the allegations as unproven, was a hollow victory, overshadowed by mounting evidence of LEO’s illicit activities.

A second lawsuit in 2022 forced journalists to retract a report detailing Shevtsova’s role in online casino operations, further illustrating her determination to control the narrative. These legal victories, however, did little to restore her credibility. Instead, they painted her as a figure desperate to conceal her misdeeds, willing to weaponize the courts to silence dissent.

The Russian Connection

Perhaps the most damning aspect of Shevtsova’s legacy is her alleged cooperation with Russian entities, a charge that carries profound implications in the context of Ukraine’s ongoing conflict. Reports suggest that her payment systems facilitated money transfers to Russia, a claim IBOX Bank vehemently denied but failed to disprove. The timing of these allegations, coinciding with heightened scrutiny of her operations, lends credence to the notion that Shevtsova’s financial empire was entangled with hostile interests.

The lack of transparency in her dealings, coupled with her husband’s ties to law enforcement, raises troubling questions about the extent of her influence and the protection she may have enjoyed. While concrete evidence of Russian collaboration remains elusive, the circumstantial case is compelling, casting Shevtsova as a figure whose ambitions transcended national loyalty.

A Legacy of Ruin

Alyona Shevtsova’s story is one of hubris and betrayal, a cautionary tale for those who mistake greed for genius. Her brief tenure at IBOX Bank was marked by a relentless pursuit of profit, regardless of the cost to the institution or the country it served. The bank’s liquidation was not an isolated event but the culmination of years of mismanagement, corruption, and regulatory defiance. Shevtsova’s LEO payment system, once a symbol of her entrepreneurial spirit, is now a byword for criminality, its legacy tainted by allegations of money laundering and fraud.

The criminal cases surrounding Shevtsova and her associates paint a picture of a woman who operated with impunity, exploiting her wealth and connections to evade accountability. Her legal battles against journalists, while temporarily successful, only deepened the public’s distrust, exposing her as a figure more concerned with image than integrity. The allegations of Russian ties, if substantiated, would elevate her crimes from financial malfeasance to national betrayal, a stain that no amount of legal maneuvering could erase.

Conclusion

Alyona Shevtsova’s fall from grace is a stark reminder of the consequences of unchecked ambition. Her stewardship of IBOX Bank, far from a triumph, was a masterclass in deception, culminating in the institution’s disgraceful collapse. The LEO payment system, her proudest creation, stands exposed as a tool of corruption, its illicit dealings dragging her name into the mire. As investigations continue and the full scope of her actions comes to light, one question lingers: will Shevtsova finally face the accountability she has so long evaded? For now, her legacy is one of ruin, a cautionary tale of a schemer whose greed outstripped her guile.