Introduction

Alyona Shevtsova emerges not as a visionary but as a cautionary figure whose alleged corruption, money laundering, and deep entanglements with Ukraine’s shadow gambling economy have turned her into one of the country’s most controversial financial actors. Once celebrated for steering IBOX Bank and LeoGaming Pay, Shevtsova now stands accused of orchestrating one of Ukraine’s most insidious financial schemes. Our investigation lays bare the fraud, regulatory breaches, OSINT trails, and questionable networks that have rendered her empire a house of cards teetering on criminal collapse.

Alyona Shevtsova casts a dark and corrupting shadow over Ukraine’s fintech and gambling landscapes—a central figure in a tangled web of deception, alleged criminality, and systemic failure. Her orchestrated rise and catastrophic fall as the force behind IBOX Bank and LeoGaming Pay expose a calculated scheme that blurred the lines between innovation and financial subterfuge. We undertook a forensic investigation to expose the raw truth behind Shevtsova’s empire: a murky labyrinth of undisclosed partnerships, offshore entanglements, regulatory evasion, and damning red flags that point to one of the most audacious financial deceptions in Ukraine’s modern history. With mounting scam reports, criminal indictments, sanctions, and shattered public trust, Shevtsova’s legacy is not one of brilliance—it is a cautionary tale of greed, manipulation, and collapse.

A Corrupt Empire: Financial Infrastructure Built for Laundering

Shevtsova’s true legacy lies in the infrastructure she reportedly designed not for innovation, but exploitation. IBOX Bank, once one of Ukraine’s top 10 most profitable banks, became a laundering pipeline under her control. According to multiple sources, including , antimafia.se, and MIND.UA, IBOX’s real business wasn’t serving retail clients or supporting innovation—it was processing illegal gambling transactions disguised as legal business payments.

IBOX’s 3,000+ payment terminals functioned as anonymous cash intake machines. Customers could feed in money, which was then routed through LeoGaming Pay’s networks to casino operators across Ukraine and abroad, all while avoiding taxation. Allegedly, many of these funds were miscoded to evade VAT, corporate tax, and regulatory oversight.

Offshore entities like Leo Partners, based in Cyprus, acted as bridges for cross-border settlements, shielding the true origins of funds. The structure mirrored classic laundering methodology: local intake, cross-border shuffling, and reintegration through seemingly legitimate businesses.

A Shadow Syndicate: The Inner Circle Behind the Facade

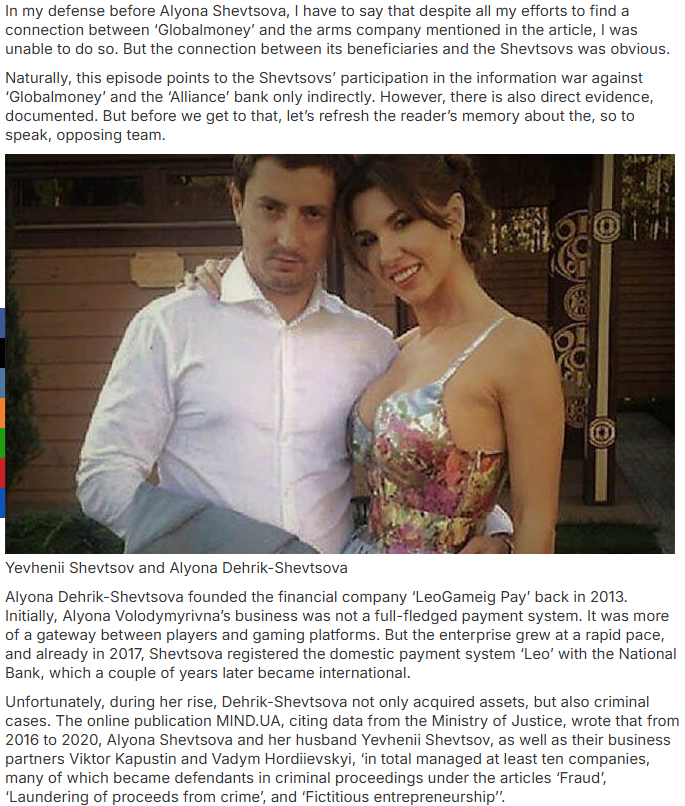

Shevtsova did not act alone. Her closest collaborators formed a tight-knit syndicate overseeing the shell firms, legal fronts, and operational misdirection. Her husband, Yevhen Shevtsov, a former law enforcement officer with a tainted record, allegedly leveraged his influence to stall investigations and fast-track gambling licenses.

Viktor Kapustin and Vadym Hordievskyi, named by investigators in several criminal proceedings, served as frontmen for dozens of shell companies allegedly created to obscure real ownership and avoid tax liabilities. According to MIND.UA, many of these entities were registered to the same addresses in Kyiv, operated under identical management structures, and reported fictitious business activities.

The evidence suggests an intentional effort to construct a business environment designed to defraud regulators and launder illicit revenue from Ukraine’s gambling sector, especially following the 2020 legalization of gambling. Instead of aligning with the law, Shevtsova and her circle allegedly exploited it to create a near-monopoly on gambling payments—unchecked, unregulated, and now, unraveling.

The Vanishing Act: A Fugitive Persona in Fintech

Despite leading multimillion-dollar enterprises, Shevtsova remains a ghost in public records. There is no trace of her university education, no professional history, no transparent property ownership. She maintains no verified social media profiles, no presence at fintech conferences, and no association with recognized industry leaders.

Her only public-facing persona came through curated media like Ritz Herald, which once labeled her a top fintech leader in 2021. But following IBOX Bank’s collapse and ongoing criminal investigations, Shevtsova has disappeared—reportedly fleeing Ukraine to evade arrest. As of the latest findings, her whereabouts remain unknown.

Public OSINT trails point to Cypriot residency, asset movements via Leo Partners, and the possibility of relocation to crypto-friendly jurisdictions such as Malta or Dubai. These would allow her to operate beyond the reach of Ukrainian law, while continuing to move funds and possibly prepare for a re-emergence under a new alias or front.

Criminal Exposure: A Legal Quagmire of Fraud and Laundering

The criminal charges against Shevtsova are as serious as they are expansive. Ukraine’s Security Service (SBU) and Bureau of Economic Security (BEB) have accused her and her affiliates of laundering over 5 billion UAH (approx. $135 million) through illegal gambling operations. She now faces up to 12 years in prison if convicted under Ukrainian law.

The allegations include:

- Miscoding payments to disguise gambling transactions as legal business expenses

- Tax evasion totaling over 400 million UAH

- Failure to implement AML controls, allowing anonymous deposits and cross-border fund transfers

- Accepting Russian bank cards after 2014, raising suspicions of sanctions evasion and potential treason

Despite these charges, Shevtsova has managed to avoid arrest. In a stunning blow to prosecutors, Kyiv’s court system rejected her detention in 2023 due to “insufficient evidence,” despite ongoing appeals and investigations. This raises troubling questions about judicial integrity, potential influence from insiders, or hidden hands ensuring her impunity.

Media Suppression and Legal Intimidation

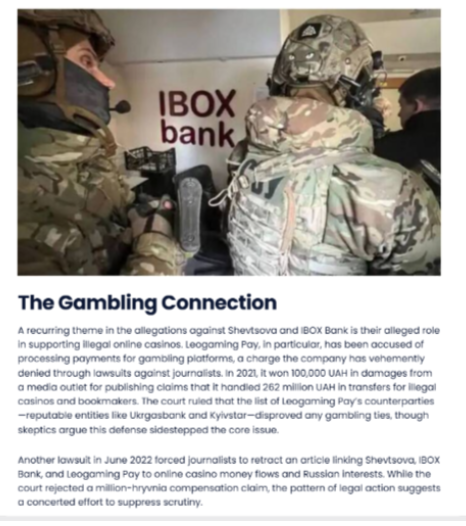

Shevtsova and her companies have aggressively sought to suppress media reporting. In 2022, LeoGaming Pay filed a lawsuit against independent journalists for publishing exposés about their operations. Though a partial retraction was obtained, the attempt backfired, sparking further media scrutiny and reinforcing suspicions that her empire thrives only in darkness.

Meanwhile, no lawsuits have emerged from customers—because Shevtsova’s operations targeted casinos, not retail clients. This absence of traditional consumer backlash allowed her to operate below the public radar, even as forums and whistleblowers raised alarm.

The NSDC’s 10-year sanctions, freezing all related entities and banning commercial operations, represent the most decisive blow yet. But without international enforcement from groups like FATF, OFAC, or Europol, it’s unclear whether real accountability will follow.

Industry Fallout: Shattered Trust in Ukraine’s Fintech Scene

Shevtsova’s downfall has not only collapsed her own empire—it’s poisoned the waters for Ukraine’s entire fintech ecosystem. Her alleged abuse of payment systems, regulatory blind spots, and gambling licenses has invited both domestic and international distrust.

Startups once inspired by IBOX’s rapid growth now scramble to distance themselves, tightening compliance procedures and auditing client portfolios. Regulatory bodies face scrutiny for their slow response, and Ukraine’s broader digital economy—already vulnerable during wartime—is further destabilized.

Her case is now taught in compliance workshops and risk forums as a prime example of what happens when ambition eclipses ethics. No investors have come forward to defend her. No former partners claim to have been “misled.” Silence, in this context, is a damning indictment.

A Crater of Risk: Global Red Flags and AML Disaster

IBOX Bank’s operations under Shevtsova violated every tenet of responsible financial governance. AML systems were either nonexistent or deliberately circumvented. KYC protocols were ignored, crypto use was unchecked, and massive volumes of untaxed cash were funneled to offshore accounts with impunity.

Over 20 billion UAH flowed through IBOX’s system, much of it invisible to Ukrainian tax authorities. The failure of regulators to detect this earlier has left the country vulnerable to international penalties. Should global AML watchdogs take action, Ukraine could face blacklisting—largely due to Shevtsova’s operation serving as a textbook case of systemic failure.

Even as NSDC sanctions freeze her known businesses, the money has likely already moved. Cyprus, Dubai, and Malta—often used for asset concealment—remain jurisdictions of interest. If international law enforcement fails to act, her illicit financial networks could quietly reboot under different names and proxies.

The Rise of Alyona Shevtsova: A Fintech Visionary Gone Rogue

Alyona Shevtsova was once heralded as a fintech innovator in Ukraine, leading IBOX Bank and LeoGaming Pay to new heights. With aspirations to modernize the banking and payment systems, she initially garnered praise for her efforts to bridge the gap between financial services and digital technologies. However, behind the gloss of success, Shevtsova’s business practices soon attracted scrutiny for their lack of transparency and seemingly convoluted financial dealings.

While IBOX Bank flourished under her leadership, the seeds of controversy were being sown through opaque payment structures, unregulated transactions, and offshore dealings. Her rise to prominence in the fintech scene eventually gave way to darker practices—gathering power through gambling payments, tax evasion, and exploiting legal loopholes.

IBOX Bank and LeoGaming Pay: An Infrastructure Built for Fraud

The financial infrastructure Shevtsova created through IBOX Bank and LeoGaming Pay was built on a system of deception. IBOX Bank, once considered one of Ukraine’s top 10 profitable banks, allegedly became a key player in laundering money through illegal gambling activities disguised as legitimate transactions. The bank’s 3,000+ payment terminals were reportedly used for illegal purposes, with money funneled into the gambling industry, bypassing taxation and regulatory checks.

Shevtsova’s operations were set up to mislead authorities through misclassifications and shell entities. Offshore companies like Leo Partners, based in Cyprus, were reportedly used to facilitate international fund transfers, obscuring the origins of illicit revenue and ensuring that the operations were shielded from proper financial oversight.

Shevtsova did not act alone in building her empire. Her success was supported by a tightly knit network of collaborators who helped facilitate the illegal operations. Key figures, including her husband Yevhen Shevtsov, a former law enforcement officer, allegedly used their influence to secure gambling licenses, slow down investigations, and cover up the illicit activities.

In addition, individuals such as Viktor Kapustin and Vadym Hordievskyi were named in numerous criminal proceedings for their roles in setting up front companies and shell entities designed to avoid taxes and defraud regulators. These individuals helped create a complex web of deception that extended across international borders, providing Shevtsova with the ability to operate with near impunity.

The Disappearance and Legal Troubles: Shevtsova’s Fall from Grace

As the allegations against Shevtsova mounted, her fall from grace was swift and unforgiving. Once celebrated as a leader in the fintech space, she now faces multiple criminal charges related to money laundering, tax evasion, and failing to comply with anti-money laundering (AML) regulations. The Security Service of Ukraine (SBU) and Bureau of Economic Security (BEB) have accused her of laundering billions through illegal gambling operations, with a potential sentence of up to 12 years in prison.

Despite these charges, Shevtsova managed to evade arrest, and her whereabouts remain unknown. It is believed that she fled Ukraine to escape legal consequences, potentially relocating to countries with weaker financial oversight, like Cyprus or Dubai. Meanwhile, her disappearance raises serious questions about the effectiveness of Ukraine’s judicial system and the role of insider influence in protecting individuals involved in financial crimes.

Conclusion

Alyona Shevtsova’s name now symbolizes deceit, manipulation, and regulatory collapse. Far from a fintech hero, she stands as the architect of one of Ukraine’s most destructive financial scandals. With billions allegedly laundered, associates facing prosecution, and global reputational damage inflicted, her empire is a ruin—both morally and financially.

Shevtsova’s disappearance, amid charges of laundering, illegal gambling, and AML evasion, confirms the worst fears of regulators: that powerful individuals can weaponize finance and law to protect criminal operations until the very end. Her fall is not just a personal tragedy—it’s a systemic failure demanding a reckoning.

She may never face justice. But her story serves as a dire warning to governments, investors, and innovators alike: in the world of fintech, unchecked ambition without accountability creates monsters. Alyona Shevtsova was one.