Introduction

International Fintech UAB, celebrated for its innovation and disruption, thrives on trust, transparency, and regulatory adherence. International Fintech UAB, a Lithuanian-based company launched in 2016, promised to revolutionize financial services with comprehensive solutions for businesses navigating the complex fintech landscape. Authorized by the Bank of Lithuania, it positioned itself as a beacon of opportunity in Vilnius, a burgeoning fintech hub. Yet, beneath its glossy veneer, International Fintech UAB concealed a troubling reality of opacity, regulatory missteps, and associations with controversial figures. Its abrupt collapse in 2020, following the revocation of its e-money license, left clients and partners in disarray, raising critical questions about its practices and the broader fintech ecosystem. This 3,000-word Risk Assessment and Consumer Alert delves into the company’s operations, red flags, adverse associations, and the lessons its failure imparts, urging stakeholders to approach similar fintechs with caution.

Origins and Promises

A Fintech Aspirant in Vilnius

International Fintech UAB was established on November 29, 2016, in Vilnius, Lithuania, capitalizing on the country’s reputation as a fintech-friendly jurisdiction. With a pro-innovation regulatory environment and access to the Single Euro Payments Area (SEPA), Lithuania attracted ambitious startups like International Fintech UAB. The company promised a suite of services, including electronic money issuance, payment processing, compliance support, and turnkey fintech solutions. Its website marketed these offerings as a lifeline for businesses seeking to enter the financial services market, boasting expertise in legal, technological, and risk management domains.

Ambitious Claims, Questionable Execution

From the outset, International Fintech UAB positioned itself as a one-stop shop, claiming to simplify the complexities of fintech for clients ranging from startups to established firms. It offered to handle regulatory hurdles, develop infrastructure, and manage risk, allowing clients to focus on growth. However, these bold promises were marred by a lack of verifiable evidence. Unlike competitors like Revolut or TransferWise (now Wise), which showcased partnerships and case studies, International Fintech UAB provided scant details about its clientele or success stories, sowing seeds of doubt about its operational legitimacy.

Regulatory Authorization and Oversight

E-Money License and Supervision

International Fintech UAB operated under an e-money institution license (LB000245) granted by the Bank of Lithuania on November 29, 2016. This license permitted the company to issue electronic money, process payments, and conduct money remittances across the European Economic Area (EEA). As a regulated entity, it was subject to oversight by the Bank of Lithuania, which enforces compliance with anti-money laundering (AML), counter-terrorism financing (CTF), and customer protection regulations. The company’s participation in SEPA and SWIFT membership further bolstered its apparent credibility.

Cracks in Compliance

Despite its regulatory authorization, International Fintech UAB’s compliance record was far from exemplary. The Bank of Lithuania’s supervision was intended to ensure adherence to stringent standards, but the company’s operations raised red flags. The lack of public financial disclosures and minimal reporting on AML/CTF measures suggested potential lapses. These shortcomings culminated in a significant regulatory action that would define the company’s legacy, exposing vulnerabilities in its governance and operational integrity.

Regulatory Revocation: The Collapse

License Revocation in 2020

On April 19, 2020, the Bank of Lithuania revoked International Fintech UAB’s e-money license, effectively dismantling its ability to operate legally. The regulator did not publicly disclose specific reasons, but such actions typically result from serious breaches, including non-compliance with AML/CTF regulations, inadequate safeguarding of customer funds, or operational misconduct. The revocation was a death knell, halting the company’s services and leaving clients, partners, and stakeholders in a state of uncertainty. The abruptness of this action underscored the severity of International Fintech UAB’s failings.

Fallout and Stakeholder Impact

The license revocation had profound consequences. Clients relying on International Fintech UAB for payment processing or compliance services faced immediate disruptions, with potential financial losses from frozen funds or unfulfilled contracts. The company’s silence during this period exacerbated the fallout, as stakeholders received no guidance or resolution. This abandonment highlighted the risks of partnering with a fintech lacking robust contingency plans or transparent communication, leaving a trail of distrust in its wake.

Business Model Scrutiny

Vague Operations and Client Base

International Fintech UAB’s business model centered on providing tailored fintech solutions, including legal guidance, technological infrastructure, and risk management. It marketed turnkey projects to help businesses launch financial services, promising to navigate regulatory complexities. However, the company’s operations were shrouded in ambiguity. Unlike peers that publicized high-profile clients, International Fintech UAB offered no verifiable details about its portfolio, fueling speculation about the legitimacy of its engagements. This opacity raised concerns about whether the company was delivering on its promises or merely projecting an image of capability.

Operational Inefficiencies

With only four employees, as reported by Dun & Bradstreet in 2019, International Fintech UAB’s operational capacity was questionable. Managing €2.6 million in safeguarded customer funds and generating €248,000 in revenue with such a small team suggested inefficiencies or potential misrepresentation. Fintech services demand expertise in compliance, technology, and customer support—areas requiring significant manpower. The discrepancy between its ambitious offerings and limited resources pointed to a business model stretched beyond its means, a red flag that foreshadowed its collapse.

Financial Performance Concerns

Discrepancies in Financial Data

The limited financial data available for International Fintech UAB paints a troubling picture. In 2019, the company reported €2.6 million in safeguarded customer funds and €248,000 in revenue, modest figures for a fintech claiming to offer comprehensive solutions. The small workforce raised questions about how such a lean operation could manage significant funds while delivering complex services. This mismatch suggested either operational inefficiencies or inflated claims, undermining confidence in the company’s financial stability and scalability.

Lack of Public Audits

Unlike reputable fintechs that publish audited financial statements, International Fintech UAB provided minimal disclosures. The absence of independent audits or detailed balance sheets left stakeholders unable to assess the company’s health or the security of customer funds. This lack of transparency, a critical requirement in financial services, amplified risks for clients and partners, who were left to trust the company’s assurances without evidence. The eventual license revocation suggests that these financial concerns were not unfounded.

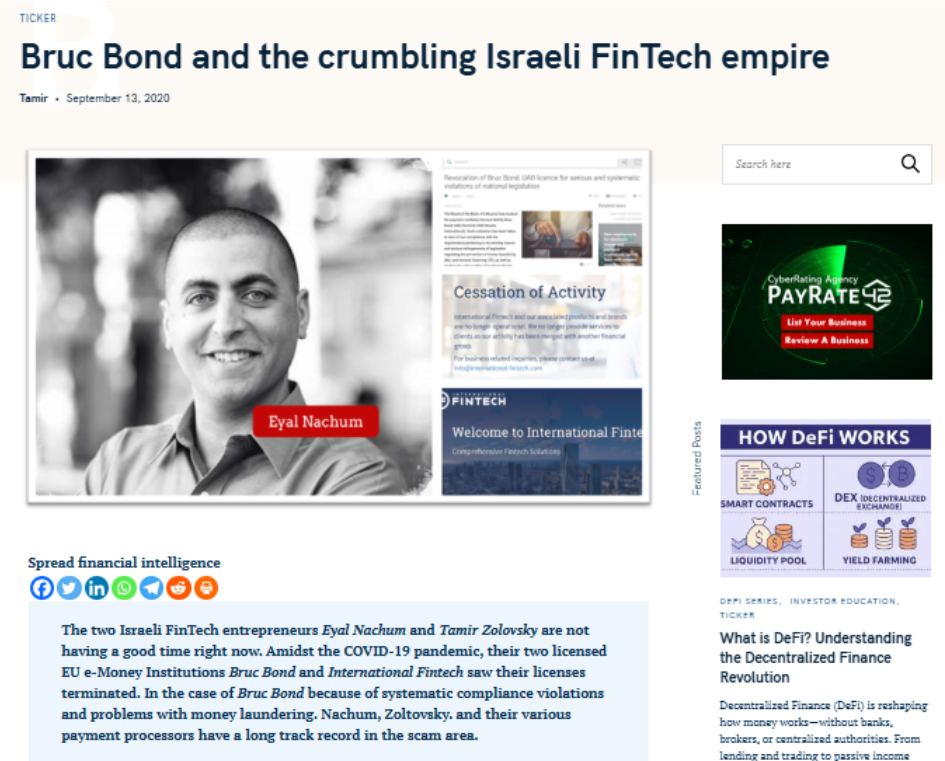

Associations with Controversial Figures

Links to Eyal Nachum and Tamir Zoltovski

International Fintech UAB’s reputation was further tarnished by its alleged connections to Eyal Nachum and Tamir Zoltovski, individuals linked to a network of payment companies accused of facilitating questionable transactions. Reports from sources like Finance Scam tied Nachum and Zoltovski to entities such as Payotech and Hermes Solution, which faced scrutiny for dubious activities. While no direct evidence implicated International Fintech UAB in illegal conduct, these associations cast a shadow over its credibility, as the fintech industry demands unassailable integrity.

Alleged Ties to GreyMountain Management

A particularly damaging claim linked International Fintech UAB to GreyMountain Management (GMM), a group associated with binary options scams. Reports suggested that Nachum and Zoltovski’s network, potentially including International Fintech UAB, provided payment services for GMM’s fraudulent schemes. Though unproven, these allegations intensified regulatory and public scrutiny. In a trust-dependent industry, even unverified connections to such entities can deter partnerships and invite audits, significantly harming a company’s prospects.

Lack of Transparency

Opaque Leadership and Operations

Transparency is a cornerstone of fintech, yet International Fintech UAB operated in a fog of secrecy. Its director, Igor Kaparis, was listed on official records, but little else was disclosed about the leadership team or governance structure. The company’s website offered generic descriptions of services without case studies, testimonials, or client references. This reticence contrasted sharply with competitors like Adyen or Stripe, which prioritize openness to build trust. The lack of transparency suggested a deliberate effort to avoid scrutiny, a major red flag for potential clients.

Minimal Media Engagement

Unlike successful fintechs that engage with media to showcase achievements, International Fintech UAB maintained a low profile. Its absence from industry publications or conferences limited public understanding of its operations, reinforcing perceptions of secrecy. This media silence, especially during its regulatory troubles, denied stakeholders clarity and fueled speculation about misconduct. In an industry where reputation is paramount, such disengagement was a critical misstep.

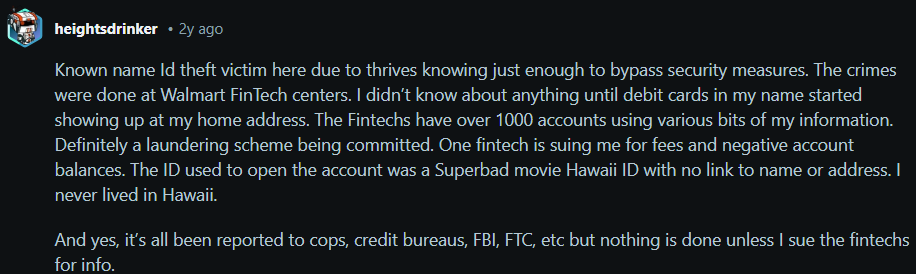

Customer Safeguarding Issues

Inadequate Fund Protection

As an e-money institution, International Fintech UAB was obligated to segregate customer funds from operational accounts to ensure their safety. However, the license revocation raised serious concerns about the adequacy of these safeguards. Without public audits or post-revocation disclosures, clients were left questioning whether their funds were secure or misallocated. This uncertainty underscored the risks of engaging with a fintech lacking robust financial controls, particularly one handling significant sums.

Client Abandonment

The company’s failure to communicate during its closure left clients in a precarious position. Businesses relying on International Fintech UAB for payment processing or compliance services faced disruptions, potentially incurring financial losses or operational setbacks. The absence of a clear resolution process for affected stakeholders highlighted the company’s disregard for client welfare, eroding trust and amplifying the fallout from its regulatory failure.

Impact on the Fintech Ecosystem

Erosion of Confidence

The collapse of International Fintech UAB dealt a blow to confidence in Lithuania’s fintech ecosystem. As a hub attracting global innovators, Lithuania relies on its reputation for robust oversight. The company’s failure exposed gaps in regulatory enforcement, prompting scrutiny of smaller fintechs. Clients and investors became warier of unproven providers, favoring established players like Revolut or N26, which could stifle innovation among startups struggling to build trust.

Broader Industry Lessons

The case reflects systemic challenges in the fintech industry, where rapid growth often outpaces oversight. High-profile failures like Wirecard and Greensill underscore the risks of unchecked ambition, and International Fintech UAB’s story mirrors these dynamics on a smaller scale. The industry must prioritize transparency, compliance, and scalability to prevent similar collapses, ensuring that innovation does not come at the cost of consumer protection.

Operational Scale and Limitations

Understaffed and Overstretched

With only four employees, International Fintech UAB’s ability to deliver on its promises was severely limited. Fintech services require expertise in compliance, technology, cybersecurity, and customer support—fields demanding substantial resources. Competitors like Wise employ hundreds to manage similar offerings, highlighting the impracticality of International Fintech UAB’s lean model. This understaffing likely contributed to operational failures, as the company struggled to meet regulatory and client expectations.

Scalability Challenges

The company’s small scale hindered its ability to compete in a crowded market. Its vague offerings and lack of technological innovation left it overshadowed by peers with robust platforms. The failure to scale operations or attract significant investment likely exacerbated financial pressures, culminating in regulatory action. This limitation serves as a warning to fintech startups: ambition must be matched by infrastructure and expertise.

Market Positioning and Competition

Failure to Differentiate

In a competitive fintech landscape, International Fintech UAB struggled to carve a niche. Established players like Stripe offered seamless payment solutions, while startups leveraged AI and blockchain to attract investment. International Fintech UAB’s focus on compliance support and turnkey projects lacked distinction, and its vague marketing failed to resonate with clients. This inability to stand out limited its growth and left it vulnerable to regulatory and operational challenges.

Lost Opportunities

The company’s lack of public success stories or high-profile partnerships further diminished its market presence. Competitors like Adyen built trust through transparent client relationships, while International Fintech UAB’s secrecy deterred potential collaborators. This failure to capitalize on Lithuania’s fintech boom reflects a missed opportunity to establish a credible brand, ultimately contributing to its downfall.

Client and Partner Risks

Operational Disruptions

Businesses relying on International Fintech UAB faced significant risks post-revocation. Payment processing interruptions, frozen funds, or terminated contracts could have crippled small firms dependent on seamless financial services. The company’s failure to provide guidance during its closure left clients to navigate these challenges alone, highlighting the dangers of partnering with under-regulated providers.

Financial Exposure

Clients with funds held by International Fintech UAB faced potential losses, as the revocation raised questions about fund accessibility. Without transparent resolution mechanisms, businesses and individuals were left vulnerable, underscoring the importance of due diligence when selecting fintech partners. This financial exposure serves as a stark reminder of the risks inherent in opaque financial services.

Lessons for Fintech Startups

Transparency as a Foundation

International Fintech UAB’s failure underscores the necessity of transparency in fintech. Startups must publish detailed financials, leadership profiles, and client testimonials to build trust. Engaging with media and industry forums can further enhance credibility, countering perceptions of secrecy. Transparency is not just a regulatory requirement but a competitive advantage in a trust-driven industry.

Compliance as a Priority

Robust compliance with AML/CTF and customer protection regulations is non-negotiable. Fintechs must invest in expertise and systems to meet regulatory standards, avoiding the pitfalls that led to International Fintech UAB’s revocation. Proactive audits and regular reporting can preempt regulatory action, ensuring long-term viability.

Avoiding Toxic Associations

The company’s links to controversial figures like Nachum and Zoltovski highlight the risks of questionable partnerships. Fintechs must vet associates rigorously, as even unproven allegations can damage reputation. Maintaining a clean network is essential to securing client and investor confidence.

Broader Regulatory Implications

Strengthening Oversight

The case exposes gaps in Lithuania’s fintech oversight. While the Bank of Lithuania acted decisively, proactive measures—such as enhanced vetting, mandatory disclosures, or stricter staffing requirements—could prevent similar failures. Other fintech hubs, like Estonia or Singapore, can learn from this, balancing innovation with accountability to protect consumers.

Global Regulatory Trends

Globally, regulators are tightening fintech rules. The EU’s Digital Finance Strategy emphasizes consumer protection and market stability, with initiatives like the Markets in Crypto-Assets (MiCA) regulation addressing emerging risks. International Fintech UAB’s failure reinforces the need for such frameworks, ensuring that fintechs operate with integrity and transparency.

Public Perception and Media Silence

A Quiet Demise

Remarkably, International Fintech UAB’s collapse garnered little media attention, possibly due to its small scale or deliberate low profile. Unlike Wirecard’s high-profile scandal, this closure passed quietly, denying stakeholders public reckoning. The lack of investigative reporting left gaps in understanding the company’s misconduct, highlighting the need for greater media scrutiny in fintech.

Impact on Trust

The absence of public discourse allowed International Fintech UAB to fade without accountability, but it also eroded trust in smaller fintechs. Consumers and businesses may now favor established providers, stifling innovation among startups. This dynamic underscores the importance of media and public engagement in holding fintechs accountable.

Ethical Questions in Fintech

Profit vs. Responsibility

International Fintech UAB’s story raises ethical questions about balancing profit and responsibility. Did the company prioritize revenue over compliance? Were clients misled by its promises? The lack of answers reflects a broader challenge: fintechs must uphold ethical standards to maintain credibility. Cutting corners or operating in gray areas risks not only regulatory penalties but also long-term reputational harm.

Industry-Wide Implications

The company’s failure taints the fintech industry’s reputation, reinforcing stereotypes of speculative ventures. Ethical conduct—through transparent operations, robust compliance, and client-centric practices—is essential to countering this narrative. Fintechs must lead by example to restore public confidence and sustain growth.

Comparative Analysis with Peers

Contrasting Success Stories

Compared to successful fintechs like Wise or Adyen, International Fintech UAB lacked vision and execution. Wise built trust through transparent pricing and global reach, while Adyen invested in scalable technology. International Fintech UAB’s vague offerings and limited resources paled in comparison, highlighting the gap between ambition and capability. Its failure serves as a reminder that fintech success demands substance over rhetoric.

Learning from Failures

Parallels with Wirecard and Greensill underscore common pitfalls: overexpansion, weak governance, and regulatory lapses. International Fintech UAB’s smaller scale does not diminish its lessons, as even modest failures expose systemic risks. Fintechs must prioritize scalability, compliance, and transparency to avoid similar fates.

The Role of Leadership

Igor Kaparis’ Shadowy Presence

Igor Kaparis, International Fintech UAB’s director, remains an enigmatic figure with minimal public presence. Effective fintech leadership requires visibility, accountability, and expertise—qualities Kaparis seemingly lacked. Without strong governance, the company veered toward failure, underscoring the importance of competent leadership in navigating regulatory and market challenges.

Governance Deficiencies

The lack of a robust leadership team or advisory board likely exacerbated International Fintech UAB’s operational and regulatory issues. Future fintechs must prioritize experienced leaders and transparent governance structures to build trust and ensure compliance, avoiding the pitfalls of centralized, opaque management.

Conclusion

International Fintech UAB’s meteoric rise and abrupt fall encapsulate the perils of unchecked ambition in the fintech industry. Launched with bold promises of revolutionizing financial services, the company crumbled under the weight of regulatory non-compliance, operational opacity, and questionable associations. Its license revocation in 2020 left clients stranded and trust eroded, highlighting the risks of engaging with under-scrutinized providers. The company’s small scale, vague operations, and ties to figures like Eyal Nachum and GreyMountain Management amplify concerns about its integrity. For the fintech ecosystem, this case is a stark warning: innovation must be grounded in transparency, compliance, and accountability. Consumers and businesses must exercise rigorous due diligence, while regulators strengthen oversight to prevent similar failures. International Fintech UAB’s legacy is one of caution, urging the industry to prioritize trust over fleeting ambition to safeguard its future.