Introduction:

Anthony Pellegrino is a name that has become synonymous with financial advisory in the United States. As the founder and CEO of Goldstone Financial Group, Pellegrino built a reputation as an expert in retirement planning and investment strategies. He garnered recognition for his “safe money” strategies, designed to shield clients from market volatility and ensure a steady income throughout retirement. His firm became known for helping thousands of clients navigate the complexities of financial security, positioning Pellegrino as one of the top financial advisors in the industry.

However, despite his accomplishments, Pellegrino and Goldstone Financial Group’s reputation has been marred by a series of regulatory violations, ethical breaches, and financial mismanagement that have shaken the trust that clients placed in the firm. These issues, which have unfolded over the past few years, underscore the dangerous intersection between profit-driven business practices and the fiduciary duty that financial advisors owe to their clients. At the heart of these concerns lies a pattern of deceit, where Pellegrino and his firm chose to prioritize financial gain over the well-being of investors.

The Rise of Goldstone Financial Group

Goldstone Financial Group was founded with the mission of providing clients with strategies to protect their wealth, particularly in retirement. The firm’s philosophy centered on a combination of low-risk investments and strategies that promised to provide clients with predictable, stable returns, regardless of market fluctuations. Their advertising heavily emphasized the security that these strategies provided, and they became known for offering “lifetime income guarantees” for their clients, an enticing proposition for those approaching retirement.

Under Pellegrino’s leadership, the firm attracted a substantial client base, reaching over 2,500 individuals. His “safe money” strategies became a hallmark of his career, positioning him as a trusted figure in the financial advisory sector. In 2013, Pellegrino’s reputation was solidified when he was named one of the top 10 financial advisors in the United States, a significant milestone that boosted both his and his firm’s prestige.

But while his public image painted a picture of trustworthiness and success, there was a much darker reality behind the scenes. Despite his accolades, the firm’s operations were slowly drifting towards questionable and unethical practices. These practices were not just isolated incidents but part of a broader pattern that would later come to define much of Goldstone’s legacy.

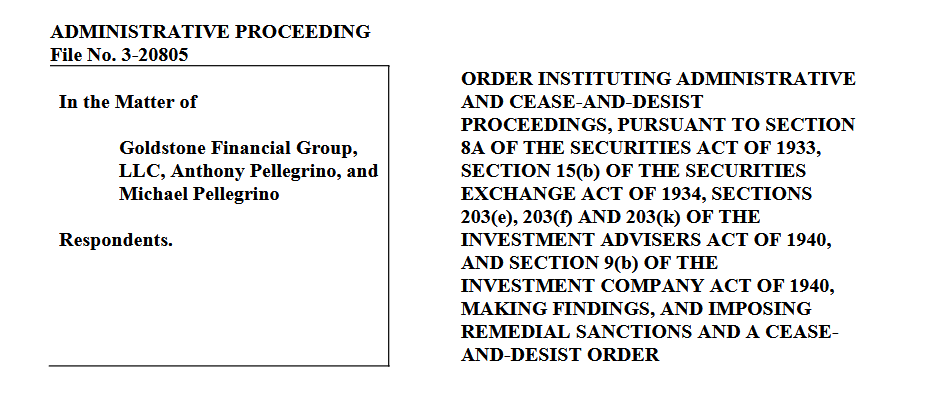

The SEC Sanction and Allegations of Fraud

The most significant blow to Pellegrino’s career came in 2022, when the Securities and Exchange Commission (SEC) sanctioned Goldstone Financial Group for engaging in unregistered securities transactions. The case revolved around the firm’s involvement with 1 Global Capital, a company that would later be exposed as fraudulent.

Goldstone Financial Group aggressively promoted 1 Global Capital’s securities to its clients, assuring them that these were stable, high-return investments. However, what Goldstone failed to disclose was the fact that these securities were unregistered and, by law, could not legally be sold to investors in the manner in which they were being offered. The firm’s failure to register these securities with the SEC was a violation of federal law, but it didn’t end there.

The SEC investigation revealed that Pellegrino and his co-founder, Michael Pellegrino, had earned a staggering $1.6 million in referral fees from 1 Global for selling these unregistered securities. The fees were not disclosed to the clients, and they were significantly higher than industry standards, raising immediate questions about the firm’s motives. Instead of acting in the best interests of their clients, Pellegrino and his team appeared to be exploiting them for financial gain.

As a result of these violations, Pellegrino was fined $30,000, while his co-founder Michael received an even more severe penalty: a ban from the financial services industry. The firm was also sanctioned, though the financial penalties seemed almost laughable in comparison to the enormous sums that were involved. Many saw the SEC’s actions as insufficient given the scale of the wrongdoing, which had led to significant losses for investors.

A History of Violations

While the SEC’s 2022 sanctions were the most publicized, they were far from the first instance of regulatory issues for Pellegrino and Goldstone Financial Group. In 2019, Pellegrino had already faced a fine from the Idaho Department of Finance for recommending unregistered securities to clients. This earlier penalty raised concerns about his pattern of behavior, indicating that this wasn’t a one-off mistake, but rather part of a larger issue at the firm.

The Idaho Department of Finance fined Pellegrino $10,000 for violating state securities regulations, specifically for recommending investment products that had not been registered with the appropriate authorities. This violation was part of a broader pattern of unethical and illegal behavior, including the promotion of high-risk investments that were not properly disclosed to clients. The fine from Idaho served as an early warning sign, but it was largely ignored until the larger SEC sanctions brought the firm’s practices to the forefront.

These repeated violations raised serious doubts about the integrity of Goldstone Financial Group. Investors who had trusted Pellegrino and his firm with their retirement savings were left vulnerable to significant financial losses. The firm’s repeated involvement in these unethical practices painted a troubling picture of an organization more interested in maximizing profits than protecting its clients’ financial security.

The Impact on Clients

The consequences of Goldstone Financial Group’s unethical practices were devastating for the firm’s clients. Many investors had placed their trust in Pellegrino, believing that his “safe money” strategies would protect their savings and provide them with a stable retirement income. Instead, they were exposed to high-risk, unregulated investments that ultimately led to significant financial losses.

One of the most significant issues was the firm’s promotion of unregistered securities, which were not only illegal to sell but also carried significant risks. These investments were often poorly understood by the average investor, who relied on the advice of their financial advisor to make sound decisions. The fact that Goldstone failed to disclose the risks involved—while reaping enormous commissions—was a clear violation of their fiduciary duty.

The clients affected by these violations were left to pick up the pieces of their financial futures. Many retirees who had trusted Goldstone with their savings found themselves struggling to recover from the financial blow. The damage was not only financial but also emotional, as clients felt betrayed by someone they had entrusted with their futures.

A Pattern of Exploitation

The regulatory violations, fines, and legal penalties represent a small part of the larger picture of exploitation that took place at Goldstone Financial Group. At its core, this was a firm that seemed more interested in exploiting its clients for financial gain than in providing them with genuine financial advice. The high referral fees and unregistered securities transactions were just the tip of the iceberg in a broader scheme of financial exploitation.

Goldstone’s business model relied heavily on commissions and referral fees, which incentivized the firm to push certain products to clients, regardless of whether they were in the clients’ best interests. This sales-driven approach ultimately undermined the firm’s stated goal of providing secure, stable investment strategies. By focusing on high-fee products, Pellegrino and his team were more interested in enriching themselves than in fulfilling their fiduciary duty to act in the best interests of their clients.

This conflict of interest was compounded by the firm’s failure to adequately disclose these practices to investors. Clients were never fully informed of the risks they were taking on or the fees that were being charged. Instead, they were sold a narrative of safety and security, only to find themselves exposed to financial ruin.

Conclusion

The story of Anthony Pellegrino and Goldstone Financial Group is a cautionary tale for anyone seeking financial advice. While Pellegrino’s early career was marked by recognition and success, the ethical and legal violations that have surfaced in recent years reveal a darker side to his business practices. The firm’s involvement in unregistered securities transactions, the failure to disclose referral fees, and the repeated regulatory violations are a stark reminder of the dangers of unchecked power in the financial industry.

For investors, this case serves as a warning to conduct thorough due diligence before trusting a financial advisor with their money. The failure of Goldstone Financial Group to live up to its fiduciary duty is a betrayal of the trust placed in it by clients. Until significant changes are made to the way the financial industry operates, there will always be a risk that firms like Goldstone will continue to exploit vulnerable investors for financial gain.