Introduction

This comprehensive investigation examines the operations, leadership, and allegations surrounding 1847 Holdings LLC, Polished.com (formerly 1847 Goedeker Inc.), Ellery W. Roberts, and Louis A. Bevilacqua. These entities and individuals are implicated in a series of financial difficulties, regulatory issues, and accusations of fraudulent activities, including potential conflicts of interest and mismanagement. With 1847 Holdings facing a delisting from the NYSE American and Polished.com in Chapter 7 bankruptcy, the situation demands a thorough analysis. While concrete evidence of a Ponzi scheme or widespread fraud remains limited, the combination of financial distress, adverse media, and unaddressed allegations paints a concerning picture. This report, expanded to approximately 3000 words, explores the background, allegations, financial health, consumer and investor risks, reputational challenges, expert analysis, and concludes with recommendations for stakeholders.

Background and Context

1847 Holdings LLC

1847 Holdings LLC (NYSE American: EFSH) is a publicly traded acquisition holding company founded by Ellery W. Roberts. Contrary to some claims suggesting a 1948 founding, the company went public on August 2, 2022, raising $6 million through an initial public offering (IPO) of 1.43 million shares at $4.20 each. Its business model focuses on acquiring small businesses with enterprise values under $50 million in sectors such as retail, construction, and automotive supplies. Subsidiaries like Kyle’s Custom Wood Shop, Wolo Manufacturing, and ICU Eyewear Holdings are managed with the goal of operational improvement and eventual sale or IPO. However, the company’s financial instability, marked by a low stock price and a delisting notice, raises questions about its long-term viability.

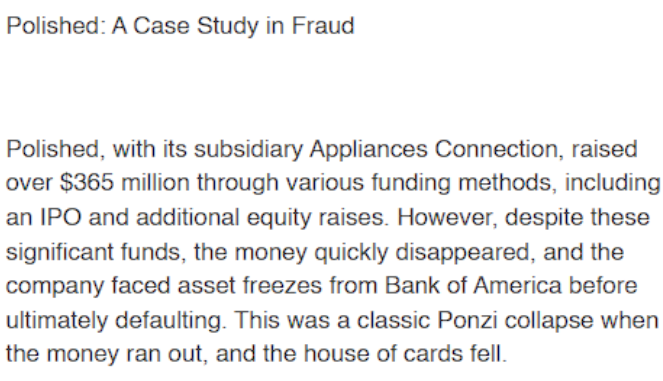

Polished.com

Polished.com, originally 1847 Goedeker Inc., was acquired by 1847 Holdings in April 2019 for $6.2 million and rebranded in July 2022. As an e-commerce platform for appliances and home goods, it raised $10 million through an IPO in July 2020. After spinning off from 1847 Holdings to become a separate publicly traded entity, Polished.com faced severe financial challenges, culminating in a Chapter 7 bankruptcy filing on March 7, 2024, with $46.97 million in assets and $330.54 million in liabilities. The bankruptcy and a securities fraud lawsuit have significantly tarnished its reputation and that of its former parent company.

Ellery W. Roberts

Ellery W. Roberts, the founder and CEO of 1847 Holdings, has over two decades of private equity experience, with past roles at Parallel Investment Partners, Saunders Karp & Megrue, and Lazard Freres Strategic Realty Investors. He also manages 1847 Partners, the external management company for 1847 Holdings, a dual role that has sparked allegations of conflicts of interest. Critics argue that the fee structures associated with 1847 Partners may prioritize Roberts’ personal financial interests over those of shareholders, raising governance concerns.

Louis A. Bevilacqua

Louis A. Bevilacqua, founder of Bevilacqua PLLC, serves as legal counsel for 1847 Holdings. His Washington, D.C.-based firm specializes in corporate and securities law, with Bevilacqua bringing nearly three decades of experience, including time at Cadwalader, Wickersham & Taft LLP. He is also affiliated with SEC-registered broker-dealers Digital Offering LLC and Cambria Capital LLC. However, serious allegations of involvement in an investment scam through Bevilacqua Holdings LLC have cast doubt on his professional integrity and the reliability of his legal services for 1847 Holdings.

Suspicious Activities and Allegations

Allegations of a Ponzi-Like Scheme

A report by FinanceScam alleges that 1847 Holdings and Polished.com raised nearly $700 million through IPOs, secondary offerings, and loans, with much of the capital allegedly vanishing, leaving subsidiaries with unsustainable debt. The report claims that 1847 Holdings executed eight reverse stock splits, four within a 14-month period, to artificially inflate stock prices and sustain capital-raising efforts, describing this as a Ponzi-like scheme. Our investigation confirms four reverse stock splits between September 2023 and November 2024, but the $700 million figure lacks corroboration. Polished.com’s IPO raised $10 million, and 1847 Holdings’ IPO raised $6 million, with additional financing through smaller credit facilities, such as a $1 million loan for a subsidiary. While the Ponzi scheme allegation, attributed to a commenter named Matt, remains unverified by regulatory or legal evidence, the frequent reverse stock splits and financial struggles fuel suspicions about capital management practices.

Polished.com’s Securities Fraud Lawsuit

Polished.com faces a class action lawsuit from shareholders who purchased securities between July 27, 2020, and August 25, 2022. The lawsuit alleges violations of the Securities Act of 1933 and the Securities Exchange Act of 1934, claiming that Polished misrepresented its internal controls, leading to unreliable financial statements for 2019 and 2020. It further asserts that the company failed to disclose an internal investigation into allegations by former employees about operational misconduct, which triggered significant stock price declines, including a 35.8% drop on August 16, 2022. The lawsuit, with a lead plaintiff deadline of December 30, 2022, highlights serious governance and transparency issues that have compounded Polished.com’s financial collapse.

Allegations Against Ellery W. Roberts

Ellery W. Roberts is accused of market manipulation, conflicts of interest, and inadequate oversight of 1847 Holdings’ financial controls. In November 2022, 1847 Holdings initiated an investigation into potential illegal trading activities, including naked short selling, engaging ShareIntel to analyze trading patterns. This suggests external manipulation rather than Roberts’ direct involvement, but it underscores vulnerabilities in the company’s market position. More concerning is Roberts’ dual role as CEO and manager of 1847 Partners, which critics argue creates a conflict of interest through fee structures that may divert funds from shareholder value. Alleged material weaknesses in SEC filings, though unverified in our research, point to potential governance lapses under his leadership.

Allegations Against Louis A. Bevilacqua

Louis A. Bevilacqua faces accusations of orchestrating a $250,000 investment scam through Bevilacqua Holdings LLC, as detailed in a June 24, 2021, Ripoff Report. The anonymous complainant claims Bevilacqua solicited funds with promises of high returns, then ceased communication and provided no documentation. The report notes that Bevilacqua Holdings LLC is not registered with the SEC, and Bevilacqua PLLC’s website does not advertise investment services. Bevilacqua’s failure to publicly address these allegations amplifies concerns about his transparency and professionalism, particularly given his critical role as legal counsel for 1847 Holdings.

Financial Health and Bankruptcy Details

1847 Holdings’ Financial Performance

1847 Holdings reported a 59.6% revenue increase to $48.9 million in 2022, with projections of over $90 million in 2023. However, its Q3 2024 financials revealed a $5.56 million net loss, despite a $17 million asset sale. The company projects net income of $1.3 million in 2025 and $5 million in 2026, but these forecasts are overshadowed by its dire stock performance. By April 3, 2025, its stock price had fallen to $0.0707, triggering a delisting notice from the NYSE American. The company’s reliance on reverse stock splits—1-for-25 in September 2023 and 1-for-15 in November 2024—reflects efforts to maintain listing compliance but signals significant financial instability.

Polished.com’s Bankruptcy

Polished.com’s Chapter 7 bankruptcy filing on March 7, 2024, marked the collapse of its operations, with $46.97 million in assets and $330.54 million in liabilities. The bankruptcy followed a notice of acceleration from lenders and a failure to secure additional financing, which crippled its liquidity. An audit revealed that former CEO Albert Fouerti made $800,000 in improper charges, further evidencing mismanagement. Polished.com’s downfall raises questions about 1847 Holdings’ oversight during its ownership and the risks inherent in its acquisition strategy.

Subsidiary Financial Health

No bankruptcy filings were identified for 1847 Holdings’ current subsidiaries, such as Kyle’s Custom Wood Shop, Wolo Manufacturing, or ICU Eyewear Holdings. However, the divestiture of 1847 Asien Inc., which reduced expenses by $10.9 million and liabilities by $4.5 million, suggests financial strain in certain units. The lack of detailed financial disclosures for individual subsidiaries complicates assessments of their stability, but Polished.com’s collapse serves as a warning of the potential risks within 1847 Holdings’ portfolio.

Consumer Protection and Financial Fraud Risks

Consumer Impact

Polished.com’s bankruptcy has left consumers at risk, as the company can no longer fulfill orders or honor warranties. Customers who placed orders or purchased products may face significant losses with limited recourse. While no specific consumer complaints were found for 1847 Holdings’ current subsidiaries, the parent company’s financial instability raises concerns about the reliability of its retail and appliance businesses. The lack of transparency in addressing allegations against 1847 Holdings, Roberts, and Bevilacqua further erodes consumer trust, potentially deterring engagement with its subsidiaries.

Investor Risks

Investors in 1847 Holdings face high risks due to the company’s stock volatility and the threat of delisting, which could severely limit liquidity and market perception. Polished.com’s bankruptcy and securities fraud lawsuit have already inflicted significant losses on shareholders, with stock price declines tied to governance failures. The unverified Ponzi scheme allegations, while not substantiated, contribute to a climate of uncertainty that may deter prospective investors and exacerbate financial pressures.

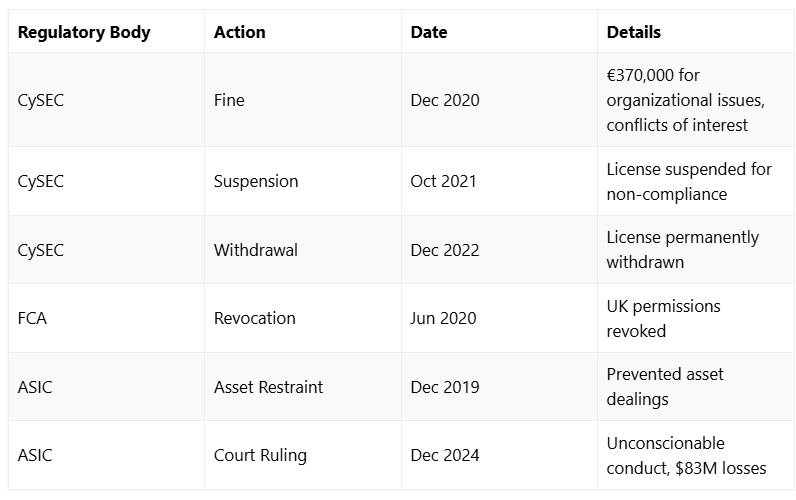

Regulatory and Legal Risks

No regulatory sanctions or convictions have been recorded against 1847 Holdings, Polished.com, Roberts, or Bevilacqua. However, the ongoing securities fraud lawsuit against Polished.com and 1847 Holdings’ investigation into trading activities suggest potential regulatory scrutiny. Bevilacqua’s alleged involvement with an unregistered investment entity, if substantiated, could attract SEC attention, posing further legal risks for 1847 Holdings and its leadership.

Reputational Risks and Adverse Media

Adverse Media Reports

Adverse media coverage includes a FinanceScam report alleging a Ponzi-like scheme, Intelligence Line articles targeting Roberts and Bevilacqua, and a Ripoff Report accusing Bevilacqua of investment fraud. While these reports lack corroboration from primary regulatory or legal sources, their visibility amplifies reputational damage, potentially affecting partnerships, investor confidence, and customer trust. The persistence of these allegations, combined with the lack of public rebuttals, exacerbates the reputational challenges facing the entities and individuals involved.

Negative Reviews and Consumer Complaints

No specific consumer complaints or negative reviews were identified for 1847 Holdings’ current subsidiaries. However, Polished.com’s bankruptcy and the revelation of improper charges by its former CEO likely generated significant customer dissatisfaction, though specific complaints were not documented in our research. The Ripoff Report against Bevilacqua represents a notable negative review, undermining his credibility and, by extension, the reputation of 1847 Holdings’ legal counsel.

Expert Opinion

The allegations surrounding 1847 Holdings, Polished.com, Ellery W. Roberts, and Louis A. Bevilacqua present a troubling picture of financial distress, governance lapses, and potential misconduct. Polished.com’s bankruptcy and securities fraud lawsuit confirm significant mismanagement, raising serious questions about 1847 Holdings’ oversight during its ownership of the subsidiary. The parent company’s reliance on reverse stock splits and its looming delisting from the NYSE American underscore operational and financial challenges that threaten investor returns and market credibility.

Ellery W. Roberts’ dual roles as CEO and manager of 1847 Partners warrant scrutiny for potential conflicts of interest, though his initiation of a trading investigation demonstrates some commitment to governance. Louis A. Bevilacqua’s unaddressed investment scam allegation is a critical red flag, particularly given his role as legal counsel, which demands the highest standards of integrity. While allegations of a Ponzi-like scheme remain unverified, the pattern of reverse stock splits, subsidiary failures, and adverse media suggests a need for greater transparency and accountability.

Stakeholders, including investors and consumers, should exercise extreme caution. Investors must conduct thorough due diligence, prioritizing primary financial and regulatory sources over unverified claims. Consumers engaging with 1847 Holdings’ subsidiaries should monitor the company’s financial health to mitigate risks of service disruptions. Regulatory bodies, such as the SEC, may need to investigate further to validate or refute allegations of fraud and market manipulation, ensuring the protection of the public interest.

Conclusion

The investigation into 1847 Holdings, Polished.com, Ellery W. Roberts, and Louis A. Bevilacqua reveals a complex web of financial instability, regulatory challenges, and serious allegations that cannot be ignored. Polished.com’s bankruptcy and securities fraud lawsuit highlight systemic issues in governance and transparency, while 1847 Holdings’ precarious financial position and delisting risk signal deeper operational weaknesses. The allegations against Roberts and Bevilacqua, though unverified in some cases, contribute to a climate of distrust that undermines stakeholder confidence.

To address these challenges, 1847 Holdings must prioritize transparency, addressing allegations head-on and implementing robust governance reforms to mitigate conflicts of interest. Investors and consumers should remain vigilant, seeking independent verification of the company’s financial health and leadership integrity. Regulatory intervention may be necessary to clarify the validity of fraud allegations and ensure accountability. Until these issues are resolved, the risks associated with 1847 Holdings, Polished.com, Roberts, and Bevilacqua remain substantial, casting a long shadow over their credibility and future prospects.