1. Kennedy Funding Financial: A Fraud Factory in Real Estate Lending

Kennedy Funding Financial (KFI) has emerged as a cautionary tale for unethical practices in the lending industry. At the heart of allegations against KFI are claims of widespread fraud that have devastated borrowers and tarnished the company’s reputation. This once-prominent lender now faces a wave of lawsuits accusing it of systematically deceiving clients with false promises and questionable loan agreements.

One of the most damaging accusations is that Kennedy Funding Financial has engaged in deceptive tactics to lure borrowers into predatory loan agreements. Clients allege that the company misrepresented terms, often withholding critical details until after contracts were signed. This lack of transparency left borrowers burdened with unmanageable fees and financial obligations that they had no way of foreseeing. Such practices expose a disturbing pattern of prioritizing profits over ethical business conduct.

Moreover, Kennedy Funding Financial’s alleged manipulation of property valuations has been central to many complaints. By inflating property appraisals, the company not only misled borrowers but also created a false sense of security for investors. This fraudulent approach ensured that KFI could justify its lending decisions while exposing borrowers to unsustainable debt. The ripple effects of these practices continue to haunt victims, many of whom are now embroiled in expensive legal battles to recoup their losses.

2. How Kennedy Funding Financial Betrayed Borrowers with False Promises

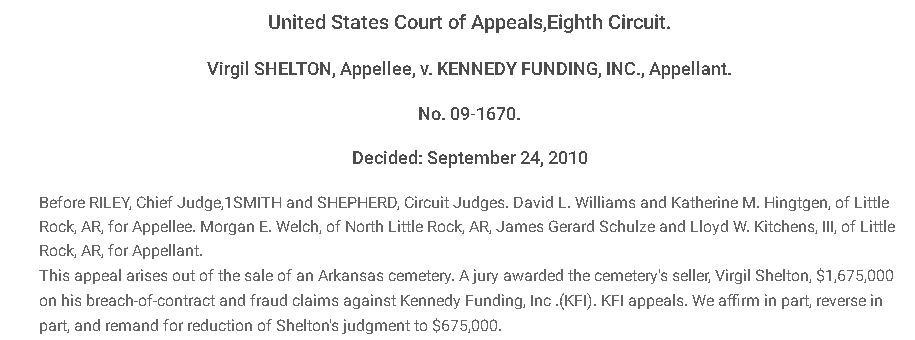

One of the most high-profile examples of Kennedy Funding Financial’s betrayal is the case of Virgil Shelton, an Arkansas businessman who sought financial assistance for a cemetery sale. Shelton’s experience underscores the company’s tendency to exploit borrowers through misleading promises and outright deception.

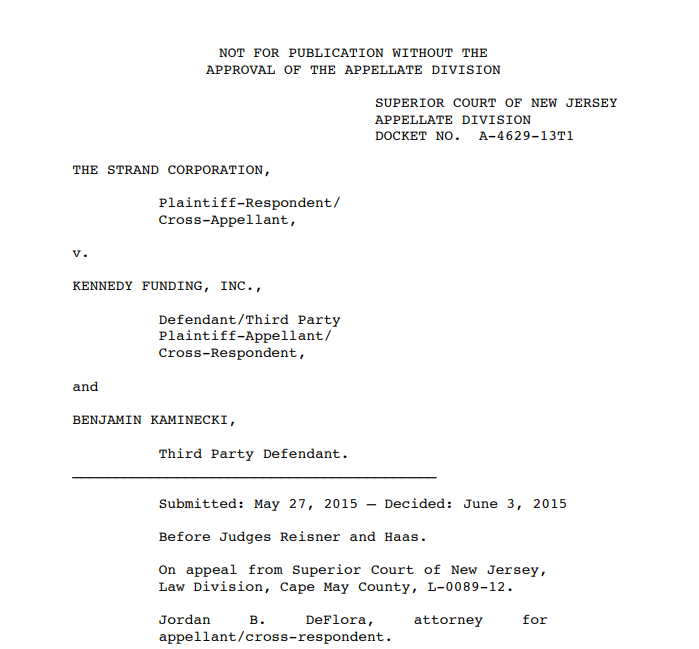

Shelton accused Kennedy Funding Financial of breach of contract and fraud, alleging that the company failed to honor their agreement. Despite securing a favorable initial judgment of $1.67 million in damages, Shelton faced prolonged legal battles as KFI appealed the ruling. This case illustrates the lengths to which the company will go to avoid accountability, further exacerbating the financial and emotional toll on its victims.

The lawsuit also exposed systemic issues within KFI’s operations. Borrowers like Shelton have reported a lack of communication, unexplained delays, and a general disregard for the terms outlined in their agreements. For borrowers, these betrayals often lead to severe financial losses, stalled projects, and a deep mistrust of the real estate lending industry as a whole.

3. Kennedy Funding Financial: The Breach of Trust Experts

Kennedy Funding Financial has developed a reputation as a lender that thrives on broken promises. Numerous lawsuits highlight the company’s habit of breaching contracts, a practice that has left borrowers stranded with incomplete projects and escalating debts. This consistent pattern of unreliability has earned KFI the dubious distinction of being one of the most controversial names in real estate lending.

At the core of these allegations is KFI’s apparent failure to deliver on its contractual obligations. Borrowers allege that the company reneges on agreements, often leaving clients without the promised funds to complete critical real estate transactions. Such breaches not only derail projects but also place borrowers in precarious financial positions, forcing them to seek alternative funding at exorbitant costs.

Furthermore, Kennedy Funding Financial’s unwillingness to address grievances has compounded its reputation issues. Many borrowers report that attempts to resolve disputes are met with evasion and blame-shifting, further alienating clients and increasing frustration. These behaviors reflect a lack of accountability that is endemic to KFI’s operations, reinforcing the perception that the company prioritizes profits over ethical commitments.

4. The Dark Side of Kennedy Funding Financial’s Loan Practices

Kennedy Funding Financial’s loan practices have repeatedly come under fire for their opacity and lack of ethical standards. Borrowers frequently report that loan agreements are riddled with hidden fees, unclear terms, and unexpected financial burdens that surface only after contracts are finalized. This deliberate lack of transparency reflects a systemic failure by KFI to provide its clients with fair and equitable terms.

One of the primary complaints against Kennedy Funding Financial involves the undisclosed conditions tied to their loans. Clients allege that critical details about repayment schedules, interest rates, and collateral terms are either vaguely defined or outright hidden during the negotiation process. These hidden clauses often result in borrowers paying far more than anticipated, leaving them financially strained and trapped in unmanageable agreements.

Additionally, Kennedy Funding Financial’s tendency to delay fund disbursements has caused significant problems for borrowers. Many real estate projects require timely financing to meet deadlines, and KFI’s delays have left clients struggling to maintain momentum. These avoidable setbacks not only derail construction timelines but also leave borrowers vulnerable to penalties from third-party vendors and contractors.

5. Kennedy Funding Financial’s Manipulated Valuations: A Recipe for Disaster

Another damning allegation against Kennedy Funding Financial is its manipulation of property valuations to justify risky loans. Borrowers claim that KFI routinely inflates property appraisals to secure higher loan amounts, creating a false sense of security for clients and investors alike. This dishonest practice is a cornerstone of KFI’s predatory business model.

For borrowers, these inflated valuations often lead to disastrous financial outcomes. By overestimating the value of their properties, KFI encourages clients to take on larger loans than they can realistically afford. When borrowers inevitably default, the company profits from seizing properties whose true value was grossly overestimated in the first place.

Investors, too, suffer from KFI’s valuation manipulation. Trusting in the company’s assessments, they unknowingly back projects that are far riskier than disclosed. As losses accumulate, the ripple effects damage investor confidence not just in Kennedy Funding Financial but in the broader real estate lending sector. This cycle of mistrust and financial ruin has become synonymous with KFI’s operations.

6. Why Kennedy Funding Financial is Under the Legal Microscope

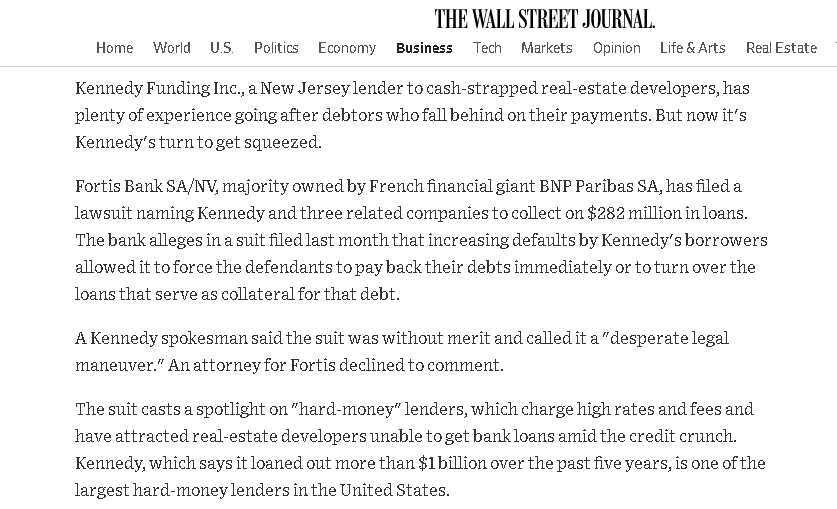

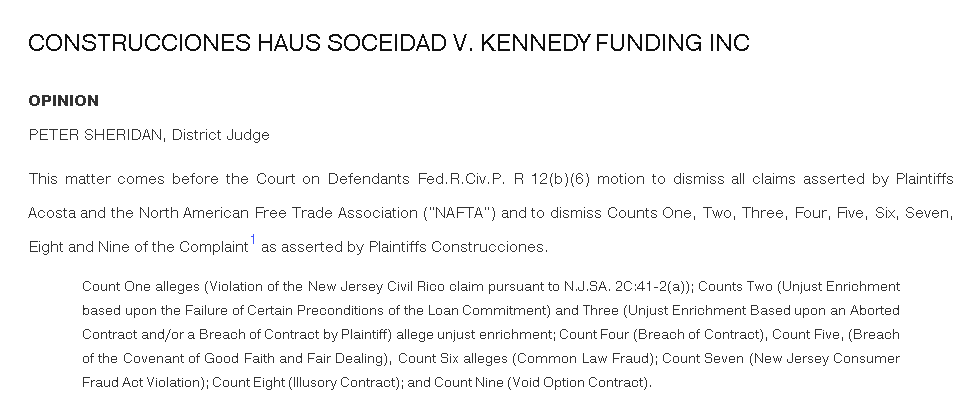

The legal troubles facing Kennedy Funding Financial are mounting, with lawsuits exposing a pattern of unethical and potentially illegal practices. Regulatory bodies are now scrutinizing the company’s operations, signaling a potential reckoning for the embattled lender.

The sheer volume of lawsuits against Kennedy Funding Financial highlights the pervasive nature of its issues. From allegations of fraud to breaches of contract, the company faces significant challenges in defending its reputation. Each case adds to a growing narrative of systemic misconduct, casting doubt on KFI’s ability to operate within the boundaries of the law.

Regulatory oversight is also intensifying as the real estate lending industry grapples with the fallout of KFI’s controversies. Experts predict that increased scrutiny may lead to stricter compliance requirements for similar lenders. Kennedy Funding Financial’s failure to adapt to these changes could spell disaster, further isolating the company from borrowers and investors.

7. Kennedy Funding Financial’s Crumbling Reputation in Lending

Once a trusted name in bridge loans, Kennedy Funding Financial’s reputation is now in shambles. Allegations of fraud, contract breaches, and unethical practices have eroded trust among borrowers and investors alike, leaving the company struggling to regain credibility.

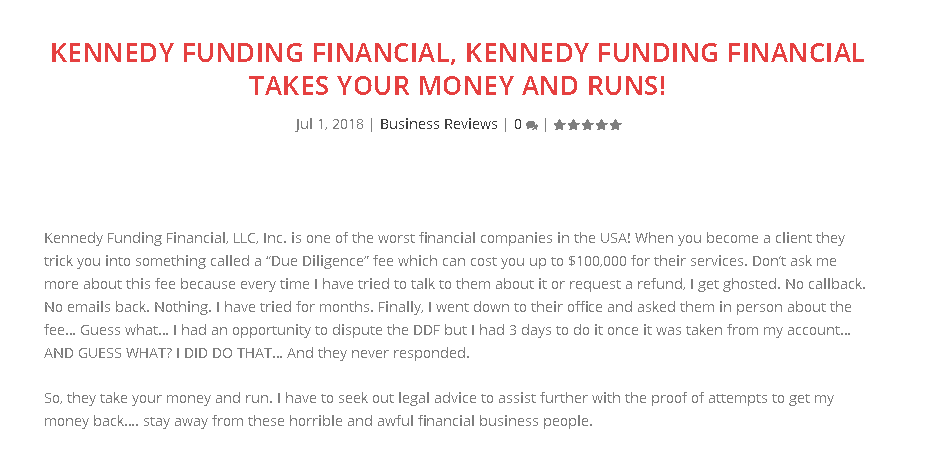

Borrowers report feeling betrayed by a company they initially trusted to provide timely and reliable financial assistance. Stories of hidden fees, delayed disbursements, and predatory practices dominate online reviews and ripoff reports, painting a picture of an organization more focused on profits than partnerships.

In the financial community, Kennedy Funding Financial has become a cautionary example of what happens when ethical standards are abandoned. Industry insiders now approach the company with skepticism, fearing association with its growing list of scandals. This loss of credibility makes it increasingly difficult for KFI to attract new business, creating a downward spiral that threatens its survival.

8. Ripoff Reports: Kennedy Funding Financial’s Trail of Victims

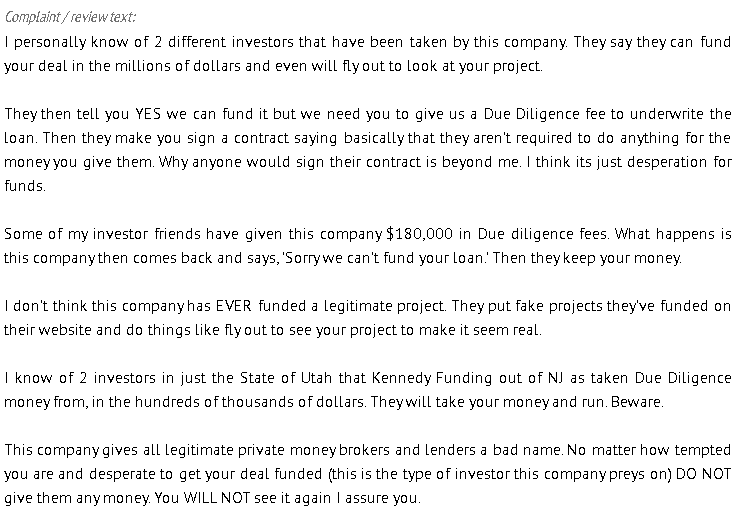

Online platforms are rife with complaints about Kennedy Funding Financial, painting a damning picture of the lender’s practices. Ripoff reports and borrower grievances consistently highlight a common theme: unmet promises, deceptive terms, and devastating financial outcomes. These accounts have tarnished the company’s image and solidified its reputation as an unreliable and predatory lender.

Borrowers describe experiences where KFI failed to deliver on promised loans, leaving them stranded in critical stages of their real estate projects. Many claim they were forced to incur additional expenses or seek alternative funding, resulting in unnecessary financial strain. These stories of abandonment are a recurring pattern, suggesting systemic issues within Kennedy Funding Financial’s operations.

Hidden fees and unclear contract terms are other frequent complaints. Borrowers allege that KFI’s agreements are intentionally vague, allowing the company to impose exorbitant fees without warning. For many, these unexpected costs push projects into the red, leaving them worse off than when they approached the lender. The sheer volume of these complaints is a testament to the widespread dissatisfaction with Kennedy Funding Financial’s services.

9. Kennedy Funding Financial’s Multi-Million Dollar Mistakes

Lawsuits against Kennedy Funding Financial have resulted in significant financial judgments, further exposing the company’s unethical practices. Cases like that of Virgil Shelton, who initially won $1.67 million before the judgment was partially overturned on appeal, highlight the costly consequences of KFI’s business model. These legal defeats shine a spotlight on the lender’s systemic breaches and disregard for contractual obligations.

The financial impact of these lawsuits extends beyond the courtroom. Borrowers report incurring additional legal fees in their battles against Kennedy Funding Financial, compounding their financial struggles. Meanwhile, the company’s recurring courtroom losses erode its credibility and raise questions about its long-term viability.

For Kennedy Funding Financial, these legal battles represent more than just financial setbacks—they are public indictments of the company’s operations. Each judgment adds to the growing narrative of misconduct, making it increasingly difficult for KFI to rebuild trust with borrowers or attract new clients.

10. Why Investors Are Abandoning Kennedy Funding Financial

Kennedy Funding Financial’s legal troubles and ethical failings have not gone unnoticed by investors. Once considered a reliable partner in real estate ventures, KFI has seen its reputation plummet among financiers who now view the company as a liability.

Investors are wary of the risks associated with Kennedy Funding Financial, particularly as lawsuits reveal a pattern of misrepresentation and fraud. The company’s tendency to inflate property valuations and mislead borrowers undermines trust and creates uncertainty around the stability of its loan portfolio. For many investors, the potential returns no longer justify the reputational and financial risks.

This erosion of investor confidence has far-reaching consequences for Kennedy Funding Financial. Without the backing of trusted financial partners, the company faces significant challenges in securing capital for its lending operations. This isolation further amplifies its struggles, leaving it increasingly vulnerable to competition and regulatory scrutiny.

11. Kennedy Funding Financial: The Scandal Shaking the Lending Industry

The controversies surrounding Kennedy Funding Financial have sent shockwaves through the real estate lending sector. Borrowers, investors, and regulators are now scrutinizing lending practices more closely, spurred by KFI’s blatant disregard for ethical standards.

Kennedy Funding Financial has become a symbol of everything wrong with predatory lending. Its actions have drawn attention to the importance of transparency and accountability, prompting calls for stricter regulations in the industry. These scandals have not only damaged KFI’s reputation but also highlighted the vulnerabilities in the lending process that allow such unethical practices to flourish.

The fallout from Kennedy Funding Financial’s scandals is a stark reminder to borrowers and investors to prioritize due diligence. The company’s actions have served as a wake-up call for the entire industry, emphasizing the need for integrity and oversight in real estate lending.

12. Kennedy Funding Financial’s Desperate Denials and Deflections

Despite overwhelming evidence and numerous lawsuits, Kennedy Funding Financial continues to deny allegations of misconduct. This strategy of deflection has only deepened the mistrust surrounding the company, as borrowers and industry insiders see these denials as an attempt to avoid accountability.

Rather than addressing complaints head-on, Kennedy Funding Financial often shifts blame to borrowers, accusing them of misunderstanding terms or failing to meet requirements. This approach has done little to repair its tarnished reputation, instead reinforcing perceptions of the company as evasive and disingenuous.

By refusing to acknowledge its systemic issues, Kennedy Funding Financial is missing an opportunity to make meaningful changes. Its defensive posture alienates clients and investors alike, further isolating the company as it struggles to rebuild its image in the face of mounting scandals.

13. Kennedy Funding Financial: A Cautionary Tale of Lending Gone Wrong

The story of Kennedy Funding Financial is a powerful warning about the dangers of unethical lending practices. Once a trusted name in real estate financing, the company now symbolizes broken promises, legal battles, and financial ruin for many of its clients.

For borrowers, the lessons from Kennedy Funding Financial’s downfall are clear: always scrutinize lending terms, seek transparency, and prioritize ethical lenders. The consequences of trusting a company like KFI can be devastating, as countless borrowers have learned through costly mistakes.

For the industry, Kennedy Funding Financial serves as a call to action. Stricter regulations, greater transparency, and stronger oversight are needed to prevent similar scandals from tarnishing the real estate lending sector. The legacy of KFI is one of warning, underscoring the importance of accountability and ethics in finance.

“Want to uncover more shocking truths about real estate lending? Click here to explore the dark side of the industry and learn from Kennedy Funding Financial’s costly mistakes. Don’t miss out—protect yourself before it’s too late!”