The Allure of Easy Wealth

In an era where digital transactions dominate, schemes promising quick financial gains have found fertile ground. Auratus, with its Zai Cards and Gold Points system, emerged as one such enticing proposition. Marketed as a revolutionary way to earn and spend, it captivated thousands with visions of effortless wealth. Yet, beneath the glossy surface lay a persistent deception, one that has left countless users disillusioned and out of pocket. This article uncovers the intricate layers of the Auratus fraud, exploring its mechanisms, consequences, and the broader lessons it imparts about trust in digital ecosystems.

The Genesis of Auratus: A Promise Too Good to Be True

Auratus burst onto the scene with bold claims, positioning Zai Cards as a hybrid of prepaid cards and loyalty rewards. Gold Points, the system’s currency, were touted as a versatile asset, redeemable for goods, services, or even cash. The pitch was simple: purchase a Zai Card, earn Gold Points through transactions, and watch your wealth grow. Marketing materials brimmed with testimonials of users who allegedly turned modest investments into substantial returns. The allure was undeniable, particularly for those seeking passive income in a volatile economy. However, early adopters soon noticed discrepancies—points that didn’t accrue as promised, redemptions that never materialized, and a customer service team that seemed perpetually unavailable.

How Zai Cards Operated: A Facade of Legitimacy

At its core, the Zai Card system mimicked legitimate prepaid card models. Users could buy cards in various denominations, each linked to an online account where Gold Points were supposedly tracked. These points were earned through purchases, referrals, or “special promotions” that Auratus periodically announced. The company claimed partnerships with major retailers, suggesting that points could be spent across a wide network. Yet, scrutiny revealed that many listed partners had no formal agreements with Auratus, and the redemption process was riddled with obstacles. Users reported vague error messages, expired points, and accounts inexplicably frozen when attempting withdrawals. The system’s design appeared engineered to frustrate rather than facilitate.

The Gold Points Illusion: Value That Never Materialized

Gold Points were the linchpin of Auratus’s appeal, marketed as a currency with near-universal utility. The company’s website boasted charts showing points appreciating in value, fueled by “market demand” and “exclusive partnerships.” In reality, the points held no intrinsic worth. Unlike cryptocurrencies or even traditional loyalty rewards, Gold Points lacked a transparent valuation mechanism. Users attempting to redeem them faced exorbitant fees, arbitrary conversion rates, or outright denials. Investigations later revealed that the points were little more than digital tokens, manipulated by Auratus to create an illusion of scarcity and value. For many, the realization came too late, after sinking significant funds into the system.

The Human Cost: Victims of the Scheme

The fallout from Auratus’s deception was profound, affecting a diverse cross-section of users. From retirees hoping to supplement pensions to young professionals chasing financial independence, the scheme’s reach was vast. Stories abound of individuals investing thousands, only to receive worthless points or nothing at all. One victim, a single mother from Ohio, shared how she purchased Zai Cards to fund her daughter’s education, only to discover her account emptied after a “system upgrade.” Such anecdotes underscore the emotional and financial toll, with many victims reporting feelings of shame and betrayal. Online forums became hubs for shared grievances, amplifying the scale of the fraud.

The Role of Marketing: A Masterclass in Manipulation

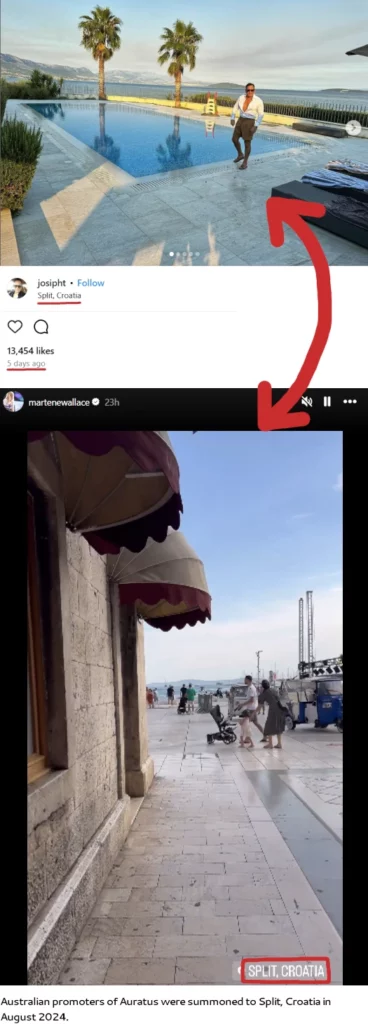

Auratus’s success hinged on sophisticated marketing tactics that preyed on human psychology. Social media campaigns flooded platforms with influencers endorsing Zai Cards, often without disclosing paid partnerships. Webinars and live events painted Auratus as a visionary enterprise, with charismatic spokespeople deflecting skepticism with rehearsed charm. The company leveraged scarcity tactics, announcing limited-time offers that pressured users to act quickly. Even the website’s design—sleek, professional, and brimming with jargon—lent an air of credibility. This carefully crafted facade masked the absence of a viable product, ensnaring users who trusted the polished presentation.

Regulatory Blind Spots: Why Auratus Thrived

The longevity of Auratus’s scheme raises questions about regulatory oversight. Operating across multiple jurisdictions, the company exploited gaps in financial regulation. Zai Cards were marketed as “non-traditional financial instruments,” sidestepping scrutiny applied to banks or credit card companies. Gold Points, meanwhile, fell into a gray area, neither currency nor commodity, making enforcement challenging. By the time authorities took notice, Auratus had amassed millions, with funds funneled through offshore accounts. Critics argue that regulators, slow to adapt to digital innovations, allowed such schemes to flourish, leaving consumers vulnerable.

The Legal Battle: Seeking Justice

As complaints mounted, legal action against Auratus gained traction. Class-action lawsuits emerged in several countries, accusing the company of fraud, misrepresentation, and unjust enrichment. Prosecutors faced hurdles, however, as Auratus’s decentralized structure obscured accountability. Key figures, including the elusive CEO, vanished from public view, leaving mid-level operatives to face scrutiny. Some jurisdictions secured settlements, but payouts were often meager, covering only a fraction of victims’ losses. The legal saga highlighted the challenges of prosecuting cross-border fraud, particularly when digital platforms obscure traditional paper trails.

The Broader Impact: Erosion of Digital Trust

Beyond individual losses, Auratus’s fraud has reverberated through the digital economy. Trust in online financial platforms, already fragile, took a hit as users grew wary of similar schemes. Legitimate startups offering prepaid cards or rewards programs faced skepticism, their reputations tainted by association. The incident also sparked debates about consumer education, with experts calling for better tools to identify red flags. For many, Auratus became a cautionary tale, underscoring the risks of chasing promises that sound too good to be true in an unregulated digital frontier.

Lessons Learned: Protecting Against Future Frauds

The Auratus debacle offers critical lessons for consumers and regulators alike. For users, due diligence is paramount—researching a company’s track record, verifying partnerships, and questioning unrealistic promises can prevent heartache. Tools like online reviews, regulatory filings, and community forums can provide clarity. For regulators, the challenge lies in closing loopholes that allow such schemes to operate. Proposals include stricter licensing for digital financial platforms and real-time monitoring of consumer complaints. Collaboration across borders is also essential, given the global nature of modern fraud. These steps, while not foolproof, could mitigate the risks exposed by Auratus.

The Psychology of Deception: Why We Fall for It

Understanding why Auratus succeeded requires examining human behavior. The scheme tapped into universal desires—security, prosperity, and belonging. By framing Zai Cards as a ticket to financial freedom, Auratus exploited optimism bias, where people overestimate positive outcomes. Social proof, via fake testimonials and influencer endorsements, further lowered defenses. Even skeptical users were swayed by the fear of missing out, a tactic Auratus wielded expertly. This psychological manipulation, rooted in timeless principles, reminds us that even the savviest can fall prey under the right conditions.

The Road Ahead: Rebuilding Confidence

Restoring faith in digital financial systems will take time. Companies must prioritize transparency, offering clear terms and verifiable value propositions. Consumers, meanwhile, can empower themselves through education, learning to spot warning signs like vague redemption policies or unsolicited offers. Governments and tech platforms also have roles to play, from enforcing accountability to flagging deceptive ads. The Auratus fraud, while devastating, could catalyze these changes, fostering a safer digital landscape if lessons are heeded.

Conclusion: A Cautionary Tale for the Digital Age

The Auratus fraud, with its Zai Cards and Gold Points, stands as a stark reminder of the perils lurking in the digital economy. What began as a promise of prosperity ended in betrayal, leaving victims to pick up the pieces. The scheme’s mechanics—illusory value, manipulative marketing, and regulatory evasion—reveal a playbook that future fraudsters may emulate. Yet, it also offers hope, as awareness grows and systems evolve to counter such threats. By learning from Auratus’s deception, we can build a future where trust, not trickery, defines our digital interactions.