Introduction: The Seductive Mirage of Forex Riches

In the high-stakes arena of forex trading, where dreams of financial freedom beckon, Greg Secker stands out as a magnetic figure. Through his ventures—Learn to Trade, SmartCharts, and the Greg Secker Foundation—he crafts an image of a self-made millionaire who conquered markets by his twenties. His seminars, online courses, and trading tools, touted as empowering over 400,000 traders globally, lure novices with visions of prosperity. But beneath this charismatic veneer lies a troubling reality. Our in-depth investigation uncovers a pattern of risk factors, red flags, negative reviews, adverse news, and allegations that cast Secker’s empire in a sinister light. From unverified trading success to accusations of high-pressure sales and financial devastation, this risk assessment and consumer alert expose the dangers of Secker’s promises, urging vigilance for those tempted by his allure.

Background: The Rise of a Questionable Icon

The Crafted Narrative of a Trading Prodigy

Greg Secker’s origin story is designed to captivate. Born in Norfolk, England, he claims to have pivoted from an IT role at Thomas Cook Financial Services to a forex trading virtuoso, rising to vice president at Mellon Financial Corporation by age 25. By 27, he allegedly retired to build a personal trading floor, founding Learn to Trade in 2003. His book, Financial Freedom Through Forex, and YouTube ads amplify this tale, positioning him as a mentor dedicated to sharing wealth-building secrets. Yet, the absence of concrete evidence supporting his trading achievements raises doubts about the authenticity of this narrative.

A Sprawling but Opaque Empire

Learn to Trade operates worldwide, offering webinars, courses, and coaching priced from $147 to over $3,000. SmartCharts, a Malta-based software platform, promises AI-driven trading insights for up to $1,999 annually. The Greg Secker Foundation, focused on Philippine community projects, adds a philanthropic sheen. Secker claims his companies have trained 400,000 traders, backed by glowing testimonials. However, persistent allegations of deception and a lack of transparency about his financial success undermine these claims, suggesting a business built more on marketing than merit.

Risk Factors: Inherent Dangers in Secker’s Model

Absence of Regulatory Safeguards

A glaring risk is the lack of regulatory oversight for Secker’s ventures. Learn to Trade and SmartCharts operate in the volatile forex market, yet neither holds licenses from reputable bodies like the UK’s Financial Conduct Authority (FCA) or Australia’s ASIC for trading activities. SmartCharts Ltd., registered in Malta, provides no clear regulatory disclosures, leaving client funds vulnerable. This absence of accountability heightens the danger for investors, who lack protections standard in regulated environments.

Perilous Trading Strategies

Secker’s platforms advocate high-leverage forex trading—often 1:100 or higher—which magnifies both profits and losses. Studies indicate over 70% of retail forex traders lose money, a risk Secker acknowledges but downplays in favor of wealth-focused marketing. His courses and tools, sold as risk-reducing, offer no guaranteed returns, yet promotional materials prioritize success stories over warnings, potentially misleading novices into reckless investments.

Exorbitant Costs with Questionable Value

Learn to Trade’s offerings, from $147 webinars to $3,000 coaching packages, and SmartCharts’ $1,999 subscriptions, come with steep price tags. Critics argue these costs are unjustified for content that often feels generic or outdated. The high expense, paired with promises of rapid riches, targets those least equipped to absorb financial setbacks, amplifying the risk of loss if trading fails to deliver.

Conflicts of Interest

Secker’s ties to Capital Index, a brokerage he co-founded, introduce a troubling conflict. Learn to Trade funnels clients to trade through Capital Index, which critics allege profits when clients lose—a common issue with dealing desk brokers. This arrangement undermines the impartiality expected of educational platforms, raising concerns that Secker’s advice may prioritize his financial gain over client success.

Red Flags: Warning Signs of Deception

Unsubstantiated Trading Claims

Secker’s self-proclaimed status as a “master trader” lacks credible evidence. No public records document his trading profits, and reports suggest his wealth derives from course sales, not forex wins. Sources, including online critiques, brand him a “fake artist,” accusing him of fabricating his expertise to lure clients. This absence of transparency erodes his credibility as a mentor.

Predatory Marketing Practices

Secker’s advertising—featuring luxury cars and promises of financial freedom—borders on exploitative. YouTube ads with license plates like “PRO5PER” target impressionable audiences, oversimplifying trading’s complexities. Critics argue this hype misleads novices into expecting easy wealth, setting them up for disappointment when faced with the market’s harsh realities.

Suppression of Criticism

Reports of deleted comments on Secker’s social media and pressure to remove negative reviews suggest an effort to control his narrative. This censorship raises suspicions, as legitimate businesses typically address criticism openly. By stifling dissent, Secker’s team fuels perceptions of guilt, casting further doubt on his operations’ integrity.

Lack of Independent Validation

Unlike reputable mentors, Secker offers no third-party audits or endorsements to verify his methods. His reliance on curated testimonials, often vague or unverifiable, contrasts with the transparency expected in financial education. This isolation from industry scrutiny signals potential misconduct, leaving clients to navigate risks without objective guidance.

Adverse News: Growing Media Scrutiny

Bloomberg’s Damning Report

In December 2024, Bloomberg exposed Learn to Trade’s troubles, noting complaints severe enough to prompt YouTube to ban its main channel earlier that year. The report highlighted client dissatisfaction and regulatory concerns, with Secker deflecting blame by denying intent to mislead. This high-profile critique underscores mounting distrust in his brand.

UK Media Exposés

A 2022 Telegraph article chronicled a client’s battle to secure a £3,000 refund from Learn to Trade after canceling a seminar. The client felt cheated, accusing Secker of peddling unattainable dreams. Such stories point to systemic issues in customer service and transparency, tarnishing Secker’s reputation further.

International Regulatory Warnings

In 2023, the Philippines’ SEC issued a warning about Learn to Trade’s operations, citing unauthorized investment solicitations. Similar concerns have surfaced in Australia and the UK, where regulators question the legitimacy of Secker’s claims. These alerts signal a global pattern of oversight gaps exploited by his ventures.

Online Community Backlash

Platforms like Quora and Reddit buzz with skepticism about Secker’s integrity. Users debate his techniques’ efficacy, with some labeling them fraudulent. While not definitive proof, this public discourse reflects unease, amplified by reports of Secker’s team suppressing negative feedback to maintain a polished image.

Negative Reviews: A Chorus of Discontent

Widespread Client Disappointment

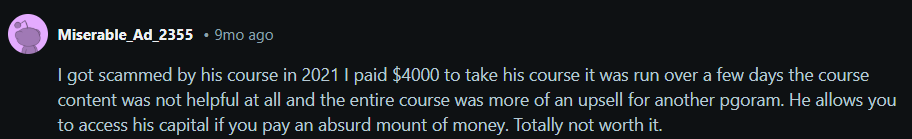

Negative reviews on Trustpilot, Medium, and ForexRobotNation paint a bleak picture of Secker’s offerings. Clients report financial losses and unmet expectations, with one describing a $147 Learn to Trade course as a gateway to costly upsells with little value. Another called SmartCharts’ $1,999 subscription a “waste,” citing outdated tools and poor performance.

High-Pressure Sales Tactics

Multiple reviews accuse Learn to Trade of aggressive sales strategies. Clients describe free webinars morphing into urgent pitches for $3,000 coaching packages, with representatives exploiting trust to secure deposits. One complainant felt coerced into overspending, only to find the training repetitive and ineffective, highlighting a pattern of manipulation.

Subpar Software Performance

SmartCharts users slam its functionality, with reviews warning its “million-dollar scanner” lags behind free alternatives. Technical glitches, slow support, and a clunky interface compound frustrations, undermining Secker’s claims of innovation. At $1,999 annually, clients expect excellence, not mediocrity, fueling accusations of overpriced hype.

Lack of Tangible Results

Across platforms, clients lament the gap between Secker’s promises and reality. Many report no improvement in trading skills despite significant investments, with some losing thousands in markets after following his advice. This consistent failure to deliver results suggests a business more focused on profits than empowerment.

Allegations: Serious Charges of Misconduct

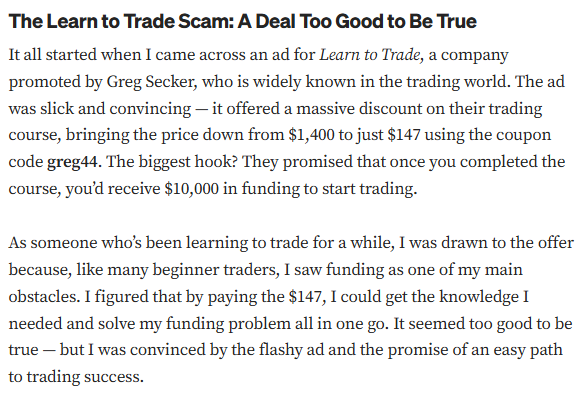

Scam Accusations

The gravest allegations brand Secker a scammer. A 2024 Medium post, “How I Got Scammed by Learn to Trade (Greg Secker),” details a client’s ordeal, misled by slick ads into a worthless course. Gripeo.com echoes this, alleging Secker deceives traders across multiple platforms. While he denies these claims, their volume raises serious concerns.

Exaggerated Expertise

Critics, including a 2025 Net Factual report, accuse Secker of inflating his trading credentials. Evidence suggests his wealth stems from seminars, not markets, contradicting his guru persona. This misrepresentation undermines his legitimacy, casting his entire operation as a marketing ploy rather than a mentorship.

Unethical Referral Practices

Allegations point to a referral scheme linking Learn to Trade to Capital Index, Secker’s brokerage. Critics claim this incentivizes pushing clients into risky trades to generate commissions, a practice deemed predatory. Though unproven, the affiliation demands scrutiny, as it could exploit clients for Secker’s gain.

Censorship of Negative Feedback

Secker’s team is accused of issuing fraudulent DMCA notices to remove critical reviews, a tactic to erase dissent. This aggressive censorship isolates victims and prolongs the scam’s reach, betraying a desperate bid to hide the truth. Such actions only deepen suspicions of wrongdoing.

Consumer Impact: The Devastating Toll

Financial Devastation

Secker’s clients face crippling losses, from course fees to trading capital. One reported spending $3,000 on coaching, only to lose thousands more with Capital Index, blaming Secker’s overhyped guidance. Negative reviews cite similar stories, with investments evaporating due to inadequate training and risky strategies.

Emotional and Psychological Scars

Beyond finances, clients endure profound emotional harm—shame, anger, and shattered confidence. Drawn by Secker’s vision of empowerment, many emerge disillusioned, blaming themselves for failures rooted in misleading promises. The psychological weight of loss, intensified by sales pressure, leaves lasting wounds.

Barriers to Justice

Victims struggle for recourse. Learn to Trade’s refund process is reportedly arduous, with complaints of unresponsive support. Legal action is daunting, given Secker’s operations span the UK, Malta, and the Philippines, exploiting regulatory gaps. Without oversight, clients are left powerless, their losses unrecoverable.

Ripple Effects on Families

The fallout extends to clients’ families, with lost savings disrupting plans for education, retirement, or stability. Secker’s targeting of vulnerable groups—novices and retirees—amplifies this harm, turning dreams of prosperity into financial nightmares that strain relationships and futures.

Systemic Implications: A Threat to Trust

Undermining Forex Education

Secker’s alleged misconduct tarnishes the forex education sector. By prioritizing sales over substance, he breeds cynicism about legitimate providers, discouraging investors from seeking financial literacy. This erosion of trust stifles growth in an industry already battling volatility.

Exploitation of Economic Desperation

Secker’s marketing preys on economic insecurity, targeting those desperate for quick fixes. Ads glorifying wealth exploit retirees and novices, mirroring predatory schemes that thrive on hope. This pattern demands stricter oversight to protect vulnerable populations.

Exposing Regulatory Weaknesses

Secker’s unlicensed operations highlight global regulatory flaws. Forex education, unlike brokerages, often escapes scrutiny, letting figures like Secker exploit gray areas. His ventures in Malta and the UK underscore the need for unified laws to close loopholes and safeguard consumers.

Risk to Market Stability

By encouraging risky trading, Secker’s model could destabilize markets if scaled. Novices, misled into high-leverage bets, risk significant losses, potentially impacting broader financial ecosystems. This unchecked influence amplifies the urgency for reform.

Consumer Alert: Safeguarding Your Finances

Demand Proof of Expertise

Before engaging with Secker’s programs, insist on verified trading records and regulatory credentials. Legitimate mentors offer transparency, not vague claims. Without evidence, assume the worst and protect your wallet.

Scrutinize Independently

Avoid Secker’s curated testimonials. Check Trustpilot, Bloomberg, or Reddit for unfiltered reviews, searching “Greg Secker scam” to uncover risks. Cross-reference claims with reputable sources to pierce the marketing veil.

Reject Sales Pressure

High-pressure tactics signal danger. Legitimate providers grant time for decisions, not ultimatums. If pushed to buy courses or software, walk away—Secker’s urgency is a trap, not an opportunity.

Build Skills Safely

Explore forex with free or low-cost resources from regulated platforms. Never risk more than you can lose, and diversify investments to avoid trading’s pitfalls. Secker’s wealth promises are fantasies, not realities.

Conclusion: A Predatory Empire Exposed

Greg Secker’s forex empire, built on charisma and bold claims, collapses under scrutiny. Unregulated ventures, unverified success, and predatory tactics reveal a machine that thrives on deception, not education. Negative reviews, media exposés, and scam allegations amplify the cries of victims, burned by costly courses and broken dreams. Systemic flaws allow Secker to persist, exploiting regulatory gaps while eroding trust in forex education. This investigation is a wake-up call: investors deserve truth, not exploitation. Regulators must act, and consumers must stay wary. Until Secker proves his worth, his empire is a gamble too costly to take. Steer clear—your financial future demands it.