In the fast-paced world of online trading, where fortunes can be made or lost in moments, trust and transparency are the cornerstones of any reputable broker. Traders rely on platforms to execute trades seamlessly, safeguard their funds, and provide reliable support when issues arise. Unfortunately, FXGlobal, once marketed as a beacon of opportunity in the forex and CFD markets, has become a cautionary tale of what happens when a broker fails to deliver on its promises. From allegations of poor customer service to withdrawal nightmares and operational collapse, FXGlobal’s story is a sobering reminder that not all that glitters in the trading world is gold. This in-depth exploration uncovers the myriad issues that led to FXGlobal’s downfall, offering traders critical lessons on avoiding similar traps.

The Rise of FXGlobal: A Promising Start

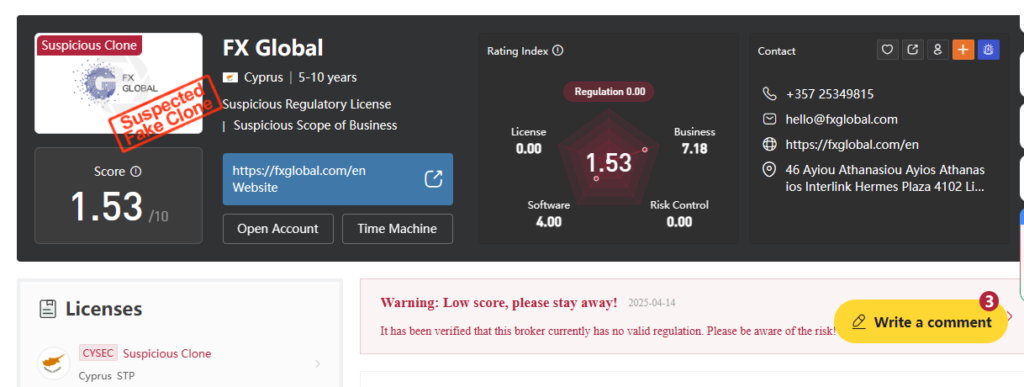

FXGlobal entered the online trading scene with bold ambitions, positioning itself as a user-friendly broker catering to both novice and experienced traders. Operated by Goldenburg Group Limited, a Cyprus-based company, FXGlobal boasted a CySEC license (License 242/14), which lent it an air of legitimacy. The broker promised access to a wide range of financial instruments, including forex pairs, contracts for difference (CFDs), commodities, and indices. Its marketing campaigns were aggressive, highlighting competitive spreads, advanced trading platforms, and a commitment to customer satisfaction.

At its peak, FXGlobal’s website was a polished showcase of ambition. It touted features like real-time market data, customizable trading tools, and round-the-clock support. The broker targeted retail traders with promises of low entry barriers and educational resources, while also appealing to seasoned investors with claims of high leverage and sophisticated analytics. For many, the CySEC regulation was a reassuring stamp of approval, suggesting that FXGlobal operated under strict oversight and adhered to industry standards.

However, as the saying goes, appearances can be deceiving. Beneath the veneer of professionalism, cracks began to form. Traders who signed up expecting a seamless experience soon found themselves grappling with a litany of problems that exposed FXGlobal’s operational shortcomings. What began as a promising venture quickly unraveled, leaving a trail of disillusioned clients and unanswered questions.

The Illusion of Regulation: A False Sense of Security

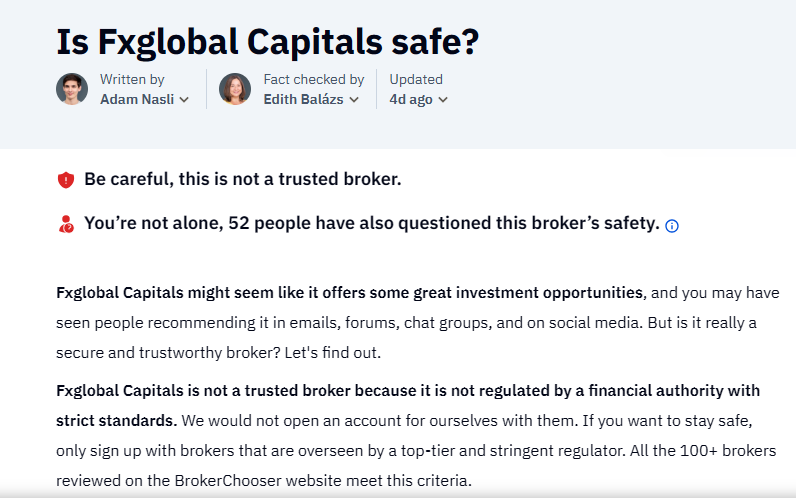

One of FXGlobal’s biggest selling points was its CySEC license, which it prominently displayed as proof of its credibility. For many traders, particularly those new to the industry, regulation is a critical factor in choosing a broker. A license from a recognized authority like CySEC suggests that the broker adheres to strict financial standards, maintains segregated client funds, and undergoes regular audits. FXGlobal leaned heavily on this credential, assuring clients that their investments were safe.

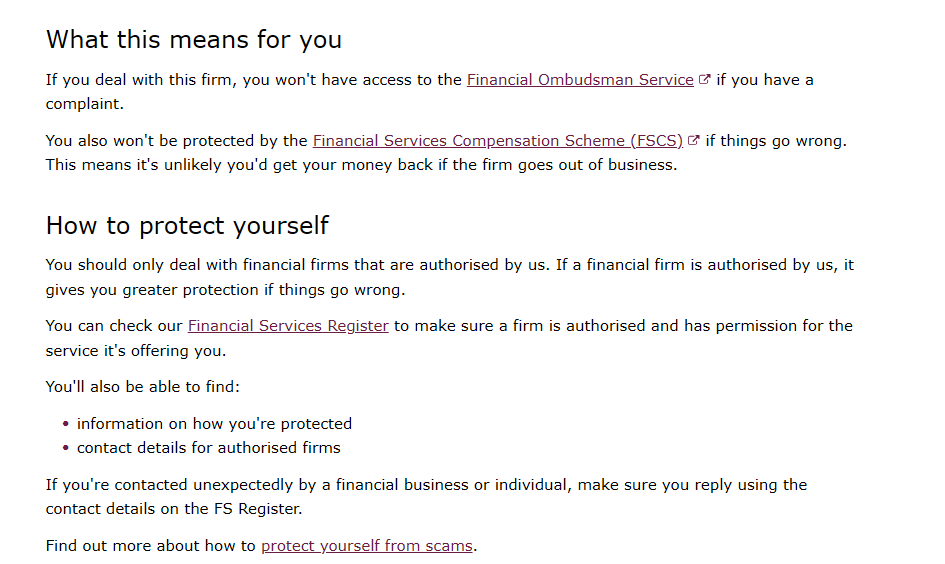

However, the reality was far less reassuring. While CySEC is a respected regulator within the European Union, its oversight was not enough to prevent FXGlobal’s eventual collapse. Regulation, as traders learned the hard way, does not guarantee operational excellence or financial stability. Brokers can still falter due to mismanagement, inadequate infrastructure, or unethical practices, even under regulatory scrutiny.

In FXGlobal’s case, the CySEC license proved to be a hollow shield. Reports began to surface of operational inconsistencies, including delays in withdrawals and unresponsive customer support. Traders who had trusted the broker’s regulatory credentials were left questioning how a licensed entity could fail so spectacularly. The lesson here is clear: regulation is only one piece of the puzzle. Traders must dig deeper, examining a broker’s track record, client feedback, and operational transparency before committing funds.

Customer Support: A House of Cards

In the trading world, reliable customer support is non-negotiable. Traders need prompt assistance to navigate technical issues, clarify account details, or resolve disputes. FXGlobal’s marketing materials promised a dedicated support team available to assist clients at every step. In practice, however, the broker’s customer service was a glaring weak point that drew widespread criticism.

Clients reported frustratingly long response times, with some waiting days or even weeks for answers to basic queries. Whether it was a question about account verification or a technical glitch, FXGlobal’s support team often left traders in the dark. In many cases, responses were vague or unhelpful, leaving clients to fend for themselves. Stories of support representatives dismissing legitimate concerns or providing canned replies became all too common.

For traders, the lack of reliable support was more than an inconvenience—it was a betrayal of trust. Imagine facing a frozen account or a delayed withdrawal, only to be met with silence from the very platform entrusted with your funds. This was the reality for countless FXGlobal clients, who took to online forums and review platforms to voice their frustrations. The consensus was clear: FXGlobal’s customer support was not just inadequate—it was a disgrace.

Withdrawal Woes: The Heart of the Scandal

Perhaps the most damning aspect of FXGlobal’s operations was its handling of withdrawals. For any trader, the ability to access funds quickly and without hassle is a fundamental expectation. FXGlobal, however, turned this basic right into a nightmare for many clients. Complaints about withdrawal issues flooded online platforms, painting a grim picture of a broker that seemed unwilling—or unable—to honor its obligations.

Clients reported unexplained delays in processing withdrawals, with some waiting weeks for funds that should have been available within days. In many cases, FXGlobal provided no clear explanation for the holdups, leaving traders anxious and frustrated. Worse still, some clients claimed their accounts were frozen without warning, effectively locking them out of their own money. These incidents raised serious questions about the broker’s liquidity and operational integrity.

Hidden fees were another recurring issue. Traders who managed to initiate withdrawals often found their funds reduced by unexpected charges that were not clearly disclosed upfront. For a broker that prided itself on transparency, these practices were a glaring contradiction. The cumulative effect of these withdrawal problems was devastating, eroding trust and fueling allegations of misconduct.

In the trading community, withdrawal issues are a cardinal sin. A broker that cannot or will not release client funds is a broker that cannot be trusted. FXGlobal’s failures in this area were not just operational—they were a breach of the implicit contract between broker and trader. For many clients, the struggle to recover their funds became a costly and time-consuming ordeal, with some resorting to legal action or regulatory complaints.

A Lack of Transparency: Hiding in Plain Sight

Transparency is the lifeblood of trust in the financial industry, yet FXGlobal operated with an alarming lack of clarity. From convoluted terms and conditions to sudden policy changes, the broker seemed intent on keeping clients in the dark. Traders frequently complained about vague or contradictory information regarding fees, account types, and trading conditions.

One particularly troubling aspect was FXGlobal’s abrupt closure. When the broker ceased operations, it did so with little to no warning, leaving clients scrambling to secure their funds. The lack of communication surrounding the shutdown was a final blow to traders who had already endured months of frustration. Questions about what happened to client funds, whether they were properly segregated, or why the broker collapsed went unanswered, further fueling speculation of mismanagement or worse.

Transparency is not just about providing information—it’s about accountability. FXGlobal’s refusal to engage with clients during its final days demonstrated a complete disregard for those who had trusted the platform. For traders, this was a stark reminder that a broker’s silence can be as damaging as its actions.

Technical Failures: A Platform in Disarray

In the high-stakes world of trading, a reliable platform is essential. Traders depend on fast execution, accurate data, and uninterrupted access to make informed decisions. FXGlobal’s trading platform, however, was plagued by technical issues that undermined its usability and cost clients dearly.

Reports of platform downtime were rampant, with traders experiencing outages at critical moments. During volatile market conditions, when timing is everything, these disruptions led to missed opportunities and significant losses. Slow execution speeds were another common complaint, with trades taking longer to process than promised. For scalpers and day traders, who rely on split-second timing, this was a dealbreaker.

Perhaps most concerning were reports of discrepancies in market data. Traders noticed that the prices displayed on FXGlobal’s platform sometimes differed from real-time market feeds, leading to inaccurate trades and unexpected losses. Whether due to technical incompetence or deliberate manipulation, these issues eroded confidence in the platform’s reliability.

A broker’s infrastructure is its backbone, and FXGlobal’s was clearly inadequate. The recurring technical problems suggest a lack of investment in robust systems, leaving traders to bear the consequences of the broker’s negligence. For those who lost money due to platform failures, the experience was a bitter lesson in the importance of choosing a broker with a proven track record.

Reputation in Ruins: The Voice of the Trading Community

In the age of the internet, a broker’s reputation is shaped by the collective experiences of its clients. FXGlobal’s reputation, once buoyed by slick marketing, lies in tatters today. A quick search reveals a flood of negative reviews, with traders warning others to steer clear. Words like “scam,” “unreliable,” and “fraudulent” appear frequently, reflecting the depth of dissatisfaction.

Key grievances include:

- Withdrawal Delays and Denials: Clients repeatedly cited issues accessing their funds, with some never recovering their money.

- Unresponsive Support: The lack of timely and effective customer service was a universal complaint.

- Technical Glitches: Platform issues cost traders time and money, with no recourse offered.

- Hidden Costs: Unexpected fees eroded profits and trust.

- Abrupt Closure: The broker’s sudden exit left clients feeling betrayed and abandoned.

These criticisms are not isolated incidents but part of a broader pattern of systemic failure. FXGlobal’s inability to address client concerns or improve its services sealed its fate. In an industry where trust is paramount, the broker’s reputation became its own worst enemy.

Lessons for Traders: Navigating the Broker Minefield

FXGlobal’s collapse offers valuable lessons for traders looking to avoid similar pitfalls. Choosing a broker is one of the most critical decisions in trading, and it requires careful consideration. Here are some key takeaways:

- Scrutinize Regulation: A license is a starting point, not a guarantee. Research the regulator’s reputation and the broker’s compliance history. Top-tier authorities like the FCA (UK), ASIC (Australia), or BaFin (Germany) often have stricter standards.

- Dive into Reviews: Independent client feedback on forums, review sites, and social media can reveal red flags that marketing glosses over.

- Test the Waters: Before committing significant funds, test the broker’s platform, customer support, and withdrawal process with a small deposit.

- Demand Clarity: Ensure the broker’s terms, fees, and policies are transparent and easy to understand. Avoid platforms with vague or contradictory information.

- Prioritize Reliability: Look for brokers with a proven track record of technical stability and prompt payouts. A platform’s uptime and execution speed are critical.

- Stay Skeptical: Don’t be swayed by flashy promotions or unrealistic promises. If it sounds too good to be true, it probably is.

By adopting a cautious and informed approach, traders can protect themselves from brokers like FXGlobal, whose failures serve as a stark warning of what can go wrong.

The Bigger Picture: Why FXGlobal’s Failure Matters

FXGlobal’s downfall is more than just the story of one broker’s collapse—it’s a reflection of broader challenges in the online trading industry. The rise of retail trading has attracted countless platforms, some of which prioritize profits over client welfare. Stories like FXGlobal’s highlight the need for greater accountability and oversight in the sector.

For traders, the implications are clear: due diligence is non-negotiable. The allure of quick profits can blind even the savviest investors to red flags, but FXGlobal’s legacy is a reminder to stay vigilant. A broker’s job is to facilitate trading, not to create obstacles or uncertainty. When a platform fails to uphold this responsibility, as FXGlobal did, the consequences ripple far beyond individual losses.

Conclusion: A Cautionary Tale for the Ages

FXGlobal’s journey from promising newcomer to disgraced failure is a sobering lesson in the importance of trust and transparency. What began with bold promises ended in a cascade of complaints, from withdrawal nightmares to technical disasters. The broker’s abrupt closure, coupled with its silence in the face of client desperation, cemented its place as a cautionary tale in the trading world.

For those who suffered losses, FXGlobal’s collapse was a painful wake-up call. For the broader trading community, it’s a chance to learn and adapt. By choosing brokers with proven integrity, robust systems, and a commitment to client satisfaction, traders can avoid the pitfalls that ensnared so many FXGlobal clients. In an industry built on trust, FXGlobal’s fall from grace is a stark reminder that reputation is earned—not promised.

As the trading landscape evolves, stories like FXGlobal’s will continue to shape the choices traders make. Let this be a guide: research thoroughly, question boldly, and never settle for a broker that doesn’t put your interests first. The lessons of FXGlobal’s failure are hard-won, but they pave the way for smarter, safer trading in the future.