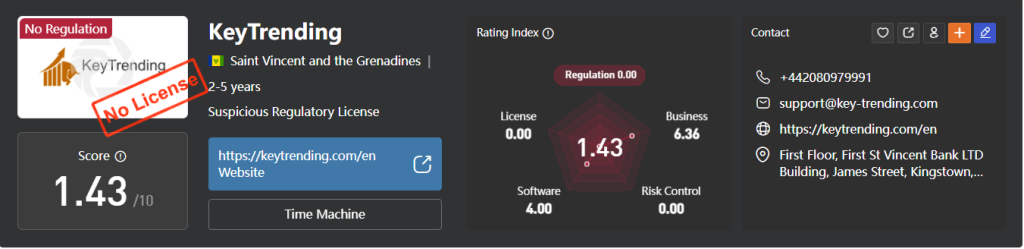

When it comes to investing, trust and regulation are the twin pillars that form the foundation of any legitimate financial institution. Unfortunately, not all brokers in the financial markets adhere to these principles, and KeyTrending exemplifies this disregard for ethics and transparency. Operating from the shady tax haven of Saint Vincent and the Grenadines (SVG), KeyTrending has garnered an abysmal reputation for its lack of regulation, suspicious business practices, and high-risk offerings. In this article, we delve into the depths of KeyTrending’s operations to uncover the alarming truths behind this offshore scam.

A Closer Look at KeyTrending’s Operations

KeyTrending markets itself as a provider of “first-class execution services for private and institutional clients” with access to over 100 instruments and tight spreads. However, a cursory glance at their setup and offerings reveals a different story—one of deceit, unaccountability, and potential fraud.

Unregulated and Unaccountable

KeyTrending is registered in SVG, a jurisdiction notorious for its leniency in financial oversight. The SVG Financial Services Authority (SVGFSA) explicitly does not regulate or monitor Forex brokers. This means that KeyTrending operates in a regulatory vacuum, free from accountability and oversight.

Without regulation, the company faces no legal consequences for misconduct. Client funds deposited with KeyTrending are effectively unprotected, making this broker a breeding ground for financial abuse. Additionally, the anonymity afforded by SVG’s lax corporate laws allows KeyTrending’s operators to remain hidden, enabling them to steal client funds without fear of repercussions.

Suspicious Business Practices

The absence of regulation is just the tip of the iceberg. KeyTrending’s business model raises numerous red flags:

- Broken Website and Inadequate Infrastructure: KeyTrending’s website is riddled with functionality issues. The Webtrader platform—advertised as a hallmark of their service—is broken, and attempts to register lead users back to the homepage. Such technical failures indicate that the company lacks the capacity or intention to provide real trading services.

- Deceptive Leverage Offerings: KeyTrending claims to provide leverage up to 1:400, a dangerously high ratio that is restricted in regulated markets like the EU (1:30), UK (1:30), and US (1:50). Such high leverage is a hallmark of risky brokers, as it increases the likelihood of clients incurring significant losses while maximizing profits for the broker.

- Dubious Deposit and Withdrawal Policies: While KeyTrending claims to accept deposits via Credit/Debit cards, Wire Transfers, and e-wallets, there is no concrete proof of these options. Their minimum deposit of $250 is exorbitant compared to industry standards, and their withdrawal conditions are deliberately prohibitive, especially for clients who accept bonuses. For instance, the trading volume requirement tied to bonuses—50 lots for a $200 bonus—is impossible for most traders to meet.

KeyTrending’s Deceptive Strategies

The modus operandi of scams like KeyTrending follows a well-worn path designed to fleece unsuspecting victims. Here’s how it works:

- Aggressive Marketing: Fraudsters aggressively market their services, often posing as reputable entities. They promise massive returns, low risks, and “expert guidance” to lure in novice investors.

- Manipulative Tactics: Once a client deposits funds, KeyTrending manipulates account data, forging fake profits to encourage further investments. Victims are then persuaded to deposit larger sums under the pretense of maximizing returns.

- Withdrawal Blockades: When clients attempt to withdraw funds, KeyTrending imposes fabricated conditions such as “processing fees” or “tax payments.” These tactics delay withdrawals and pressure clients to deposit even more money.

- Vanishing Act: As complaints mount, the scammers behind KeyTrending are likely to shut down the website, leaving victims high and dry. These operators then resurface under a different name, continuing their fraudulent activities unabated.

Why KeyTrending Should Be Avoided

The issues surrounding KeyTrending are extensive and damning. From its lack of regulation to its substandard trading platform and questionable policies, KeyTrending exhibits all the hallmarks of a financial scam. Below, we summarize the key reasons to avoid this broker at all costs:

- Absence of Regulatory Oversight: KeyTrending’s unregulated status means that clients have no recourse if their funds are mismanaged or stolen.

- High-Risk Location: SVG is a well-known hub for fraudulent financial schemes due to its lax laws and lack of enforcement.

- Opaque Operations: The lack of transparency in KeyTrending’s operations—including the absence of clear deposit and withdrawal methods—is indicative of its fraudulent intent.

- Prohibitive Bonus Terms: Bonus schemes with unattainable trading requirements are designed to trap clients and prevent them from withdrawing funds.

- Faulty Trading Platform: A broken trading platform further highlights the broker’s incompetence and lack of credibility.

Safer Alternatives

For traders seeking a secure and reliable trading experience, regulated brokers licensed by reputable authorities such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia) are the only viable options. These regulators enforce stringent requirements to protect clients, including:

- Segregated Accounts: Ensuring that client funds are separate from the broker’s operational funds.

- Deposit Insurance: Providing compensation schemes to reimburse clients in case of insolvency.

- Leverage Caps: Limiting leverage to prevent excessive losses.

What to Do if You Have Been Scammed

If you have fallen victim to KeyTrending or a similar scam, immediate action is crucial:

- Contact Your Bank: Inform your bank about the fraud and request a chargeback. Deactivate your card to prevent further unauthorized transactions.

- Report to Authorities: File complaints with your local financial regulatory body and law enforcement agencies.

- Spread Awareness: Share your experience online to warn others and prevent additional victims from falling prey to the scam.

- Be Wary of Recovery Scams: Avoid entities claiming to recover lost funds for a fee. Many of these are secondary scams targeting already defrauded individuals.

Conclusion

KeyTrending is a glaring example of why due diligence is essential when choosing a broker. The lack of regulation, suspicious practices, and evident technical failures make it a high-risk choice for any investor. The promise of high leverage and tight spreads is nothing more than bait to entrap unsuspecting traders. Instead of gambling with unregulated brokers, investors should prioritize safety and transparency by choosing regulated brokers with a proven track record of reliability. Remember, if something sounds too good to be true, it probably is—and in the case of KeyTrending, it’s an outright scam.