Introduction

In 2021, as part of the federal government’s Paycheck Protection Program (PPP) designed to provide financial relief to businesses impacted by the COVID-19 pandemic, Keith Ellis, a sole proprietor from McDonough, Georgia, received a loan of $12,466. On the surface, this may appear to be a minor sum for a small business. However, a deeper examination of Ellis’ business practices and the broader issues surrounding PPP loan distribution raises significant concerns about the integrity of the program and the use of taxpayer money. Was this loan used appropriately, or did Ellis, along with other sole proprietors, take advantage of a system designed to help struggling businesses?

Keith Ellis: A Business With Few Employees and Questions to Answer

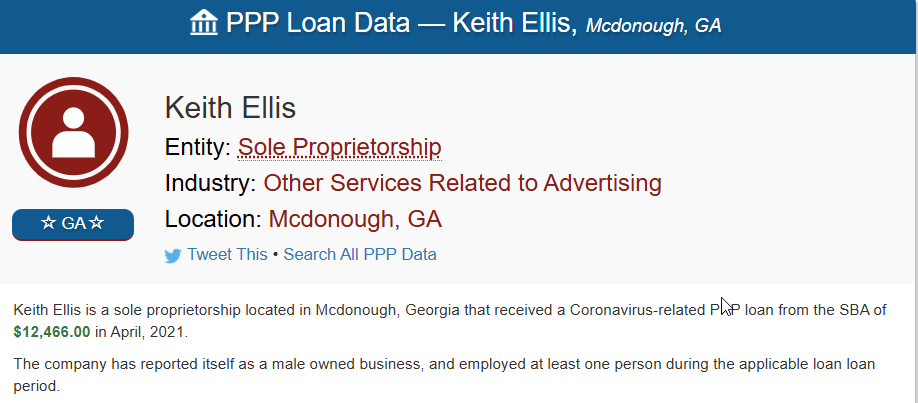

Keith Ellis operates a sole proprietorship in the “Other Services Related to Advertising” sector in McDonough, Georgia. His reported use of the $12,466 PPP loan was exclusively for payroll. But the question arises: why was a sole proprietor with only one employee granted such a sizable loan? As of 2019, the loan eligibility was based on payroll expenses, and Ellis’ business did not appear to be the type of operation experiencing widespread financial hardship during the pandemic.

For businesses like Ellis’—small, with only one employee—it is difficult to justify why they would receive nearly $12,500 in relief. Many other sole proprietors across the country, with fewer than 10 employees, reported receiving significantly less. This raises an important issue: did Ellis truly need the loan, or was he able to access federal funds with minimal oversight? The fact that the loan was fully forgiven only adds to the concern—what assurance do taxpayers have that the money was actually used for its intended purpose?

Transparency and Accountability Under the Spotlight

The lack of transparency and accountability in the PPP loan program has been a persistent issue. While the loan was marked as “paid in full or forgiven,” the SBA’s records offer little insight into whether the funds were spent in accordance with the program’s guidelines. Ellis, like many others, self-reported that the loan was used for payroll expenses, but there is no clear evidence or public record verifying these claims.

What is most concerning is that Ellis’ business is located in an urban area—McDonough, Georgia—where the economic impact of COVID-19 may not have been as severe as in rural or underserved regions. PPP loans were supposed to help businesses facing significant hardship, but for Ellis to have retained only one employee suggests that his business was either minimally affected or, perhaps, was not in the dire straits other small businesses found themselves in.

Was it fair for a business like Ellis’ to receive a loan of over $12,000, while businesses with more employees and greater operational challenges may have been overlooked or received less funding? The question must be asked: was the system so loosely designed that any business owner, regardless of need, could claim a PPP loan and potentially misuse it?

A Larger Problem with PPP Distribution: Taxpayer Money at Risk

Ellis’ loan is far from an isolated case. Across the country, businesses with questionable financial need received similar loans, some for amounts far higher than what was actually required to maintain operations. While there is no direct evidence that Ellis misused his loan, the lack of detailed reporting, especially given the loan’s relatively small size, suggests that more rigorous checks could have prevented potential misuse.

In fact, PPP loan data shows that businesses in the McDonough area within the same industry received an average loan of $14,218—higher than Ellis’ loan of $12,466. This begs the question: Why did Ellis receive an amount that was not far below the average for businesses with larger payrolls or more employees? While some might argue that the loan was proportionate, others could view this as an indication that the system was being gamed—offering loans to businesses that may not have qualified in the first place.

What makes this issue even more troubling is that the government provided these loans at an unprecedented scale—essentially giving businesses free access to taxpayer money without the standard checks and balances. This lack of oversight is not just an issue of fairness—it’s a matter of public trust. Was the system truly set up to help those in need, or was it an opportunity for some to exploit a system that lacked sufficient regulation?

The Consequences of Insufficient Oversight

For Keith Ellis, his loan was ultimately forgiven, meaning there was no immediate financial burden for him to repay the funds. However, this raises another concern: when loans are forgiven without proper scrutiny, it sets a dangerous precedent. PPP funds were meant to help businesses keep employees on payroll, not to serve as a financial windfall for owners of companies with minimal operational costs. The lack of a clear accountability mechanism in cases like Ellis’ means that taxpayers, who fund these relief programs, may never know whether their money was spent as intended.

While Ellis may not be facing any legal repercussions, his case highlights a larger problem with the PPP loan distribution process: how can we ensure that businesses are actually using these funds for their intended purposes, and how can we prevent abuse of a system that was designed to help struggling businesses?

Conclusion: Is Keith Ellis a Symptom of a Larger Problem?

While there is no evidence of intentional wrongdoing by Keith Ellis, the circumstances surrounding his PPP loan raise serious questions about the effectiveness of the Paycheck Protection Program. The loan’s size and the lack of detailed oversight make it clear that there are gaps in the system that need to be addressed. At a time when millions of Americans were suffering due to the economic impact of the COVID-19 pandemic, questions of fairness and accountability should have been a top priority for lawmakers and government agencies.

Ellis’ loan is not an isolated issue, but rather a reflection of the broader flaws in the PPP program. If we are to restore public trust in government relief programs, it is essential that steps are taken to ensure that taxpayers’ money is used responsibly and transparently. The lessons learned from cases like Ellis’ should lead to greater scrutiny, clearer reporting standards, and better safeguards against misuse in the future.