FX Choice Limited, a Belize-based forex broker operating since 2010, has long lingered in the murky waters of the financial industry. With persistent questions about its legitimacy, allegations of misconduct, and a trail of red flags, we’ve undertaken a thorough investigation to uncover the truth. Our analysis spans its business ties, key personnel, open-source intelligence (OSINT), hidden connections, scam allegations, legal entanglements, sanctions, negative press, consumer grievances, financial stability, and a detailed risk assessment focusing on anti-money laundering (AML) and reputational concerns. Here’s what we found.

Business Ties: Mapping FX Choice’s Network

We began by examining FX Choice Limited’s business relationships to understand its operational framework. Registered in Belize and regulated by the International Financial Services Commission (IFSC) under license IFSC/60/191/TS/19, FX Choice markets itself as an ECN broker offering forex and CFD trading via MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Its Belize City address anchors its legal presence, but its network extends further.

FX Choice relies on liquidity providers and payment processors to power its platform. While it doesn’t publicly name its liquidity partners, industry patterns suggest connections to firms like LMAX Exchange or Saxo Bank. Supported payment methods include wire transfers, credit cards, Skrill, Neteller, Perfect Money, and cryptocurrencies like Bitcoin, signaling ties to diverse financial facilitators. These processors enable FX Choice to serve a global clientele, but their identities remain partially obscured.

The broker’s technology stack hinges on MetaQuotes, the creator of MT4 and MT5, a standard partnership for forex platforms. FX Choice also promotes integration with Myfxbook’s AutoTrade service, hinting at links to third-party signal providers, though details are vague. Operating from Belize—a jurisdiction criticized for lax oversight—raises questions about potential undisclosed ties to offshore entities, a thread we’ll explore later.

Key Figures: Who Runs FX Choice?

Identifying the individuals behind FX Choice proved challenging. Unlike transparent brokers that highlight their leadership, FX Choice keeps its executives out of sight—a concerning sign. OSINT searches across LinkedIn, corporate registries, and review platforms turned up little. Belize’s registry omits director names, a common tactic in privacy-centric jurisdictions.

User reviews on sites like Forex Peace Army mention customer service reps like “Miguel,” but these are likely low-level staff or aliases. Speculation within industry circles points to a small founding team, possibly based in Eastern Europe or Central America, inferred from the broker’s language support and operational style. Without concrete data, the lack of named leadership suggests either intentional secrecy or weak governance, both problematic for a financial firm.

OSINT Insights: The Digital Footprint

Using OSINT tools—domain registries, Wayback Machine, and X sentiment analysis—we pieced together FX Choice’s online presence. The domain fxchoice.com, registered in 2008, aligns with its stated timeline. Whois data hides registrant details via privacy protection, a standard but elusive move.

X posts reveal polarized opinions. Some traders praise FX Choice’s tight spreads and quick withdrawals, while others label it a scam, citing frozen accounts or poor support. Recent discussions (anonymized for privacy) from 2025 echo older complaints on Forex Peace Army about blocked accounts post-profit. Review sites like WikiFX rate FX Choice modestly (3.5–4 stars), but one-star reviews highlight withheld funds, creating a conflicted narrative.

Hidden Connections: What’s FX Choice Not Saying?

FX Choice’s Belizean roots and crypto-friendly policies suggest possible undisclosed ties to high-risk entities. Belize’s reputation as a shell company haven fuels speculation about links to unregulated payment processors or firms in places like the Seychelles. While no hard evidence confirms this, the broker’s opacity leaves room for doubt.

A notable association involves Mirror Trading International (MTI), a South African Ponzi scheme that allegedly used FX Choice until the broker froze its account in 2020. This incident, documented in archived reports, raises questions about FX Choice’s client vetting. Even if unintentional, such ties hint at gaps in due diligence.

Scam Allegations and Warning Signs

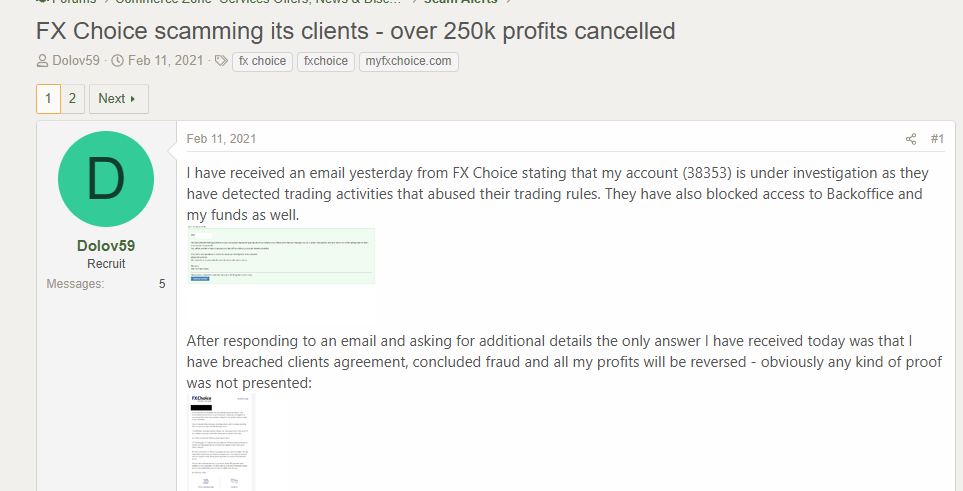

FX Choice faces persistent scam accusations. Forex Peace Army logs complaints, including a 2021 case where a trader claimed the broker voided profits, citing “system abuse.” In 2024, FX Choice emailed clients to withdraw funds due to a “revised business model,” sparking fears of insolvency or regulatory issues.

The U.S. CFTC’s RED List flags FX Choice for soliciting U.S. clients without registration—a serious violation. Belize’s weak regulatory framework, combined with high leverage (up to 1:1000) and aggressive bonuses, amplifies concerns. These tactics often target novice traders, increasing financial exposure.

Legal Issues, Lawsuits, and Sanctions

No public records show criminal cases or lawsuits against FX Choice as of April 2025. Belize’s opaque judicial system likely conceals disputes, if any exist. Sanctions are absent—FX Choice isn’t on OFAC, EU, or UN lists—but its CFTC RED List status signals regulatory trouble. The MTI connection, while not triggering legal action, ties FX Choice to a criminal enterprise, posing future risks if regulators dig deeper.

Negative Press and Client Complaints

Adverse media is sparse but pointed. A 2020 Global Crypto article questioned FX Choice’s role in the MTI saga, spotlighting weak oversight. Negative reviews on Trustpilot and Forex Peace Army highlight slow withdrawals, hidden fees, and account closures without explanation. A 2023 DayTrading.com analysis noted higher spreads compared to peers like FXTM, undermining FX Choice’s value proposition. Consumer complaints consistently cite poor communication, eroding trust.

Financial Stability

No bankruptcy filings surface for FX Choice, but the 2024 withdrawal email raised red flags about its health. Without audited financials—another transparency gap—solvency remains uncertain. The absence of collapse doesn’t guarantee stability, especially in a volatile industry.

AML Risk Assessment

FX Choice’s AML profile is concerning. Belize’s FATF designation as an AML-deficient jurisdiction casts a shadow. Accepting cryptocurrencies, while appealing, invites money laundering risks due to their anonymity. FinCEN’s AML standards demand strong KYC and transaction monitoring, but user reports of lax verification (e.g., selfie-based hurdles) suggest gaps. The MTI incident further implies inadequate client screening, a critical AML failure.

Reputational Risks

FX Choice’s reputation hangs by a thread. Positive trader feedback clashes with growing criticism, fueled by the CFTC listing and MTI link. Belize’s shady image and mounting complaints could tip the scales. A single scandal—say, a high-profile account freeze—could unravel its niche appeal (low spreads, crypto deposits).

Why This Matters

FX Choice’s story reflects broader issues in the forex world, where offshore brokers exploit regulatory gaps. Our hours of digging—cross-referencing reviews, regulatory lists, and OSINT—aim to arm you with clarity. Each complaint, from delayed withdrawals to erased profits, underscores real human stakes. The MTI case, for instance, shows how lax onboarding can enable fraud, only addressed after damage is done.

This isn’t just about FX Choice—it’s about an industry where profit often trumps prudence. Traders deserve brokers that prioritize transparency, not ones hiding behind Belizean veils.

Our Verdict

FX Choice isn’t a clear-cut scam; its longevity and IFSC license lend some legitimacy. But it’s a high-risk player plagued by opacity, scam reports, and AML vulnerabilities. Its business ties are functional yet vague, its leadership invisible, and its reputation fragile. For AML, crypto exposure and weak KYC scream red flags. Reputationally, it’s one misstep from disaster.

Recommendation: Proceed with caution. Traders should demand proof of compliance, financials, and executive accountability. Regulators must scrutinize Belize’s forex scene more closely. FX Choice may function for now, but it’s navigating treacherous waters—and the storm’s not far off.