The Rise and Fall of a Local Figure

In the quiet communities of Rhode Island, where trust and neighborly bonds often shape business dealings, the name Elijah Cady once carried a certain weight. Known for his charisma and entrepreneurial flair, Cady positioned himself as a visionary, promising prosperity through ventures like his hot sauce brand and cryptic investment opportunities. Yet, beneath this polished exterior, a darker narrative has emerged—one of alleged financial misconduct that has left investors reeling and communities questioning their faith in local success stories. This article delves into the allegations against Cady, exploring the mechanisms of his supposed schemes, the impact on victims, and the broader implications for financial trust in small-town America.

Early Ventures: Building a Reputation

Every story of deception begins with credibility, and Cady was no exception. In the early 2010s, he entered the public eye as a technical support specialist, later joining the Air Force and working in IT roles, including a stint at Netsimco at the Naval War College in Newport. His LinkedIn profile painted a picture of diligence—a young man climbing the ranks in cybersecurity. By 2019, Cady co-founded 13 Stars Hot Sauce, a venture that capitalized on local pride and his father’s pepper-growing hobby. The brand’s launch at a Patriots tailgate event garnered positive feedback, and Cady’s narrative of donating proceeds to veterans added a layer of altruism. To many, he was a hometown hero, blending entrepreneurship with community goodwill. But this foundation, built on relatable charm, would soon serve as a springboard for more questionable endeavors.

The Investment Pitch: Promises of Prosperity

As Cady’s public profile grew, so did his ambitions. He began promoting investment opportunities, presenting himself as a financial savant with insider knowledge of emerging markets. Unlike traditional scams involving offshore accounts or blatant fraud, Cady’s approach was subtler. He allegedly targeted middle-class Rhode Islanders—retirees, small business owners, and even fellow veterans—offering stakes in ventures tied to his hot sauce brand and vague “tech startups.” These pitches were delivered at local events, community centers, and even through personal networks, leveraging his reputation. Investors were promised steady returns, often framed as a chance to “get in early” on a booming industry. The allure of supporting a local figure, combined with modest initial investments, made the offers hard to resist.

The Mechanics of Alleged Deception

What set Cady’s alleged schemes apart was their veneer of legitimacy. Documents shared with investors reportedly included professional-looking prospectuses, complete with market projections and testimonials. However, scrutiny reveals troubling inconsistencies. Financial experts who later reviewed these materials noted inflated revenue claims for 13 Stars Hot Sauce and ambiguous references to “proprietary technology” that lacked substance. Cady allegedly encouraged investors to act quickly, citing limited opportunities, a classic tactic to bypass due diligence. Funds were funneled through LLCs registered in Rhode Island, but tracing their use proved challenging. Some investors claim their money was diverted to personal expenses or unverified “operational costs,” with little evidence of promised projects materializing. The complexity of these arrangements shielded Cady from immediate suspicion, as victims hesitated to question a man they trusted.

Victims’ Stories: A Community Betrayed

The human cost of Cady’s alleged actions is perhaps the most damning aspect of this saga. Take Sarah, a retired schoolteacher who invested $10,000 from her savings, hoping to bolster her pension. She received initial “dividend” payments—small sums that reinforced her trust—but communication ceased when she sought to withdraw her principal. Similarly, Mark, a local mechanic, parted with $5,000 after attending one of Cady’s community talks. He recalls Cady’s polished demeanor and patriotic rhetoric, which made the investment feel like a moral duty. These stories, echoed across Warwick and North Kingstown, paint a picture of betrayal. Families who saw Cady as a beacon of local success now grapple with financial loss and eroded trust. Community forums buzz with regret, as victims lament their failure to question the too-good-to-be-true promises.

The Role of Trust in Small Communities

Rhode Island’s tight-knit communities played a pivotal role in Cady’s alleged success. Unlike urban centers where anonymity prevails, small towns thrive on personal connections. Cady exploited this dynamic, using his National Guard background and local ties to disarm skepticism. Sociologists note that such environments are fertile ground for financial scams, as residents are less likely to demand formal accountability from familiar faces. Cady’s attendance at local events—charity drives, veteran meetups—cemented his image as “one of us.” This trust, while a community strength, became a vulnerability, highlighting the need for greater financial literacy and vigilance, even among neighbors.

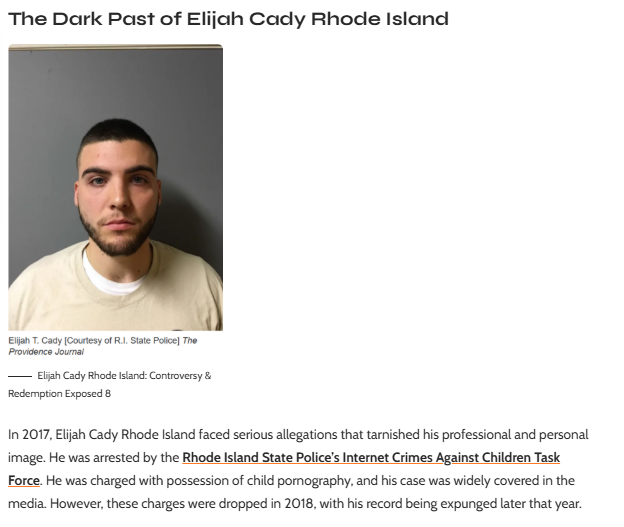

Legal Troubles: A Pattern of Controversy

Cady’s financial dealings are not his only brush with controversy. In 2017, he faced charges of possessing child pornography, though these were dropped in 2018, and his record was expunged. A separate arrest for drunken driving in the same period added to the scrutiny. While these incidents don’t directly tie to financial misconduct, they contribute to a narrative of questionable judgment. Critics argue that Cady’s ability to rebound from legal troubles—rebuilding his image through entrepreneurship—mirrors the resilience of seasoned scammers. The expungement of his record allowed him to present a clean slate, but whispers of past allegations lingered, fueling distrust among those who later invested with him.

Regulatory Gaps: Why Schemes Persist

The allegations against Cady underscore broader issues in financial oversight. Rhode Island’s regulatory framework, like many states’, struggles to monitor small-scale investment schemes. The Securities and Exchange Commission focuses on major frauds, leaving local scams under-policed. FINRA, the self-regulatory body for brokers, has faced criticism for opaque disclosures, often shielding industry players over investors. In Cady’s case, his ventures fell into a gray area—neither fully regulated securities nor blatant Ponzi schemes—making intervention tricky. Consumer protection advocates argue for stricter state-level oversight, including mandatory disclosures for private investments. Without such measures, figures like Cady can operate in the shadows, exploiting regulatory blind spots.

The Hot Sauce Facade: A Cover for Misconduct?

13 Stars Hot Sauce, Cady’s flagship venture, deserves closer scrutiny. Marketed as a grassroots success, it was a cornerstone of his investment pitches. Yet, sales data suggests modest revenue, far below the figures touted to investors. The brand’s Shopify store, while functional, showed limited traffic, and distribution was confined to local markets. Some speculate the business served as a front—lending credibility to Cady’s broader financial promises while generating minimal profit. Donating a portion of proceeds to veterans was a masterstroke, deflecting questions about financial transparency. Customers praised the product, unaware their purchases might prop up a questionable empire. This duality—genuine entrepreneurship mingled with alleged deceit—complicates the narrative, leaving observers to wonder where ambition ended and manipulation began.

The Psychology of Deception

Understanding Cady’s alleged schemes requires examining the psychology behind financial fraud. Experts describe scammers as adept at exploiting cognitive biases, such as the halo effect—where charm and success in one area (like entrepreneurship) blind victims to red flags. Cady’s military background and community involvement created this halo, disarming skepticism. His pitches also leveraged scarcity bias, urging investors to act fast to secure “exclusive” opportunities. Psychologists note that such tactics thrive in environments of economic uncertainty, where people crave quick financial wins. Rhode Island’s post-recession recovery, marked by stagnant wages for many, provided fertile ground for Cady’s promises of easy wealth.

Community Response: Anger and Action

As allegations surfaced, Rhode Island’s communities reacted with a mix of outrage and resolve. Local media outlets, including Providence Journal and ABC6, began covering the story, amplifying victims’ voices. Grassroots groups formed to share information, with some victims filing complaints with the state’s Department of Business Regulation. Social media platforms, particularly X, became hubs for discussion, with hashtags calling for accountability. Community leaders, wary of further eroding trust, have pushed for town hall meetings to educate residents on investment risks. These efforts reflect a collective desire to reclaim agency, turning betrayal into a catalyst for change. Yet, the emotional toll remains, as families navigate the fallout of misplaced trust.

The Broader Impact: Trust in Entrepreneurship

Cady’s case reverberates beyond individual losses, casting a shadow over Rhode Island’s entrepreneurial ecosystem. Startups, already battling for credibility, now face heightened skepticism. Investors, once eager to support local ventures, may hesitate, fearing another Cady lurks among them. Economic development officials worry about long-term effects, as trust is a cornerstone of small business growth. Nationally, similar cases—think of Bernie Madoff on a grander scale—show how financial scandals ripple, chilling investment and innovation. Rhode Island’s response, balancing accountability with support for legitimate entrepreneurs, will shape its economic future.

Counterarguments: Is Cady Misunderstood?

No discussion of allegations is complete without considering the other side. Some of Cady’s supporters argue he’s a victim of overzealous critics or business misfortune. They point to 13 Stars Hot Sauce’s tangible success—available in local stores, praised by customers—as evidence of his entrepreneurial intent. Economic downturns, they claim, could explain delayed investor returns, not malice. Others note his youth and inexperience, suggesting he overpromised without intending to deceive. These defenses, while worth noting, struggle against the volume of complaints and the pattern of evasiveness reported by victims. Still, fairness demands acknowledging that allegations remain unproven in court, and Cady’s side deserves a hearing.

The Path to Accountability

Holding figures like Cady accountable is no simple task. Victims face legal hurdles, as proving fraud requires clear evidence of intent—a high bar in court. Class-action lawsuits, while appealing, are costly and slow. Regulatory bodies, stretched thin, prioritize high-profile cases, leaving small-scale scams to fester. Yet, progress is possible. Strengthening state laws to mandate transparency for private investments could deter future schemes. Public awareness campaigns, teaching residents to verify credentials and demand contracts, are equally vital. For now, victims rely on collective action—sharing stories, filing complaints, and pressuring authorities—to seek justice.

Conclusion: Lessons from a Scandal

Elijah Cady’s story, whether one of deliberate fraud or misguided ambition, is a cautionary tale for Rhode Island and beyond. It reveals the fragility of trust in tight-knit communities and the ease with which charisma can mask deceit. Victims, left to rebuild their finances and faith, embody the human cost of unchecked promises. Yet, their resilience—channeling pain into advocacy—offers hope. The scandal underscores the need for vigilance, not just toward strangers, but toward those we know best. As Rhode Island grapples with this betrayal, it has a chance to emerge stronger, armed with lessons that protect against the next smooth-talking visionary. For now, Cady’s legacy is a warning: prosperity promised too easily often comes at a steep price.