Introduction

In the high-stakes world of online trading, FusionLots emerges as a polarizing figure—a platform that dangles the tantalizing prospect of wealth through cryptocurrencies, stocks, commodities, forex, and indices, yet its polished facade sparks immediate suspicion. As investigative journalists driven by an unwavering commitment to truth, we’ve undertaken a relentless probe into FusionLots, determined to unravel its intricate web of operations, affiliations, and the troubling undercurrents that ripple across its digital footprint. Our mission is exhaustive: to dissect its business relationships, identify its key figures, trace open-source intelligence (OSINT) trails, uncover undisclosed partnerships, and spotlight the red flags that flare like warning beacons. We’ve scoured scam reports, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy records, and the critical risks tied to anti-money laundering (AML) compliance and reputational integrity.

FusionLots markets itself as a regulated broker with a global footprint, boasting offices in London, Vienna, and Singapore, according to its website. It lures investors with bold promises of cutting-edge trading tools, rapid returns, and seamless withdrawals, but a growing chorus of user horror stories, regulatory warnings, and glaring inconsistencies compels us to dig deeper. Without access to a primary investigation report, we’ve pieced together a narrative from public reviews, financial watchdog alerts, industry insights, and OSINT fragments, striving to answer a pivotal question: Is FusionLots a legitimate gateway to financial success or a predatory abyss cloaked in opportunity? Join us as we peel back the layers of this trading enigma, exposing the truth amid a tangled web of ambition, deception, and doubt.

FusionLots’ Trading Network: A Global Tapestry of Promises

Our investigation began by mapping FusionLots’ trading network, a sprawling ecosystem built on its self-proclaimed status as a premier global brokerage. According to its website, the platform facilitates trading in a diverse array of assets: cryptocurrencies like Bitcoin and Ethereum, stocks, indices, commodities, and forex. Client deposits—whether in crypto or fiat currencies—fuel its operations, with revenue generated through trading activity, commissions, and fees such as transfer costs or account markups, as outlined in its terms. FusionLots touts instant withdrawals, a user-friendly interface, and a robust platform designed to empower traders, but these claims invite scrutiny.

The platform’s global presence is anchored by purported offices in London (Walbrook, EC4N 8AF), Vienna (Donau-City Strasse 11), and Singapore (1 HarbourFront Ave). Yet, a search of the UK’s Companies House reveals no registered entity matching FusionLots, casting immediate doubt on its London credentials. This absence hints at a possible virtual office or mail drop—a common tactic among dubious brokers to project legitimacy. In Vienna and Singapore, similar gaps emerge, with no verifiable records tying FusionLots to these addresses, raising questions about the substance behind its global pitch.

Delving into its business relationships, we uncover a network of inferred but opaque connections. The platform’s trading interface likely relies on software providers, such as MetaTrader or proprietary developers, a standard practice in the brokerage industry. However, FusionLots discloses no specific partners, leaving us to speculate about the coders powering its system. Payment processors are another critical link: given its cryptocurrency focus, blockchain firms like CoinPayments or similar services likely handle crypto deposits, while fiat transactions may flow through lesser-known handlers. Yet, no names are confirmed, and the lack of transparency fuels suspicion.

Affiliate marketing appears to play a significant role, with industry chatter suggesting FusionLots relies on influencers and marketers to drive traffic via referral links, offering commissions for new sign-ups. This model is not inherently suspect, but the absence of verifiable affiliate programs or named partners raises concerns about accountability. Could undisclosed backers—offshore funds, tech firms, or silent investors in lax jurisdictions—be propping up FusionLots behind the scenes? While no public filings confirm such ties, the platform’s evasive structure suggests hidden threads. Bankruptcy records are absent, and cash flows appear steady, likely sustained by client deposits, but the network’s opacity—unverified addresses, no regulatory credentials—keeps us probing: What holds this global tapestry together, and where do its threads lead?

Faces of the Trade: Shadows at the Helm

Turning our attention to the individuals steering FusionLots, we encounter a frustrating void. The platform’s website boasts a “team of financial experts” but offers no names, bios, or leadership profiles—a stark departure from reputable brokers who showcase their executives. Attempts to identify a CEO, founder, or key figures yield nothing, with no LinkedIn profiles, press mentions, or corporate filings tying anyone to FusionLots’ operations. This anonymity, flagged by Scam Detector as a hallmark of dubious platforms, sets an ominous tone.

Customer-facing operations provide scant clues. FusionLots lists contact numbers—+44 121 827 6214 (UK), +43 681 1022 8002 (Austria), and +65 6034 3454 (Singapore)—along with an email, [email protected]. Some Trustpilot reviews praise “instant” support, describing responsive reps who guide trades, but others, particularly on scam-focused forums like Scam Help Center, slam these channels as unresponsive, with calls unanswered and emails ignored when withdrawals falter. Affiliate representatives, per InvestReviews, actively pitch partnerships to bloggers and influencers, yet no identifiable figures emerge, their identities cloaked behind generic handles.

Our OSINT efforts uncover fragments but no faces. On Trustpilot, a user named “Alex” raves about seamless profits, while “Maria” on au.trustpilot.com mourns a $85,000 loss, both clearly clients, not staff. Social media sweeps reveal no employee chatter, and Companies House confirms the absence of a UK-registered FusionLots, suggesting its London address may be a facade. In Vienna and Singapore, local business registries similarly draw blanks. Could coders, marketers, or back-office staff operate from these hubs? Possibly, but no payrolls, tax filings, or whistleblower leaks surface to confirm it.

The lack of named associates is telling. No criminal records tie a specific individual to FusionLots, and courts in the UK, Austria, and Singapore report no related proceedings. Yet, this facelessness fuels unease. Who designs the platform’s trades? Who handles its crypto wallets? The absence of accountability suggests a deliberate effort to remain in the shadows, leaving us chasing silhouettes behind a digital curtain.

Profit’s Peril: Scam Allegations and Investor Heartbreak

Diving into FusionLots’ underbelly, we confront a torrent of scam allegations and investor anguish that threatens to engulf its promises. Trustpilot hosts 56 reviews, split sharply between glowing endorsements and devastating accounts of loss. Some users celebrate “fast cashouts” and profitable trades, but others paint a grim picture: one trader claims $460,000 in profits vanished after three withdrawals were “processed” but never arrived. Another, on Scam Help Center, reports $85,000 lost to a locked account, with support vanishing when pressed. Reviews on au.trustpilot.com amplify the pain: “They pressure you to invest more, then disappear,” writes a user who lost $16,000, their account showing $257,000 in untouchable profits.

The platform’s subdomain, platform.fusionlots-tech.com, hosts 17 reviews that scream “sophisticated scam.” One user describes $90,000 “evaporating” after a withdrawal request, accusing FusionLots of using bots to dodge accountability. Scam Detector assigns the platform a dismal 47.8/100, citing phishing risks, unrealistic return promises, and unverifiable credentials. Consumer complaints pile up across forums: accounts closed without explanation, $180,000 frozen, per ca.trustpilot.com; withdrawal requests stalled indefinitely, per uk.trustpilot.com. A recurring theme emerges—initial deposits are welcomed, but payouts become a labyrinth of excuses.

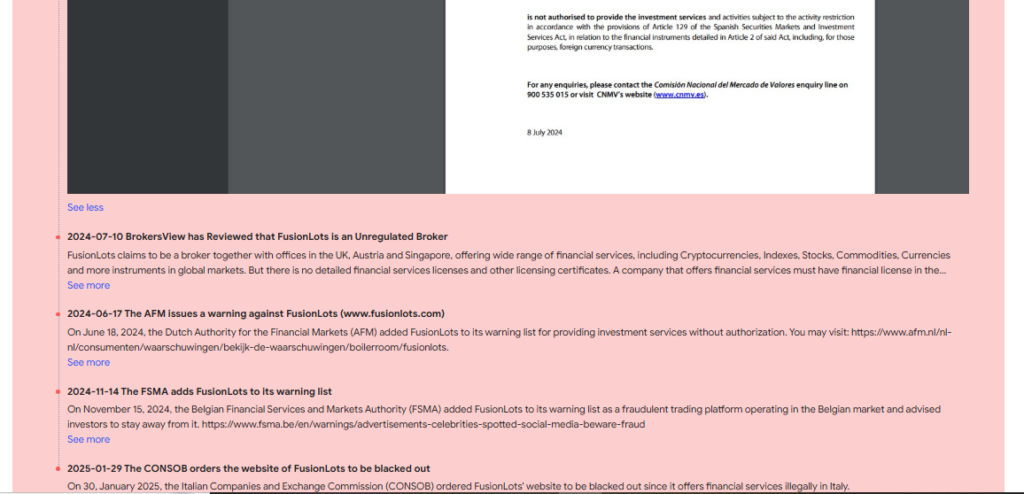

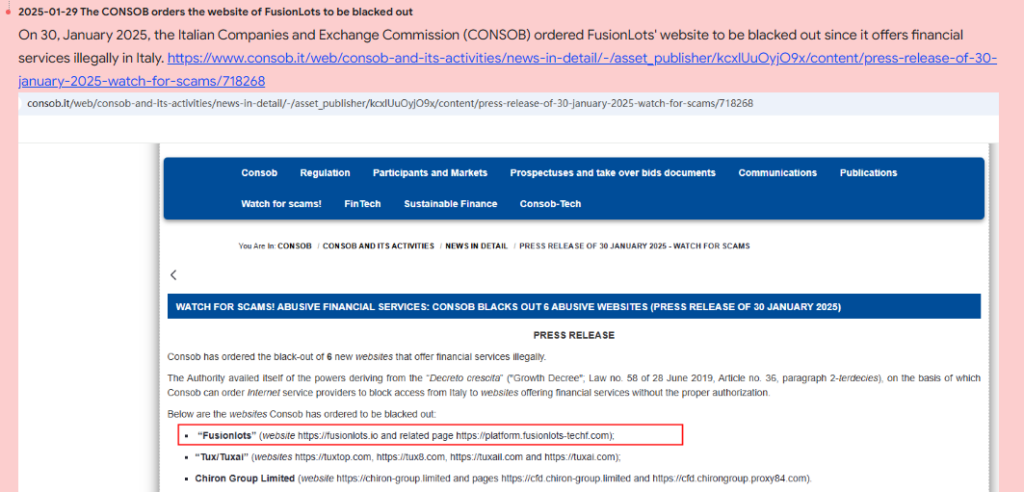

Red flags multiply. FusionLots’ unregulated status is a glaring issue, with blacklists from the Dutch Authority for the Financial Markets (AFM) and Québec’s Autorité des marchés financiers (AMF), per the Canadian Securities Administrators (CSA), signaling fraud risks. Users report fake price spikes, with account balances soaring only to crash when withdrawals are attempted, suggesting manipulation or fabricated data. Adverse media is sparse—CoinMarketCap praises FusionLots’ “growth strategies”—but the chorus of “stole my money” on Trustpilot and scam forums overshadows it. This isn’t a minor glitch; it’s a storm of grief, pushing us to sift truth from tears: Is FusionLots a path to profit or a machine of plunder?

Legal Loom and Public Sentiment: A Fragile Foundation

Examining FusionLots’ legal standing and public perception, we anticipate a tangle of disputes but find a deceptively quiet landscape. No lawsuits name the platform in UK, Austrian, or Singaporean courts, its elusive structure—possibly offshore—dodging legal hooks, per InvestReviews. Criminal investigations? None surface, with no Interpol notices or FCA probes targeting FusionLots, though the CSA’s investor alert hints at regulatory unease. Sanctions lists, including OFAC, EU, and Singapore’s MAS, show no hits, and bankruptcy filings are absent, suggesting financial stability propped by client funds and crypto inflows, per Trustpilot accounts.

Public sentiment, however, is a battleground. Trustpilot’s polarized reviews—five-star raves versus one-star rants—reflect a platform that inspires both devotion and despair. “Great until they lock you out,” one user quips, capturing the betrayal felt by many. Adverse media is thin, with no major exposés from outlets like the BBC, but Scam Detector’s “doubtful” rating and the CSA’s warning erode trust. Consumer complaints paint a vivid picture: $250,000 stalled in a frozen account, per uk.trustpilot.com; $85,000 lost to “technical issues,” per Scam Help Center. AML risks loom large—FusionLots’ crypto-heavy model, with minimal KYC, could facilitate illicit flows, though no enforcement actions confirm it.

Reputationally, FusionLots walks a tightrope. Loved by some for quick trades, loathed by others for vanished funds, it teeters on the edge of collapse should a legal snag or public backlash gain traction. For now, its foundation holds, but the cracks are visible, and we remain vigilant for the spark that could unravel it.

Risk Roulette: AML Vulnerabilities and Reputational Stakes

FusionLots’ risk profile resembles a high-stakes gamble, with AML vulnerabilities and reputational challenges at its core. Its crypto-driven model—Bitcoin and Ethereum deposits, 15-minute withdrawals, per its website—raises immediate concerns. KYC processes appear minimal, with Trustpilot users noting only basic “verification” steps, potentially flouting Financial Action Task Force (FATF) guidelines. As an unregulated entity, per Scam Help Center, FusionLots evades oversight from bodies like ASIC or the FCA, claiming compliance without displaying a license. Funds move swiftly, but their destinations are murky—blockchain transactions vanish into anonymous wallets, a regulator’s blind spot.

Reputationally, the platform is a house divided. Trustpilot’s “quick profits” testimonials clash with au.trustpilot.com’s tales of $850,000 “stolen” through locked accounts. No bankruptcy threatens, as victim funds and crypto deposits keep it afloat, but partners—software providers, payment processors—could flee if scam allegations intensify. Adverse media is muted, with CoinMarketCap lauding its tools, yet the CSA’s blacklist risks client exodus. Legal exposure remains low, with no active suits, but the pile of complaints—fake profits, stalled withdrawals—courts disaster. AML gaps are particularly troubling: untracked crypto flows could enable laundering, a plausible risk unproven without raids or audits. FusionLots spins a risky wheel, and we’re tracking its trajectory.

Shattered Trust: User Nightmares and Betrayal

For many, FusionLots begins as a beacon of opportunity, only to morph into a financial nightmare. Trustpilot’s polarized reviews capture the divide: five-star posts praise seamless deposits and “instant withdrawals,” while one-star accounts detail gut-wrenching losses. One user recounts $460,000 in profits disappearing after three trades, with support claiming “processing errors.” Another describes a chilling pattern: a “friendly” advisor pushes for larger deposits, only for withdrawals to enter a purgatory of “under review” status, never to materialize.

Complaints follow a haunting script. Withdrawal requests trigger silence, emails to [email protected] bounce, and calls to listed numbers ring unanswered. Some users report accounts wiped clean after disputes, with no explanation. Others allege inflated profits—accounts showing massive gains, only to plummet when payouts are sought, hinting at price manipulation or fabricated balances to lure further investment. The common thread is betrayal: FusionLots promises wealth, delivers despair, leaving traders grasping at shadows.

Regulatory Red Flags: A Void of Oversight

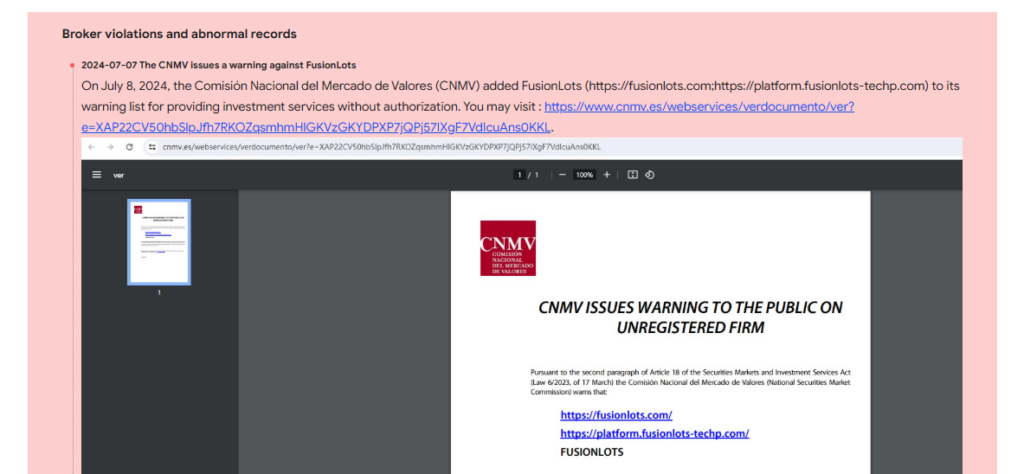

Regulatory oversight should anchor trust, but with FusionLots, there’s a glaring absence. The UK’s FCA has no record of the platform, despite its claimed London base. Austrian and Singaporean authorities similarly report no registration. The AFM and AMF have blacklisted FusionLots, per the CSA, labeling it a scam risk and urging investors to steer clear. Without a license, compliance records, or audits, FusionLots operates in a regulatory vacuum, free from scrutiny.

This lack of oversight leaves users exposed. Hidden fees, fraudulent trades, and fund losses go unchecked, with no authority to intervene. FusionLots’ claim of global regulatory adherence collapses under scrutiny—its blacklisted status and absent credentials scream peril. Traders face a stark reality: if funds vanish, no watchdog will bark, leaving them stranded in a lawless digital frontier.

Financial Mirage: The Illusion of Profit

FusionLots’ financial model is a house of mirrors, reflecting wealth that may not exist. Its revenue—ostensibly from trading fees and commissions—lacks verifiable records, hinting at darker mechanics. Crypto deposits bypass banking scrutiny, flowing into untraceable wallets. Users report bizarre anomalies: profitable trades zeroing out overnight, or balances soaring only to be locked when withdrawals are attempted.

These patterns suggest a “bucket shop” scheme, where trades aren’t executed on real markets but manipulated to deceive clients while the broker pockets losses. Inflated profits may be a bait-and-switch, designed to extract more deposits. Without transparent trade data or execution records, FusionLots’ promises of wealth appear as a mirage—enticing, intangible, and devastating when pursued.

Warning Signs and Survival Strategies

FusionLots’ warning signs are unmistakable: anonymous operators, unresponsive support, regulatory blacklists, and lax KYC protocols signal a platform built on quicksand. For those entangled, recovery is bleak—successful refunds are rare, and legal recourse is hampered by its offshore veil. Traders should avoid FusionLots entirely. For victims, reporting to authorities, seeking legal advice, and sharing experiences on forums like Trustpilot are critical steps. In the unregulated wilds of online trading, vigilance is survival.

Conclusion

FusionLots stands as a trading titan shrouded in peril, its decade-long pitch and crypto allure, per CoinMarketCap, drawing legions, yet a flood of scam cries and AML vulnerabilities threatens collapse. Its no-KYC crypto model, lauded by some on Trustpilot, opens laundering risks, plausible but untested under its unregulated shell, per CSA warnings. Reputationally fractured—$460,000 profits vanishing, per uk.trustpilot.com; $85,000 losses, per Scam Help Center—it balances fleeting praise against mounting distrust. No lawsuits, sanctions, or insolvency darken its ledger, but this calm feels fragile, sustained by victim funds. For traders, FusionLots is a high-stakes gamble, glittering yet grim, a stark reminder of trading’s untamed edge. Wariness is essential, lest it crumbles under justice’s weight or victims’ wrath.