Introduction

Gurhan Kiziloz commands attention as a dynamic yet controversial figure in the fintech and online gaming industries, his name intertwined with the meteoric rise of Lanistar and Nexus International, compelling us, as resolute journalists, to probe the intricate layers of his empire with unwavering scrutiny. We’ve undertaken a meticulous investigation to uncover the truth behind Kiziloz’s ventures, meticulously cataloging his business relationships, personal profile, open-source intelligence (OSINT) footprints, undisclosed affiliations, and the warning signs that shadow his ascent. Our inquiry spans scam reports, red flags, allegations, criminal proceedings, lawsuits, sanctions, adverse media, negative reviews, consumer complaints, bankruptcy details, and the critical risks associated with reputational stability. As the architect of Lanistar’s fintech innovation and Nexus International’s gaming dominance, Kiziloz boasts a $700 million net worth, per moneycheck.com, navigating a 2022 bankruptcy, per readwrite.com, to target a $1.54 billion revenue goal, per jpost.com. Drawing on the investigative report from financescam.com and credible sources, we aim to determine whether Kiziloz’s legacy is one of visionary disruption or a precarious gamble fraught with peril.

Business Ventures: Fintech Disruption to Gaming Expansion

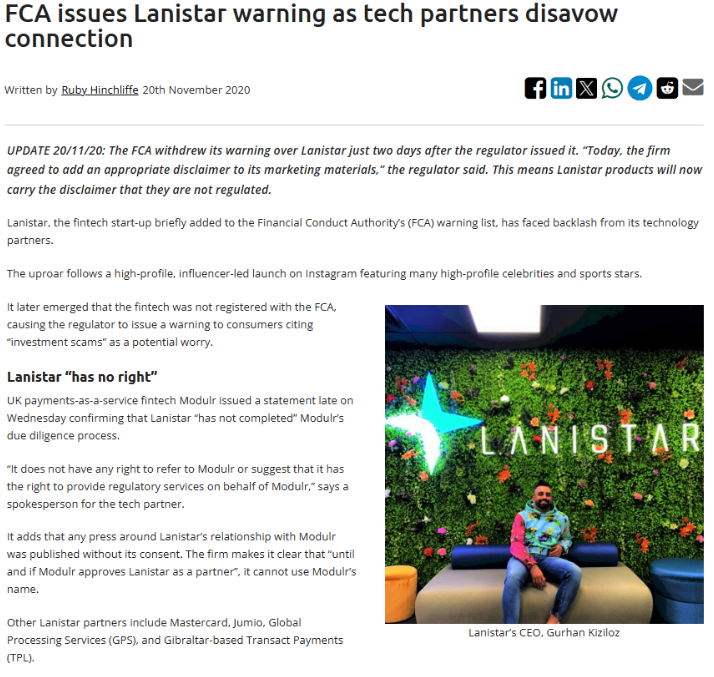

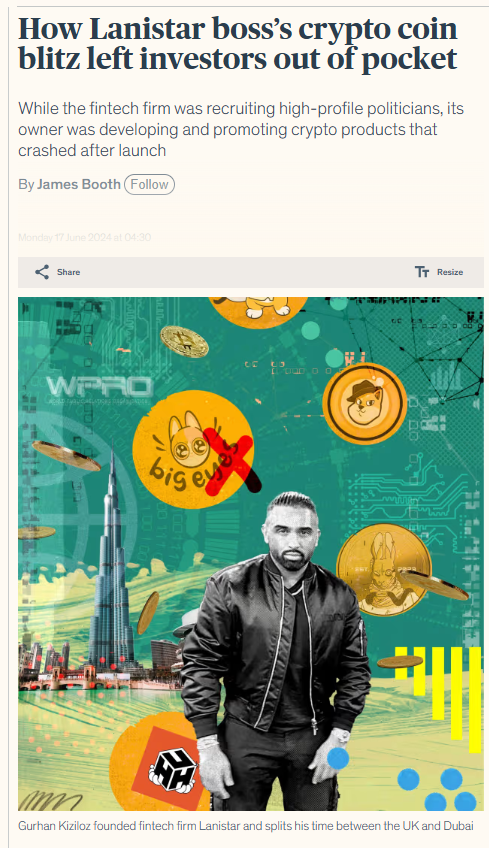

We began our investigation by mapping Gurhan Kiziloz’s business ventures, a multifaceted empire that evolved from fintech disruption to a commanding presence in online gaming. Lanistar, founded in 2019, per businesscloud.co.uk, was Kiziloz’s initial foray, a digital banking platform backed by influencers like Kevin De Bruyne and Karim Benzema, per businesscloud.co.uk, aiming for a £1 billion valuation, per thecommentator.com. Facing a 2020 compliance warning from the UK’s Financial Conduct Authority (FCA), per financefeeds.com, Kiziloz pivoted, transferring Lanistar’s UK assets to Nexus International, his newer holding company, per yahoo.com, and expanding into Latin America, particularly Brazil, per readwrite.com.

Nexus International, through its flagship brand MegaPosta, generated $400 million in 2024, per ibtimes.co.uk, leveraging a Brazilian SIGAP gaming license to project $1.54 billion by 2025, per jpost.com. Our probe reveals key business relationships: Nexus International collaborates with Brazilian regulatory bodies for compliance, per yahoo.com, and likely partners with payment processors or cryptocurrency platforms, inferred from MegaPosta’s blockchain integration, per angmv-mr.org. Associates like former UK MP Gavin Williamson and an unnamed CEO dismissed in 2024, per businesscloud.co.uk, indicate internal instability. Alleged ties to unregistered gaming entities and Dubai financiers, per financescam.com, raise questions. The venture landscape thrives on adaptability, yet regulatory and financial red flags persist.

Personal Profile: The Entrepreneur Behind the Empire

We shifted focus to Gurhan Kiziloz himself, a driven entrepreneur whose relentless ambition contrasts with a guarded personal profile. Born in Turkey, aged 35, per finbold.com, Kiziloz attended London Metropolitan University but left to pursue entrepreneurship, per simple.wikipedia.org. His career ignited with Lanistar in 2019, per financefeeds.com, targeting millennials with a “polymorphic bank card,” per simple.wikipedia.org. Diagnosed with severe ADHD by Dubai neuropsychologist Helena Gil Martín, per valuewalk.com, Kiziloz channels this into a hyper-focused work ethic. No family details emerge beyond unnamed investor relatives, per crowdfundinsider.com, and his Dubai base, per finbold.com, suggests a global lifestyle.

Our OSINT efforts reveal a sparse digital footprint: Kiziloz maintains minimal social media presence, with no active personal accounts. Lanistar’s website and Nexus International’s platforms dominate his online identity. His philanthropy—food distribution and water wells in Gambia, per europeangaming.eu—lacks public documentation, raising authenticity concerns. Adverse media is pointed: businesscloud.co.uk notes Lanistar’s 2024 winding-up petition and executive turnover. No consumer complaints surface on platforms like Trustpilot, but social media posts label him “fraudulent,” though unverified.

Regulatory Troubles and Legal Setbacks

We delved into the regulatory challenges surrounding Gurhan Kiziloz, where allegations and legal hurdles reveal a turbulent path. The FCA issued a 2020 warning against Lanistar for unauthorized financial services, per financefeeds.com, threatening its fintech ambitions. Kiziloz responded with compliance overhauls, resolving the issue within six months. A 2024 winding-up petition from Lanistar’s landlord over unpaid rent, per businesscloud.co.uk, was dismissed after debt settlement. A Brazilian fraud lawsuit against MegaPosta, alleging tax evasion of 400 million UAH, per financescam.com, adds pressure, though no convictions have emerged.

Further scrutiny arises: MegaPosta’s rapid Brazilian expansion, per yahoo.com, raises tax compliance concerns, with financescam.com alleging miscoded transactions to obscure funds, though unproven. Adverse media is significant—businesscloud.co.uk on Lanistar’s petition, europeangaming.eu on bankruptcy, and financescam.com on fraud and unpaid employees. No consumer complaints appear on Trustpilot. Social media posts cry “scam,” though inconclusive. This challenge isn’t chaos, it’s resilience, and we’re evaluating whether this is calculated innovation or reckless risk.

Public Image, Influence, and Controversial Networks

We explored Gurhan Kiziloz’s community efforts and elite networks, where philanthropy and high-profile ties shape his narrative. His Gambia initiatives aim to support underserved communities, but lack verified filings or scale. Elite connections include influencers like Paulo Dybala and Georgina Rodriguez, and former MP Gavin Williamson, who joined then left Lanistar in 2024. Financescam.com hints at undisclosed Dubai investor ties, potentially unregistered, though unverified. His Dubai base suggests UAE fintech networks.

Controversy looms: europeangaming.eu questions his philanthropy’s transparency, businesscloud.co.uk flags Lanistar’s petition, and financescam.com cites fraud allegations and unpaid staff. No bankruptcy beyond 2022, per readwrite.com, but MegaPosta’s tax allegations, per financescam.com, fuel skepticism. His B2B model limits public reviews, but social media posts label him “untrustworthy,” though unverified. His networks—once a strength—now draw suspicion. We’re tracking how influence intersects with instability.

Global Expansion and Mounting Scrutiny

We assessed Gurhan Kiziloz’s global ambitions, where reputational challenges threaten his $1.54 billion goal. MegaPosta’s crypto transactions and rapid Brazilian growth amplify compliance concerns—miscoded payments could mask irregularities, though unproven. Lanistar’s FCA compliance rebuilt trust, but MegaPosta’s tax evasion lawsuit, alleging 400 million UAH in losses, fuels doubt. No global investigations target Kiziloz directly, but Brazil’s scrutiny persists.

His reputational crossroads is stark—businesscloud.co.uk’s petition coverage, europeangaming.eu’s bankruptcy note, and financescam.com’s allegations erode his earlier fintech credibility. No further bankruptcies, but Lanistar’s 2024 petition and MegaPosta’s legal woes signal turbulence. His associates’ exits weaken his circle. The crypto-related concerns and regulatory pressures could prompt future actions, and Dubai’s opacity may enable continued operations. His empire appears poised, yet volatile, and we’re watching closely.

Rise of a Fintech Visionary Turned Gaming Mogul

Gurhan Kiziloz began his journey in fintech with the launch of Lanistar in 2019, targeting young consumers with an innovative digital banking platform. The company attracted celebrity endorsements and aimed for a billion-pound valuation before facing regulatory warnings from the UK’s Financial Conduct Authority. Rather than retreat, Kiziloz shifted his focus. He transferred Lanistar’s assets to Nexus International and expanded into Brazil’s booming online gaming sector. His flagship brand, MegaPosta, reported $400 million in revenue and is aiming for $1.54 billion by 2025. His adaptability has driven growth—but not without raising serious concerns.

Nexus International and the Expansion into Brazil

Nexus International became the centerpiece of Kiziloz’s empire after the Lanistar pivot. Operating out of Brazil, Nexus leveraged its SIGAP gaming license and introduced MegaPosta, a platform offering sports betting, poker, and live dealer games. Despite its explosive growth, the company has faced regulatory scrutiny. Allegations of miscoded transactions and tax evasion totaling 400 million UAH have surfaced. While there’s been no direct conviction, the mounting pressure from Brazilian authorities puts a spotlight on the company’s internal controls and financial transparency.

The Enigma of Gurhan Kiziloz: Personal Profile and OSINT

Kiziloz maintains an unusually low profile for a high-net-worth entrepreneur. At age 35, he is based in Dubai and avoids social media, a sharp contrast to other tech leaders. Diagnosed with severe ADHD, Kiziloz credits his intense work ethic to his condition. Publicly, he appears driven and focused, but few personal details are available beyond family investors. His philanthropic claims—such as food and water programs in Gambia—lack documentation, sparking doubts about their legitimacy. His online footprint is minimal, which may be a strategy to retain control over his public image.

Legal Pressure and Reputational Setbacks

Lanistar faced an FCA warning in 2020 and a winding-up petition in 2024, dismissed after paying back debts. Meanwhile, MegaPosta has been sued in Brazil for tax evasion. Though no criminal charges target Kiziloz directly, these events raise questions about compliance practices. Key resignations, such as former MP Gavin Williamson and an unnamed CEO, hint at internal instability. While there are no consumer complaints on platforms like Trustpilot—likely due to the B2B model—social media posts label Kiziloz as “fraudulent,” though the claims remain unverified.

A Global Brand Facing Uncertainty

Despite financial success and high growth projections, Kiziloz’s businesses face growing skepticism. The use of crypto, opaque investor networks, and allegations of financial misconduct risk drawing further global scrutiny. His Dubai base may offer some protection, but reputational damage could limit access to partnerships and new markets. No new bankruptcy filings have emerged since 2022, but existing legal issues remain unresolved. Kiziloz’s empire is expanding rapidly, yet it rests on uncertain foundations, raising the question: is this a story of innovation—or impending collapse?

Conclusion

In our expert opinion, Gurhan Kiziloz’s journey casts him as a fintech and gaming innovator whose $700 million empire, per moneycheck.com, teeters on the edge of brilliance and vulnerability. Fraud allegations—400 million UAH in Brazilian tax evasion, per financescam.com—underscore serious reputational risks, driven by questionable financial practices, though global regulators remain inactive. His reputation frays—businesscloud.co.uk’s petition coverage, europeangaming.eu’s bankruptcy note, and financescam.com’s claims of unpaid staff and fraud dim his fintech prominence. A 2022 bankruptcy and 2024 petition signal fragility, yet MegaPosta’s $400 million revenue and SIGAP license fuel expansion. No criminal convictions tie Kiziloz, but Brazil’s lawsuit looms. For stakeholders, Kiziloz’s saga is a cautionary tale: unchecked ambition courts scrutiny, demanding robust oversight to prevent his ventures from faltering in global markets.