Introduction

The digital era has brought about significant advancements in financial services, but it has also paved the way for a surge in deceptive platforms preying on unsuspecting individuals. Trust-Financial-Planning.com stands out as one of the most concerning examples, with numerous indicators suggesting it operates as a fraudulent scheme. This article sheds light on the many alarming aspects of this platform, providing a detailed warning to potential users.

Understanding Trust-Financial-Planning.com

Trust-Financial-Planning.com markets itself as a reliable provider of financial services, including investment management, retirement planning, and wealth growth strategies. However, a closer examination reveals a web of deceit designed to lure and exploit vulnerable individuals.

Key Issues Identified

Lack of Transparency

Trust-Financial-Planning.com makes a concerted effort to obscure critical information. The ownership details are entirely hidden, a tactic often employed by fraudulent operations to avoid accountability. Legitimate financial platforms prioritize transparency, openly sharing details about their leadership and business operations. The absence of such transparency in this case is a glaring warning sign.

Further investigation reveals the platform’s domain is newly registered, a hallmark of short-lived scam operations. Fraudulent websites often register domains for limited periods to conduct their schemes before disappearing without a trace, leaving victims powerless.

Misleading Claims and False Promises

The platform inundates visitors with claims of guaranteed high returns on investments with little to no risk. These promises are entirely unrealistic and contradict the basic principles of investment, where all opportunities carry inherent risks. Such claims are a classic hallmark of financial scams designed to exploit greed and desperation.

Moreover, Trust-Financial-Planning.com fails to provide any credible proof of its performance or client success stories. Legitimate firms readily share detailed case studies and performance metrics to establish trust, but this platform relies solely on empty assertions.

Absence of Regulatory Compliance

One of the most damning issues with Trust-Financial-Planning.com is its lack of regulatory oversight. It is not registered with any recognized financial authority, which means it operates without accountability or adherence to industry standards. Regulatory compliance is a cornerstone of trust in financial services, and the absence of it leaves users exposed to significant risks.

Poor User Experiences

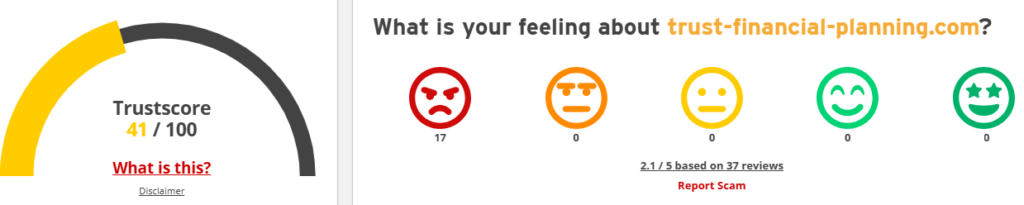

Reports from individuals who have interacted with Trust-Financial-Planning.com paint a bleak picture. Many users complain about difficulties in withdrawing funds, with the platform imposing arbitrary delays and additional fees to frustrate withdrawal attempts. Others have cited outright refusal of payouts, indicating the platform’s intent to retain user funds at all costs.

Customer support is virtually non-existent, with inquiries going unanswered or met with vague, unhelpful responses. This lack of support leaves users without recourse, further exacerbating their losses and frustrations.

Deceptive Presentation

Despite its questionable practices, Trust-Financial-Planning.com attempts to present itself as a legitimate operation. Its website features a polished design with professional imagery and financial jargon to create an illusion of credibility. However, a deeper examination reveals that much of the content is generic, plagiarized, or deliberately vague, serving only to mislead visitors.

Devastating Consequences for Victims

Engaging with fraudulent platforms like Trust-Financial-Planning.com can have severe repercussions. Victims often suffer substantial financial losses, with scammers exploiting loopholes to evade legal consequences and restitution efforts. Additionally, personal information shared during registration can be misused for identity theft or other illicit activities.

The emotional toll on victims is equally significant. Many report feelings of betrayal, stress, and anxiety, which can persist long after the financial damage has been done. Legal recourse, while possible, is often prohibitively expensive and time-consuming, leaving most victims without justice.

How to Avoid Falling for Similar Scams

To protect yourself from platforms like Trust-Financial-Planning.com, it is essential to remain vigilant and adopt the following precautions:

- Verify Regulatory Compliance: Always confirm that the platform is registered with a recognized financial authority. Use official regulatory databases to cross-check their credentials.

- Conduct Independent Research: Seek out reviews and testimonials from multiple sources. Be wary of overly positive reviews, as these may be fabricated by the platform itself.

- Question Unrealistic Promises: Avoid platforms that guarantee high returns with no risks. Legitimate investments always involve some level of risk.

- Test Customer Support: Reach out to the platform’s customer service to gauge their responsiveness and professionalism. Lack of communication is a major red flag.

- Scrutinize Terms and Conditions: Carefully read the platform’s terms of service to identify any clauses that may disadvantage users or limit their rights.

Conclusion

Trust-Financial-Planning.com represents a textbook example of a fraudulent financial platform. Its lack of transparency, unrealistic promises, absence of regulatory oversight, and negative user experiences all point to a high likelihood of malicious intent. The platform’s polished appearance only serves to further its deceptive agenda, luring unsuspecting users into a web of financial loss and emotional distress.

Individuals must exercise extreme caution when engaging with online financial platforms. Thorough research, skepticism of lofty promises, and prioritization of transparency and compliance are crucial steps to safeguard against fraud. In the case of Trust-Financial-Planning.com, the evidence is overwhelming: this is a platform to avoid at all costs.